Fertilizer International 510 Sept-Oct 2022

30 September 2022

Water-soluble fertilizer products and producers

MARKET REPORT

Water-soluble fertilizer products and producers

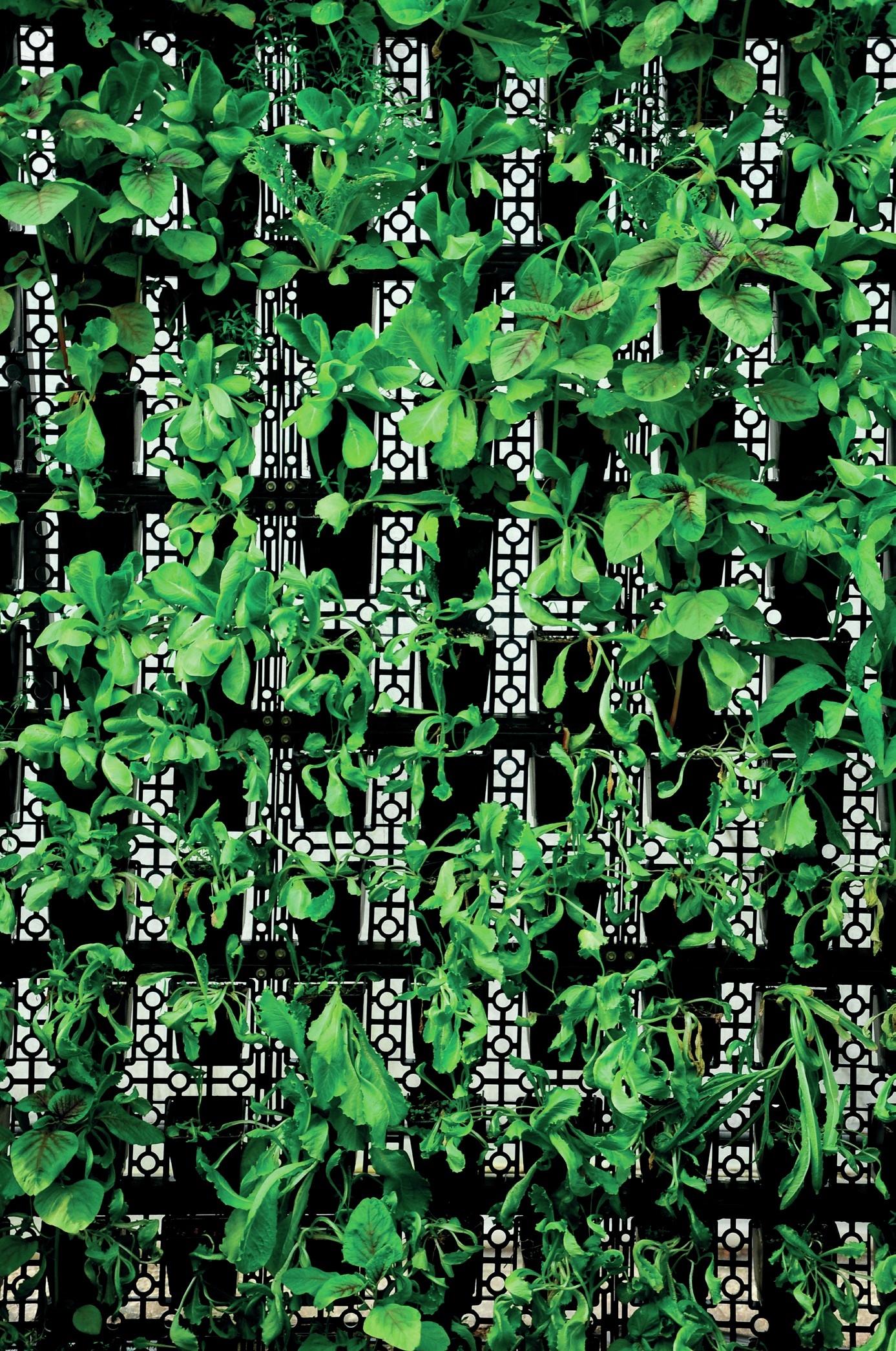

Applying dissolved fertilizers via micro-irrigation systems or leaf sprayers offers commercial fruit and vegetable growers clear-cut gains – in terms of input costs, nutrient use efficiency, labour, time and energy.

Water-soluble fertilizers (WSFs) occupy a niche but strongly growing segment of the global fertilizer market. The world market for WSFs – valued at $14-15 billion according to some estimates – generates around $3.6 billion in wholesale revenues annually1 .

Recent global sales volumes are estimated at 3.6 million t/a, up by around 360,000 tonnes in two years, a rise of more than 10 percent. East Asia and Europe are the leading regional consumers of WSFs with a market share of 33 percent and 23 percent, respectively. Latin and North America combined are also responsible for a further 24 percent of world WSF consumption1 (Figure 1).

These figures are based on a 2019 market assessment by Rams & Co commissioned by the International Fertilizer Association (IFA)1 . A separate 2019 assessment by CRU estimated total WSF demand at 4.3 million tonnes2 . This represents roughly 55 percent of the total global market for calcium nitrate (CN), technical monoammonium phosphate (tMAP), mono-potassium phosphate (MKP) and potassium nitrate (NOP). This excludes other end markets for these products such as foodstuffs, industrial products, open-field agriculture and liquid fertilizers2 .

Applying fertilizers in dissolved form, via irrigation systems or leaf sprayers, offers commercial vegetable and fruit growers clear-cut cost gains, in terms of input costs, nutrient use efficiency, labour, time and energy. The adoption of WSFs also comes at a time of agricultural intensification – the drive to get more crop per drop and per acre – a trend that is in turn linked to constraints on water and land availability.

The market for WSFs is split between fertigation, with a two-thirds share of consumption, and foliar applications which account for most of the remaining one-third of usage.

Key market drivers

Growing demand for WSFs has been a natural consequence of the adoption of drip irrigation systems in fruit and vegetable growing. The rise of fertigation – the delivery of water-soluble fertilizers via drip irrigation systems – has been a particular strong driver of market growth.

Globally, almost 16 million hectares of cropland are now watered via drip irrigation – also known as micro-irrigation. Adoption is particularly high in China, the US, India, Spain, Turkey and Iran (Figure 2).

CRU also attributes WSF market growth to the rising adoption of micro-irrigation, as well as other drivers such as:

- Increasingly sophisticated agricultural technologies

- Higher nutrient efficiency targets

- Expanding fruit and vegetable cultivation.

Micro-irrigation in turn is being driven by the need to optimise agricultural water use in countries with growing populations and rapidly rising water demand, suggests CRU2 .

Generally, only high value crops such as fruit, vegetables and tree nuts justify the premium price of WSFs. The land devoted to such crops, however, now accounts for around nine percent of global crop area (120 million hectares) and has been steadily climbing for decades2 .

Europe, where deployment of high-tech hydroponic and micro-irrigation systems is relatively widespread, represents a sizeable and mature market for WSFs. The WSF market in Africa has also benefitted from the growth in horticulture to serve the European market and the attendant rise in micro-irrigation that has accompanied this.

The scale of the WSF market in North America, in contrast, has been constrained historically by competition with liquid fertilizers (Fertilizer International 508, p18). and relatively weak vegetable cultivation in the region. India, meanwhile, is a small (around 150,000 t/a) but skyrocketing growth market for WSFs1 .

The world market for WSFs is forecast to grow at around 5-7 percent p.a. during the current decade to reach 6.4 million tonnes by 20281 . Underlying long-term growth fundamentals remain good, with the strong expansion potential for fruit and vegetable growing in Asia providing a particularly strong demand push. The future trajectory of Chinese agriculture – including tighter environmental regulation, rising labour costs and efficiency improvements – also offers favourable growth prospects1 .

The water-soluble fertilizer market can be divided into four main product categories (Figure 3):

- Potassium nitrate (NOP)

- Calcium nitrate (CN)

- Water-soluble phosphates – mainly monoammonium phosphate (MAP) supplemented by monopotassium phosphate (MKP)

- Potassium sulphate (SOP)

Potassium nitrate (NOP)

Potassium nitrate (KNO3 ) is a soluble source of two major and essential plant nutrients. It is typically marketed as a speciality NK (13-0-45) fertilizer for higher value crops that prefer chloride-free potassium and the nitrate form of nitrogen (Fertilizer International 503, p28). The fertilizer – also known as NOP (nitrate of potash) – is commonly sold in water-soluble crystalline form for fertigation and foliar use or as prills for soil application.

The total value of the world potassium nitrate market – including both agricultural and industrial segments – reached $ 1.66 billion in 2021, and is projected to grow at more than three percent p.a. to reach $2.02 billion by 2027.

Potassium nitrate is a high-value niche product with a two percent share of the global potash market. World production capacity (primary and secondary) is around 1.3 million tonnes K2 O. On a product basis, the size of the global market for agriculture was estimated at 1.8 million tonnes in 2016. Production was forecast to grow at around four percent p.a. out to 2021.

Leading global producers and products include:

- SQM: Ultrasol K and Ultrasol K plus and Qrop K

- Haifa Group: Multi-K

- Yara International: UNIKA PLUS and KRISTA K/ULTRASOL™ K PLUS

- Kemapco

- Uralchem: Solar Potassium Nitrate

- Kingenta l Wentong Group

- Migao Corporation.

Prayon also markets Kemapco potassium nitrate as part of its Hortipray product portfolio.

Chile’s SQM is the world’s largest supplier and exporter of potassium nitrate. The company is a primary producer and sources nitrates from natural caliche ore and brine deposits in northern Chile. Its production complex at Coya Sur includes four potassium nitrate plants with a total capacity of 1.3 million t/a.

SQM’s largest international competitor is Israel’s Haifa Group with a potassium nitrate production capacity of around 300,000 t/a. Haifa is a secondary producer, manufacturing crystalline, prilled and special grades of potassium nitrate from ammonia and nitric acid. These are sold as standalone products and also incorporated into water-soluble NPKs and controlled-release fertilizers. Haifa helped pioneer the use of potassium nitrate in the fertilizer market and its high-quality Multi-K product portfolio remains a market-leading brand.

Jordan’s Kemapco, a fully-owned subsidiary of the Arab Potash Company (APC), is a major primary producer. Its main markets are Europe, Mediterranean countries and Asia. Kemapco successfully completed a $19 million expansion project in May 2018. This has raised its annual production capacity by nearly 30 percent, from 135,000 tonnes to 175,000 tonnes. A feasibility study for a second expansion to double Kemapco’s current production is currently underway.

China is a key market for potassium nitrate, with annual demand from agriculture estimated at 400,000-420,000 tonnes, although this is largely fulfilled by domestic producers. The country currently imports just 20,000-30,000 tonnes of potassium nitrate annually. China’s tobacco growers and horticultural sector are the main consumers, with an annual requirement of around 130,000 tonnes and 120,000 tonnes, respectively.

The Qinghai Salt Lake Nitrate Industry Stock Co – part of Chinese chemicals conglomerate Wentong Group – is said to have a potassium nitrate production capacity of 400,000 tonnes. It was formed in 2016 from the merger of Qinghai Salt Lake Yuantong Potash Fertilizer Co with Qinghai Wentong Yanqiao Fertilizer Co.

The Migao Corporation operates an 80,000 t/a capacity potassium nitrate production plant in Sichuan and a 400,000 t/a capacity potassium nitrate/NPK plant in Yunnan. The company’s secondary production process is based on combining potassium chloride with ammonium nitrate. SQM constructed a 40,000 t/a potassium nitrate production unit in China as part of a joint venture with Migao dating from 2008. This plant has been operational since 2011.

Calcium nitrate (CN)

The calcium nitrate (CN) market and its key producers are outlined in our article on secondary nutrients (Ca and Mg) on page 28.

Monoammonium phosphate (MAP)

The water-soluble phosphates market (Fertilizer International 497, p48) is a sizeable global market of almost one million tonnes3 – roughly equivalent to around 25 percent of the total world market for WSFs. Main products include:

- Monoammonium phosphate (MAP, 12-61-0)

- Monopotassium phosphate (MKP, 0-52-34)

- Phosphoric acid

- Diammonium phosphate (DAP, 18-46-0)

- Urea phosphate (UP, 18-44-0)

- Polyphosphates

MAP and MKP combined account for almost 90 percent of consumption. MAP is the dominant product in the global marketplace, with a market share of more than 70 percent3 .

MAP is by far the most widely produced and consumed type of water-soluble phosphate globally. World consumption is around 680,000-690,000 t/a, with China alone accounting for almost six-tenths of the global market. The EU, Latin America – particularly Brazil and Mexico – and Mediterranean countries such as Turkey also represent sizable regional markets for water-soluble MAP3 .

Average global growth in the water-soluble MAP market (4-5% p.a.) masks distinct regional variations. Much strong growth prospects in Asia (14% p.a.) contrast with the more stagnant growth rates (1-2% p.a.) seen in the mature markets of North America and the EU3 .

Global water-soluble MAP production capacity is circa 695,000-745,000 t/a, with the majority of this capacity (400,000450,000 t/a) being located in China. Major global producers include3 :

- Prayon: 70,000 t/a capacity

- Israel’s ICL Specialty Fertilizers and Haifa Group: combined 75,000 t/a capacity (including MKP)

- Russia’s Uralchem, GMZ and Euro-Chem: 70,000 t/a capacity combined

- North America’s Innophos: 50,000 t/a capacity

- China’s Monband and Kingenta with 30,000-40,000 t/a and around 60,000 t/a capacity, respectively.

Having rapidly expanded its production capacity since 2010, China now dominates global production, consumption and trade in highly water-soluble, technical-grade monoammonium phosphate (tMAP), according to CRU. China and Russia have both emerged as major tMAP producers in recent years taking market share from incumbents in Europe and Israel. New North African entrants are also capturing export volumes from established producers. Global tMAP exports have grown rapidly over the past decade to reach around 600,000 tonnes p.a., CRU estimates2 .

Monband (Hebei Monband Water Soluble Fertilizer Co), founded in 2009 and headquartered in Shijiazhuang, Hebei, was one the first Chinese companies to register and produce water-soluble fertilizers. The company has been one of China’s biggest suppliers of technical-grade MAP and water-soluble fertilizers since 2013. It currently operates six water-soluble fertilizer production lines with a combined annual output of 60,000 tonnes. These produce water-soluble MAP, MKP, NOP, NPK with micronutrients and SOP.

Monband also produces 20,000 tonnes of granular fertilizers annually from two production lines, and has a further three production lines dedicated to liquid fertilizers. Its main product lines include ammonium sulphate, calcium nitrate, technical-grade MAP and MKP.

The company exports around 50-60 percent of its output, supplying speciality fertilizers to more than 50 countries globally. Its main international markets are Southeast Asia (50%), Africa (30%) and South America (20%).

Prayon has been manufacturing horticultural phosphates in Europe for over 40 years. The Belgian company markets a comprehensive range of water-soluble fertilizers. These were consolidated under the single Hortipray® brand in 2011. The Hortipray® range of fertilizer products are designed for application to fruits, vegetables, flowers and plants by fertigation. All these products are recognised for their purity and high solubility. They include:

- Monoammonium phosphate (MAP)

- Monopotassium phosphate (MKP)

- Potassium nitrate (NOP)

- micronutri Fe

- Pbooster

Notably, Prayon also markets the Hortipray® anticalc range of water-soluble fertilizers for fertigation. This includes ‘anticalc’ versions of both of its standard Hortipray® MAP and Hortipray® MKP products. These prevent the build-up of limescale and phosphates on irrigation pipes and the growth of bacteria. This reduces the risk of blockages and uneven irrigation. It also extends the life of irrigation pipes.

Monopotassium phosphate (MKP)

Fertilizer-grade monopotassium phosphate (MKP) is a high-analysis product (0-52-34) that provides plants with a concentrated supply of both potassium and phosphorus. MKP is primarily marketed as a speciality fertilizer for use on high-value crops. Its high purity and water solubility makes it ideal for hydroponics.

MKP is fully water-soluble with a low salt index and is free of chloride, sodium and other deleterious constituents. It can be used as a buffering agent in fertigation solutions due to its moderately low pH. Applications are said to increase the sugar content of fruit crops. Its use is especially valuable in situations where nitrogen fertilization needs to be limited.

Estimates of world MKP production vary widely, although a recent CRU study reported global production of around 500,000 t/a and exports in excess of 200,000 t/a2 . Despite China taking a growing production share over the last decade, ICL and Haifa remain significant MKP producers/exporters and – together with Prayon – are the most important manufacturers outside of east Asia2 .

Israel’s ICL Specialty Fertilizers (Nova PeaK) and Haifa Group (Haifa MKP) both have the capacity to produce around 35,000 tonnes of MKP annually, with Belgium’s Prayon (Hortipray MKP) producing a further 20,000 tonnes each year. Yara International (YaraTera Krista MKP) is another notable producer.

Historical growth set to continue

The adoption of water-soluble fertilizers is part of a wider shift to more lucrative speciality products within the global fertilizer market. More than 20 million tonnes of speciality fertilizers were consumed globally during 2018, excluding micronutrient products. Although this still represents a minor – if growing – proportion of overall sales volumes, the higher margins achieved by speciality products generated $5 billion in added-value for fertilizer producers1 .

Historical growth in the WSF market (circa 6% p.a.) has been driven by the adoption of micro-irrigation, as well as wider market factors such as the need for crop quality and yield improvements, better water and nutrient use efficiency, and environmental concerns over greenhouse gas emissions and eutrophication.

Looking ahead, the positive growth of the last decade is likely to be maintained, supported by production cost reductions and technological advances. There are early signs that the rise of speciality products, in general, marks a fundamental shift away from commodity fertilizers (market de-commoditisation) and their future move into the mass market as mainstream products1 .

References