Sulphur 401 Jul-Aug 2022

31 July 2022

Sulphur: a critical component in soil and plant health

SULPHUR FERTILIZERS

Sulphur: a critical component in soil and plant health

Sulphur is becoming an increasingly vital crop nutrient, due to a combination of lower sulphur deposition from the atmosphere, the increasing prevalence of high-analysis fertilizers and higher cropping intensity.

The sulphur cycle

Similar to nitrogen and phosphorus, sulphur follows a cycle (Sulphur 392 p. 16). This cycle illustrates:

- how sulphur moves between land, air and sea in different forms;

- key processes such as crop uptake, leaching and volatilisation;

- the microbial action which makes sulphur plant-available by changing it from organic to inorganic form.

Crops access and remove sulphur through their roots in sulphate form. It can also be taken up as sulphur dioxide gas.

Sulphur typically enters the soil solution by the mineralisation of organic matter. Every 1% of soil organic matter can supply around 1.4-2.3 kg of sulphur via mineralisation. Some soil microbes and plants immobilise (fix) sulphur while others mineralise (oxidise) it into sulphate. These mineralisation and immobilisation processes often occur simultaneously within soils as part of sulphur removal and replenishment. Because 95% of sulphur found in soils is associated with organic matter, low organic matter soils are typically sulphur deficient (Sulphur 392 p. 16).

From 2005 to 2014, the average amount of fertilizer sulphur used annually in global crop production was 10.6 million tonnes, with some 53% (5.6 million tonnes) of this applied to cereals1 . However, recent calculations suggest that, on average, only one million tonne of the total sulphur applied in cereal crop production was subsequently recovered in the grain – suggesting a sulphur use efficiency (SUE) of around 18%1 . Reasons for low SUE include sulphur:

- leaching;

- adsorption;

- retention in residues;

- immobilisation;

- failure to adhere to best agronomic practice, e.g. the 4Rs.

The fourth crop nutrient

Sulphur has become increasingly valued by the farm sector in recent years, to the extent that some now describe sulphur as ‘the fourth crop nutrient’ (Fertilizer International 497, p24).

Sulphur is present in all crops and plays an important metabolic role. It is essential for the formation of proteins, amino acids, vitamins and enzymes, and vital for photosynthesis, energy metabolism and carbohydrate production. Sulphur also contributes to the flavour and aroma of crops such as onions and can therefore influence the quality of farm produce.

Importantly, sulphur does not act alone as a plant nutrient, as it works in tandem with nitrogen to enable the formation of amino acids during protein synthesis. Sulphur is also part of the plant enzyme required for nitrogen uptake.

In crop nutrition, sulphur plays a critical role in early crop establishment and improves resistance to environmental stress. Deficiency stunts early plant growth, leading to later yield losses, and is exacerbated by the following conditions: l light and sandy soils with low soil organic matter;

- sulphur leaching during high winter rainfall;

- low sulphate mobility during dry spring conditions;

- slower mineralisation at low temperatures;

- low input of organic matter and mineral sulphur;

- low atmospheric deposition of sulphur to soils.

The main signs of sulphur deficiency – pale green colouration, stunted growth and delayed maturity – mirror the symptoms of nitrogen deficiency. However, sulphur deficiency affects in newer growth, typically in the top leaves or whorl, while nitrogen deficiency shows up in the bottom leaves of the plant. A lack of sulphur in corn and wheat slows down photosynthesis and root/plant development as shown by a pale green colour and a lack of vigour.

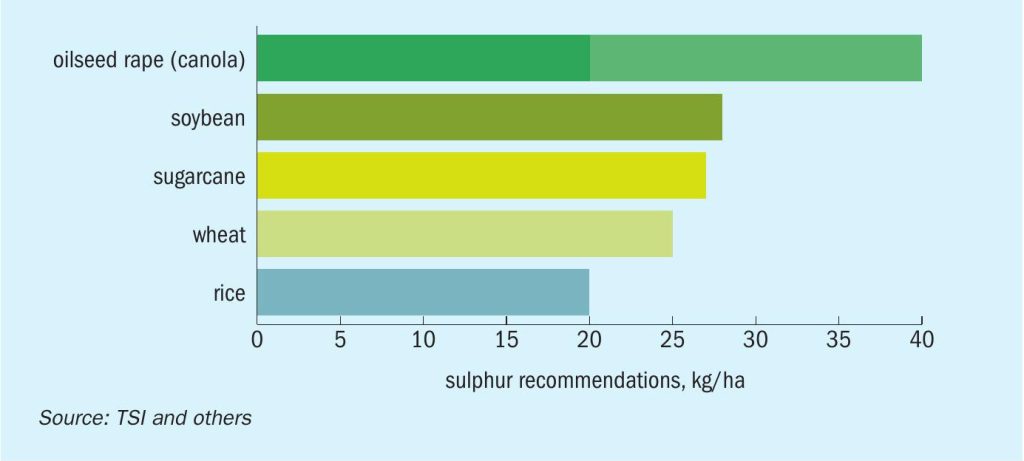

Crops can typically remove between 15 to 30 kg of sulphur per hectare from soil. Root vegetables, onions and brassica, especially oilseed rape (canola), have a particularly high demand for sulphur. Pasture and other widely-grown crops such as coffee, corn, cotton, rice, soybean, sugarcane and wheat also require moderately high sulphur applications (Fig. 1). For these crop types, sulphur requirements can match or even exceed demand for phosphorus.

A bushel of corn, for example, removes 77 grams of sulphur in total – 36 grams in the grain and 41 grams in the stalk. That means 200 bushels of corn will remove sulphur at a rate of 38 kg/ha. This is equivalent to an actual removal rate of plant-available sulphate (SO4 ) of 114 kg/ha (Sulphur 392, p. 16).

Increasing agricultural value

Sulphur is becoming an increasingly important crop nutrient due to three main factors (Fertilizer International 497, p.24):

- Falling atmospheric deposition: Soil sulphur deficiency, a relative rarity 20 years ago, is becoming more common. The deposition of sulphur dioxide emissions from the atmosphere used to guarantee that soils in many regions were automatically enriched and replenished with sulphur. This is no longer the case as increasingly stringent environmental regulations and the introduction of low-sulphur fuels have sharply cut emissions.

- The prevalence of high-analysis fertilizers: Farmers are continuing to switch to high-analysis products, containing little or no sulphur, at the expense of sulphur-rich, lower analysis products. This longterm buying trend has also put sulphur replenishment on a downward path.

- Rising cropping intensity: Improving crop yields are withdrawing ever larger amounts of sulphur from the field.

These three factors are, however, opening up opportunities for fertilizer producers. A number of leading manufacturers are capitalising on the value of sulphur by broadening their portfolios and supplying sulphur-enhanced fertilizers as premium products to meet growing market demand.

Global and regional consumption

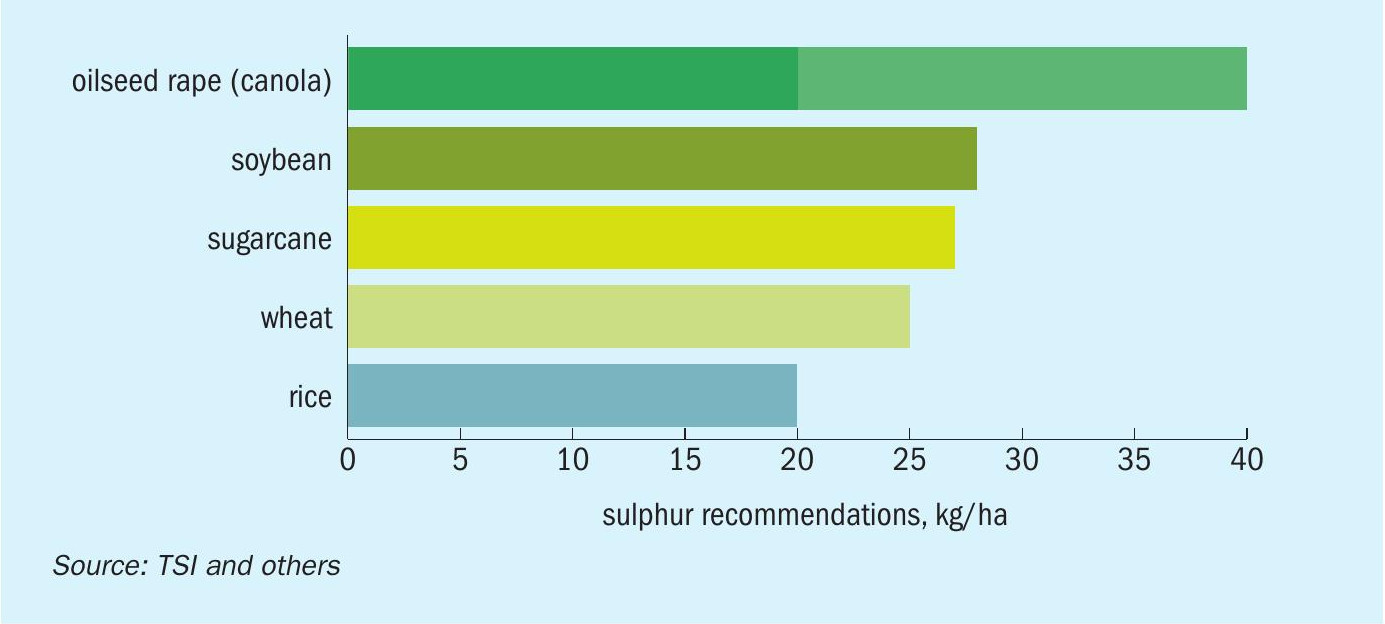

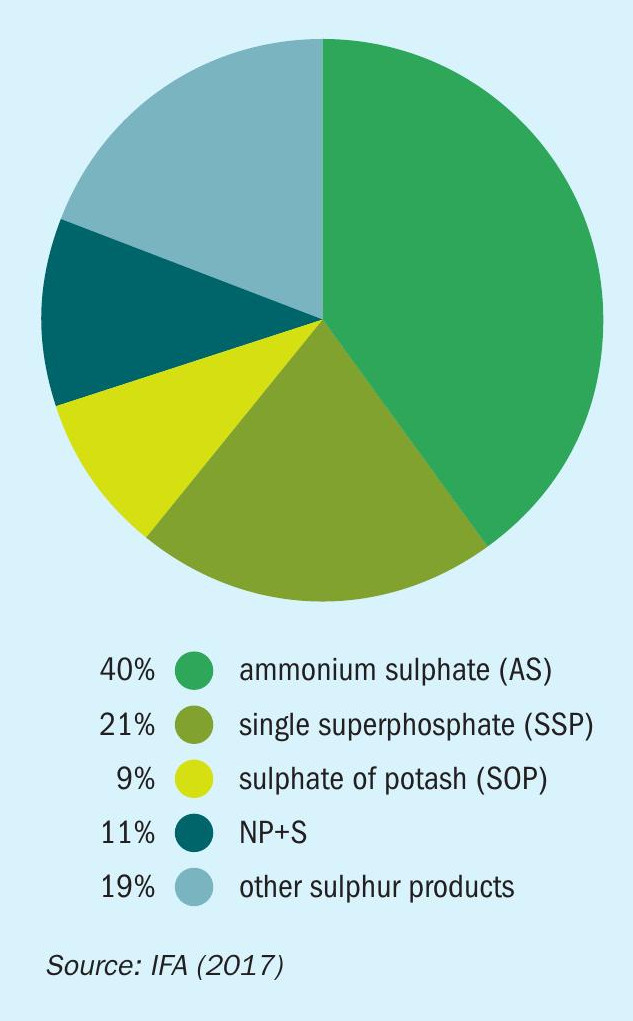

Accurate and up-to-date figures on sulphur fertilizer consumption are hard to come by. Despite this, the market is mainly divided between the following products, in order of popularity:

- ammonium sulphate;

- single superphosphate (SSP);

- sulphate of potash (SOP);

- NPS products;

- ammonium thiosulphate (ATS).

The total world market for sulphur-containing fertilizers was estimated at more than 66 million tonnes in 2015. On a nutrient basis this equates to global agricultural sulphur consumption of around 11.1 million tonnes. Sulphur consumption is greatest in Latin America (2.4 million tonnes), East Asia (2.1 million tonnes) and Southeast Asia and Oceania (1.8 million tonnes), with these three regions accounting for 57 percent of global agricultural sulphur usage2 .

However, worldwide agricultural consumption of sulphur could be closer to 13.3 million tonnes (Fig. 2), according to a first-of-its-kind assessment by the International Fertilizer Association (IFA)3 . This volume is much higher than the frequently quoted estimate of 10-11 million tonnes. However, this latest tonnage is probably still an underestimate, suggests IFA, as it excludes data for some NPK+S products3 .

Market trends

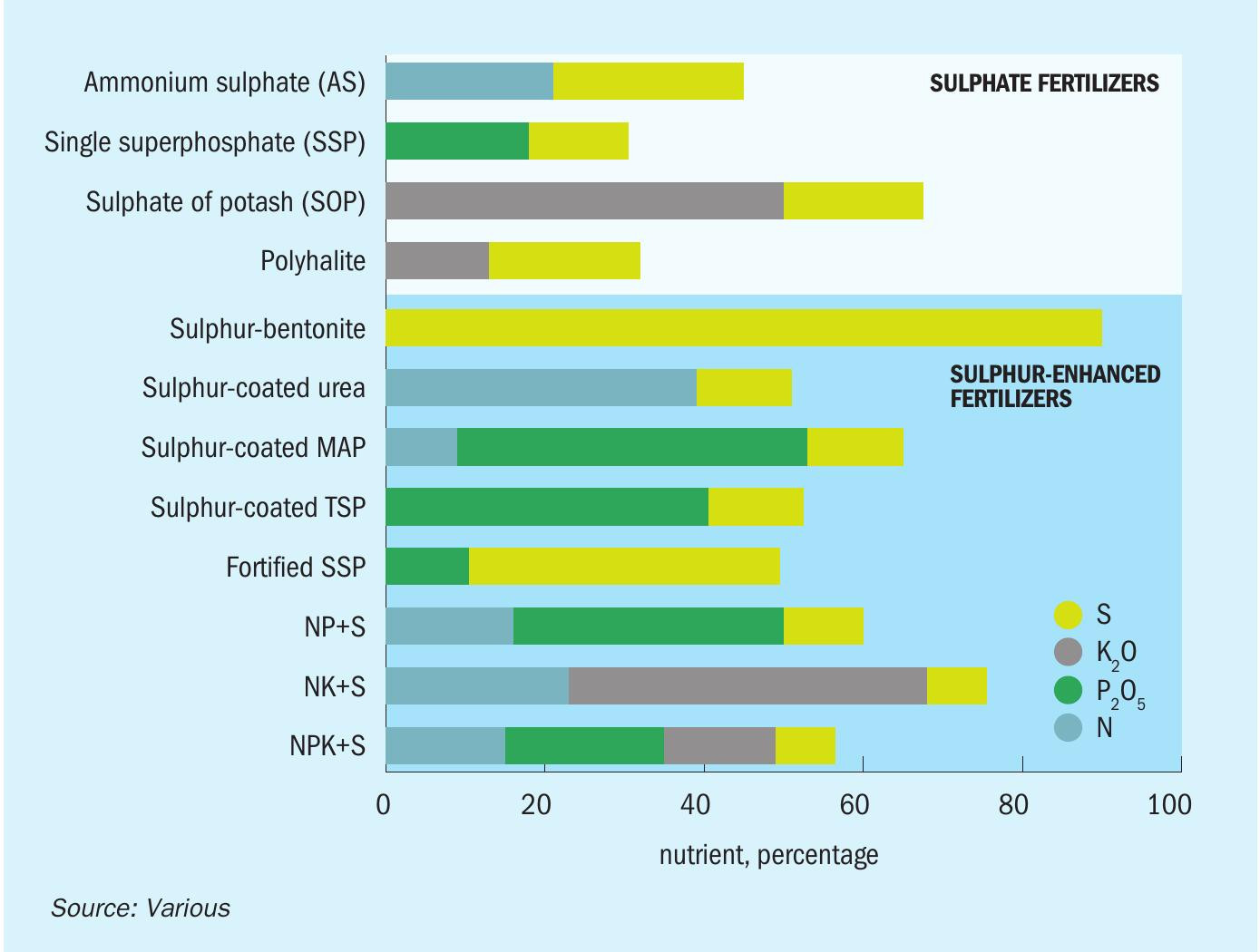

The sulphur fertilizer market divides into two main categories – traditional sulphate fertilizers and sulphur-enhanced fertilizers. These have a wide range of nutrient compositions (Fig. 3).

Traditional sulphate fertilizers have long dominated global demand (Fertilizer International 476, p. 19). They include:

- Single superphosphate (SSP) is the second largest selling phosphate fertilizer on the market after diammonium phosphate (DAP). Consumption is concentrated in four main markets, China, Brazil, India and Australia, which collectively account for around 85% of total global demand. SSP is a low-analysis fertilizer with a nutrient content of around one-fifth (1822% P2 O5 ). Because of this, it tends to be consumed in the country of origin, and export volumes have declined due to increasing competition from more economic high-analysis phosphates. SSP consumption has contracted by almost a third in the past 20 years.

- Ammonium sulphate (AS) consumption, in contrast, is on the rise even though its nitrogen content is much lower than urea and ammonium nitrate. World supply (26.4 million tonnes) has been boosted by the massive growth of ‘involuntary’ production capacity in China. Consumption of AS is concentrated in the Americas (the US, Brazil, Mexico and Canada) and East and Southeast Asia (China, Indonesia, Vietnam and Malaysia). Turkey and Germany also offer sizeable markets for AS (Fertilizer International 469, p. 20). The use of AS in NPK blends has become increasingly popular as awareness of sulphur deficiency in soils has become more widespread. Rapid growth in world oilseed rape (canola) production has been a notable factor behind the rise in AS demand.

- Sulphate of potash (SOP) is valued as a chloride-free source of potash for lucrative cash crops such as tobacco, tree nuts and citrus fruits. Agricultural consumption is 7-8 million tonnes currently. China accounts for more than half of global use and has been responsible for much of the expansion in SOP demand globally in recent years. North America and Europe are also sizable markets accounting for some 60% of demand outside of China (Fertilizer International 475, p. 49). Global demand is supply-constrained meaning that SOP trades at a premium.

- Sulphate of potash magnesia (SOPM) global demand has grown strongly in recent years. The market for SOPM, similar to SOP and SSP, is highly concentrated with just four countries, China, the US, Canada and Germany, accounting for the lion’s share of consumption. Production is also mainly located in three countries, China, the US and Germany.

- Ammonium phosphate sulphate (APS), a fertilizer with a 60% ammonium sulphate and 40% MAP composition, is a commonly produced grade of NP+S fertilizer (16-20-0-14S). It is directly applied to forage crops in many countries, particularly legumes, and is also a popular choice of fertilizer for small grains and oilseed rape (canola). The global sulphur fertilizer market is still dominated by AS, SSP and SOP, with these three products combined being responsible for 70% of agricultural sulphur consumption (Fig. 2).

Sulphur-enhanced fertilizers

Crop requirements for sulphur were projected to exceed 24 million tonnes by 2020. Fertilizer producers have reacted to this widening demand gap by developing sulphur-enhanced fertilizers. Many of these premium products are manufactured by analysis fertilizers, either within granules or as an external coating. Introducing a liquid sulphur spray to urea, TSP, MAP or DAP during drum or pan granulation, for example, results in NPS products with a 5-20% elemental sulphur content.

Sulphur-enhanced fertilizers combine nutrient availability with high use-efficiency, and also have good storage and handling properties. Examples include:

- sulphur bentonite;

- sulphur-coated urea, MAP or TSP;

- sulphur-enriched SSP;

- sulphur-enhanced MAP enriched with sulphate.

Sulphur-enriched SSP is popular in countries such as New Zealand and can contain twice as much sulphur as ordinary SSP. Added elemental sulphur complements SSP’s existing sulphate content and helps meet crop needs during the whole growing season by providing both immediate and reserve stores of sulphur. This makes it particularly suitable for applications in areas with high leaching losses.

Controlled release fertilizers (CRFs) can be produced by coating highly-soluble nutrients with relatively insoluble elemental sulphur. Sulphur-coated urea (SCU), for example, combines 77-82% urea (36-38% N) with a 14-20% sulphur coating. SCU is suitable for multiple nitrogen applications on sandy soils under high rainfall or irrigation conditions. It is marketed as a CRF for grass forage, turf, sugarcane, pineapple, cranberries, strawberries and rice.

To be of value to crops as a nutrient, the elemental sulphur (S8) present in sulphur-enhanced fertilizers firstly needs to be oxidised into plant-available sulphate by thiobacillus soil bacteria. This process requires the availability of oxygen and moisture and only occurs within a certain temperature range.

Fine elemental sulphur (40-150 microns) can be combined with 5-10% swelling clay to form sulphur-bentonite pastilles. The minor clay component promotes microbial conversion into sulphate early in the growing season by dispersing and releasing sulphur particles into the soil. This helps guarantee the supply of sulphur throughout the season and minimises leaching losses. Sulphur-bentonite is widely-used to treat sulphur deficiency in the US and India and is suitable for blending as well as direct application.

Liquid sulphur products

Liquid sulphur products – thiosulphates – are also favoured in some countries and regions, particularly in North America and Europe.

Thiosulphates offer sulphur in both immediately plant-available form and in slower release form available to plants over a longer period of time. Thiosulphates also have a modest acidification effect, benefitting crops growing on alkaline (calcareous) soils. Providing sulphur to crops by applying thiosulphates offers a number of specific benefits:

- enhances crop protein and chlorophyll content;

- assists the synthesis and functioning of enzymes in the plant;

- optimises fertilizer efficiency by stabilising nitrogen;

- improves availability of nutrients in the soil, particularly phosphorus and micronutrients and their uptake by the crop;

- energy efficient assimilation in the plant;

- provides prolonged sulphur nutrition;

- a controlled and localised pH adjustment effect in the soil.

References