Sulphur 402 Sept-Oct 2022

30 September 2022

Price Trends

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

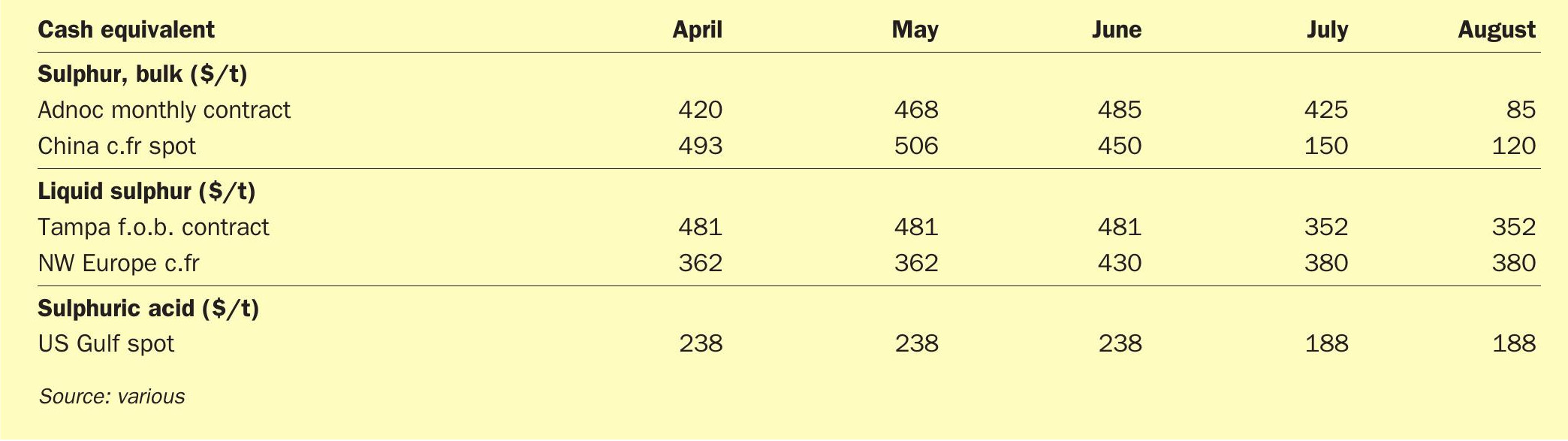

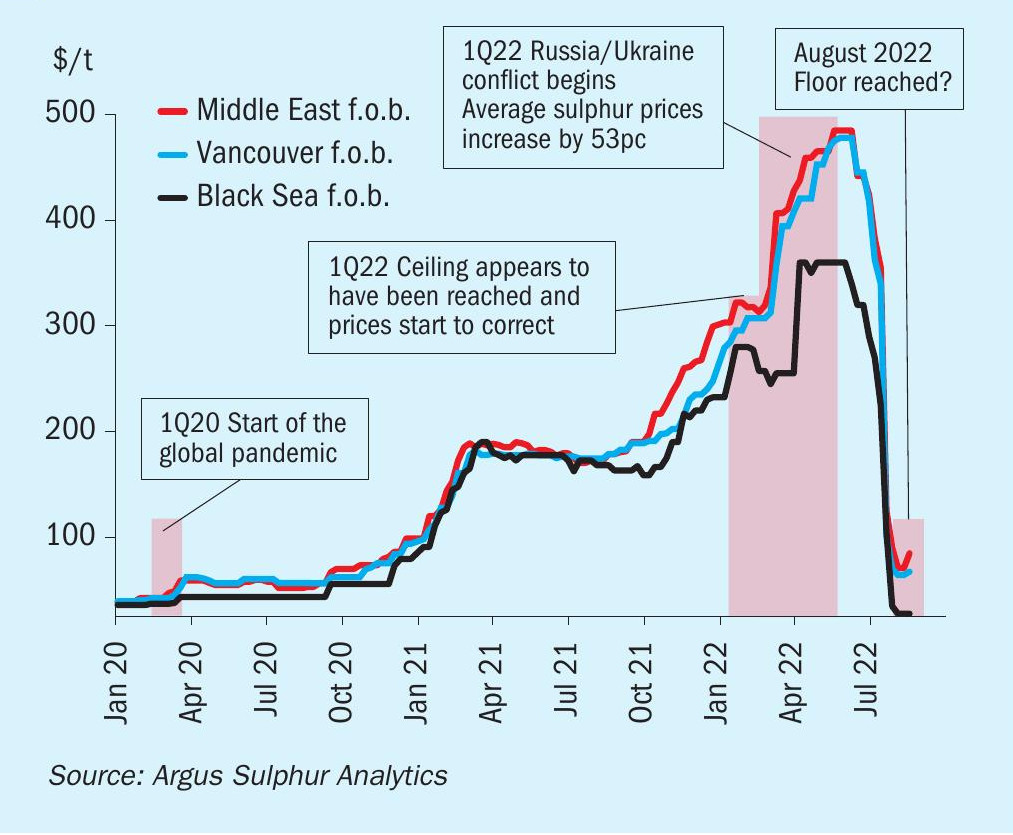

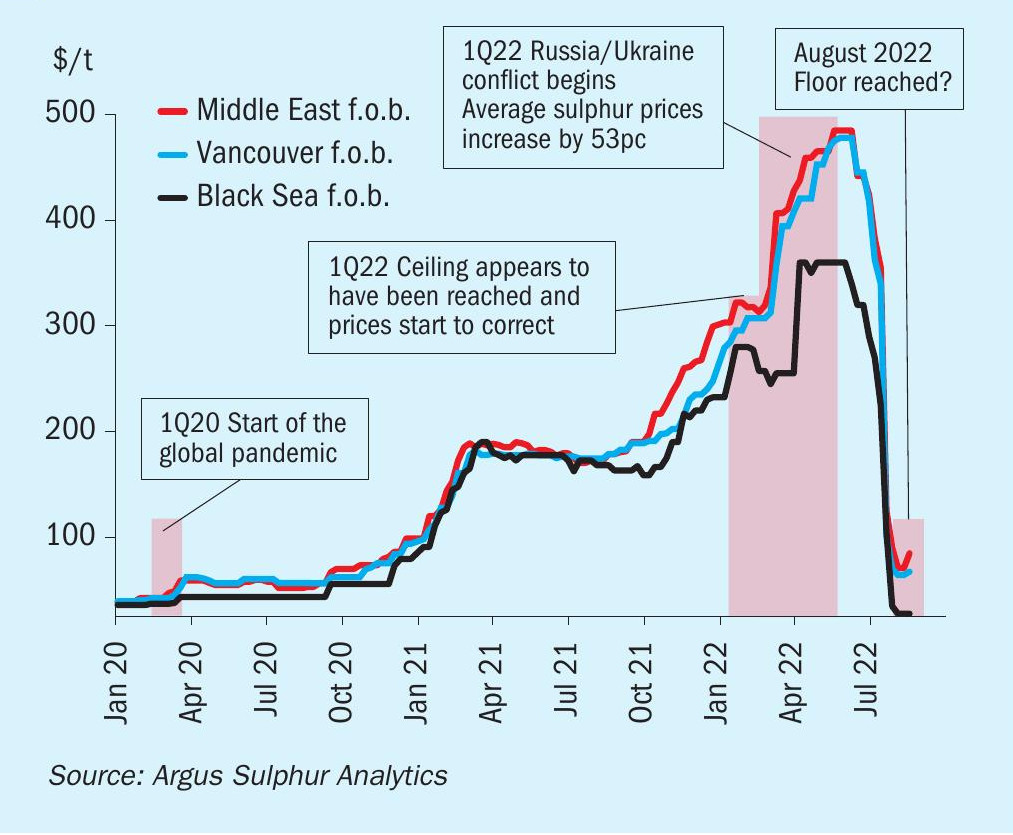

The global sulphur market has seen a marked shift since the early part of the third quarter, with major benchmarks falling by more than $300/t in many regions. Restrictions on the export of processed phosphates from China led to rapid demand destruction. The demand outlook for phosphates for the fourth quarter of this year and the first quarter of 2023 is a weak one, owing largely to affordability concerns. This in turn will cut demand for sulphur and impact pricing. On the supply side for sulphur, operating rates at refineries are expected to remain elevated as the market continues to replace sanctioned Russian oil and gas. This will help keep sulphur availability healthy, putting more downwards pressure on pricing in some regions.

The recent crash in global sulphur pricing started in China. Several unsold vessels were being used as floating storage at a time when demand was low, leading to the initial price drop. Average prices dropped from a high of $485/t f.o.b. Middle East in June 2022 down to just $71/t f.o.b. at the start of August. Since then, prices appear to have reached a floor and a recovery is underway, albeit this is currently expected to be short-lived amid demand destruction and ample availability.

The recent sulphur price crash has led to comparisons bring drawn with the last time prices dropped at such a dramatic rate in 2008. Sulphur prices collapsed within three months of the July 2008 spike in the wake of the global financial crisis with 2009 becoming a year of low prices, reaching negative netbacks in many cases. At the peak, average prices reached $825/t f.o.b. Middle East, dropping down to $32/t during the market collapse. Following the sulphur price crash in 2008-09 sulphur prices remained at much lower levels in a stable to slightly firm trend for several months before running back up into the $100s/t f.o.b. again. The price cycle this time is expected to face sustained downward pressure from the processed phosphates market.

Average Middle East prices decreased by $332/t between the end of June 2022 and the beginning of September 2022 down to $92/t f.o.b. and are around $200/t lower than prices at the start of the year. Kuwait’s KPC set its September sulphur lifting price at $95/t f.o.b., up by $5/t from the August price. Muntajat set its September Qatar sulphur price at $89/t f.o.b. Ras Laffan/ Mesaieed, up by $12/t from the August QSP of $77/t f.o.b. This follows the substantial drop from July to August of $351/t, and indicates the rebound seen in the market following the steep drop from the highs reached in June. Meanwhile ADNOC set its September official sulphur price (OSP) for liftings to India at $92/t f.o.b. Ruwais, up by $7/t from the August price of $85/t f.o.b.

Moroccan fertilizer producer OCP renegotiated its third quarter contract price with Middle East suppliers at $70-120/t c.fr. Suppliers accepted the need for the unprecedented renegotiation following the collapse of the sulphur market. Import demand for Morocco has been slow following the slight uptick in the first half of the year as a result of lower processed phosphate fertilizer production. This is adding to the bearish tone for the short term view. The ammonia market remains a risk factor for the sector. The rising cost of energy through the northern hemisphere’s winter season will push feedstock costs up further. This coupled with the potential for softer phosphate fertilizer prices is likely to squeeze producer margins and impact sulphur demand.

The China c.fr all forms range was assessed by Argus at $55-140/t c.fr at the start of September, with the low end reflecting molten product and the high end granular sulphur. Average prices increased by around $23/t through the month of August but were around $140/t lower than at the start of 2022. China imports increased in January-July by 1% year on year to 4.8 million tonnes. South Korean and Japanese molten sulphur imports combined totalled over 1 million tonnes over the period, marking a significant increase. This was likely because of the broad price differential with solid sulphur. Middle East supply to China was led by the UAE, the second largest supplier so far this year after South Korea at around 600,000 t.

Future supply of molten sulphur is likely to be impacted by changing dynamics in the energy sector in the region. Japanese refiners are pushing ahead with plans to cut capacity in anticipation of reduced domestic demand for oil products, despite recent strong profit margins that have been boosted by soaring product prices as a result of the Russia-Ukraine conflict. Domestic demand for refined products is forecast to edge down in 2022-23, following the post-pandemic rebound in 202122, averaging just over 2.6 million bbl/d.

SULPHURIC ACID

With sulphur prices dropping so dramatically, the acid market has not been shielded from the downturn. A more bearish tone has emerged, leading to a price correction, expected to continue through the coming months. Average sulphuric acid prices in NE Asia have dropped over the last quarter. Prices from China have declined by $88/t at the mid-point while South Korean and Japanese export prices are down by $46/t. The downturn has come on the back of demand losses, a softer processed phosphates market and the sulphur market price crash. NW European f.o.b. prices have also been impacted by the bearish tone, with average prices dropping by $66/t on the previous quarter. Delivered acid prices have also moved down. Indian prices dropped sharply by over $100/t at the mid-point. The Chilean market has softened with ample supply at terminals with short term spot demand unlikely to pick up. In North Africa, OCP/ Morocco has remained out of the market, adding to the bearishness.

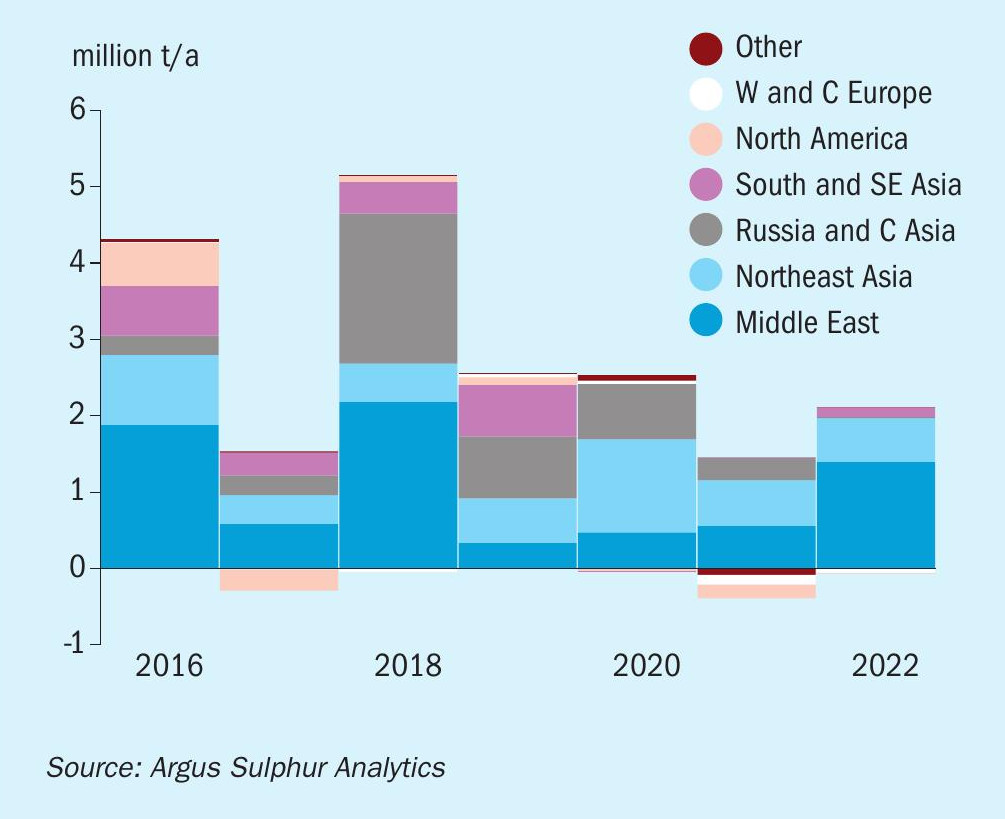

Global sulphuric acid demand is expected to rise by just 2.3 million tonnes in 2022 on 2021 levels because of demand destruction in the processed phosphates sector. Total phosphoric acid demand is forecast to drop by 3.7 million t/a before recovering in 2023. Moroccan acid demand will rise by 3.4 million t/a by 2023 but production from sulphur burners will also rise as OCP brings on new capacity. Total consumption is forecast to rise to close to 25 million t/a in 2023.

On the supply side we expect this to rise by 21.7 million t/a in the 2021-23 period. Smelter-based capacity is expected to see a boost at 4.4 million t/a, representing 20% growth over the period. Northeast Asia is the main driver as new smelters ramp up in China.

The weaker tone in the base metals markets is also adding to the softer outlook for acid. Bearishness in copper markets since 2Q22 has been attributed to several factors, but China’s sluggish recovery from Covid-19, global interest rate hikes and subsequent recession fears are key to understanding why many markets have been dropping in value. Copper prices on the London Metal Exchange (LME) fell to a 20-month low on 15 July, trading at $7,000/t. Prices have since recovered to around $7,500-$8,000/t but are still just 80% of what they were in April 2022.

On 16 August, the LME banned Russian-origin nickel from its two approved warehouses in the UK exported on or after 20 July. Russia is the world’s top supplier of Class 1 nickel, and the country’s mining group Norilsk Nickel the biggest source of European supply. The move by the LME will act to increase tightness in the market. Nickel prices are expected to find more support because of demand from the EV sector in the long term, even with market sentiment remaining cautious at present.

Metals producers in the Central African region continue to face mounting production costs against a backdrop of declining base metals prices. High energy costs and inflationary pressures are squeezing mining firms’ margins. The ramp-up of Ivanhoe Mines’ Kamoa Kakkula copper mine in the DRC is boosting regional demand for trucking, tightening access to transport facilities for other operations. Acid demand for the metals sector is expected to total 8.3 million t/a in 2022 but this could be revised down as mines potentially underperform in the current circumstances.

Over in China the Daye Non-Ferrous Copper project is close to starting up but has continued to face delays. The project was initially expected to reach completion in 2021 but Covid-19-related disruption led to postponement. The smelter had pushed start-up to mid-June from late 2021 because of a delay in the shipments of its imported equipment and parts. Start-up is now expected during the second half of this year. Sulphuric acid capacity is 1.5 million t/a and 400,000 t/a of copper. Daye Non-Ferrous Copper has resold some feedstock deliveries in July and August to the spot market and has requested its suppliers to postpone some deliveries originally planned for August and September.

Chinese sulphuric acid exports totalled 2.6 million tonnes in the first seven months of the year. This is a 92% increase on the same period a year earlier. Not only this but full year 2021 imports were 2.8 million t/a.

PRICE INDICATIONS