Sulphur 402 Sept-Oct 2022

30 September 2022

Industrial and feed phosphates

INDUSTRIAL PHOSPHATES

Industrial and feed phosphates

While most sulphuric acid demand for phosphates is based on the production of phosphate fertilizer, non-fertilizer sources of demand such as animal feed and industrial processes additionally represent a relatively small but growing sector of the market.

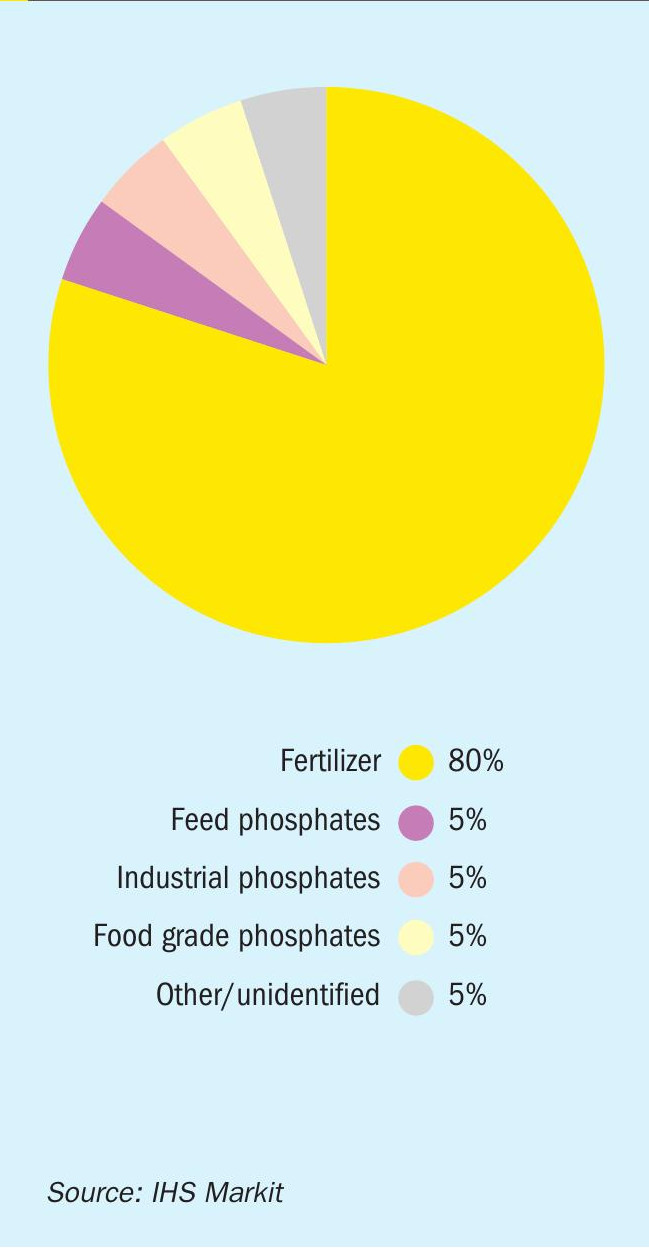

Phosphates are crucial for living creatures; the very backbone of the DNA molecule consists of phosphate chains, and phosphates are used plasma membranes, and as energy containing molecules such as adenosine phosphates. For this reason the phosphate industry is intimately bound up with food and agriculture. The market for phosphates is of course dominated by the use of phosphates as plant fertilizer, as shown in in Figure 1. Phosphate fertilizer represents 80% of the market for processed phosphates. However, in addition to this there are other important sectors, including phosphates used in animal feed (feed phosphates), and those used as additives in human food and drink (food grade phosphates). Finally, there is also the industrial phosphate sector.

Feed phosphates

Just as with humans, a lack of phosphorus in an animal’s diet can lead to health problems such as bone malformation or rickets, as well as poor uptake of nutrition from feed and, in ruminants such as cows, reduced rate of milk production. Feed phosphates are therefore added to animal feed to ensure that the animal achieves optimal growth, fertility and bone development, alongside nutrients such as calcium and magnesium. They are often associated with improvements in the quality of meat and dairy products, including greater tenderness in meat, higher calcium content in milk and higher selenium content in eggs.

Most (around 90%) of the feed phosphates used in agriculture are calcium phosphates in various forms, including monocalcium phosphate, dicalcium phosphate, and tricalcium phosphate. The addition of calcium in the animal’s nutrition is to assist bone development and other aspects of growth. Breeding animals (e.g., egg-laying chickens, sows and dairy cows) generally have higher calcium phosphate requirements. Younger livestock also benefit more from additives versus older herd members, as this helps to optimise bone growth during their early development stage.

Overall, world demand for feed-grade phosphate additives is estimated at around 7 million t/a of product or about 3 million t/a P2 O5 , equivalent to a 5% share of overall phosphorus demand, although it is worth remembering that, since 30-35% of the world’s crop output is ultimately used as animal feed, animal husbandry in effect claims around 18 million t/ a P2 O5 of phosphate demand, or roughly 30% of the total phosphate market. Geographically, feed phosphate demand is concentrated in China, with Europe, Brazil and the US also major consumers. These four markets represent about 80% of feed phosphate demand between them.

Growth in the sector is projected to be 3.5-4.5% AAGR over the next five years. Rising meat and meat product consumption in Asia is a major market driver, along with nutrient requirements for poultry production in the US and pork and poultry production in Europe. Increasing prevalence of livestock diseases is also driving increased consumption to improve animal health. Negative growth factors include the high cost of phosphates and the availability of alternatives such as phytase and distillers’ and brewers’ grains, and a slow switch away from meat consumption towards plant-based foods in the developed world.

In an article last year in our sister publication Fertilizer International (issue 505, Nov/Dec 2021), IHS Markit predicted an overall positive demand outlook for the feed phosphate sector, with growth likely in those markets that are currently consuming feed phosphates at a sub-optimal level, spurred on by rising populations and a still-growing appetite for animal protein in the diets of people in emerging economies. There may also be a boost in demand for aquaculture-grade products from the growing adoption of fish farming and commercial algae production, and uses such as shrimp farming in southeast Asia.

Phosphate food additives

Food grade phosphates are used as additives in a number of processed food products in order to incorporate a variety of different properties. For example, they act as emulsifiers in processed cheese and tinned soups; as a raising agent in baked goods; to hold moisture in processed meats such as sausages; as a flavour enhancer in carbonated drinks like colas; and as accelerants, dispersants, precipitants, flow agents, buffers, bases, acidity regulators etc. All of these combined are roughly equivalent to the market for animal feed additives; around 3 million t/a P2 O5 . Increasing consumption of processed foods is driving market growth of 5-5.5% year on year.

However, there are concerns about the amount of phosphate that is being consumed in some countries. The human body only absorbs around 50% of phosphates that occur naturally in food, but around 90% of processed phosphates/ High phosphate intake can be associated with kidney problems in vulnerable groups. The European Food Safety Authority has recommended a maximum levels of processed phosphate intake of 1,000 mg/day, and the US recommended daily allowance is 700 mg/day, but people who eat a lot of processed food routinely consume double that amount or more. At present there is no evidence to suggest that high phosphate levels are an issue for healthy individuals, but there are campaigns for better labelling of products in both the US and Europe.

“Rising meat and meat product consumption in Asia is a major market driver.”

Industrial phosphates

Industrial phosphates are used in a broad range of end uses including detergents and personal hygiene products. Phosphates and derivatives are also used in the construction industry. Polyphosphoric acid is used as a modifier for asphalt to prevent agglomeration, and tripolyphosphates are used in cement to delay setting. Sodium trimetaphosphate is used in plasterboard as a firming agent, and it is also used in paints to make pigments disperse more evenly. Phosphates are also used in the pharmaceutical industry as excipients (non-active carriers of the pharmaceutical), in water treatment for corrosion resistance and pH control, to prevent corrosion in metal finishing and electronics, and in flame retardant applications such as fire extinguishers, and flame retardant furniture and curtains.

Detergents used to be the largest end use for industrial phosphates, with sodium tripolyphosphate widely used as a chelating agent for sodium and potassium ions, leading to more efficient cleaning, as well as preventing corrosion and dispersing dirt particles. However, the subsequent presence of large quantities of phosphate in waste water led to algal growth in water courses into which waste water was drained and consequent eutrophication and effects on fish and other creatures. As a result, environmental pressure on the detergent industry to reduce the phosphate content of detergents, especially dishwasher tablets, has led to a significant decline in consumption in Europe and North America over the past decade. This has been balanced by a rise in use in countries such as China. Chinese consumption dominates the use of industrial phosphates, with around 50% of the market, with the US and Europe the next largest consumers at around 15% each. More recently, producers in North America and Europe where consumption has been declining have begun to identify new markets in food, horticulture, and water treatment applications, and overall industrial phosphate consumption is forecast to rise roughly in line with GDP.

One area which may see above trend growth however is in the battery sector. Phosphorus is a component of lithium iron (Fe) phosphate (LFP) batteries. A combination of low cost, low toxicity, high thermal stability and good electrochemical properties make LFP batteries a potential replacement for lead acid batteries in applications such as automotive and solar power, provided that charging systems are configured not to deliver excess charge. LFP batteries can sustain up to 10,000 charging cycles; roughly 10 times that of a lithium ion battery. Use is projected to more than double over the next five years.

Costs

The main raw materials for industrial and food phosphates are phosphate rock, merchant grade acid (MGA) and sulphur. Over the past two years, prices of these have all risen significantly. Phosphoric acid prices, which spent much of the 2010s at $600-700/t, peaked above $2,000/t in early 2022. These cost pressures encourage substitution, especially in the animal feed sector, where agricultural margins can be thin. Nevertheless, overall, non-fertilizer phosphate markets are likely to grow at 3-4% year on year over the next few years, roughly comparable with long term trend growth in the fertilizer phosphate sector.