Sulphur 407 Jul-Aug 2023

31 July 2023

Price Trends

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

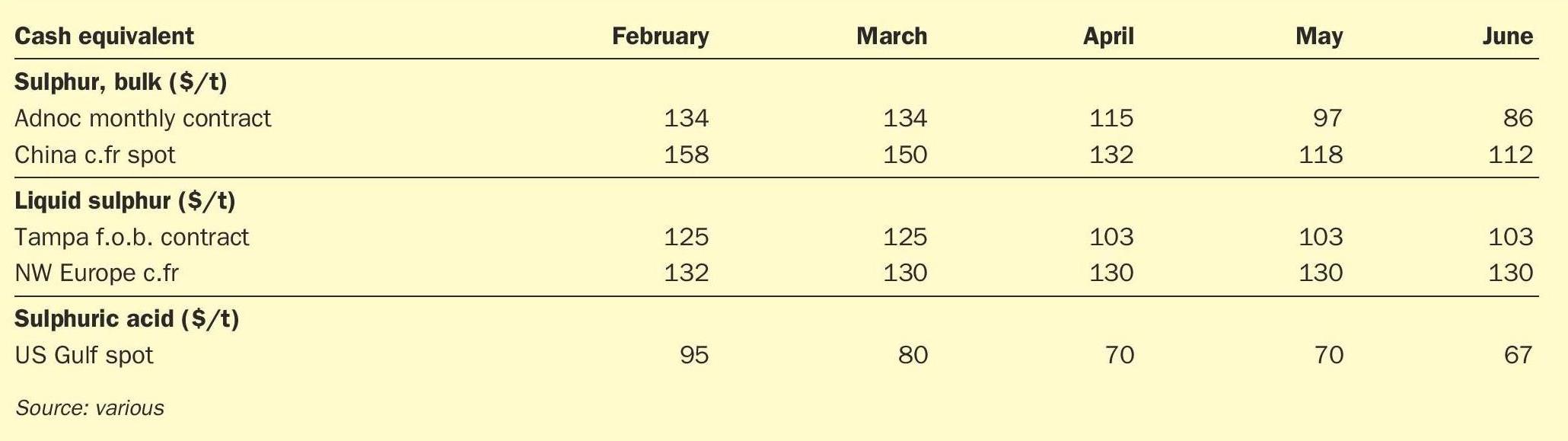

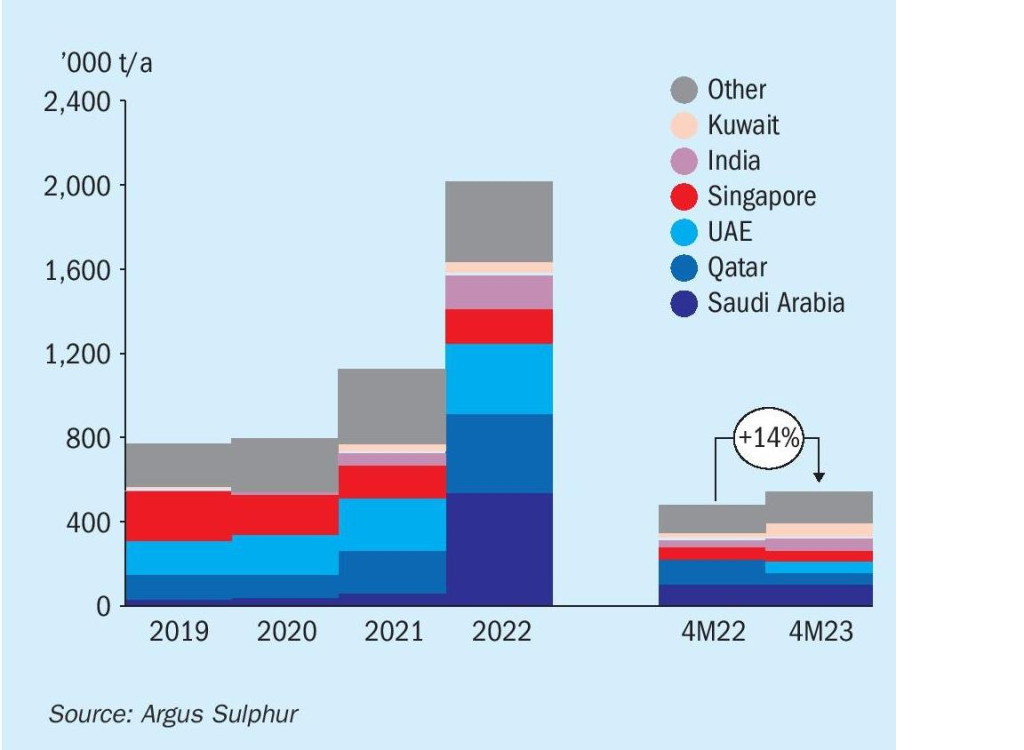

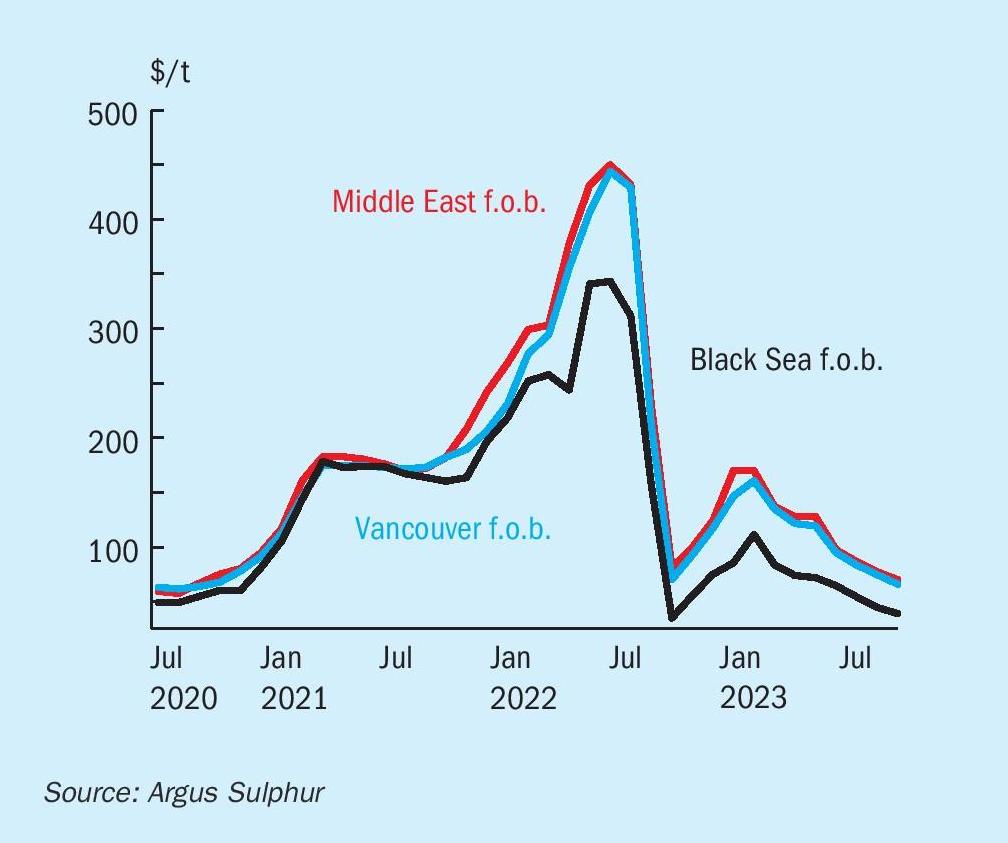

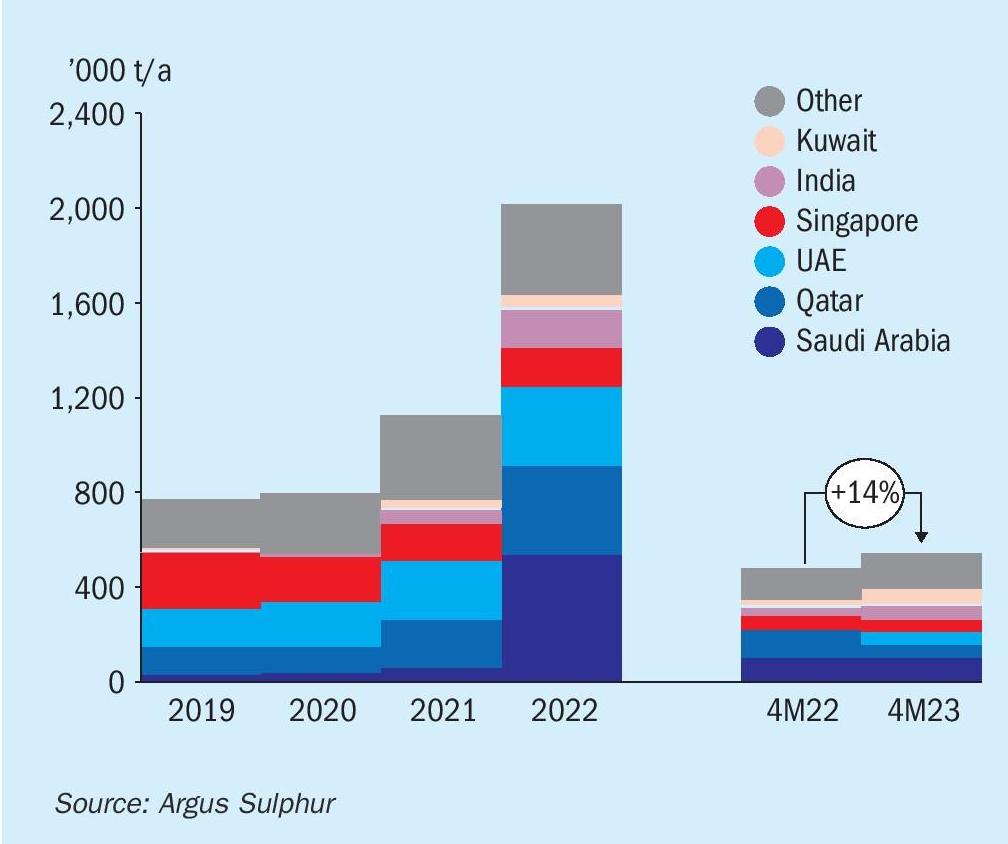

The global sulphur market has continued to soften through the second quarter as expected, with demand remaining relatively steady, at a time when there is ample availability from key suppliers, with the exception of Russia. Third quarter contract negotiations were ongoing in some regions at the start of July but some settlements had been concluded at decreases. Global spot prices have continued on a downtrend in recent months, but this is expected to turn to stabilisation and a possible uptick during July. The Argus global sulphur trade balance reflects a surplus for the next 12 months, a factor expected to put a ceiling on the uplift we expect at present. The rate and pace of new capacity from new projects will impact how quickly export availability grows, particularly from the Middle East, with both Kuwait and Saudi Arabia expected to lead the rise in 2023.

The ADNOC monthly Official Sulphur Price (OSP) for June was down to $86/t f.o.b., its lowest level since last August, when fears of shortages eased in the wake of the conflict in Ukraine. This was a 36% fall from March in just three months and reflecting weakness in markets across the board, and a massive decline from the highs seen last year. In the US, refinery utilisation averaged 97% in May, and sulphur output was up by 100,000 tonnes compared to the first five months of last year.

Despite some interest in China briefly lifting and stabilising spot prices, this gave way to further softness in May-June. The high end of the range increased very slightly, up by $2/t in early July to $88/t c.fr. The domestic price increase added pressure to stabilise prices alongside signs of demand emerging from markets outside of China. Port inventory in the country increased in June, with Fangcheng port starting to reach upper limits at warehouses and some cargoes were diverted to Dafeng port instead. A busy arrival schedule in July at Zhenjiang port may also lead to some logistical congestion. Processed phosphate fertilizer fundamentals have remained weak with operating rates at DAP and MAP plants in the 55-60% range on average. The forecast for sulphur demand growth is to see a slight uptick for the production of phosphoric acid, with the first half of 2024 likely to see only a stable to slight uplift in the sector. The main supportive factor for sulphur consumption is the industrial sector.

Battery materials are a sector for potential sulphur demand growth, although historically this has impacted the merchant sulphuric acid sector. New sulphur burning capacity is being added however, and this will lead to an uptick in consumption. Chinese new energy firm Lubei Wanrun has launched a lithium iron phosphate (LFP) material and iron phosphate plant in Wudi county, in north China’s Shandong province. The plant has a nameplate capacity of 240,000 t/a for LFP and 240,000 t/a for iron phosphate, with an investment of 6.5 billion yuan ($913 million). Details on including construction schedules and launch dates have not been disclosed. LFP batteries have taken over the majority share of the lithium-ion power battery market because of their lower manufacturing costs. On the supply-side in China, sulphur production continues to be robust, another bearish factor for import demand in the second half of this year. Our current estimate is that sulphur production will rise to more than 10 million t/a this year, up from more than 9 million t/a last year.

Indian demand is expected to see a boost in the short term with new sulphur-burning capacity in 2023-24. Domestic fertilizer producer CIL is still expected to bring on line its burner in the second half of 2023. Iffco Paradeep’s burner is scheduled to ramp up in the first quarter of 2024. Combined, the two burners would add over 400,000 t/a sulphur demand at capacity.

In Europe, molten sulphur contracts settled at a reduction of $40/t on the second quarter, down to a range of $87-103/t c.fr Benelux. The contracts reference molten product moving from the region’s refineries to regular local customers. Demand in the region has been subdued, amid the economic downturn and downstream product margins being squeezed. On the supply side, the end of refinery and gas field maintenance in Germany may ease supply tightness amid turnarounds, logistics delays and strikes.

Brazilian spot prices have dropped to below $100/t c.fr in June. Logistics-related maintenance is expected to affect short-term sulphur import flows to the country, but we still expect a robust year of demand. Trade data reflect significant year-on-year shipments so far this year. Santos’ Tiplam bulk terminal is scheduled to undergo maintenance from 10 July-15 August, and Termag is expected to be down from 15 July-15 October, restricting the discharge of bulk vessels at the port. This has affected sulphur availability from the US Gulf, with the usual spot demand in Brazil not emerging for this period.

Pressure remains from the processed phosphates sector, and we expect to see Brazilian spot prices bottom out in the $70s/t c.fr in July before a slight rebound through the second half of this year as import demand returns.

Meanwhile Chilean sulphur demand has been increasing and is forecast to rise throughout this year and remain healthy in the first half of 2024. Demand is for Noracid’s sulphur burner, with the acid produced sold to the local copper industry. Imports increased by 72% in January-April 2023, compared with the same period in 2022, with Canada remaining the leading source of supply. There has been no disruption to trade to the country in the aftermath of ongoing wildfires in Alberta.

SULPHURIC ACID

Global sulphuric acid prices have been under pressure with the downturn in processed phosphates sector and sulphur markets adding even more bearishness. Average acid prices have continued to soften through the first half of the year with a floor yet to be reached at the start of July. Prices in Asia are expected to see further pressure as suppliers look to place cargoes against a backdrop of weak sentiment. Some demand has emerged in Western markets but OCP in Morocco remains out of the market and there is limited spot market interest in Chile.

Average Chilean spot prices were $90/t c.fr at the midpoint in end June – early July, down by $20/t on the previous quarter and the first time the price has dropped below $100/t in this year. A lack of appetite for demand has been cited for the quarter ahead because of ample inventory levels. Chile’s state-owned Codelco announced the closure of its Ventanas smelter on 31 May. The company decided to shut the smelter last year in response to environmental concerns. It received permission to close the plant from the geology and mining authority in mid-May. The smelter was in operation for 58 years.

Recent heavy rains in the Chile has led Codelco to estimate losses of around 7,000 tonnes of copper following disruptions at its Andina and El Teniente operations. The state-owned copper company is now expecting 2023 copper production to come in at the lower end of the previously estimated range of 1.35–1.42 million t/a. Chile imported 1.6 million tonnes of sulphuric acid in the first five months of the year, slightly up on the figure of 1.5 million tonnes a year earlier

Base metal prices rose in early July following recent softening, even amid signs the US Federal Reserve will raise its benchmark interest further over the rest of this year. Reports reflecting a tight labour market in July reinforced signals from the minutes of the June Federal Reserve policy meeting that more rate increases are likely this year as the Fed battles to quell inflation, even after hiking 10 times in the last 15 months.

Swedish metal producer Boliden’s Ronnskar smelter and refinery has partially resumed production after it was damaged in a fire on 13 June, the company said on 30 June. But the facility will produce only copper anodes until further notice because the electrolytic refinery, which processes the metal into cathodes, was completely destroyed in the fire. Many of its production lines will operate in a limited capacity until July. Because of the switch to anodes, even production lines that were undamaged by the fire will run at only a limited capacity. Ronnskar, Boliden’s largest smelter, produced 218,000t of copper and 550,000t of sulphuric acid last year.

Price Indications