Sulphur 412 May-Jun 2024

31 May 2024

Is sulphur nutrient supply meeting crop demand?

CRU INSIGHT – SULPHUR FERTILIZERS

Is sulphur nutrient supply meeting crop demand?

Sulphur plays an important role in crop nutrition. Indeed, sulphur is increasingly being recognised as the fourth major crop nutrient alongside N, P and K. However, a combination of intensive agricultural practices, increasing application of high-analysis fertilizers and tighter air quality regulations has led to increasing sulphur deficiency in soils. In this insight article, CRU’s Peter Harrisson looks at what’s driving sulphur deficiency and whether there’s a gap in the market for sulphur fertilizers.

The sulphur cycle

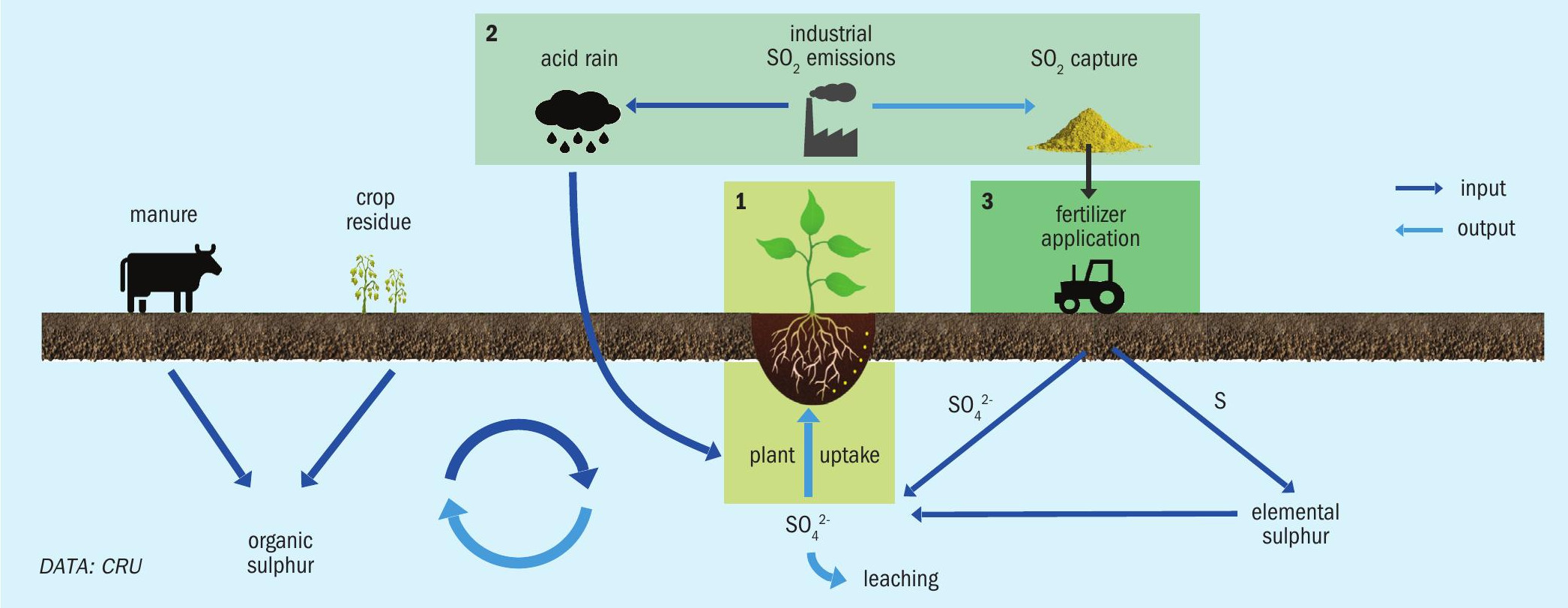

Plants are able to take up sulphur as a soil nutrient in sulphate form. This can be supplied directly through atmospheric deposition and sulphate fertilizers, or via the oxidation of organic sulphur or elemental sulphur fertilizers. Organic sulphur accounts for around 95 percent of the sulphur found in soils and, when converted into sulphate, is either taken up by plants or lost from the system by leaching. The major factors influencing the levels of available sulphur in soil are the rate of plant uptake versus replenishment by atmospheric deposition, animal/crop wastes and fertilizer applications (Fig. 1).

In the past, little attention was paid to artificially applying sulphur as a nutrient because soils had abundant natural supply. Yet increasing issues with crop quality and yields in recent years are being attributed to soil sulphur deficiency. The reasons behind growing global soil deficiency include:

- Falling atmospheric SO2 emissions

- Rising crop areas and yields

- Increasing consumption of high-analysis fertilizers.

Falling atmospheric emissions

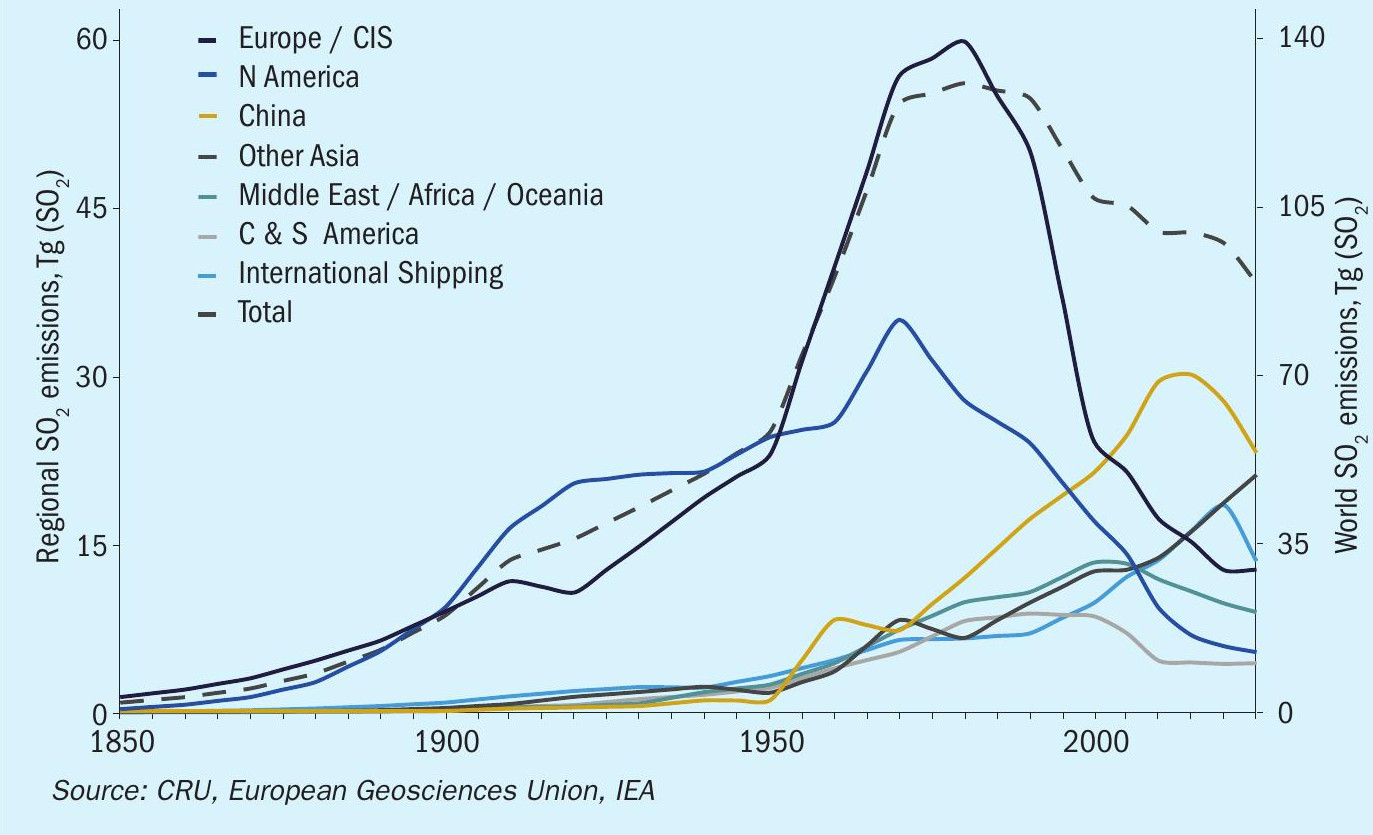

Tight emissions controls have reduced the amount of SO2 entering the atmosphere and being deposited as acid rain. Emissions in Europe and North America have been in decline since the 1980s, with the rest of the world now implementing similar policies.

While the introduction of sulphur limits in liquid fuels has been the main policy driving down sulphur emissions, increased SO2 capture from power generation and industrial processes (including base metals smelting) has also led to SO2 emissions falls. Sulphur emissions from industry in North America and Europe have fallen furthest and fastest, with emissions in China and other Asian countries only beginning to decline from the mid-2010s (Fig. 2).

Rising crop areas and yields

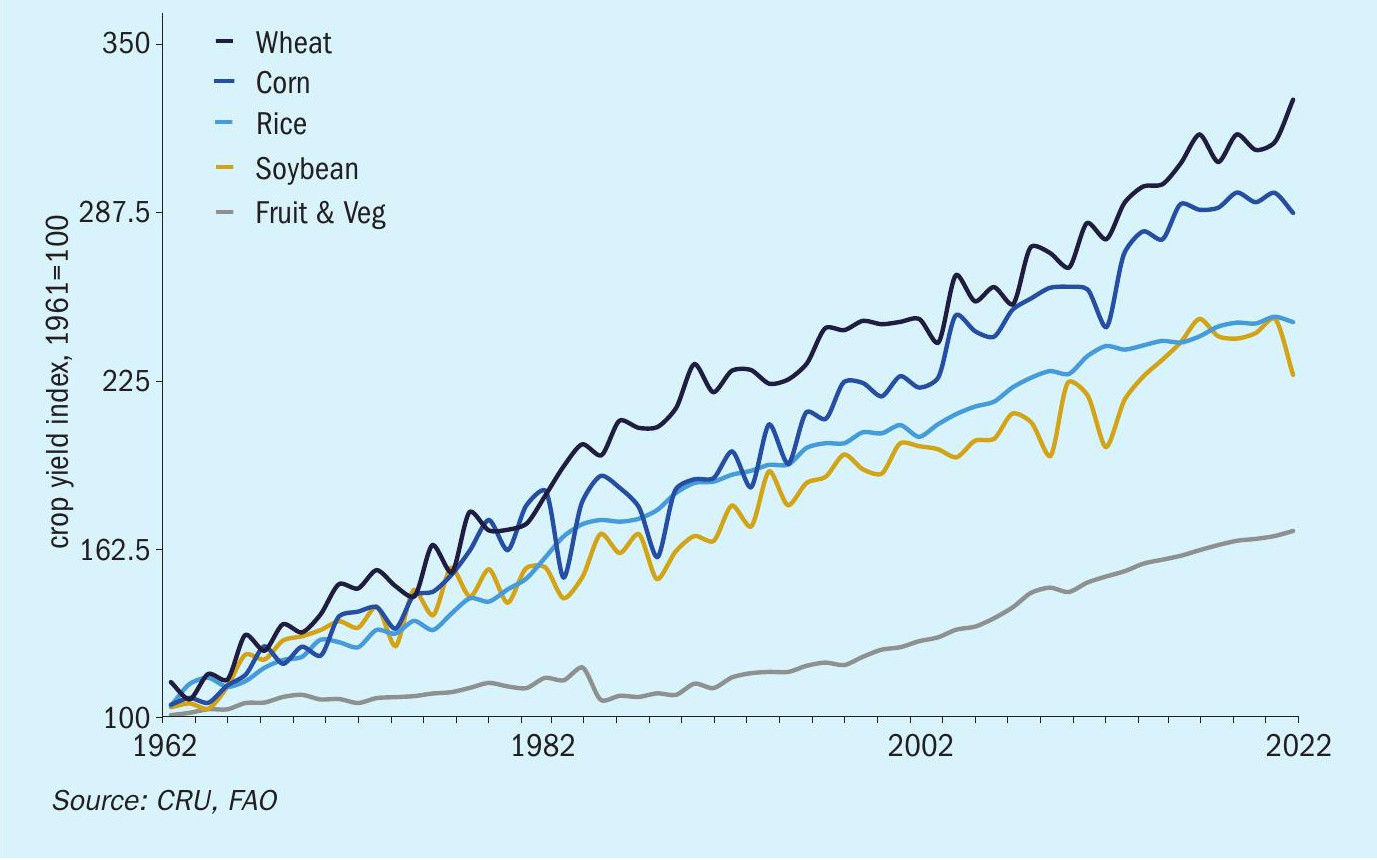

Modern agriculture is removing more nutrients from the soil as it become more intensive, with higher yielding crops, shorter growing seasons and more frequent crop rotations (Fig. 3). Agricultural expansion has accentuated this issue, as increased N, P, K and S nutrient applications are typically required on previously unproductive (and often low quality) land. The planting of crops with a fundamentally higher sulphur nutrient requirement, such as sugar, canola and soybeans, has been another factor behind the increasing agricultural need for sulphur.

Increasing consumption of high-analysis fertilizers

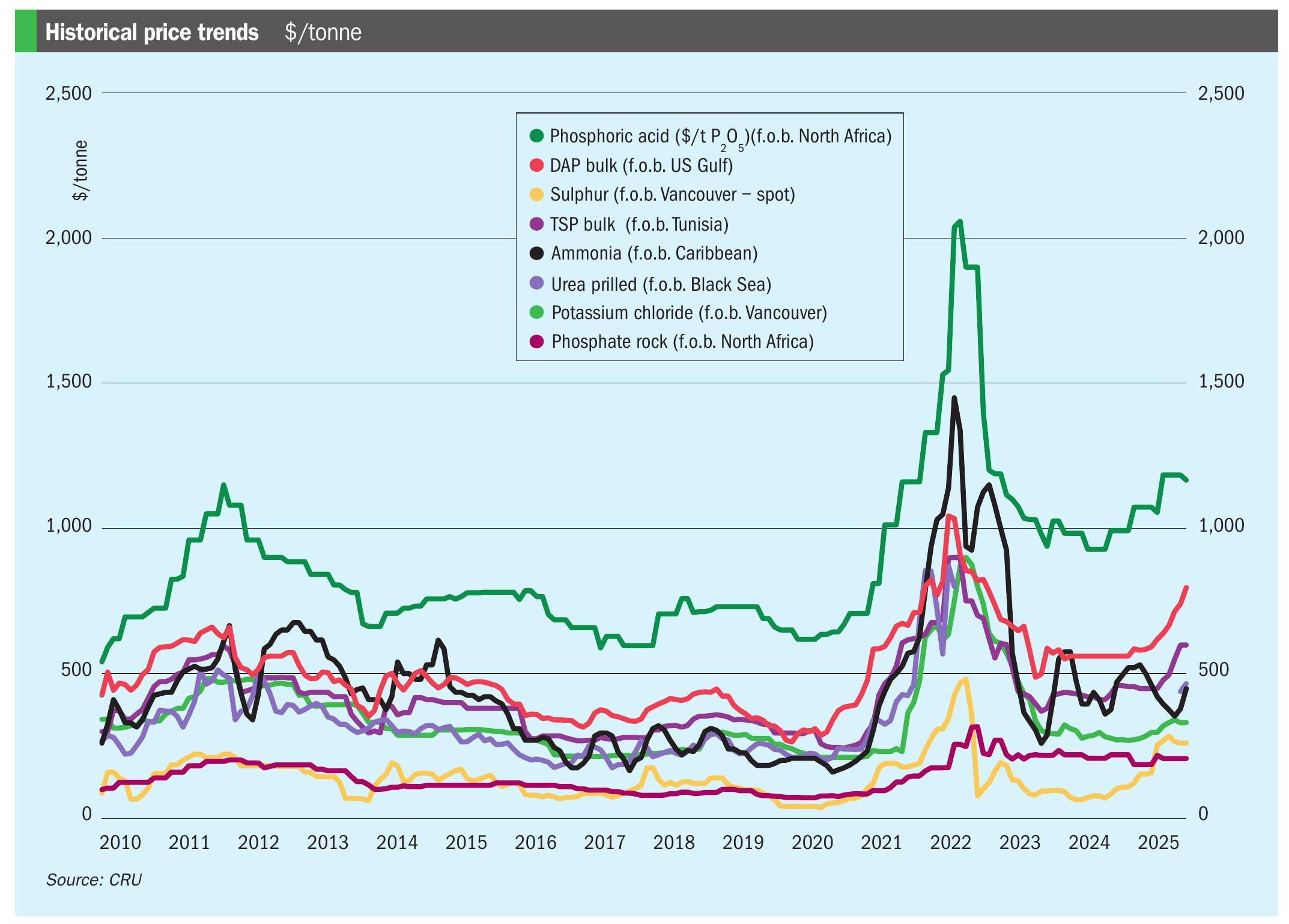

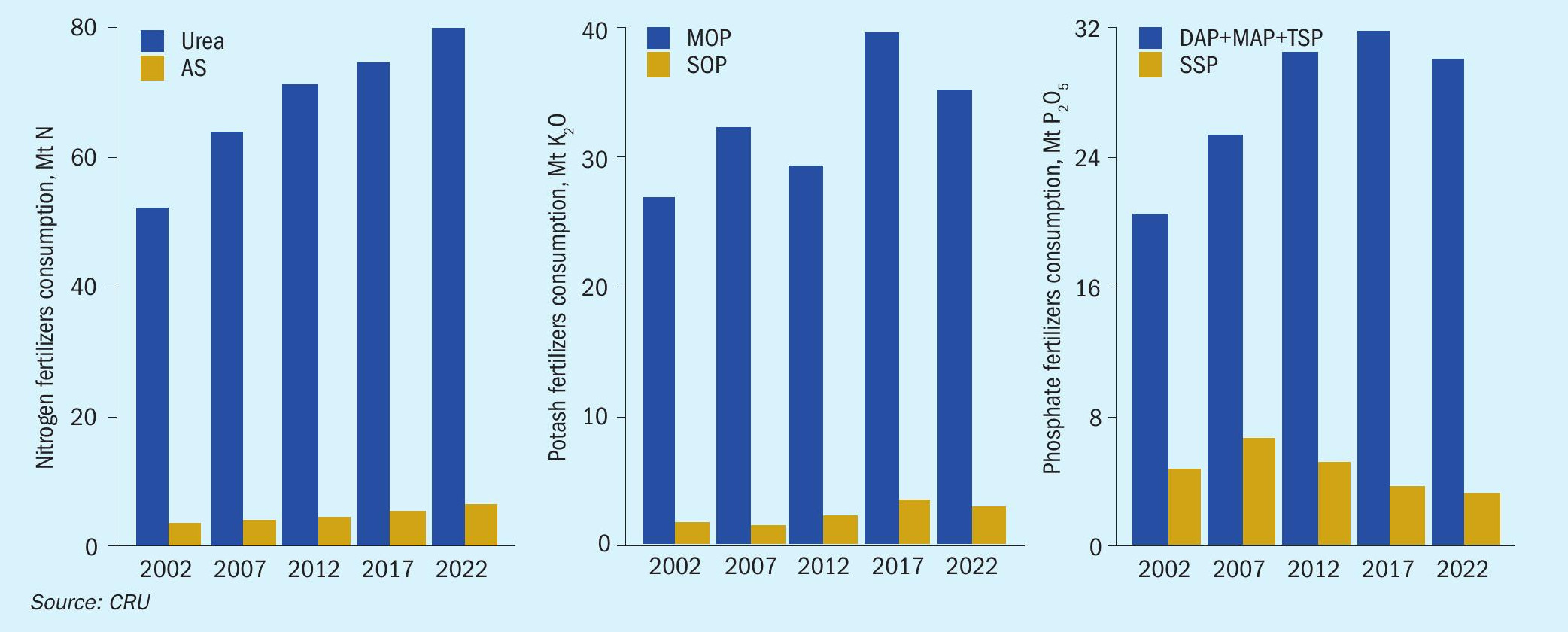

The relative and/or absolute decline in the consumption of traditional sulphate-containing fertilizers, including ammonium sulphate (AS), single superphosphate (SSP) and sulphate of potash (SOP), and their increasing replacement with high-analysis fertilizers, such as urea, diammonium phosphate (DAP) and muriate of potash (MOP), has been a long term trend (Fig. 4). Consequently, the dominant fertilizers across N, P and K products all have low or no sulphur content, as sulphate-containing fertilizers now supply only a minor share of primary nutrient demand.

Current market for sulphur fertilizers

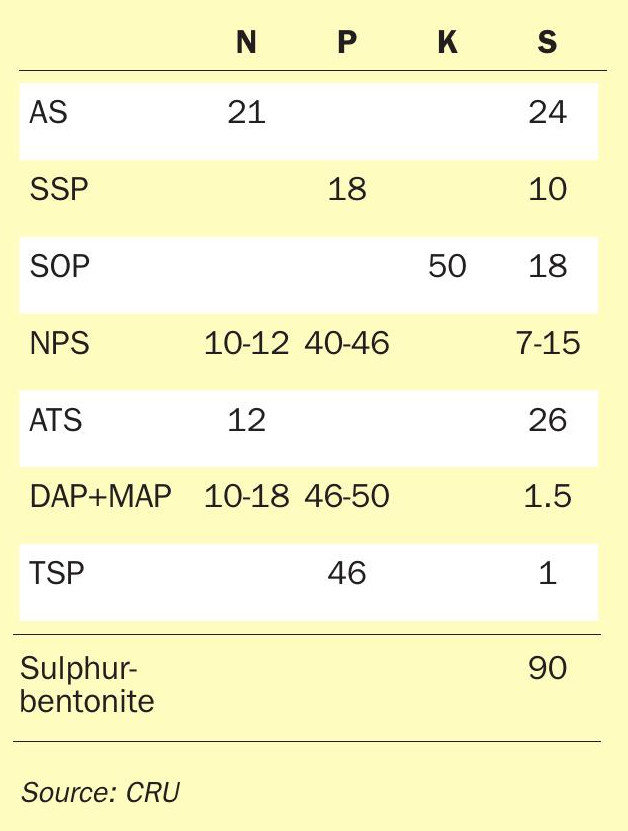

Sulphur nutrient supply to agriculture has been calculated from consumption data for sulphur fertilizers. This includes large-scale sulphate-containing products such as AS, SSP, SOP, ammonium thiosulphate (ATS) and gypsum, alongside NP+S and sulphur-bentonite, together with the residual sulphur content found in DAP, monoammonium phosphate (MAP) and triple superphosphate (TSP). The nutrient contents of these major sulphur-containing fertilizers are shown in Table 1.

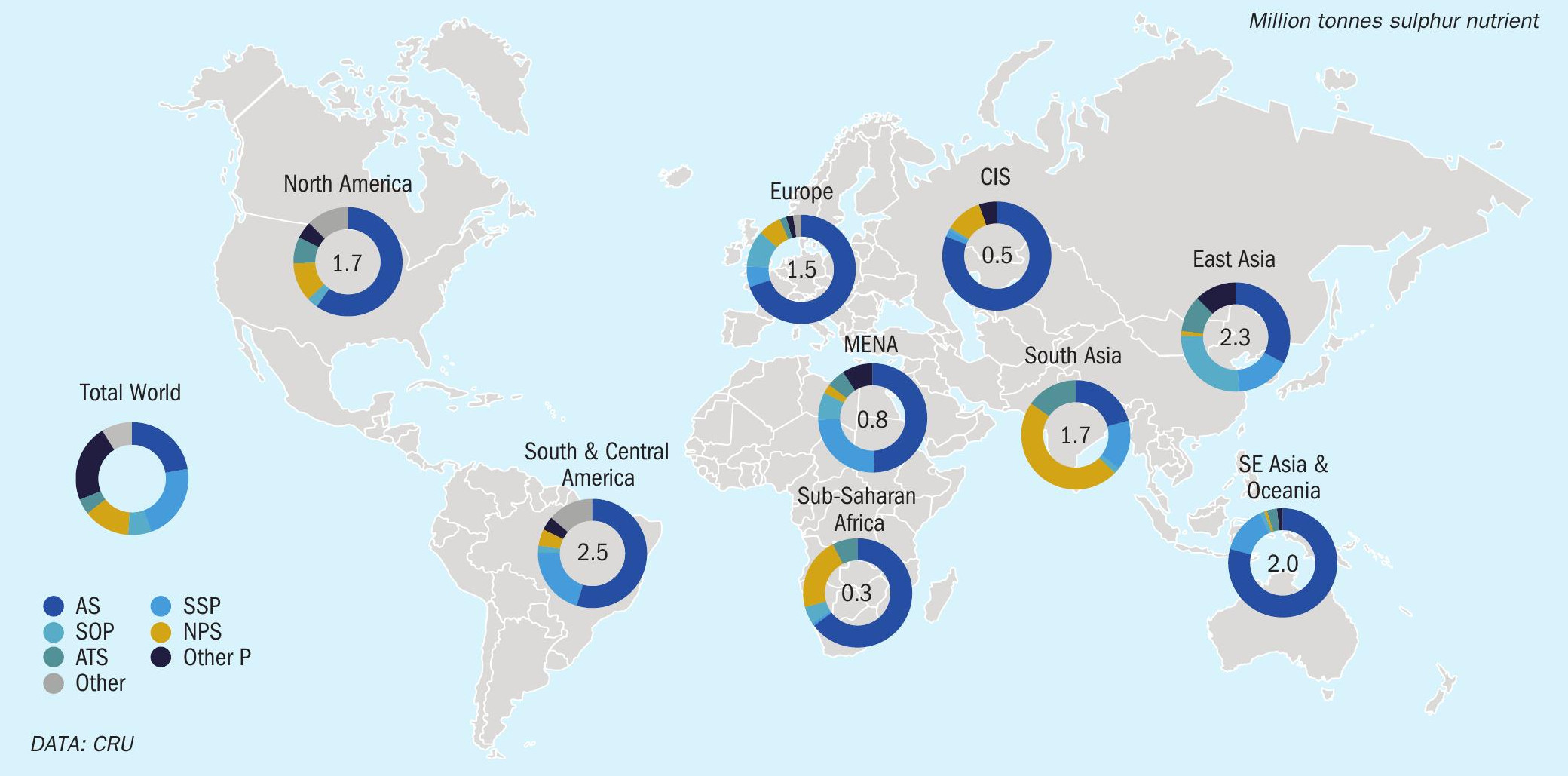

In 2022, global sulphur nutrient supply is estimated at 13.8 million tonnes, with sulphate-containing fertilizers such as AS and SSP accounting for 68 percent of this total (Fig. 5).

The AS market has grown in recent years because of increasing involuntary production in China (as a by-product of caprolactam production), while at the same time the country’s SSP demand has halved. In contrast, SSP demand remains strong in Brazil, India and Australia (Fig. 5), although total global consumption has still declined over the last decade.

SOP commands a small market relative to MOP, which is 10 times larger, despite being highly prized as a chloride-free potassium and sulphur source for high-value crops. Chinese SOP demand has grown considerably since 2000, outpacing more modest demand growth across other regions.

The NP+S product group has been responsible for the greatest change in sulphur nutrient consumption globally. At the start of the decade, NP+S emerged as a new sulphur fertilizer with strong demand in India, Brazil and the United States, with new demand having been developed in Ethiopia and Australia.

The types of NP+S consumed vary between regions with the Americas and Africa focussed on DAP/MAP-like products with only 5-10 percent sulphur content, whereas India and Southeast Asia have a preference for products such as 20-20-0-13.

Other notable sulphur fertilizers include: gypsum, the calcium sulphate by-product of phosphate fertilizer production which has traditionally been soil-applied in Brazil; sulphur bentonite, a product specifically designed to help combat sulphur deficiency in North America, India and other countries and regions.

How does sulphur nutrient supply compare to crop demand?

Crops use sulphur to produce essential amino acids, proteins, oils and other organic compounds – and is especially important in initial plant growth stages. Sulphur demand varies with agricultural practice. Pasture for a low intensity grazing operation, for example, will typically require an S application of only 5-10 kg/ ha, whereas sulphur hungry crops, such as canola, may require up to 5-10 times this application rate.

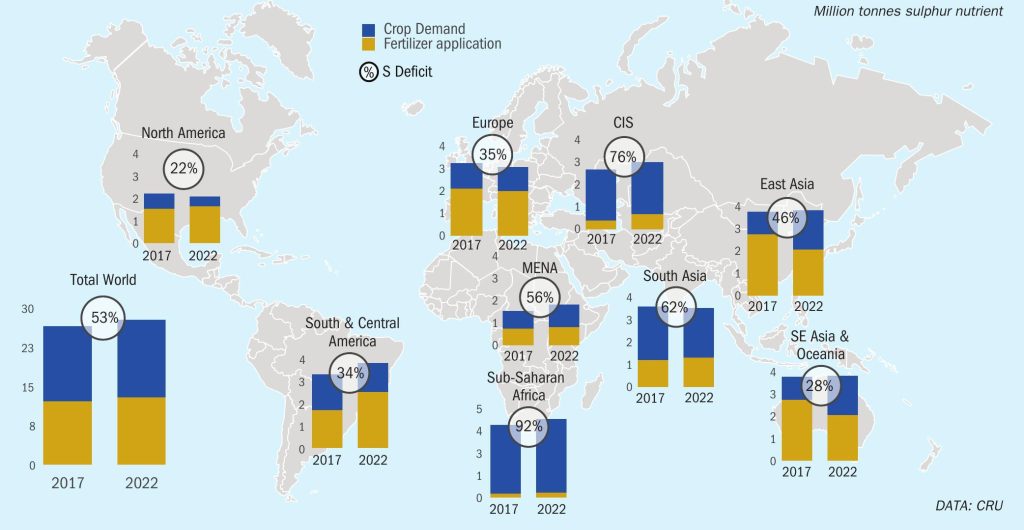

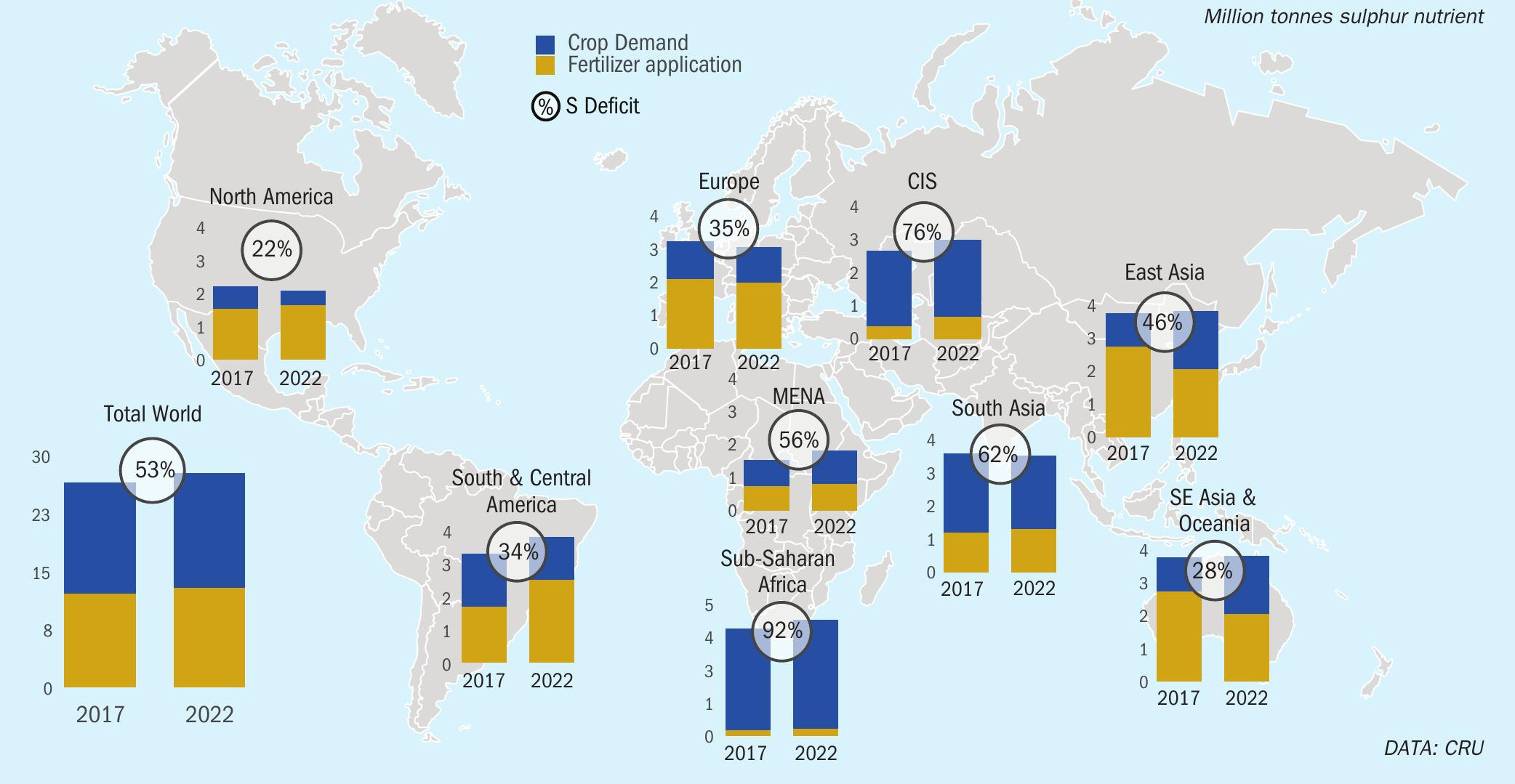

Only around half of the global sulphur requirement from crops is being met by fertilizer applications currently, based on CRU estimates for 2022. All global regions are calculated to be operating with a sulphur nutrient deficit, this being most pronounced in India, Africa and the CIS region. Despite high levels of sulphur nutrient application in East Asia and South Asia, sulphur nutrient deficits are calculated at 46 percent and 62 percent, respectively (Fig. 6).

In parts of Asia, the atmospheric deposition to soils from high sulphur emissions will help to ‘naturally’ fill some of these nutrient gaps – although deficits will still occur in agricultural areas located far from industry. Unmet crop demand will also be affected by extreme climate conditions in some regions where high sulphur losses from the soil are often sustained due to high rainfall events.

Agricultural use and crop nutrient demand for sulphur have both steadily risen in the Americas, driven by crop choice on the demand side and high volume AS and NP+S applications (e.g., from Mosaic’s sulphur- and zinc-enhanced MicroEssentials MAP product) increasing nutrient supply.

Prospects for sulphur demand

The fundamental demand for sulphur in agriculture will only keep growing in CRU’s view. The mainly sulphate-containing fertilizers currently produced have – to date – been unable to fully fill the widening demand gap in recent years, as the world continues to reduce atmospheric sulphur emissions. Consequently, the contribution from sulphur-enhanced fertilizers, which either coat or incorporate sulphur into the matrix of high-analysis fertilizers, is expected to grow as they become more popular and their industrial production increases.

Therefore, although increasing incidences of sulphur deficiency are being recognised across the world, the global sulphur deficit is expected to narrow marginally over the coming five years. Increases in sulphur nutrient consumption are mostly expected to take place in regions where there is already a major focus on sulphur crop nutrition, such as the Americas, Southeast Asia and Oceania.

Sulphur nutrient supply expected to close the gap to crop demand

Sulphur is one of the key nutrients required in crop production. Changing agricultural practices and new environmental regulations have caused sulphur levels in soils to fall quite significantly. Cases of sulphur deficiency are becoming more widespread and have affected the quality and yield of certain crops more than others.

Despite growing sulphur nutrient demand over the near term, the gap between supply and demand is projected to narrow. CRU expects the demonstrated success of NP+S, alongside other sulphur-containing products, to continue to incentivise investment in sulphur-enhanced fertilizer technology to meet projected strong future demand.

About the author

Peter Harrisson is CRU’s Principal Analyst – Sulphur and Sulphuric Acid Fertilizers.

Email: peter.harrisson@crugroup.com Tel: +44 20 7903 2249