Sulphur 407 Jul-Aug 2023

31 July 2023

Sulphuric Acid News Roundup

Metso introduces battery black mass recycling process

Metso is launching an advanced sustainable battery black mass recycling process as part of its battery minerals technology offering, which covers concentration and hydrometallurgical processing as well as related services. Demand for battery minerals is increasing sharply with the ongoing transition to clean energy sources. An electric car battery weighs approximately 200 kg. Recycling of black mass from batteries with Metso’s process can reduce up to 60% of embedded carbon compared to use of virgin materials and enables the treatment of mechanically separated and shredded batteries for recovering battery raw materials like nickel, cobalt, and lithium, as well as manganese and copper.

The process is based on Metso’s proprietary VSF® X solvent extraction technology and complemented with OKTOP® reactors, Larox® PF filters, dual media and LSF filters, and thickeners and scrubbers. The process flowsheet can be tailored according to feed materials and desired end products with a possible phased approach for adding equipment also for the recovery of less valuable materials.

“With the launch of the battery black mass recycling process, our offering for the battery minerals value chain covers 90% of the end-to-end production process. We can provide sustainable technology and equipment for the entire lithium, nickel, and cobalt production chain from the mine to battery materials and black mass recycling with project scopes ranging from equipment packages to plant deliveries. We can also support our customers in the design of the process with our comprehensive testing and research capabilities,” said Mikko Rantaharju, Vice President, Hydrometallurgy at Metso.

TAIWAN

SAR awards contract for spent acid regeneration

SAR Technology Inc. has awarded MECS, Inc., a subsidiary of Elessent Clean Technologies a contract to supply of proprietary technology and equipment as part of a new spent acid regeneration plant at Tainan. By incorporating MECS® sulphuric acid recovery technology in its electronic grade sulphuric acid plant, SAR aim to position themselves as a reliable supplier of regenerable high purity sulphuric acid to the semiconductor industry in Taiwan, which is the world’s largest consumer e-grade sulphuric acid.

The semiconductor industry is one of the fastest growing markets in the world, and its manufacturing process creates numerous by-product waste streams. Disposal of this waste has become a challenge with the extreme growth experienced by the industry, and one way to combat waste disposal issues is by recycling the by-product spent acid from semiconductor fabrication. MECS designs sulphuric acid regeneration plants to balance operating temperature, acid concentrations and corrosion rates to ensure consistent, productive uptime of the equipment while guaranteeing environmental compliance and offering proven protection of plant equipment from acid condensation.

“Every manufacturer in the industry wishes to embrace a circular economy on waste streams, especially at a time with such high demand. It is exciting to work with SAR Inc. who is shouldering the responsibility to ensure the sustainability of the e-grade acid supply chain.” said Eli Ben-Shoshan, CEO, Elessent.

SAR Inc. was established in 2018 to provide a full-cycle electronic-grade sulphuric acid factory to deliver a sustainable solution for by-product waste in the semiconductor industry. Start-up of the plant is slated for June 2023 and is expected to improve utilisation of domestic resources and help address sulphuric acid disposal challenges.

UNITED STATES

Sumitomo buys Saconix

Sumitomo Corporation has announced its acquisition of Saconix LLC, a company engaged in the procurement, sale, storage and distribution of sulphuric acid in the United States. Sumitomo bought Saconix from Dallas-based Copperbeck Energy Partners. Saconix is one of the leading sulphuric acid distributors in North America providing logistics and storage solutions with strategically located assets, adding value through its functions and services that are very similar to Sulphuric Acid Trading Company (SATCO), another Sumitomo Group company. Saconix owns, leases and operates in seven strategic logistics facilities in the US Gulf and West Coast. The acquisition expands Sumitomo’s footprint in the US sulphuric acid business, adding operations and access now in both the Gulf region and West Coast region, including California, Nevada and Arizona, and will take the Sumitomo Group’s worldwide annual volume of acid handled to 3.5 million t/a via 19 tanks with approximately 330,000 tonnes capacity.

“We identified Saconix as a strategic investment because its business model is extremely compatible with our current investments, and brings a high potential of growth synergy for our sulphuric acid business in the US, increasing our global competitiveness,” said Masaya Sato, Basic Chemical Group General Manager of SCOA.

Sumitomo Group’s sulphuric acid business began with the export of sulphuric acid produced from the smelting of nonferrous metals from Japan, and since 1994, when it acquired Interacid Trading in Switzerland, the parent company of SATCO. The company handles one of the world’s largest sulphuric acid maritime transport transactions and provides a wide range of logistics services in countries such as the US and Chile, including the trading of sulphuric acid by sea, regional distribution, and storage of sulphuric acid. Interacid owns and operates its own storage tanks for sulphuric acid, providing customers with just-in-time delivery of product, and if needed, leasing of storage tank space to customers requiring personalized logistics services.

Approval reversed for phosphate project

On June 2nd, 2023, a federal judge reversed previous US government approval for a phosphate mining project in southeastern Idaho. The judge ruled that the US Bureau of Land Management violated environmental laws when it approved the Caldwell Canyon Mine in 2019. Those include a failure to consider the indirect impact of processing ore at a nearby plant and the impact on sage grouse. The mine has been proposed by P4 Production LLC, a subsidiary of German pharmaceutical giant Bayer AG, and was to include two new open mine pits to extract phosphate ore, over a mine life of 40 years, with ore taken by truck or rail to a nearby processing plant.

ZIMBABWE

Zimplats commissions concentrate plant

Zimbabwe Platinum Mines (Ltd) (Zimplats), part of the mining conglomerate Implats Group, has commissioned its third concentrator plant as part of a $1.8 billion expansion plan. The concentrator, with a capacity of 900,000 t/a, processes platinum ore and separates the most valuable minerals or metals while discarding the rest of the ore as tailings.

Speaking at the official opening of the facility at Mhondoro Ngezi, Implats board chair Thandi Orleyn said: “This is a culmination of a long journey which started over 20 years ago when lmplats decided to invest in Zimbabwe and resuscitate the mothballed BHP operations.” Zimplats’ expansion programme, approved and adopted in 2021, comprises nine projects in Ngezi, including the concentrator, and will be implemented over a 10-year period. The plant will process platinum group metals ore including platinum, palladium, rhodium, ruthenium, iridium, and osmium through crushing, milling, floatation and filtration. Projects include the installation of a 110 megawatt solar power plant with sufficient capacity to satisfy the company’s and related mining and mineral beneficiation facilities, as well as a 100,000 t/a sulphuric acid plant which will supply the manufacture of fertilizer in the country, reducing acid imports.

CHINA

Zinc market boosted by Chinese government economic support

Zinc markets have picked up after China’s central bank lowered interest rates for the first time since August 2022 to restore market confidence and prop up a stalling post-pandemic recovery. Further interest rate cuts are expected in 2H 2023 to boost the economy. There is also hope that the government will try to support China’s depressed property sector, a consumer of a number of commodity metals and raw materials.

Chinese refined zinc output for the year stood at 564,500 tonnes in May, an increase of 24,500 tonnes per month and 9.6% up year on year. However, some smelters in Henan have reduced production due to high sulphuric acid inventories. The global zinc market remains in surplus, estimated at 26,700 tonnes in March, according to the International Lead and Zinc Study Group (ILZSG), though this surplus is falling. During the first three months of 2023, ILZSG data showed a surplus of 49,000 tonnes, versus a surplus of 116,000 tonnes in the same period of 2022.

AUSTRALIA

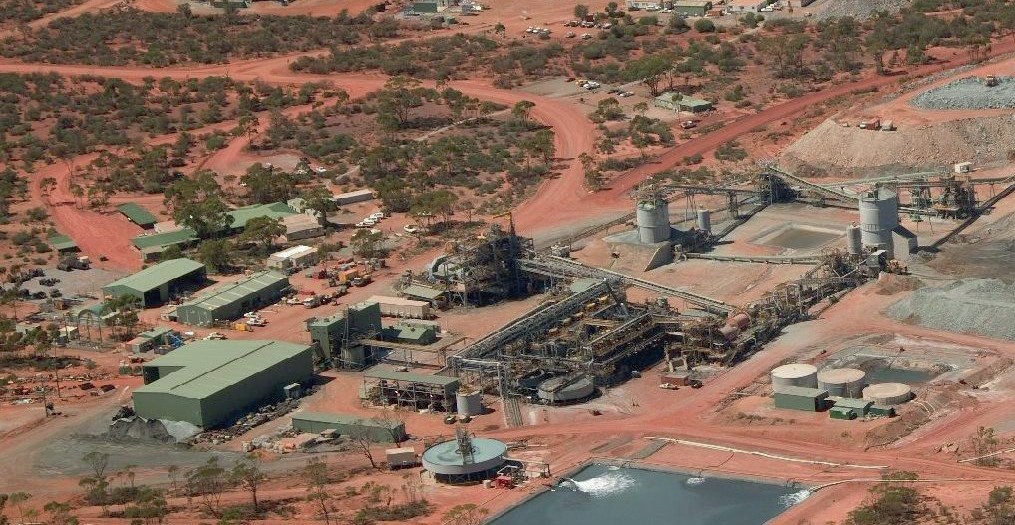

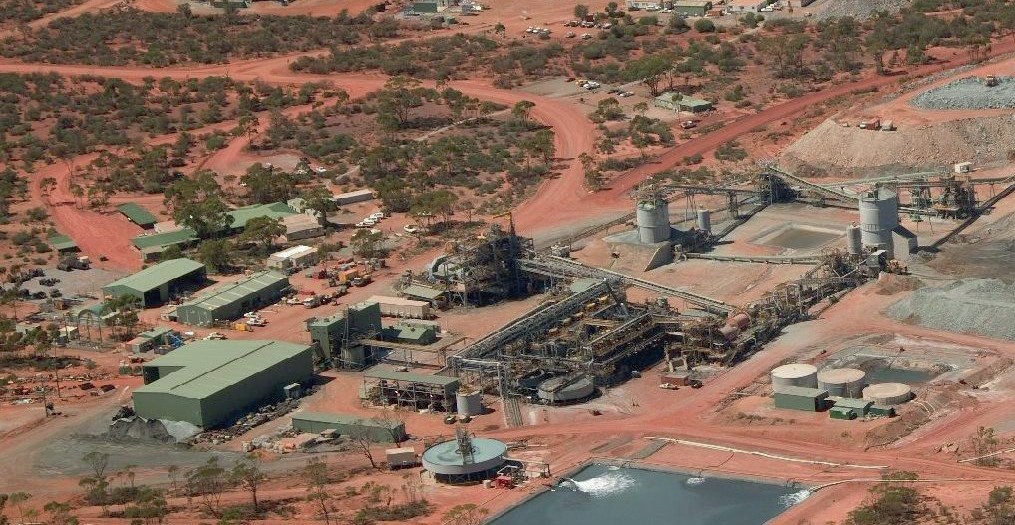

Poseidon continuing with Kalgoorlie restart

Poseidon Nickel Ltd says that it has made significant progress towards the restart of its Black Swan smelter-grade concentrate project, situated 50 km northeast of Kalgoorlie in Western Australia. The restart is based on the November 2022 bankable feasibility study for the 1.1 million t/a mill feed option to produce smelter-grade concentrate. A final investment decision (FID) is due to be made in late June or early July this year. Work continues on the expansion project which is based on treating 2.2 million t/a of mill feed and producing a rougher concentrate. The rougher concentrate product has a lower nickel grade and higher magnesium oxide content than conventional smelter feed and is more attractive as a feed for either pressure oxidation (POX) or high-pressure acid leach (HPAL) plants rather than a conventional nickel smelter.

Construction begins at Arafura

Ground preparation and early works construction has begun at the Nolans rare earths project, being developed by Arafura, 135 km from Alice Springs in Australia’s Northern Territory. Arafura says that it has begun equipment procurement including sulphanation bake and cooler units, and has begun constructing roads and earthworks and a construction camp. The company recently signed an offtake agreement with wind turbine manufacturer Siemens Gamesa Renewable Energy for the supply of neodymium and praseodymium for the manufacture of permanent magnets. The company has also signed an offtake agreement with Hyundai. Nolans is considered one of the world’s largest rare earth deposits and could supply 10% of the world’s demand for the metals used in rare earths magnets. The company plans a hydrometallurgical plant and sulphuric acid plant as part of the project.

TOGO

Phosphate output up

Togo’s phosphate industry recorded substantial growth in production and sales in 2022 on the back of high global prices for the commodity. Recent figures from the Central Bank of West African States (BCEAO) show Togolese phosphate production grew by 5.9% in 2022, reaching 1.54 million t/a. Sales rose by 14% from 1.39 million t/a to 1.58 million t/a, its highest value since 1999. Growth was mainly spurred by a 116% increase in global raw phosphate prices over the year, extending an upward trend that took root in late 2020. Togo’s phosphate company, SNPT, has also benefited from the rising dollar exchange rate.

SNPT has signed several agreements with OCP Group for the establishment of a fertilizer plant in Togo, and there is also a new NPK fertilizer plant at Adétikopé, being developed by Singapore-based NutriSource Pte Ltd. The factory is expected to produce 200,000 t/a of fertilizer.

INDIA

Vedanta invites bids to restart operations at Sterlite

The Vedanta Group has announced an invitation for Expressions of Interest (EOIs) to restart operations at the Sterlite Copper plant located in Tuticorin. The EOI includes safety assessment/audit of structures and buildings, refurbishment or replacement of plant and machinery, and repair works, aimed at restoring the Sterlite Copper plant to its design capacity (400,000 t/a of copper and 1.2 million t/a of sulphuric acid).

The Vedanta Group says that maintenance and upkeep activities at the plant have recommenced as permitted by a Supreme Court order on May 4th, 2023, in coordination with district authorities. The final hearing on the matter is scheduled for August.

Considering the significant restoration required after the plant’s closure for over five years, the procurement and deployment of necessary materials and resources for restoration and restart might be a time-consuming process lasting several months. In this context, the EOI has been issued to ensure the selection of suitable partners as part of the preparatory measures for resource planning. The Sterlite plant has been closed since May 2018 after violent local protests against its operations. Prior to that it had met 40% of India’s refined copper demand, and was the largest producer of sulphuric and phosphoric acid in South India.

CHILE

Ceibo attracts $30m of investment

Chilean copper extraction technology company Ceibo says it has raised $30 million in Series B financing. The round was led by Energy Impact Partners, with participation from a syndicate of new mining-focused investors including CoTec Holdings, Audley, Orion Resources, Unearth and Pincus Green along with existing investors Khosla Ventures and Aurus Ventures. The funding round will enable Ceibo to accelerate the scale-up of its proprietary technology, drive several on-site trials and prove the technology’s value and versatility at scale.

Declining ore grades, changing mineralogy and constrained permitting processes threaten to limit copper supply growth and challenge the energy transition. Ceibo has developed a novel leaching process and solution that economically increases the production of copper, using existing infrastructure at mines with a lower environmental footprint than current state-of-the-art. Ceibo’s technology targets chalcopyrite and other refractory copper minerals which hold 70%+ of known copper reserves. It economically and sustainably unlocks supply of copper from sulphide ores, which traditionally are expensive and environmentally intensive to produce.

“Following positive results from a lengthy validation process using minerals from leading copper companies, we’re now poised to rapidly scale our technology,” said Cristóbal Undurraga, CEO and Co-founder of Ceibo. “This capital raise, together with the strategic support from investors experienced in scaling clean, industrial, and mining technologies, will help us accelerate plans to deploy our technology globally and meet society’s need.”

IRAN

Copper leach operations begin in northwestern Iran

Iran has started up a new copper cathode production plant in its northwestern Azerbaijan region where the country’s second largest copper reserves are located. According to Islamic Republic of Iran Broadcasting, the new copper cathode plant at Varzaqan will be able to produce 3,000 t/a of copper cathode via heap leaching. Iranian president Ebrahim Raeisi, announcing the start of operations, also said that he would make preparations for the launch of an independent company in the region to control the Sungun copper mine which is the largest open-cast copper mine in Iran. Sungun had been controlled by National Iranian Copper Industries Co. (NICICO) a company that is mostly focused on copper mines and smelters in Iran’s southeastern province of Kerman.

INDONESIA

Nickel Industries seeking financing for Excelsior

Australia’s Nickel Industries says that it is seeking A$943 million (US$645 million) in funding for its Excelsior nickel project in Indonesia. The company says it has agreed a deal with Chinese-based Shanghai Decent, who will take the right to a 20% equity interest in Stage 2 of the project. Excelsior is aiming to produce 72,000 t/y of nickel equivalent as a mixed hydroxide precipitate, and will be capable of producing both nickel sulphate and cathode, differentiating it from the current generation of high-pressure acid leach (HPAL) plants being built across Indonesia, and providing Nickel Industries with significant operating flexibility through the cycle. Shanghai Decent will provide a capital expenditure (capex) guarantee, whereby total construction and commissioning costs will not exceed $2.3 billion. The capex guarantee includes a tailings solution, which is best of breed for tailings storage and management, and an integrated sulphuric acid plant that will generate significant heat that can be turned into power, significantly lowering the carbon footprint of the operation. Construction is expected to start in either December 2023 or March 2024, or sooner if both parties agree. Commissioning will start no later than 24 months thereafter.