Sulphur 404 Jan-Feb 2023

31 January 2023

A looming sulphur shortage?

SULPHUR

A looming sulphur shortage?

Last year attention was drawn to the potential for large scale decarbonisation to leave the world short of the key resources of sulphur, and hence sulphuric acid. But is there a global sulphur shortage on the distant horizon?

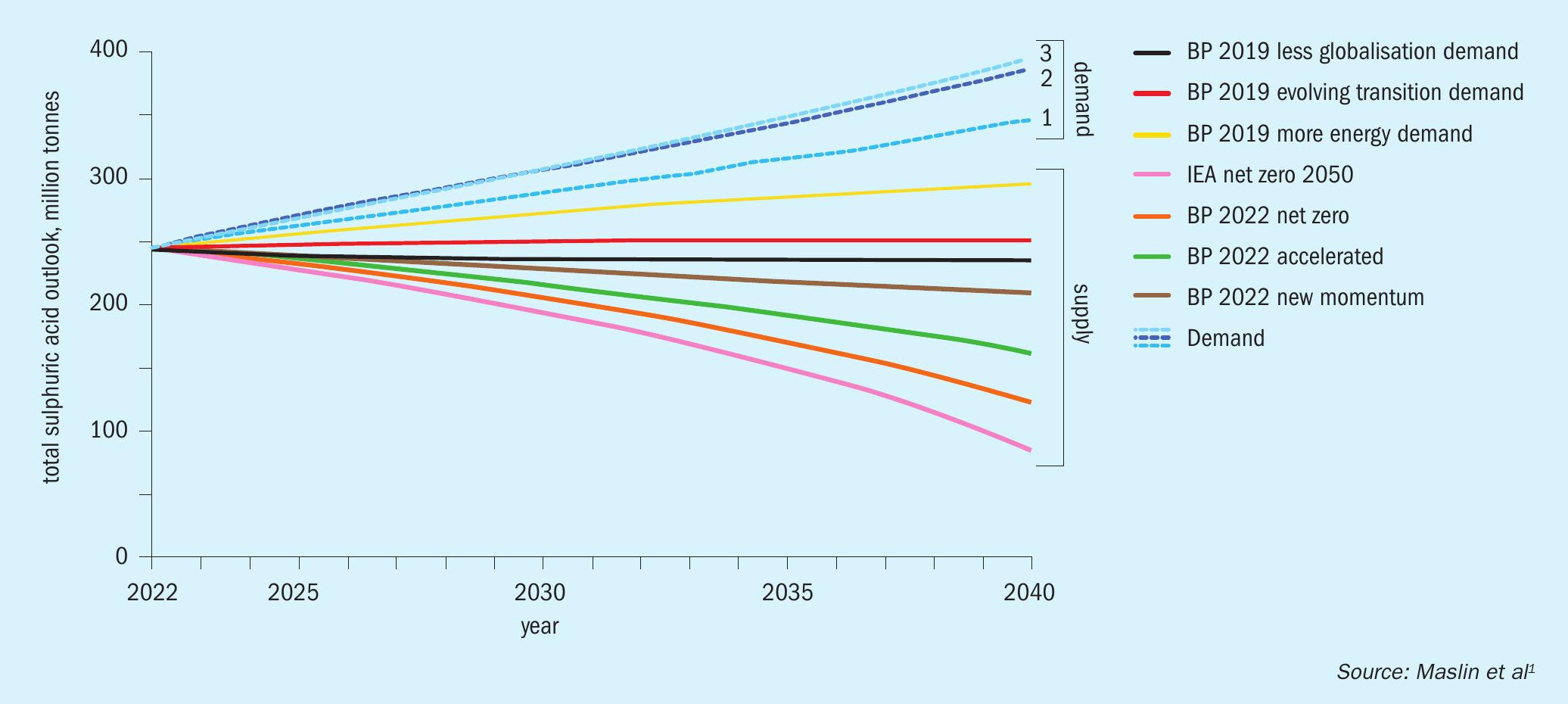

The article was written by professor Mark Maslin of University College, London, and published in The Geographical Journal; the journal of the highly regarded Royal Geographical Society1 . It projected forward sulphuric acid demand to 2040, ending up at a figure of 400 million t/a, and looked at what the reduction in sulphur supply from oil and gas might be under various future scenarios being examined by BP as part of its transition away from being a fossil fuel company. The conclusion was that under an optimistic forecast there would be a shortfall of 100 million t/a of acid supply, and under a pessimistic one up to 320 million t/a, or 80% of the requirement by 2040.

This is certainly a worrying prospect, and it echoes other warnings, including ones from within the industry. In 2012 at the CRU Sulphur Conference, Dr Peter Clark of Alberta Sulphur Research highlighted the potential shortfall in sulphur from reduced oil consumption2 , and this was followed up with a joint paper with Angie Slavens in 20183 . Dr Clark’s forecast was in some ways less gloomy, but mainly because he forecast a far slower phaseout of fossil fuels than the studies used by Maslin. Even so, he foresaw a shortfall by 2030. So how worried should we be?

Sulphuric acid demand

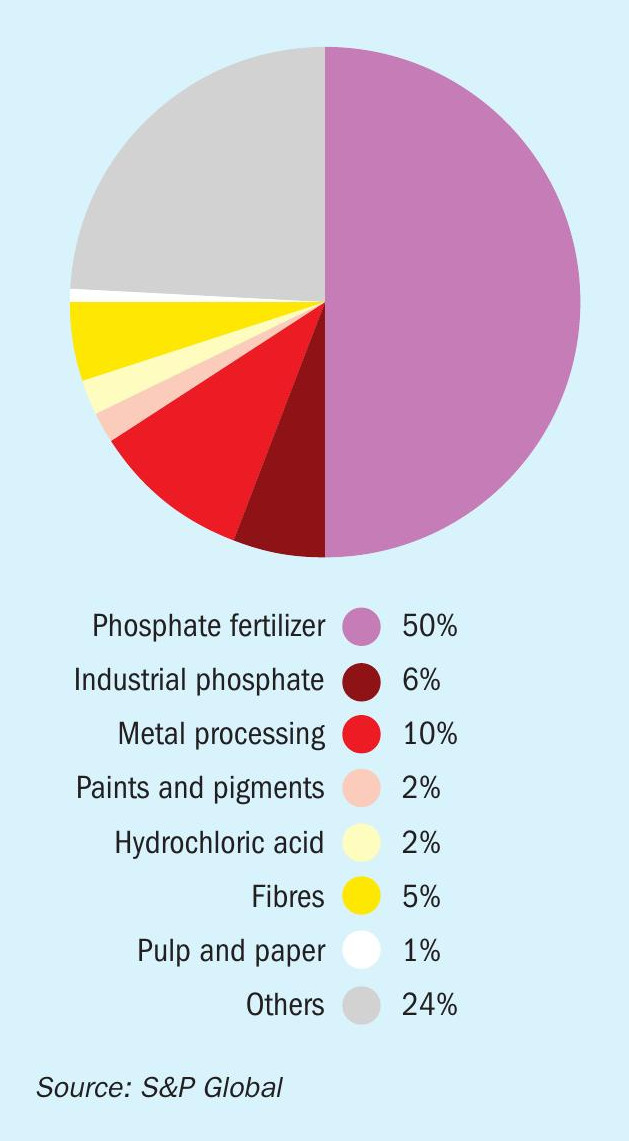

Sulphur remains one of the key raw materials for the modern world. Its main derivative, sulphuric acid, is the largest global industrial chemical by volume, with over 260 million t/a consumed in 2021. Its primary use is in the fertilizer industry, for extraction of phosphates from phosphate-bearing ores, but it also performs a similar function in the copper, nickel, uranium and other metal extraction industries, as well as titanium ore for paints and pigments. Other major uses are as a catalyst in refinery alkylation of gasoline, manufacture of hydrochloric acid, water treatment, and in a wide variety of industrial and pharmaceutical processes. At present, around 55% of acid goes to make phosphates – most of that destined for fertilizer use, 10% to metal processing, 2% to titanium dioxide, and a similar amount to hydrochloric acid production, 5% to production of various fibres, and 24% to the many industrial processes using it (Figure 2).

Nor is this demand for sulphuric acid likely to go away soon. Indeed, projections for this decade indicate that its use could rise to over 300 million t/a by the end of the decade, an annual rise of around 2%. If this rise were to continue at that rate, demand would have reached 370 million t/a by 2040, and 440 million t/a by 2050 (the Maslin study used a higher growth rate of 2.3% year on year to reach its figure of 400 million t/a by 2040). However, it is possible that this ‘steady state’ projection may underestimate the potential for demand growth.

Phosphates

Rapid growth is unlikely to come from the phosphate side; phosphate fertilizer demand growth has been relatively steady and has actually slowed over the past couple of decades. During the 2000s phosphate demand increased by around 3.5% year on year, but in the 2010s this slowed to an average of around 1.8% AAGR. It is also subject to short-term setbacks such as the disruption to the fertilizer market caused by high prices and lack of availability seen in 2022, leading to an approximately 9% year on year fall in phosphate fertilizer consumption last year. Nevertheless, on a long-term basis it continues to grow, albeit perhaps at around 1.5% year on year for the rest of this decade, following a correction in 2023 to bring demand back up to around the 2021 level.

It remains to be seen how long phosphate fertilizer consumption will continue to rise. Many major global markets such as the US and Europe are already relatively mature in terms of consumption, and may see falls due to increased efficiency of use and, in Europe, regulations on sourcing phosphates from sewage and other forms of nutrient recycling. China has actually seen falling fertilizer applications as it moves to greater nutrient use efficiency and tries to tackle overapplication of fertilizer and consequent deleterious environmental effects. Chinese phosphate production has also fallen due to measures to tackle pollution and overcapacity. Likewise the rate of increase of global population, which was a major driver of fertilizer consumption in the late 20th century, continues to slow. Estimates of when peak global population will be reached used to cluster around 2100 according to UN estimates, but these estimates were contingent on fertility rates in China and Japan picking up, which has not happened -if anything the reverse. Current estimates put peak global population at around 206065, and it may even be as soon as 2050. Conversely, industrialisation continues to increase, and this has driven higher calorie consumption and more intensive agriculture, requiring more fertilizer. Greater disposable income is correlated with increased protein consumption and higher fertilizer demand in developing countries. And while some markets are mature, there is still room for growth in South America, especially Brazil, and Africa in particular still has some way to go both before population levels settle to replacement values, incomes near global norms and fertilizer applications match global averages. Much of the coming growth in phosphate demand may eventually come from Africa. There is thus still long-term potential for increased phosphate fertilizer demand, and a figure of a 1.5% year on year increase may not be far wrong even out as far as 2050.

Electrification

The same is not true of metals processing, however. As the world makes greater use of electricity, especially for vehicle power trains, so demand for transition metals for batteries grows, almost exponentially at present. The International Energy Agency has estimated that global copper demand is likely to increase by 2.1-3.4 times by 2050 compared to its 2020 value, and demand for nickel and cobalt will increase by a factor of 10 times and lithium 20 times its current value. Industry figures are more conservative. BHP forecasts a 4-5 fold increase in nickel demand by 2050. Even so, that would mean that consumption would rise from just over 2 million t/a to over 11 million t/a.

How will all of this metal be extracted? Nickel processing employs a variety of forms, from pyrometallurgical processes which often leave it alloyed with iron (ferronickel and ‘nickel pig iron’) to smelting of sulphide ores. But deposits of sulphides are relatively rare compared to the abundance of oxidised laterite ores. Production of large volumes of the high purity nickel that will be required for the battery industry has increasingly looked to high pressure sulphuric acid leaching of the ore – the HPAL process, and the current expansion in electric vehicle manufacture has already seen a number of large scale HPAL plants built in Indonesia, with the potential for other large projects to be developed in Australia and elsewhere. This could see sulphuric acid requirements increase dramatically over the next decades.

Increased production of copper may not be as dramatic for acid demand because for copper the abundance of sulphide vs oxide ores is reversed compared to nickel. While acid leaching of copper will increase, this only accounts for around 20% of copper production, and there presumably will also be a corresponding increase in copper smelting, which generates sulphuric acid as a by-product and which will presumably be able to feed some of the new nickel extraction.

There is also the question of battery recycling. As global use of EVs increases, there will be increased pressure, and presumably increased cost incentive, to recycle more of these strategic metals. At the moment recycling electric vehicle batteries is an expensive process involving high temperature melting and recovery, but most forecasts assume that there will be much greater use of recycling of scrap nickel, perhaps as much as 40% by 2050.

This would reduce the need for new mined nickel and HPAL processing.

Long term acid demand

Taking these factors together, how much extra acid demand could we see? A growth in phosphate demand of 1.5% per year would mean an increase in demand of 35% from 2020 to 2040, or around an extra 50 million t/a of acid. Metal leaching could add 25 million t/a under even fairly conservative forecasts for nickel and copper, and assuming an increase in recycling. Other industrial uses would add another 70 million t/a, assuming they tracked average long term global GDP growth rates of 3% year on year. This combined would take acid demand to 415 million t/a by 2040 – higher, though not by a long way, of the projections used by the Maslin paper, which assumed 370 million t/a, and averaging around 2.35% growth per year.

Sulphur supply

Production of sulphur ‘in all forms’ was just over 90 million t/a last year. This includes sulphuric acid generated in the smelting of metal sulphide ores and acid generated from the thermal breakdown of iron pyrites. However, the majority; around 65 million t/a, came from elemental sulphur recovered from oil at refineries and from natural gas at gas plants. It is future use of these commodities which will determine the long-term supply situation for sulphur.

Future oil demand

Oil has dominated the world’s primary energy mix for nearly six decades. Although its share peaked in the mid-1970s, when it accounted for almost half of the world’s energy consumption, its demand continues to grow in absolute terms. For instance, in 2019, the world consumed more than three times the number of oil barrels per day than it did in 1965. Oil demand growth in the first two decades of the 21st century – aside from the dip caused by the covid pandemic – was just under 2% year on year. While some oil goes to heating or the production of petrochemicals, about 60% of it is used as a liquid fuel, following refining, and so it is vehicle use that dominates and will dominate demand. Within the transport sector, however, there are trends which are likely to see the rate of increase in demand fall over the next two decades. The main three are improvements in the fuel efficiency of vehicles, slower population growth and increasingly saturated markets for vehicles, similar to what we discussed earlier with the phosphate market, and, increasingly, the electrification of the transport sector.

The greatest impact may be decided by the rate of penetration of EVs into the transport market. In 2012, only 130,000 electric vehicles (EVs) were sold worldwide, accounting for 0.01% of total cars sold. By 2021, the figure was 6.6 million, representing 9% of the global car market and more than tripling the market share from just two years earlier, according to the International Energy Agency (IEA). Many developed nations are no looking to phase out the sale of new diesel or gasoline cars. The US has a target of making 50% of all new vehicles sold in the country in 2030 zero-emissions vehicles while the UK and several other European countries have announced a ban on the registration of new gasoline and diesel cars and vans by 2030. Nearly 30 countries have committed to a ban on new gasoline/diesel vehicles by 2040.

What this will mean for oil consumption depends upon whose figures you believe. BP has an optimistic forecast of up to 70% EV use by 2050, while OPEC puts its 2045 figure at only 20%. OPEC believes that global oil consumption will rise from 97 million bbl/d in 2021 to 110 million bbl/d in 2045, and puts 2035 as the time when oil demand will plateau – other forecasters have progressively brought their prediction of peak oil demand closer to the present, and 2030 is now a favourite time for this. If oil demand does peak in 2030, what matters most is how fast it falls thereafter. Most forecasts expect a prolonged plateau of several years, which would mean that sulphur recovered from oil may only rise from 35 million t/d at present to about 38 million t/a by 2040.

But some projections call for a faster decline in the use of oil in order to meet targets for carbon dioxide emissions and keep the resulting increase in global temperatures to a minimum.

Natural gas

Natural gas was the fastest growing source of energy for the second half of the 20th century, mainly for electrical power generation. It has progressively replaced coal-fired generating capacity in North America and Europe, and become the favoured energy source in the Middle East. The development of a large international market for liquefied natural gas (LNG), removing the need for long and often expensive pipelines, has allowed the gas boom to spread to new regions. Recovery of sulphur from sourer natural gas fields, beginning in Europe and North America, but now spreading to the Middle East, Central Asia and China, has been the fastest growing source of new sulphur over the past few decades.

From 1980-2000, gas demand increased by about 2.6% year on year, rising from 1.5 trillion cubic metres (tcm) to 2.5 tcm. From 2000 to 2020 the increase was 2.4% year on year, and gas demand touched 4 tcm in 2019. Gas has benefited from being seen as a cleaner form of energy than coal or oil, and thus preferred for investment decisions by government policy in various countries. The past couple of years, however, have seen something of a change in attitudes, partially due to increased pressure to decarbonise power generation and concentrate more on renewable energy, and partially because of the price hikes to gas worldwide, and especially in Europe, caused by the invasion of Ukraine and consequent attempt by Europe to boycott Russian gas. Currently the International Energy Agency is only forecasting an average annual demand increase of 0.8% out to 2025, with industrial demand, for production of hydrogen, ammonia and methanol, for example, accounting for 60% of incremental demand as compared to power generation or domestic heating. China, India and southeast Asia remain the largest growth markets. There is expected to be a shift towards more renewable power generation, especially in Europe and North America, but China has also been a pioneer in this regard. Nevertheless, urbanisation, global wealth and GDP and use of electricity in transport increases, so demand for power will rise rapidly and it is likely that demand for gas will continue to increase overall. The Gas Exporting Countries Forum (GECF) – a sort of gas equivalent of OPEC – projects that global gas demand will continue to rise, by a total of 46% from 2020 to 2050, reaching 5.6 tcm. While this is a substantial jump, it is only a 1.1% rise per annum, reflecting the increasing use of renewables.

Where this gas will be sourced from will determine how much sulphur is generated from its production. In the Middle East and China, a lot of sulphur is coming from new sour gas reserves which have remained untapped hitherto because of the extra expense and difficulty in exploiting them. On the other hand, in Central Asia gas developments have often preferred to reinject acid gas into wells because of the lack of local sulphur demand and difficulty of transporting it from a remote land-locked region. Greater use of shale gas, generally lower in sulphur content, may also affect the sulphur balance of gas production. Saudi Arabia is soon to begin tapping its large shale gas field at Jafura and projects that it will be producing 2 bcm/day from this source by 2030. Overall, it may be a reasonable assumption that the sulphur balance from gas production will remain roughly constant, with new shale gas developments balancing sour gas exploration and production. This then might mean that sulphur production from sour gas rises by about 10 million t/a out to 2040.

The acid balance

At the moment, then, combining the projections for both oil and gas, our outlook would see sulphur recovery from oil and gas rise by about 13 million t/a from 2020 to 2040, equivalent to about 40 million t/a of additional sulphuric acid production. Set against the increase in acid demand of 100-140 million t/a that we have projected, this would indeed lead to a significant shortfall in acid capacity, as the Maslin paper has argued. Prof Maslin concludes that this would mean rising acid prices, possibly pricing fertilizer production out of the market and making food production more expensive.

However, this figure does not take into account any additional acid produced by copper and other metal smelting. Remembering that copper demand is forecast to more than double over the period as the transport system electrifies, then a consequential doubling in smelter acid production would reduce that shortfall almost to nothing. If the price is right, and in the event of any shortfall, acid can also be produced, as it still is to a small extent in China, by iron pyrite roasting. Furthermore, as Maslin argues, increased use of recycling of fertilizer nutrients, more efficient fertilizer use, or switching to industrial processes that avoid intensive use of sulphuric acid could also reduce any potential acid supply shortfall. Nitric acid produced from ammonia using hydrogen generated from renewable electricity for example could be a substitute in some industrial processes.

The conclusion then would seem to be that – for the moment – there is no need to worry about a sulphur shortfall, or at least a sulphuric acid shortfall, for the next couple of decades. Beyond that, as oil use falls and gas use peaks, that situation may begin to slowly change, but we are not about to run out of sulphuric acid just yet.

References