Sulphur 406 May-Jun 2023

31 May 2023

Market Outlook

SULPHUR

- New sulphur burning capacity in India is expected to come online in the coming months at fertilizer producer operations. This will lead to an increase in sulphur import demand but also impact sulphuric acid imports to the country.

- The ramp up of new refining capacity in China continues to push up the view for sulphur production in the short term and limit expected sulphur imports for the year. The rate and pace of start up will impact spot market activity.

- Indonesian sulphur demand at HPAL nickel operations continue to drive trade to the country and support pricing. This is likely to be a bright spot in the short term for consumption but is not expected to be enough to support the market during a period of weakness in processed phosphates.

- The start of construction at Lithium Americas’ Thacker Pass lithium mine in Nevada in the US is a key point of interest for the market but sulphur demand is not expected until the 2026-27 period. The electric vehicle and battery materials markets remain key drivers for new demand growth for sulphur in the medium term.

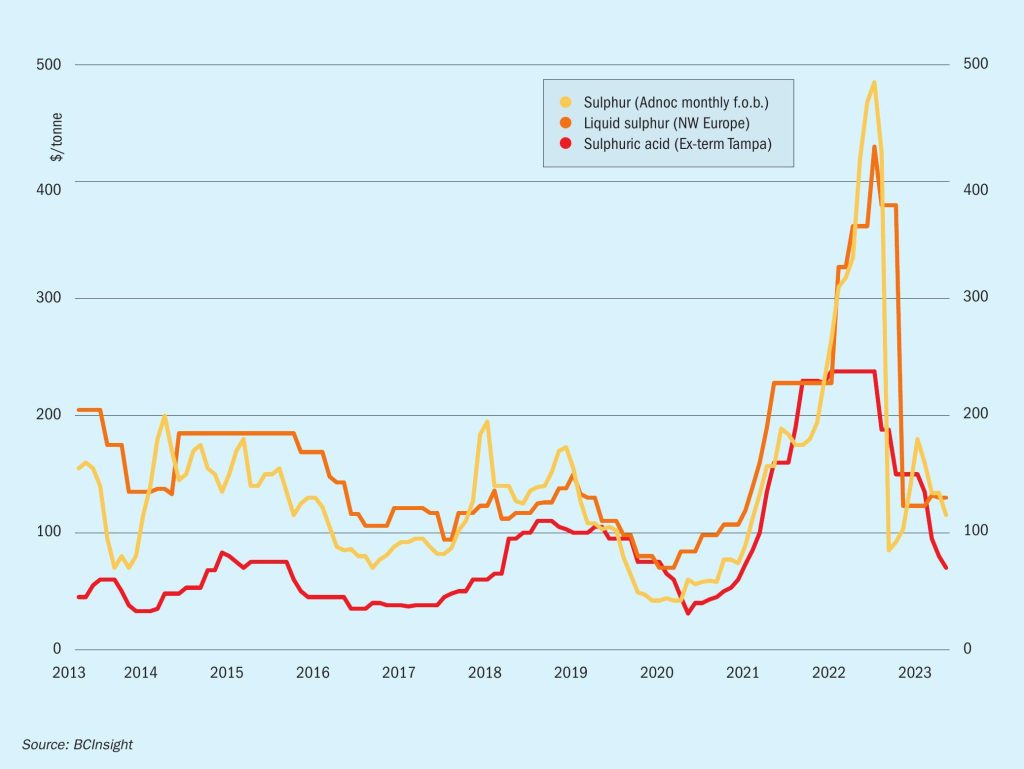

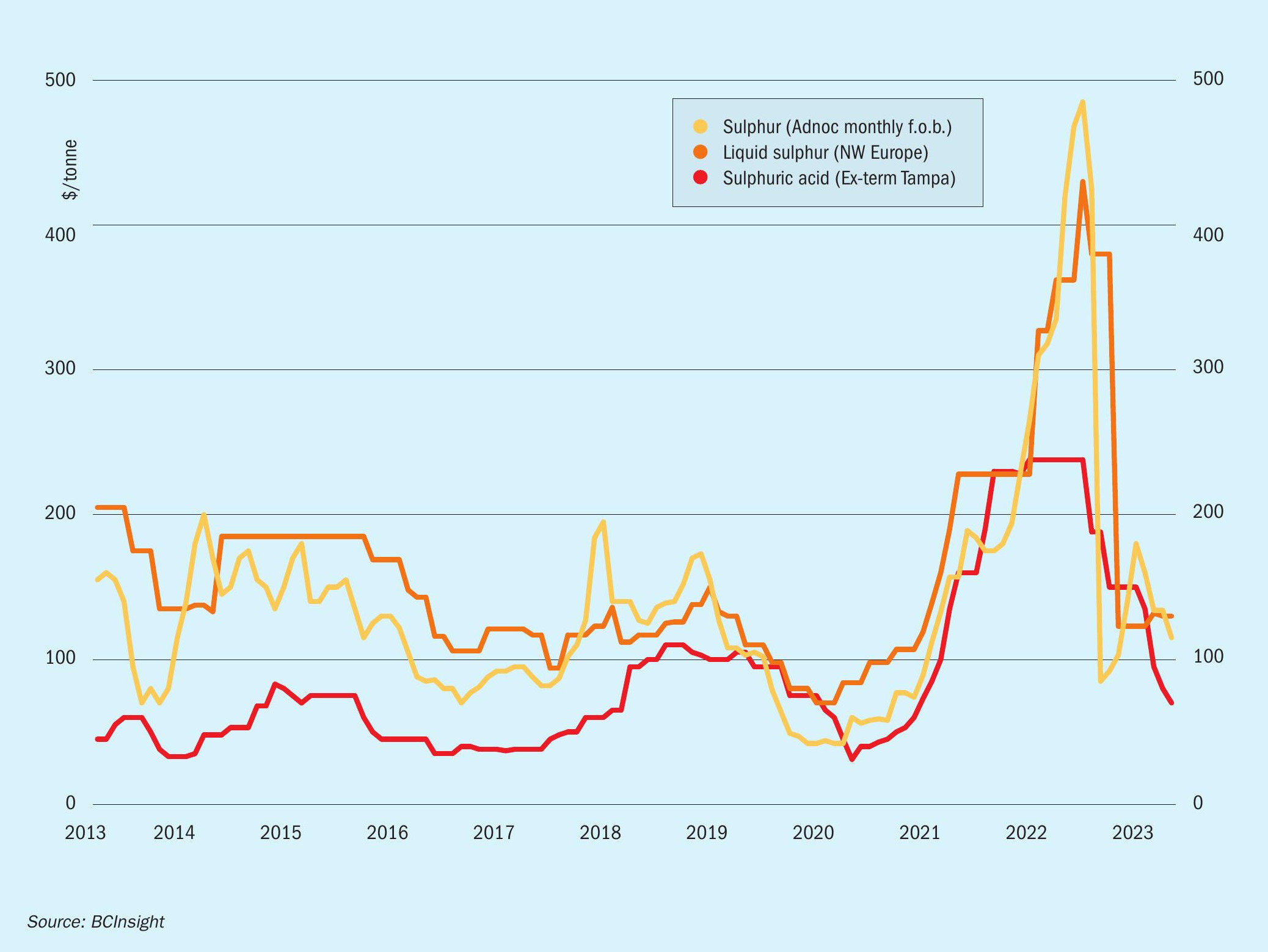

- Outlook: Global sulphur prices are forecast to drop further before reaching a point of stability and potential rebound. Sluggish demand from a weakening processed phosphates market and ample supply remain the main bearish factors in the short term. The potential for an uplift in the market will come later in the year as demand improves and the global balance turns to a trade deficit.

SULPHURIC ACID

- The NW European acid market has moved to balance in the short term despite the absence of key importer OCP in Morocco. Smelter based producers are sold out until July and the spring maintenance schedule through the second quarter will tighten spot availability.

- Indonesian sulphuric acid imports have increased to record levels so far in 2023. First quarter imports totalled 214,000 tonnes, up over 300% on a year earlier. China was the leading supplier. Demand has been boosted by nickel HPAL operations and remains a bright spot for short term trade and pricing.

- The US acid market remains balanced despite a busy turnaround schedule in the second quarter. Spot demand is expected to emerge later in the quarter, testing the pricing outlook when a major smelter goes into turnaround.

- Outlook: The short term outlook is for stable pricing but the downturn in sulphur and processed phosphates prices alongside slower import demand in India and Morocco may weigh on the recovery. Potential demand uplift could support pricing in the second half of the year.