Sulphur 409 Nov-Dec 2023

30 November 2023

The future of phosphate production

PHOSPHATES

The future of phosphate production

In spite of changing patterns of demand, deglobalisation and environmental concerns, phosphate mining and acid-based processing are likely to be the mainstay of the industry for years to come.

The phosphate industry has come under scrutiny on various fronts over the years, from its environmental impact, to concerns over resource depletion and even the concentration of its production in the hands of a few, often state-owned companies. But in spite of all of these pressure on the industry, the cost base of acid-leached phosphate for use as a fertilizer is likely to remain the dominant force in phosphate production.

New demand

Around 80-85% of phosphate is used for fertilizer production, either as mono- or diammonium phosphate, or single or triple superphosphate. Animal feed additives represent another 7-8%, and the remaining 7-10% is taken up industrial uses for phosphate, including human food additives, toothpaste, detergents, water treatment, metal production, etc. However, a new and promising area of demand for phosphates is coming from the battery industry in the form of lithium iron (Fe) phosphate or LFP. LFP production has increased dramatically in China, mainly for use in car batteries for electric vehicles. As we discussed in our article in the previous issue, current annual growth rates are around 13-14%, albeit form a low base. However, it is unlikely to eclipse fertilizer uses for phosphates in the medium term and is more of a niche rather than a major new use for phosphate. By 2030, demand for lithium iron phosphate for battery production is expected to be around 2.0-3.5% of overall phosphate demand, depending upon the share of the battery market that LFP eventually claims. Fertilizer will still represent the lion’s share of phosphate demand going forward.

However, the rare earths content of phosphate projects is also attracting attention. Sedimentary phosphate deposits can contain considerable amounts of accompanying rare earth elements (REEs), which are needed for electronics and in renewable energy production. The demand for REEs is expected to grow four to six times over the next two decades. Most wind turbines use magnets which contain neodymium and praseodymium to strengthen them, and dysprosium and terbium to make them resistant to demagnetisation. Phosphate rock containing rare-earth elements (REEs) is considered one of the most promising potential secondary sources of REEs and extraction of them could be a useful side income stream for new phosphate projects and a way of tipping them into profitability.

Resource constraints?

In spite of annual fluctuations, over the long term phosphate demand has continued to grow at a steady rate this century, averaging 2.1% year on year over the period 2000-2022. Although there are indications that the long term growth rate is slowing as markets mature and there is increased concern over overapplication of phosphates, this may mean an average growth rate of 1.5% year on year over the next decade or so, equivalent to around 3.5 million t/a of phosphate rock, or one large scale mine per year.

The steadily increasing demand for phosphate and uncertainty about the size of phosphate reserves have driven a concern that humanity may be running out of one of its key resources. Drawing a comparison with the depletion of oil reserves and the famous Hibbert Curve of ‘peak oil’ production, some scientific papers have even raised the spectre of ‘peak phosphorus’ and the idea that some time over the course of the 21st century we may find ourselves running out.

Worries over ‘peak oil’ production were very common in the 2000s, but have fallen away as shale drilling opened up new reserves and more efficient vehicle engines the transition to electric drive trains has led to demand plateauing and soon probably falling. Indeed, the peak oil concern for the industry now is one of demand rather than production and a transition away from oil. However, with phosphorus the concern never seems to have quite gone away in spite of more recent surveys of rock reserves showing potentially hundreds of years of resources. In 2010, IFDC geologist Steven Van Kauwenburgh estimated the world’s supply of phosphate rock at 60 billion metric tonnes in World Phosphate Rock Reserves and Resources, and another survey by Argus and the International Fertilizer Association (IFA) was published in March 2023 which found that, despite reports in some quarters to the contrary, there is no global shortage, and that there are sufficient deposits of mineable and processable phosphate rock for about 350 years’ supply at projected usage rates and using current technology. This figure assumes no advance in mining and processing technology from the present day and can be seen as a low-ball estimate. In theory, if total available global resources are considered, more sustainable farming practices are more widely adopted and fertilizers are used in an increasingly efficient way, a higher-end limit could be more than 1,000 years. There is no absolute resource constraint on phosphorus that we need worry about this century.

Deglobalisation

However, while reserves are plentiful, their distribution and cost do remain concerns. The five-fold increase in the price of phosphate fertilizer that happened in 2008 led to a major – albeit temporary – fall in demand worldwide. The price spike was caused by a number of factors. These included an imbalance between supply and rapidly expanding demand, especially in Asia, and the growing demand for fertilizers to be used for biofuels to replace oil in the US, Brazil and Europe. But some have pointed to the concentration of phosphate resources as a potential worry in its own right.

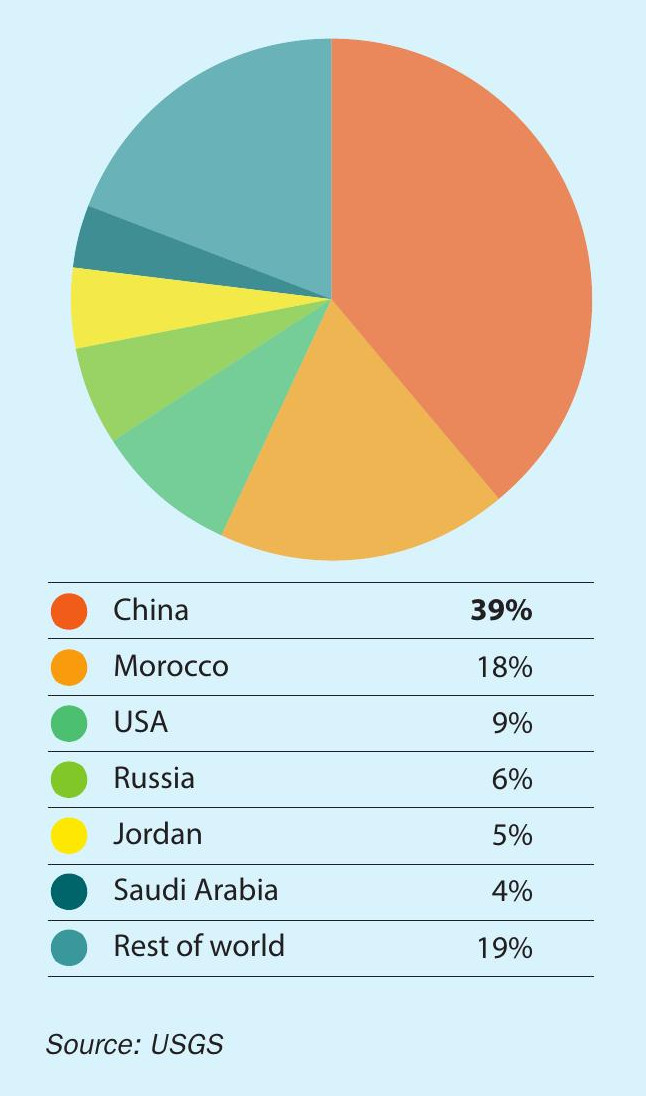

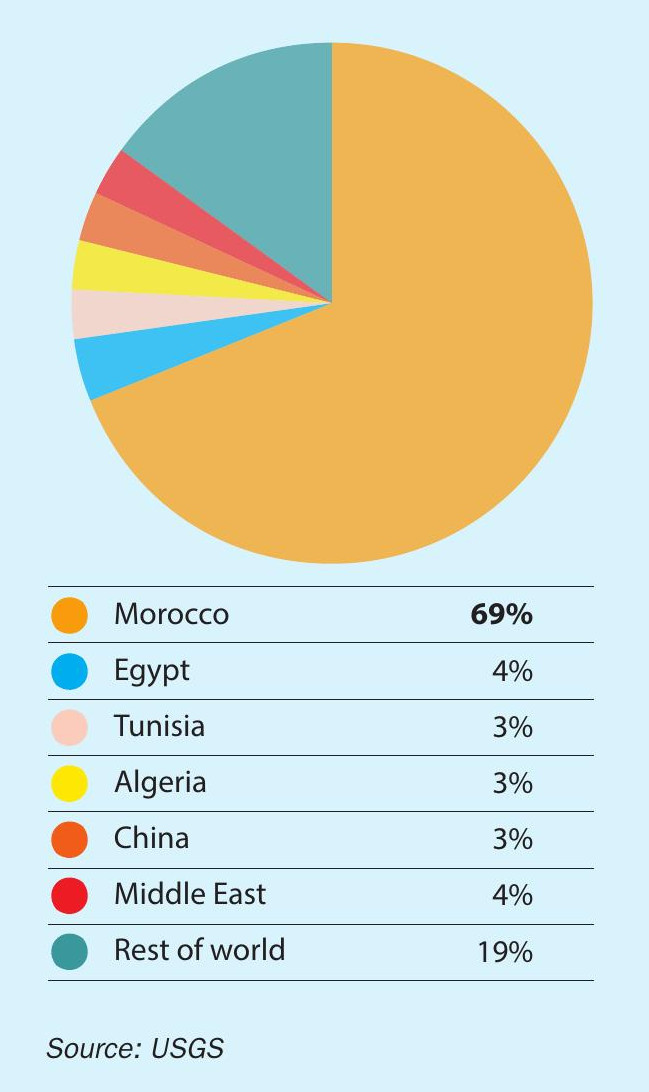

As Figure 1 shows, 80% of the world’s current annual phosphate supply is concentrated in six countries; China, Morocco, the US, Russia, Jordan and Saudi Arabia. Phosphate reserves, meanwhile, are even more concentrated, with 83% concentrated in North Africa and the Middle East, as shown in Figure 2, and 69% in Morocco alone. And as far as phosphate trade goes, 70% of trade is supplied by Morocco and the Middle East (mostly Egypt, Jordan and Saudi Arabia). This is far more concentrated than the market for oil, which even with the addition of Russia to OPEC+ only controls around 40% of world oil production, and 60% of trade (although 80% of reserves, mainly in the Middle East). The spectre of an ‘OPEC for phosphates’ has been raised by the major changes in the world economy and geopolitics of the past decade or so, with a retreat from the globalisation that drove world growth in the 1990s-2000s and a move to what the World Economic Forum has called deglobalisation, something that has been accelerated by the covid pandemic and the war in Ukraine. In the phosphate industry, Chinese protectionist measures such as its export ban has also helped change the global phosphate trade. This is potentially a worry for major importing regions such as India, Europe and Brazil. It is worth saying that there is no sign that governments in e.g. Saudi Arabia, Morocco or Jordan are trying to cartelise the phosphate market. Nevertheless, there is a policy drive in some countries to try and secure control over supply.

Diversification of the supply base depends upon a number of ‘junior’ phosphate mining projects in countries such as Australia, Canada, Brazil and South Africa. Brazil, for example, is looking to reduce import dependence on phosphates. Following the outbreak of war in Ukraine it has introduced a National Fertilizer Plan in 2022, and the Tres Estradas project received a construction license and secured funding later that year. Of the $40 billion expected to be invested in mining in Brazil over the period 2022-26, 15% is earmarked for phosphate projects. In South Africa Kropz is developing two major phosphate projects; at Elandsfontein, on South Africa’s west coast, which is nearing production, and Hinda in the Republic of Congo. South Africa’s Afrimat has also acquired the Glenover phosphate project in South Africa and is looking at developing both rare earths as well as phosphates from the project.

There are also considerable reserves in Quebec, Florida, Kazakhstan and Togo, as well as Brazil, where Vale and Anglo American each hold significant phosphate interests. Other phosphate mining countries include Peru and Mozambique. In Canada, last year, the Quebec environment ministry gave the go-ahead to the $750 million Arnaud phosphate mining project.

Over the next decade several of these projects are likely to come to fruition, with attendant downstream fertilizer production and sulphuric acid demand in new regions for the phosphate industry.

Environmental issues

Other concerns over phosphates are environmental. There are several strands to this. One is based around the unsightliness of phosphate mines and the disruption to the surface environment that they cause, although most are reclaimed and remediated at the end of their lives. Nevertheless, this has driven some opposition in places such as the US, and perhaps been a factor in the phosphate industry being constrained in developing new capacity there and instead decamping to countries where the government perhaps has to pay less attention to local concerns.

Phosphate mines also produce large amounts of phosphogypsum tailings, and because there is naturally-occurring uranium, thorium and radium found in phosphate rock this ends up in this waste and can make it very mildly radioactive. This has limited the use of phosphogypsum as a construction material in Florida and meant that miners there must maintain large gypsum stacks, although there have been recent moves by both federal and state governments to authorise its use. A study is due to report back in April 2024, but again this has constrained US phosphate development and expansions even at existing mines.

In Europe, the concern has been around cadmium, which can also be found in phosphorite and apatite rocks and which can end up in phosphate fertilizers and via them the food chain. The EU has set a limit on cadmium in phosphate fertilizers at 60 mg/kg from July 2022, and some member states have sought to set the limit lower still, reducing to 40mg/kg after three years and to 20mg/kg after 12 years. However, this would have effectively prohibited use of phosphates from Morocco and North Africa – responsible for 70% of EU imports – and privileged use of Russian phosphate, which has much lower levels of cadmium. The EU was unable to agree on the lower limit, but in 2019 did to publish new guidelines which allow labelling of phosphate products which are low in cadmium. One of the fallouts from the Ukraine war and sanctions on Russia has been to very much push this debate to the ‘back burner’ in the EU.

The circular economy

But perhaps the greatest environmental concern regarding phosphate fertilizer use is that of eutrophication – leaching of phosphates into water courses and causing algal blooms which remove oxygen from the water and cause damage to marine ecosystems. The Food and Agriculture Organisation of the United Nations (FAO) estimates that only 15 to 30% of phosphorus in fertilizers is actually taken up by plants in the year of its application. This can vary considerably due to different types of soil and their ability to bind phosphorus, making it unavailable to the plant.

Increasing phosphorus nutrient use efficiency is perhaps the most obvious way to tackle this, but increasing phosphorus use efficiency (PUE) is not a simple matter, and can range from increasing root presence in the uppermost part of the soil (which tends to be highest in P) to using varieties of crop with better uptake. Some areas have a surplus of P in the soil, while others, often in poorer soil areas, often have a deficit – up to 50% of soils are reckoned to be P-deficient globally. Obviously greater use of P in P-deficient soils and less in P-surplus soils would lead to greater PUE, but this might still lead to a reduction in yield in those P-surplus areas. Effective capture and recycle of animal manures in mixed livestock-cropping systems could also help move some regional P deficits closer to net zero P balances, particularly in forage croplands with extensive P deficits. But achieving more effective manure P recycling at the global scale may require broader management or structural changes in livestock farming, such as improved access to manure collection and treatment technologies, changes in livestock diets, or even reductions in livestock densities.

There have been some moves in recent years, especially in countries like the Netherlands which have particular problem with phosphate leaching and eutrophication, to attempt to capture and recycle phosphorus as part of a move towards the ‘circular economy’. Phosphorus recovery at waste water treatment plants is an emerging technology, but the economics are hampered by the fact that it is much more (up to six times more) expensive to recover phosphorus from large quantities of low-phosphorus sludge than to extract from smaller quantities of higher-phosphorus ore. It is also overall a more carbon-intensive method of phosphate production than mining. The phosphorus recovery rate from waste water can reach up to 40-50% with current technologies, while recovery rates from sewage sludge and sewage sludge ash can reach up to 90%. However, few of these methods have been demonstrated on an industrial scale. Phosphate mining will likely remain as the main supply of phosphorus for the foreseeable future.

Alternative techniques

While most (>80%) phosphoric acid is produced today via acid treatment of phosphate rock, other methods are available. It can be produced via thermal treatment of rock, which generates acid of a higher purity for the manufacture of high grade chemicals, pharmaceuticals, detergents, food products, and other non-fertilizer products. Most thermal processes involve the addition of steam to the phosphorus burner to produce and maintain a film of condensed polyphosphoric acids which protect the stainless steel burner tower. The products from the burner tower pass directly into a hydration tower where the gaseous phosphorus oxide is absorbed in recycled phosphoric acid. Alternatively, the phosphorus may be burnt in dried air. The phosphorus pentoxide is condensed as a white powder and separately hydrated to phosphoric acid. This method allows heat to be recovered and reused.

However, thermal production of phosphoric acid is much more energy intensive than wet phosphoric acid production, and correspondingly more expensive, and as long as sulphuric acid remains relatively cheap, they are unlikely to make much inroad in phosphate fertilizer production where the purity requirements are lower.

More of the same

Recent disruptions to the traded phosphate market caused by sanctions on Russia pushed up prices in 2022 and led to a major fall in consumption last year. However, this year is expected to see a rebound in demand and overall the long term trend in increased fertilizer demand for phosphate remains unchanged. Brazil has a rising planted area and higher cash crop yields, and India is likely to remain a major consumer and importer, with moves to more balanced nutrient application supporting future growth in phosphate demand. At the same time, Chinese export capacity remains constrained by the government’s determination to ensure continuity of domestic supply by whatever means necessary, while continuing to bear down on more polluting and less efficient domestic capacity.

There may be an increased push towards some new projects outside of traditional growth areas like Morocco and the Middle East, driven by concerns over supply security, such as in Brazil. The Arianne Resources Lac a Paul phosphate project is also due to come on-stream in Canada in 2026. There are also indications that China is becoming concerned about its remaining phosphate deposits and may be content to see cuts in downstream capacity over the medium to longer term in order to preserve domestic reserves. However, in spite of some geographical shifts in phosphate production, and side-streams like rare earths recovery, the basic formula of phosphate mine, and sulphuric acid-based fertilizer production looks unlikely to change significantly over the next two decades or more.