Sulphur 404 Jan-Feb 2023

31 January 2023

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

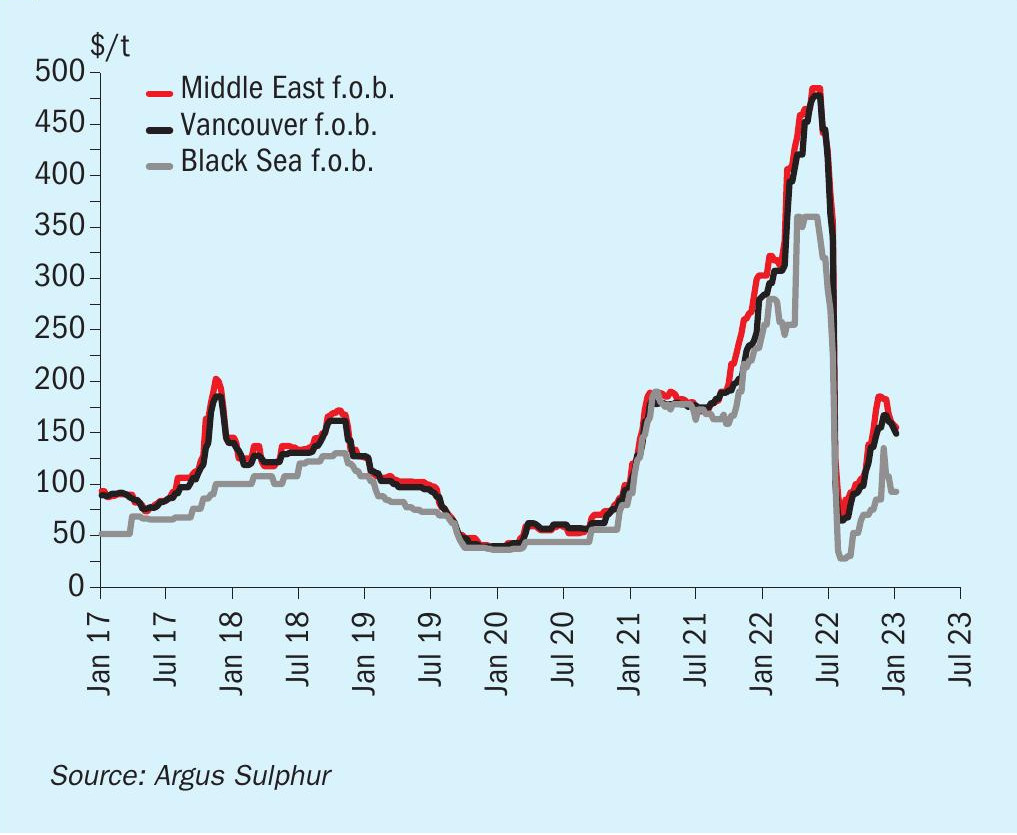

Global sulphur prices have been on a softer trend since the end of the fourth quarter of 2022 and going into the new year. All key indicators point towards a softer sulphur market in the short term. Spot demand out of southeast Asia was a key driver for prices firming during the tail end of firming towards the end of last year but other major markets appear to be on the sidelines, at least for now, particularly during the period when quarterly contracts are beginning to conclude, while some discussions are ongoing. Chinese demand for the short term is subdued and fundamentals appear weak. Markets have been somewhat sluggish coming into 2023 with some contracts for the first quarter of the year settle at increases on the fourth quarter but below the peak of spot pricing achieved in the period.

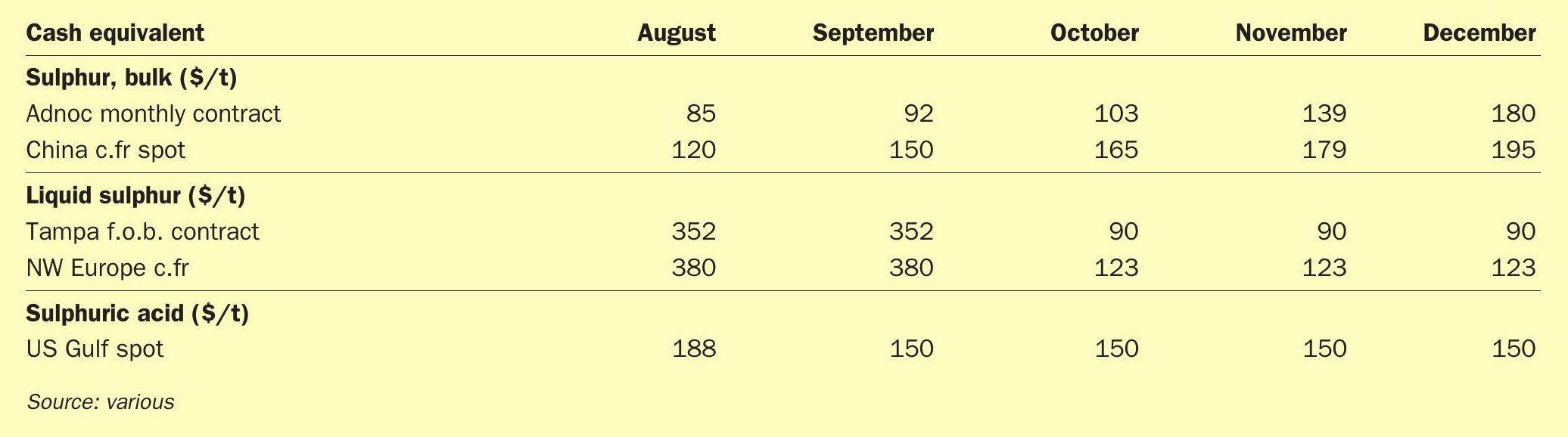

Average Middle East prices decreased by around $18/t between the end of 2022 and mid-January 2023, down to $155/t f.o.b. and are around $160/t lower than prices at the start of 2022. Kuwait’s KPC set its January sulphur lifting price at $154/t f.o.b., down by $29/t from the December price. Qatar’s state-controlled Muntajat set its January Qatar sulphur price at $155/t f.o.b. Ras Laffan/Mesaieed, down by $30/t from the December QSP of $185/t f.o.b. The January QSP implies delivered pricing to China of $177-184/t c.fr at current freight rates, which were estimated at $22-25/t to south China and at $27-29/t to Chinese river ports for a shipment of 30,000-35,000t. Meanwhile Abu Dhabi’s state owned ADNOC set its January official sulphur price (OSP) for liftings to India at $160/t f.o.b. Ruwais, down by $20/t from the December price of $180/t f.o.b. On quarterly contracts, Middle East prices were reported at around $140155/t f.o.b. for supply to be delivered in the first quarter of 2023, though the low end was not confirmed.

Sulphur capacity from Kuwait is on the rise following the start of commercial operations of Kuwait’s state owned KPC’s Al Zour refinery at the end of 2022. Operations are expected to ramp up at the 615,000 bbl/d project with the start-up of a second crude distillation unit (CDU) in the second quarter of 2023. Al-Zour has so far sold low-sulphur diesel, low-sulphur fuel oil and jet fuel cargoes. The refinery project faced repeated setbacks, first because of technical and logistical issues with contractors and more recently because of issues related to the Covid-19 pandemic. Kuwait had aimed to begin commissioning al-Zour in mid-2019 and have it fully operational by 2020.

China’s post-Covid reopening is fuelling a rally in the country’s gasoline demand, even as infections surge. The national health commission announced 10 policy changes on 7 December 2022, including relaxing some quarantine and testing requirements, better targeting of lockdown measures and encouraging vaccination among the elderly. The relaxation of the zero-Covid policy is going to have important ramifications for Chinese and global GDP growth, as trade bottlenecks potentially ease. The IMF projects that China will account for 30pc of aggregate global growth in 2023. GDP growth and oil demand are closely linked and we are already seeing an uptick in oil demand, supporting the view for robust sulphur production in the coming months.

On the demand side, the future of Chinese export restrictions on processed phosphates will impact fundamentals this year. We expect to see exports returning to normal from the second quarter, which will help push the global sulphur balance into a potential net deficit in the second half of the year. Sulphur pricing in China has been easing in line with the shift in sentiment, assessed by Argus at the start of January at $90-173/t c.fr. for the ‘all forms’ spot range, with the low end representing molten shipments. Further decreases were expected in the second half of January in the run up to the Lunar new year.

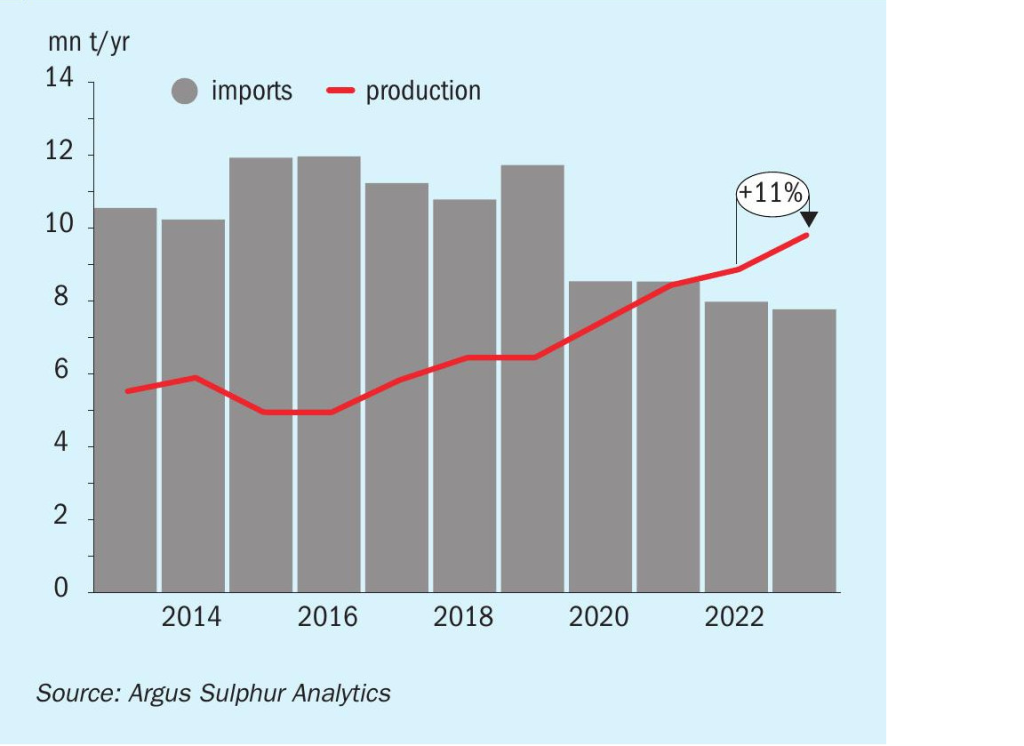

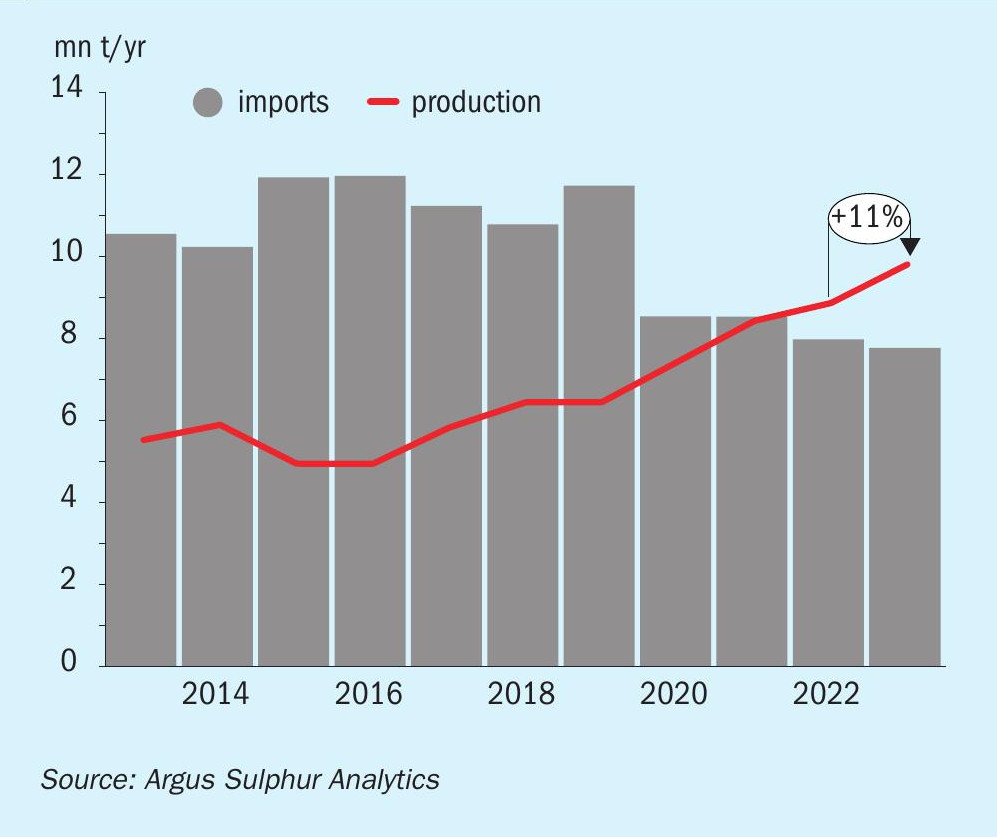

New supply is expected to come onstream in China and add additional sulphur capacity to the balance this year, adding downward pressure to import demand in the country. In project news, Shenghong Petrochemical started trial runs at its 320,000 bbl/d Lianyungang refinery in east China’s Jiangsu province from around 6 November and was running at around 60% for the month. Shenghong may raise Lianyungang’s operating rates to nameplate capacity after the lunar new year holiday ends in February 2023. PetroChina is preparing to start up its new 400,000 bbl/d Jieyang refinery in Guangdong province. PetroChina started injecting crude into the refinery’s crude units at the end of October 2022. Combined, these two projects will add around 1.4 million t/a of sulphur capacity.

Elsewhere in Asia, there is much focus on Indonesia with the continued ramp up of sulphuric acid capacity at nickel HPAL projects. PT Ningbo Lygend was in the market for early February arrival, covered by traders from the Middle East. The first phase of Lygend’s project reached 42,000 t/a of nickel metal equivalent in 2022. The company is planning to build more than 400,000 t/a of nickel metal equivalent capacity by 2024. Sulphur trade to the country is expected to rise to over 2 million t/a in 2023 because of developments in the nickel sector.

SULPHURIC ACID

Global sulphuric acid price movements have been more limited compared to sulphur in the new year and have increased or decreased, pointing to a continued mixed picture in the market. Average prices out of Northwest Europe increased on the December average by just $2.5/t, assessed by Argus $37.5/t f.o.b. at the midpoint in mid-January. High freight rates to key export markets have exerted downward pressure on the benchmark in recent months. On the contract front, most first quarter 2023 negotiations were complete at a rollover to euro 30/t for both smelter and sulphur burner acid. Uncertainty remains in the region because of high energy prices impacting downstream consumers and smelter operating rates.

Phosphoric acid production is expected to see a boost in 2023 following demand destruction last year, supporting the view for sulphur and sulphuric acid in this sector. Total sulphuric acid consumption in the sector is forecast to rise by around 4.5 million t/a in 2023, representing 44% of global growth. Key markets to see a boost include Morocco and India. Both markets are importers of sulphuric acid. We expect Moroccan sulphuric acid imports to rise slightly on 2022 levels to just under 2 million t/a. This will be dependent on the ramp up of sulphuric acid capacity at OCP’s processed phosphates facilities.

Global acid consumption is forecast to rise by over 10 million t/a in 2023 on 2022. Outside of fertilizers the metals and industrial sectors are also expected to rise. Around 4 million t/a of demand is forecast for industrial uses, while metals processing will grow by over 1 million t/a on the previous year. On the supply side we now expect this to rise by 11.1 million t/a in the 2022-23 period. Smelter-based capacity is expected to see a boost of 1.8 million t/a, representing 15% of growth over the period. Northeast Asia is the main driver for this sector as new smelters continue to ramp up in China.

China’s copper concentrate imports in 2023 are likely to increase from a year earlier, despite Beijing’s push to boost copper scrap consumption at smelters to achieve its target of peak carbon emissions by 2030 and carbon neutrality by 2060. There is expected to be a limited increase in production for domestically produced copper concentrate in China. The new 400,000 t/a copper smelting facility at China’s Daye Non-ferrous started feed supplies on 23rd October 2022 and is expecting to ramp up production this year. This is the biggest demand driver for copper concentrate imports in the coming year and a major sulphuric acid supply addition. We expect a gradual ramp up at the project, located in Huangshi city in Hubei province with 1 million t/a of sulphuric acid capacity to be brought online in 2023.

Copper prices on the London Metal Exchange (LME) hit a seven-month high in official morning trading on 11th January, supported by continued expectation of slower target interest rate rises by the US Federal Reserve and increased demand from China driven by the reopening of its economy. This is supporting the forward view for sulphuric acid consumption and pricing. Three-month LME prices of copper settled at $8,995/t, up by 2.3% on the day to their highest official session close since June 2022. The contract breached the $9,000/t mark in intra-day trading. China reopened its borders on 8th January after three years of travel restrictions as part of its zero-Covid policy. Incoming travellers will now no longer need to quarantine upon arrival. Markets reacted positively, though concerns persist over further spikes in Chinese Covid cases as a result of the relaxation of lockdown restrictions.

PRICE INDICATIONS