Nitrogen+Syngas 389 May-Jun 2024

31 May 2024

New merchant ammonia projects

AMMONIA

New merchant ammonia projects

Although global ammonia supply is set to increase this year, there is a shortage of new merchant capacity after 2024 which may lead to rising prices in the medium term.

Global production of ammonia rebounded in 2023 after a contraction in 2022 caused by the run of extremely high prices following Russia’s invasion of Ukraine. Production reached an estimated 192 million t/a in 2023, up from 188 million t/a in 2022. The merchant ammonia market remains a small fraction of this, totalling 14.1 million t/a in 2023, only 7% of production and consumption, and down from 17.1 million t/a in 2022. Much of the fall was due to reduced imports from Europe due to shutdowns of downstream industrial and fertilizer capacity.

Most ammonia is consumed at the point of production, mainly (ca 75%) in captive downstream urea, ammonium nitrate, nitric acid and ammonium phosphate production, as ammonia is more difficult and expensive to transport than most downstream products. Merchant ammonia production therefore skews towards either industrial uses such as caprolactam, acrylonitrile, adipic acid, and isocyanates, or for ammonium phosphate manufacture, which is centred on regions of phosphate mining like Florida, Morocco, Jordan etc. A small amount is imported by urea and ammonium nitrate producers in regions with relatively high domestic gas cost which makes local ammonia production less economic, such as southern Africa.

Merchant production is driven by production costs, and is concentrated in low gas cost regions with easy access to ports and overseas shipping. Most of it is in Russia, Trinidad and the Middle East, with the United States also becoming an increasingly important supplier.

Changing patterns of supply and demand

Figures 1 and 2 show the top 10 importers and exports of ammonia in 2023. The largest importers, historically, have been the United States and India, but last year Morocco moved into second place in terms of imports. India is building new ammonia capacity, but this is mostly associated with downstream urea capacity, and the impact on imports for Indian DAP production is expected to be fairly small. Morocco is also increasing its imports for downstream MAP/DAP production. As Figure 2 shows, on the production side, the market is much more concentrated, with the top ten producers responsible for more than 80% of all exports, and the top five responsible for 60 of all exports in 2023.

Global ammonia trade is forecast to recover to 17.1 million t/a in 2024, a 2.9 million t/a rebound after the decline last year. This will be driven at least in part by a resumption of Russian exports, with additional demand in Europe, Morocco, and the Far East, stimulated by lower prices and a combination of increasing fertilizer and technical demand.

North America

US imports of ammonia have been on a steady downward trend over the past decade as more domestic capacity is built or re-started. This has been a consequence of the shale gas boom which has dramatically reduced US gas feedstock costs. In 2012, at the peak of its import demand, the US bought 7.8 million t/a of ammonia from overseas. Last year this had fallen to 1.3 million t/a, and the US also exported 822,000 t/a, for a net import figure of less than 500,000 tonnes. The start-up of the new 1.3 million t/a Gulf Coast Ammonia plant in Texas City is expected to turn the US into a net exporter, but start-up for this plant has been pushed back from Q1 2024 to most likely Q4 2024 following delays in construction.

Trinidad

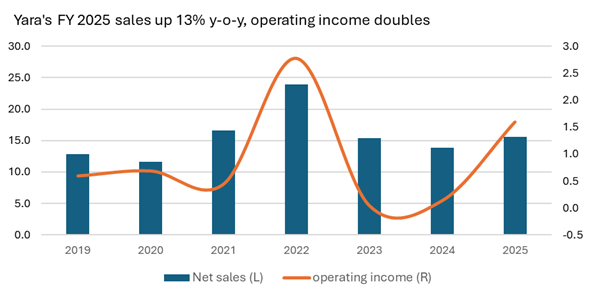

Trinidad, conversely, had been facing pressure on its ammonia exports as US demand contracts. Trinidad returned to its position as the largest exporter of ammonia in 2023 due to contractions in Russian exports, but domestic gas supply issues have hit production in recent years, reducing operating rates to below 75%. Trinidad’s exports of ammonia were 3.1 million t/a in 2023, but this is down from 5.3 million t/a a few years earlier. However, the gas supply situation has begun easing in 2023, and production from Nutrien and Yara has been improving from 3Q 2023. Trinidad’s exports are forecast to reach 4 million t/a in 2024 and remain at that level or even slightly higher over the medium term future.

North Africa

Egypt and North Africa remain major exporters of ammonia, while Morocco is a large next exporter. OCP, the world’s largest phosphate company, is continuing to increase its downstream processed phosphate production in Morocco to gain a greater slice of this market. Operating rates at OCP’s existing phosphate plants are also improving as the phosphate market rebounds. Overall, Moroccan imports are forecast to rise to 2.3 million t/a in 2024, and continue to rise to 2.8 million t/a by 2028.

Far East

China’s ammonia industry has been through a shakeout due to more stringent environmental legislation and a move towards more efficient use of fertilizer and zero growth in fertilizer demand. Overall, China has become a net importer of ammonia (about 690,000 tonnes in 2023), and increasing industrial demand may see this rise to 940,000 t/a this year. There are some capacity increases on the cards which will serve inland areas and probably reduce imports in the medium term.

Elsewhere in the far East, increased technical demand for ammonia in South Korea and Taiwan, China is expected to see imports pick up to 2.1 million t/a in 2024 for the region.

Europe and Russia

Russia’s invasion of Ukraine in 2022 has had by far the largest impact on the ammonia market over the past two years. As well as ending grain and oil exports from Odessa, the war also ended ammonia exports, with the closure of the pipeline from Russia. The fall in Russian gas supplies to Europe also led to record gas prices across the continent, leading to a knock-on effect on ammonia markets as European ammonia producers curtailed production. At one point around two thirds of European ammonia production was idled, and ammonia prices surged past $1,000/t, peaking at over $1,400/t, even $1,600/t c.fr NW Europe in April-May 2022, four times their previous average. Since then gas prices have eased and some production has restarted in Europe, bringing ammonia prices back down to more normal levels. Dutch TTF natural gas prices averaged $37/MMBtu in 2022, but this had fallen back to $13/MMBtu in 2023, and with increased LNG supply to Europe, a mild winter and reduced consumption rates, this is expected to drop to an average of $7.90/MMBtu this year, with a longer term average of around $7.00/MMBtu. This would actually put India back at the top of the ammonia cost curve, whereas Europe has been setting floor prices for the past two years. European ammonia production is expected to recover gradually, from 13.2 million t/a in 2024 to 16.2 million t/a in 2028. Consumption should recover faster, and imports will increase this year and over the medium term.

For Russia, meanwhile there is a new export terminal due to open at Taman either in 2H 2024 or at the start of 2025, with a capacity of 2 million t/a. Russian ammonia exports are expected to increase back up to 1.8 million t/a in 2024, mainly via the Baltic Sea, and longer term there are still expansions planned at Togliatti and Volgafert which could see exports climb to 4.6 million t/a by 2028.

Iran

Iran exported around 498,000 t/a of ammonia in 2023, making it one of the largest exporters in the Gulf, mainly to India. However, it remains constrained by natural gas availability as well as continuing sanctions.

New capacity

Longer term factors

The past two years have seen a supply shock on a scale never before seen in the ammonia industry. But outside of temporary factors which will likely see a reorientation of supply and probably the permanent closure of some capacity in Europe, there are some major longer-term factors which will begin to affect the industry later this decade.

One is ammonia’s use as a fuel, both for merchant shipping to help decarbonise the shipping industry, and, especially in Japan, as a feedstock to be co-fired in power stations to reduce the carbon impact of the power industry. Demand from the power sector and bunkering for ammonia will see the fuel share of total ammonia demand rising to around 4% in 2030, and possibly to as high as 29% in 2050; Japan alone expects that it will be consuming 3 million t/a of ammonia as fuel for power plants by 2030 and 30 million t/a by 2050.

On the supply side, the generation of ammonia via hydrogen from water electrolysis using renewable energy also has the potential to change the way that the ammonia market works, with some countries with large solar resources potentially becoming major exporters, such as Australia and various Middle Eastern and North African nations. Europe too may be able to use wind to generate ammonia and free itself from the dependence on Russian gas that has caused the current crisis. At the moment these plants are relatively small scale, pilot units, but there are aggressive ambitions in countries such as Norway to completely decarbonise ammonia production within the decade.

CRU expects 10 million t/a of blue and green ammonia capacity to commission from 2024-2028, taking into account greenfield projects which have reached a final investment decision. While ‘blue’ ammonia with carbon capture and storage, particularly in the US, accounts for most of this, up to 3 million t/a will be green ammonia, and most are expected to be merchant plants which will in theory supply the traded market. The above mentioned demand for ammonia co-firing in Japanese power plants and emerging demand for low carbon ammonia for marine uses are expected to absorb this capacity, but should this demand fall short of expectations there could be additional, albeit higher cost ammonia available to the merchant market. n