Fertilizer International 516 Sept-Oct 2023

30 September 2023

IFA 2023 Annual Conference

CONFERENCE REPORT

IFA 2023 Annual Conference

Some 1,400 delegates from 533 companies and 83 countries gathered in Prague, Czech Republic, for the 90th International Fertilizer Association (IFA) Annual Conference, 22 May – 24 June 2023. We report on the main highlights of this three-day flagship event.

IFA’s long standing annual conference is the largest and most prestigious event on the global industry’s calendar. For decades now, it has provided a once-ayear opportunity for fertilizer professionals to congregate, network and catch-up on the latest industry developments.

The theme of this year’s conference was ‘Fertilizers 2023: Where Food and Energy Markets Meet’. This reflected the fertilizer industry’s increasingly high profile and its impact on other global industries.

Opening remarks

The conference was opened by Svein Tore Holsether, IFA’s outgoing chair and the president and CEO of Yara International. He highlighted the interconnection between food and energy:

“Why do we eat food in the first place? It is to get energy. It takes energy to produce food, whether that’s for fertilizers or to grow food itself.

“What we’ve been through in the past few years – from Covid, war or climate change – has had an impact [on food and energy markets] and it’s important we explain the implications of that. We have to, as an association, be a credible source of information and contribute to policy making and decisions.”

Farmers are on the front line when it comes to climate change. All parts of the food system are also interdependent. Holsether therefore called for an integrated approach involving every player in the food value chain – all the way through to the consumer.

“There are very few professions, if any, that are as affected by climate change as farmers are,” he said. “The whole food system is part of the problem, it’s also a significant part of the solution. That’s why – despite our differences – we need to pull together to secure the decarbonisation of the food system, and we all have a role in doing that and, ultimately, this is really our license to operate as an industry.”

Everything goes back to energy, suggested Holsether:

“We have to be in the driving seat. Our industry has an advantage when it comes to decarbonisation as we have the technologies to decarbonise, whether it’s carbon capture and storage, green energy producing green hydrogen, or through precision farming. Renewable energy will be key and needs to be driven with even higher speed across the world – particularly in Europe where we are lagging behind on the implementation of green energy for fertilizer production.”

Leadership on sustainability

Katy Jarrett, head of the UK sustainability practice at Spencer Stuart, gave the keynote address. She provided an overview on how well the fertilizer industry and related sectors are performing when it comes to leadership on sustainability.

“What I can tell you about [sustainability] leadership is that it’s incredibly hard and it’s never been harder since the energy transition that’s come upon us,” said Jarrett. “What we realised is that… nobody was equipped to lead when it came to sustainability as they were either a generalist, or they were a specialist five rungs down the company and couldn’t meet the CEO, or they put money to work but didn’t really understand climate change.”

The pursuit of perfection was a major obstacle, she suggested.

“Underlying all of this, was this idea that there was a limited time to save the planet, but there was an obsession about what the perfect corporate action is. So, nobody takes any action because everyone’s worried about being perfect,” Jarrett said.

There were signs of progress, however, as Spencer Stuart had observed a very real shift in the background of sustainability leaders during the last five years, as Jarrett explained:

“We tried to think about what the perfect leader would be when it came to sustainability and climate change. We interviewed 100 companies [in 2022] who were facing the energy transition problem – about 50 of them were within the fertilizer supply chain – interviewing people who were executing on the sustainability mandate, and we had some quite interesting results.

“The people with the background you have now executing on sustainability in the energy transition are [mainly] social and environmental scientists or people who are formally in strategy. It’s unfortunate that supply chain, which is such a huge disruptor when it comes to the energy transition, are so underrepresented – but we’re hoping to get that up as well.”

Encouragingly, two metrics in Spencer Stuart’s 2022 survey confirmed that sustainability leaders have a frequent access to CEOs and that most of these meetings were judged to be productive.

“The positive one is the [internal relationship] between CEOs and sustainability [leaders] which is fantastic,” said Jarrett. “91 percent of people said that the CEO is now actively supporting their strategy, and they have roughly the same amount of facetime as success in communicating with the CEO.”

Encouragingly, this suggests sustainability strategies are now being taken seriously at the very highest levels in companies faced with the energy transition.

Food security and sustainable supply chains

This theme was discussed during a lively debate between Matt Simpson, CEO of Brazil Potash, Julian Palliam, CEO of Foskor and Jaine Chisholm Caunt OBE, director general of the Grain and Feed Trade Association (Gafta).

A balance was needed between globalisation, on one hand, and domestic security of supply on the other, argued Matt Simpson.

Brazil, for example imports 95 percent of its potash requirements. This had left the country extremely exposed when potash prices hit $1,200/t in April last year. Did this make sense when Brazil was sitting one of the world’s largest undeveloped potash deposits, asked Simpson.

“Where these elements [raw materials] are essential and leave you very vulnerable, if it is possible to produce these domestically, then you should, even if it does come at a higher cost,” he said. “Because [then] you won’t have the susceptibility to the supply chain shocks we’re seeing.”

Jaine Chisholm Caunt made a robust defence of international trade. Gafta’s view was that sustainability means producing grains such as soybeans in places where they can be grown most efficiently, at large scale with fewer agricultural inputs and less water, and then shipped to where they are needed the most.

“There isn’t a single country in the whole world that is totally self-sufficient, we all rely on each other,” she said. “One in six people rely significantly on international trade to actually feed themselves.”

Some form of globalisation remains necessary, agreed Jullian Palliam, as this will enable Africa to use its abundant resources, such as uncultivated agricultural land, to contribute to world food security.

However, Palliam suggested that, in southern Africa, supply chain reforms were needed to increase trade. Exports of key raw materials could be boosted, for example, by improving port access and availability. Allowing ships to berth quickly would make a tangible difference, in his view, by reducing the demurrage charges that ultimately get passed on to farmers and other suppliers.

Unlocking finance was also vital.

“From an energy point of view, in Africa we have a lot of sun and a lot of water, we can see renewable energies playing a bigger part,” Palliam said. “The biggest hurdle is actually money. Africa needs patient capital, capital that is willing to wait not just one season, but multiple seasons – and also not pricing risk that is ludicrous, with interest rates across Africa 2-3 times worse than anywhere else in the world.”

Clean energy to feed and fuel the world

In this session, Alzbeta Klein, IFA’s director general and CEO, sat down for a ‘fireside chat’ with Tony Will, the president and CEO of CF Industries and IFA’s incoming chair.

The two discussed both food security and energy security as the fertilizer industry moves into clean energy markets. The new opportunities being created for the industry by the energy transition, and the contrasting policy approaches to net zero, were also highlighted.

Will praised the US Inflation Reduction Act (IRA). He contrasted the IRA’s incentives-based system – its “carrot approach” – with energy transition policies in the EU, Canada and the UK which, in pushing for net zero, had “gone after it with a stick” with measures such as carbon taxes.

“The US Inflation Reduction Act, in combination with the Infrastructure Bill, has put an $85/t tax credit available on carbon capture and sequestration,” said Will. “For our industry, that provides the right level of incentive to work with other partners – in our case Exxon Mobil – to find ways to actually inject [CO2 ] into the ground and sequester it permanently.”

Will also extolled the wider benefits of fertilizer industry decarbonisation – especially the creation of capacity to supply low-carbon ammonia – both to agriculture and emerging markets such as power generation.

“We have a blueprint for how we are going to get to net zero by 2050,” said Will. “The fact that we can provide a low-carbon intensity product that will help others decarbonise difficult-to-abate industries is a situation where one plus one equals much more than two.”

Summing up, Will said: “Sustainability has to start with profitability. Because if you’re no profitable you’re certainly not going to be sustainable in the longer term.”

Embracing the energy transition

The event’s second panel discussion put together Marco Arcelli, the CEO of ACWA Power, Dimitrios Koufos, the head of sustainable business and infrastructure, climate strategy and delivery at the European Bank for Reconstruction and Development (EBRD), and Stuart Neil, director of strategy and communications at the International Chamber of Shipping (ICS).

The three panellists explored the energy transition theme in greater depth, especially the opportunities for decarbonisation of the fertilizer and shipping industries.

Preparedness was the key to the energy transition for Marco Arcelli. He paraphrased Hemingway to make his point:

“Bankruptcies happen gradually and then suddenly – it’s the same for decarbonisation,” Arcelli said. “Decarbonisation will happen at some point, it will be very quick, and you need to prepare for that. Saudia Arabia is at the centre of the world for this.”

EBRD is scaling up its climate finance and is planning to allocate around $1011 billion annually in future, according to Dimitrios Koufos. But this is just a fraction of the finance that will be necessary to deliver the energy transition.

“The scale of the challenge is enormous,” said Koufos.“Between now and 2030, we’ll need to find capital equivalent to the GDP of China, about $14 trillion.”

The EBRD is currently working with the Egyptian government on decarbonising its domestic fertilizer sector. “The bank will be expanding its operations in sub Saharan Africa from 2024, which has a lot of important aspects of food security and energy,” Koufos said.

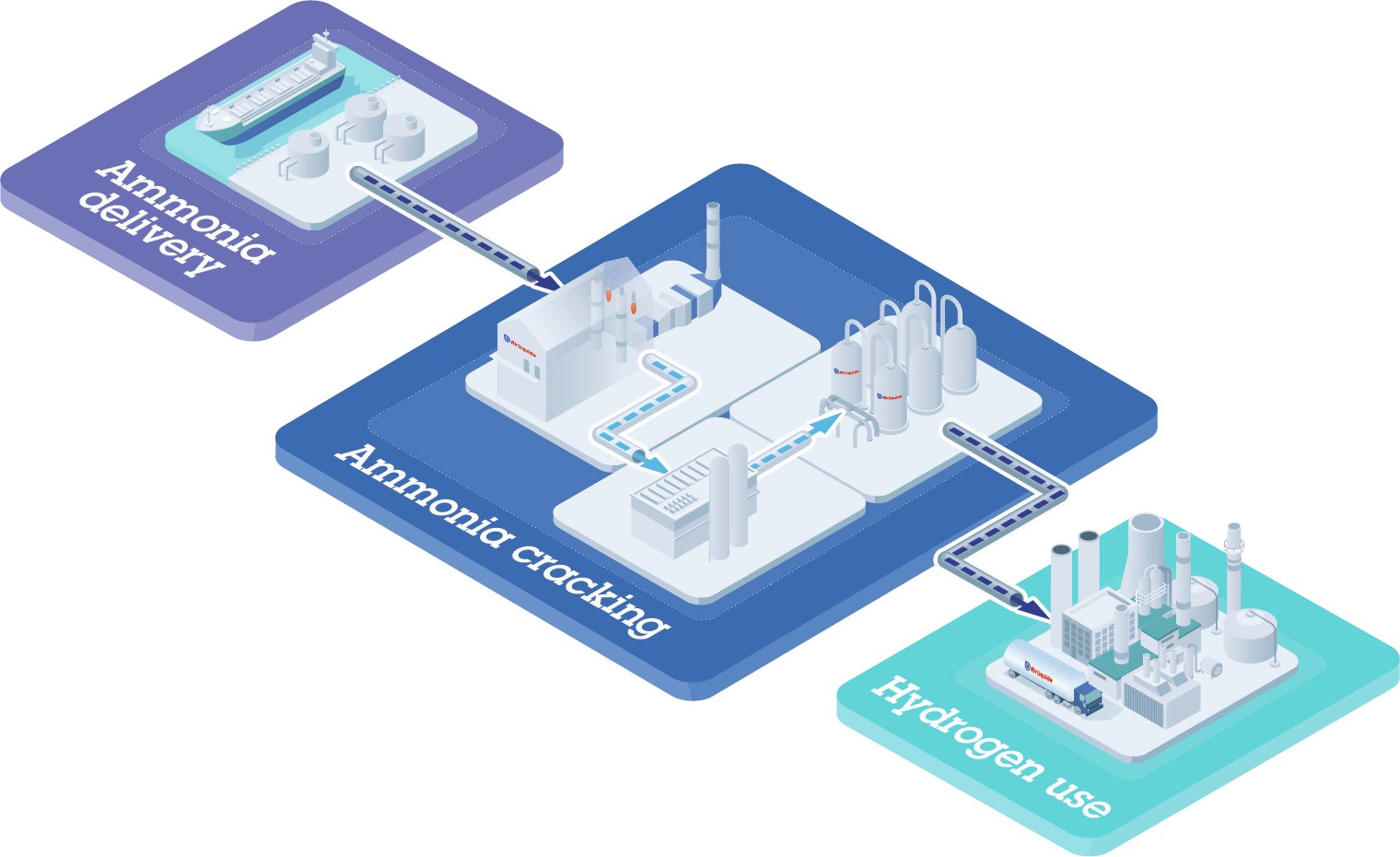

Stuart Neil gave a sober assessment of the scale of the change needed to decarbonise shipping. The ICS, which represents 80 percent of the global merchant fleet, recently surveyed its membership. “They don’t see ammonia as [a shipping fuel] being significant for another six years and probably nearer 20 years – it’s just the scale,” Neil said.

He added: “When you look at how much energy is going to be needed to decarbonise to meet the IEA’s net zero target … shipping’s going to need 3,000 terrawatt hours. That’s the whole of renewables at the moment – but there is a massive opportunity.”

Ships will not be able to run on ammonia without the necessary global infrastructure – Clean Energy Marine Hubs (CEM-Hubs) – in place. “Clean Energy Marine Hubs are looking at the offtake, the ports, the shipping, all the elements in the supply chain from production to end use – and de-risking that with governments to … make it happen,” he said.

As Neil mentioned during the conference, the CEM-Hubs initiative was formally adopted at the Clean Energy Ministerial (CEM) summit in Goa, India, in July. “We’re building the coalition of private sector and governments ready for when this gets launched by energy ministers in July,” said Neil. “We are very open to working with everyone to make this a reality.”

Leadership

In the final keynote panel, Jeanne Johns, then CEO of Incitec Pivot Limited, Bob Wilt, Ma’aden’s CEO, and Alexander Schmitt, the CMO at Anglo American, shared their views on the business leadership qualities needed to deliver food security and the energy transition.

“We can’t fail, it’s not an option for us,” urged Bob Wilt, referring to the fertilizer industry. “We are too vital, whether it’s the energy transition or food security, we are at the epicentre – this group has got to succeed.”

Population growth was not taking place in wealthier regions such as Europe, observed Jeanne Johns: “It’s going to be places where affordability really matters. We need to make sure we find solutions that keep the food affordable as well as green.”

The need to act now was imperative for Alexander Schmitt. “2050 sounds far away – but I think of my son who is 12 years old now,” Schmitt said. “He will be 40 then, younger than many of us in this room, and that’s the perspective we need to think about, the generations to come.”

Medium-term market outlook

The 2023-2027 medium-term outlook was presented by Laura Cross, IFA’s director of market intelligence, and IFA’s demand program manager, Armelle Gruère.

On the demand side, Armelle highlighted the continuing importance of fertilizer affordability. This would remain the number one factor influencing fertilizer use over the medium-term, according to a recent IFA survey, followed by water availability and climate change.

After a two-year contraction, fertilizer demand looks set to rebound this year. IFA expects global consumption to recover by 4.0 percent in the fertilizer year (FY) 2023, following a 2.8 percent decline in FY 2021 and a 4.9 decline in FY 2022.

Laura Cross summarised IFA’s 20232027 outlook using the following ‘hack’:

Nitrogen. Demand growth of 1.9 percent p.a. Driven by recovery in Eastern Europe & Central Asia, Latin America and South Asia, offset by a slowdown in mature markets. Supply growth driven by Russia, China and a wave of low-carbon (green and blue ammonia) projects.

Phosphate. Demand growth of 2.6 percent p.a. Led by South Asia and Latin America and driven globally by improved affordability in 2023. Supply growth driven by a small number of large projects.

Potash. Demand growth of 2.5 percent p.a. Driven by Latin American yields and, globally, by improved affordability capped by availability. Supply driven by a large projects offset by the impacts of sanctions.

Cross praised the industry’s performance on fertilizer supply.

“The industry did a pretty phenomenal job of keeping supply moving, keeping trade flowing globally in the last year, especially in light of those sanctions uncertainties,” she said. “Raw material costs [i.e. natural gas] remain elevated and that’s something we need to watch over the short- and long-term.”

While sanctioned countries had fortunately found a route to market, observed Cross, fertilizer supply from Belarus and Russia had not normalised and recovered to its pre-2022 levels.

“That’s been a good thing for farmer affordability and food security globally. But they haven’t returned to their normal rates,” she said. “So, this isn’t a universal recovery and that will continue to disrupt things in the next five years.”

The industry’s investment cycle and priorities are changing, advised Cross, with a wave of blue and green ammonia projects emerging. “We need to keep track of the different incentives in place at the local level if we want to understand exactly how much new low-carbon capacity is likely to commission,” she observed.

On the demand side, Cross said that although affordability has improved it remains the key determinant of fertilizer use. She also warned of El Niño’s arrival in 2023.

“Weather risks are coming and will become another driving force as we get into the second half of 2023,” she said. “South Asia and Latin America are our largest drivers of short- and medium-term demand, and when it comes to weather risks most of those are in the southern hemisphere – it’s therefore mostly the global south that will be impacted by El Niño.”

Cross also highlighted Africa as a demand region on the rise. “Even though major growth is still centred in those big agricultural-producing regions, we do see Africa emerging as the fastest growing market at the end of our medium-term outlook,” she said.

The fertilizer industry was less in the spotlight than it was 6-12 months ago, suggested Cross, as the supply and price fears of a year ago had waned.

“Things have improved from a farmer affordability perspective,” summed up Cross. “But we are now starting to see lots of other factors coming into play – the role of climate regulation, low-carbon investment, as well as food security and how fertilizers impact that.”

AFRICA AGTECH STARTUP SHOWCASE

New to this year’s annual conference was The Africa AgTech Startup Showcase. This was launched by IFA and Morooco’s Mohammed VI Polytechnic University (UM6P) with the support of OCP Group. The following eight finalists were given the opportunity to pitch to delegates:

- Phospholutions develops technologies that increase fertilizer efficiency, affordability, and minimise the environmental impact of global phosphorus use

- Natura Crop Care offers innovative, patented climate-resilient solutions for sustainable soil health that are capable of reducing carbon footprints and doubling the income of farmers

- Agri IOT is developing Croptune, a real-time mobile application that recognises and helps correct nutritional deficiencies in crops

- Foodlocker is a platform that connects African smallholder farmers with large buyers through market access and precision agriculture, as well as linking up farmers with inputs, credit and expertise

- Albo Climate offers a remote and accurate solution for quantifying, mapping, and monitoring the carbon sequestered in ecosystems globally

- Farmer Lifeline Technologies has developed a solar-powered device that scans crops and alerts farmers to pests or diseases while providing recommendations on fertilizers or pesticides

- Agricolleges International is an online learning institution that provides affordable, accessible and industry-relevant education and training in agriculture and related industries

- Safi Organics is using decentralised fertilizer production to help rural under-served rural communities become self-sufficient in both crop production and the consumption of agricultural inputs.

Following questions and scoring by a jury of industry experts, Phospholutions won the first prize of e20,000, while runner-up Farmer Lifeline Technologies was awarded e10,000 in prize money.