Sulphur 413 Jul-Aug 2024

31 July 2024

Phosphate markets

PHOSPHATE

Phosphate markets

Intermittent supply from China due to export restrictions and US duty changes have kept markets guessing over the past couple of years, and there is no sign of that changing.

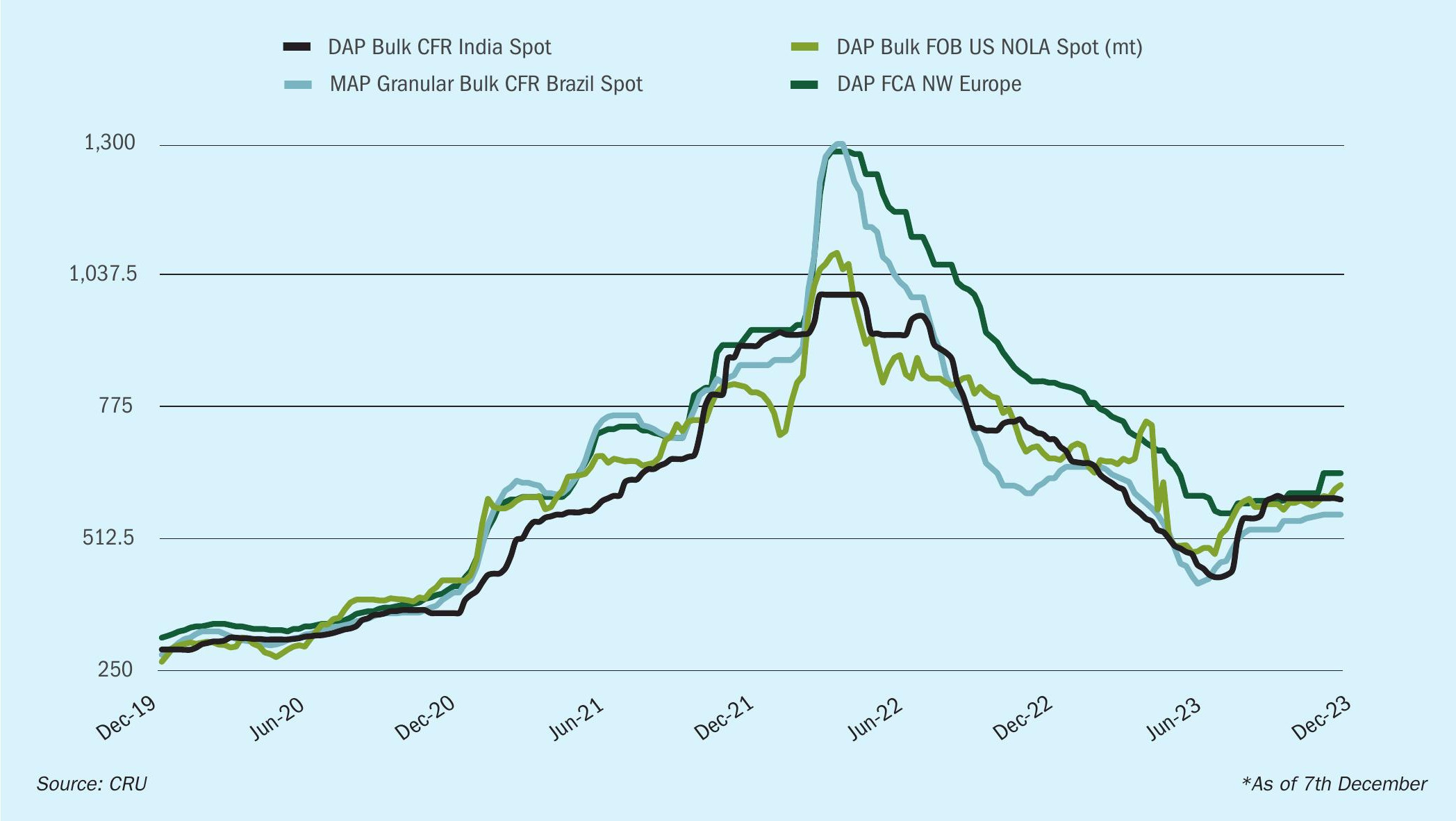

Phosphate prices started 2023 still at elevated levels after the price spikes seen in 2021-22 (Figure 1). They slid towards the end of the second quarter, albeit still at levels higher than before the run-up in prices that began in 2020, but then turned sharply back upwards again towards the end of 2023 and into 2024. The second quarter of 2024 has seen prices soften again as Chinese export restrictions appear to have moved the market into an annual cycle.

Key events of 2023

Last year saw prices of phosphate fertilizers soften in most key global markets at the start of the year. Demand was limited in India, the US, and Europe. Even so, steady sales were recorded from China, despite the reported lack of Chinese DAP/MAP availability under Q1 export quotas set by the government. These Chinese export sales added to the downward price pressures linked to weak demand. Brazil was the one market which bucked this general early 2023 trend, with the affordability of MAP relative to crop prices favourable enough to encourage buying interest.

DAP/MAP demand remained weak over most first quarter, which more than compensated for low supply from China and Morocco. OCP was operating its granular fertilizer capacity at just 50%, according to CRU estimates, and prices were pushed lower in early Q2 by a combination of reduced raw-material costs, rising stocks, limited demand, and growing expectations of easing export quotas in China.

In the US, however, the Easter period saw a phosphate price surge on the back of spring demand. This resulted in the New Orleans (NOLA) DAP price becoming the world’s highest benchmark, reaching $620-700/st f.o.b. ($681-770/t) during this period. But the US price surge eventually came to a halt when India’s Q2 phosphoric acid contract price was agreed at $970/t c.fr in April, down $80/t from Q1. This prompted a memorable collapse in NOLA DAP prices in early May.

It was around this time that China’s government acted to ease export restrictions by cutting inspection times for DAP/ MAP exports to a maximum of 10 days. The move almost immediately resulted in greater overseas market availability at more aggressive prices. Consequently, China’s DAP export prices started slipping below $500/t f.o.b. in mid-to-late May, while domestic prices also tumbled.

This fall continued throughout June, but although India’s DAP prices remained under downwards pressure at the start of Q3, other markets did finally reach their floor around then. Brazil’s MAP prices started to firm on the back of improved demand, and tight supply in the US supported a strong rebound in DAP/MAP prices. By August, a drop in DAP export supply from China prompted a price surge in India, with price rises spreading the bullish sentiment to other markets.

Prices climbed higher across most key global benchmarks in September as global DAP/MAP supply tightened. Availability from China was scaled back and plant maintenance restricted Russian availability in September-October. Production issues were also reported in the US and in Saudi Arabia. In addition, monthly volumes from OCP were judged to be below production capacity, despite an apparent increase in sales. Steady demand from India also tightened supply.

India once again took centre stage in late October as the government finally announced a cut to the nutrient-based subsidy (NBS) for fertilizers in the Rabi season. The 31% drop in the NBS for DAP from 1st October was widely expected in the market and therefore did not impact DAP prices. At the same time, however, China’s National Development and Reform Commission (NDRC) tightened DAP/MAP export restrictions by suspending export inspections. The US Department of Commerce (DoC) also slashed the countervailing duty rate on imports from Morocco’s OCP from 19.97% to just 2.12% at the start of November, while at the same time tripling the CVD on imports from Russia’s PhosAgro. This was initially expected to lead to more Moroccan exports to the US, but earlier this year the DoC reversed its earlier decision and moved CVD rates for Morocco back to 14%, and the increase in Morocco imports to the US is unlikely to arise now.

Supply

China remains the key question on the supply side. Export restrictions were tight for the first quarter of 2024, and there were virtually no exports from January-March, when restrictions were eased again. They are expected to remain at their relatively lax state until October, when they will likely be tightened again; restrictions in 2024 and future years are expected to continue on this pattern, with almost no exports in Q1 and Q4, before loosening in Q2 and Q3, and very high availability. The quota allocation for Chinese phosphate exports has been set at 6.6 million tonnes of DAP and MAP combined for 2024. This is down from 6.9 million t/a in 2023, and China has probably passed its peak of phosphate exports as the government continues to prioritise domestic food security and fertilizer availability. Domestic consumption has also been on a secular decline, owing to a historic overapplication of fertilizers. Overall Chinese DAP/MAP/TSP exports are expected to stabilise at a total figure of 7.5 million t/a for the next few years.

Elsewhere, in Morocco OCP is expected to bring more availability to the market in 2024 compared to 2023, but their strategy remains uncertain. OCP maintained a volume control strategy in 2023 as prices soared, but increased exports in Q1 2024, when exports of finished phosphates were 1.9 million tonnes, near record levels and an increase of 30% year on year. TSP availability in particular has been better, with 2024 likely to see 1.7 million t/a of exports, largely to Bangladesh and Brazil, a 63% year on year increase. OCP continues to use its flexible production lines to slowly shift to more TSP production, as it avoids using imported ammonia, which has been expensive over the past few years. Total phosphate exports could reach 9.3 million t/a in 2024, up 5.6% on 2023. However, given the reversal in US countervailing duty, OCP is unlikely to return to the US market. And as ammonia prices fall, OCP may switch back towards MAP/DAP production.

In the US, Mosaic’s MAP production continues to decline, as the company continues to shift production from DAP/MAP to its line of lower grade Microessentials (between 33-40% P2O5 content), possibly due to lower rock quality in Florida. DAP+MAP production has fallen from an average of 4.8 million t/a from 2018-2021 to an average of 3.5 million t/a. Production was also impacted in Q4 2023 by sulphuric acid production issues.

Strong export growth from Saudi Arabia is likely, especially once the Ma’aden Phosphate Company’s third plant is operational, with 1.5 million t/a of capacity in 2028 and another 1.5 million t/a by the end of the decade.

Russian exports are likely to fall however in spite of some marginal increases in production. Domestic demand is growing rapidly. Although there are some export restrictions, the quotas have been set above typical export levels, and are not expected to have a significant impact. But a shortage of Russian phosphate rock means that operations at Lifosa in Lithiania are unlikely to resume.

Overall global phosphate production is expected to be down 2% and trade down 8%, mostly due to fewer Chinese exports.

New capacity

OCP and Ma’aden make the bulk of upcoming capacity additions. Ma’aden is expected to commission its Phosphate III mega-project by 2027-28. OCP has ambitious expansion plans, with an additional granulation line next year and two gigantic TSP production centres in the years after that. OCP has finished the first two of its three 1 million t/a expansions at Jorf Lasfar, with the third expected in 2025. It also has plans for a large expansion in TSP production at Jorf Lasfar, aiming to bring 1 million t/a of capacity on-stream by 2025. There are also plans for a TSP production hub in its central-Safi axis. The Mzinda Phosphate Hub will use rock from Gantour and from the new Meskala mine, and will bring another 2 million t/a of TSP capacity online by about 2028. There are also two more projects which remain more uncertain, including another 2 million t/a of unspecified fertilizers in the Safi axis, and a new facility in Boucrâa.

Demand

Agricultural demand has been good, with record global production of corn and soybean expected in the 2023/24 growing year. However, falling crop prices have stabilised during Q2 with weather in Brazil causing supply concerns. Nevertheless, grains and oilseeds supply is expected to improve considerably this year which will cap any further rises.

The US is likely to plant 92 million acres of corn in 2024/25, down nearly 3 million acres from 2023, but soy area is conversely likely to expand by more than 4 million acres to 88 million acres – the highest area since 2018, boosted by more favourable pricing dynamics and a US EPA mandate for the production of 3.04 billion gallons of renewable diesel fuel this year. Brazil’s soybean planted area is set to rise by about 2.6% this year, but despite China importing corn in bulk quantities from Brazil, the outlook for corn area in Brazil is less optimistic, with an 8.5% year on year drop expected.

In the medium term, fertilizer demand is likely to keep growing, but demand may not return to pre-2022 levels until late 2025 because of a tighter global supply, as China continues export restrictions and OCP appears to scale back exports for longer than expected. In practice, this means that theoretical agricultural demand is outpacing real fertilizer demand, in turn resulting in a necessity for more efficient applications. This is most prominent in China, which has a growing agricultural demand but a falling fertilizer demand. Counterbalancing this is better affordability and increasing crop areas in India, the US and Brazil. US phosphate demand is expected to be stagnant over the next few years, with an increasing reliance on lower-spec products like micro essentials. Indian demand has been slightly inflated by a low Maximum Retail Price in the build-up to the 2024 elections and is likely to slow its growth into next year. Import demand is very dependent on pricing and availability from China, but there is also growing SSP production in the country. India continues to be a major importer of merchant-grade phosphoric acid – it accounts for around half of global imports.

Elsewhere in South Asia, after two years of very low phosphate application due to floods and financial difficulties, Pakistan looks set to increase its import volumes into 2024, after largely depleting its stocks last year.

Brazilian stocks are low, and the country will need to import heavily from May to be able to fulfil demand. This appears to be possible with better Chinese supply and falling prices, and affordability is improving. Some relief will be provided by the commissioning of the Serra do Salitre plant, but imports will still need to dramatically ramp up in coming months to meet domestic demand.

Pricing

A stalemate of supply and demand finally broke in 2024 Q2, as DAP/MAP prices fell following increased supply availability from China. This coincided with the peak importing periods in Brazil and India, allowing for better supply availability until restrictions return in October. The floor price is likely to be reached in India by August, just breaking the breakeven prices of $485/t. At this point, the pressure to build stocks in preparation for China’s export restrictions and peak Rabi demand will cause prices to rebound.

Prices of inputs are softening, meanwhile. Sulphur prices are at a notable low, but with overall upwards pressure. However, it is low enough that it is not a significant cost factor into finish product prices.

Ammonia saw a rally in late 2023 but is already falling again. Phosphate rock prices are softening as OCP begins to significantly increase exports from the end of 2023. Freight rates increased dematically because of drought in the Panama Canal, but have since fallen significantly, as less congestion has led to lower auction prices and shorter waiting times, making transit once again a more viable option compared to diverting around South America. Bulk freight rates in the Red Sea have increased due to the attacks by Houthi rebels in Yemen on shipping, but sharp rate rises have been more present in container freight markets. In any event, freight rates only make a small portion of phosphate c.fr prices and will not be significantly impacted by the conflict in the Red Sea.

Overall, the phosphate cost floor is expected to remain reasonably flat. As input costs continue to fall, and DAP/MAP prices stay high, the marginal tonne will just meet the DAP f.o.b. Morocco prices, before both plateau over the coming years.