Sulphur 414 Sep-Oct 2024

30 September 2024

Market Outlook

Market Outlook

SULPHUR

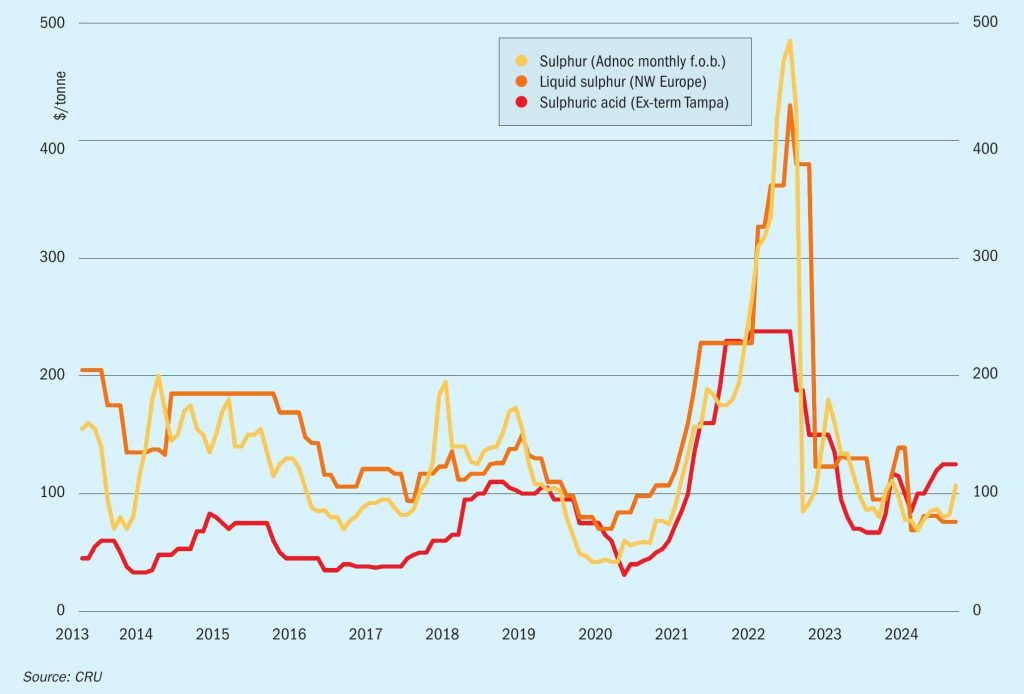

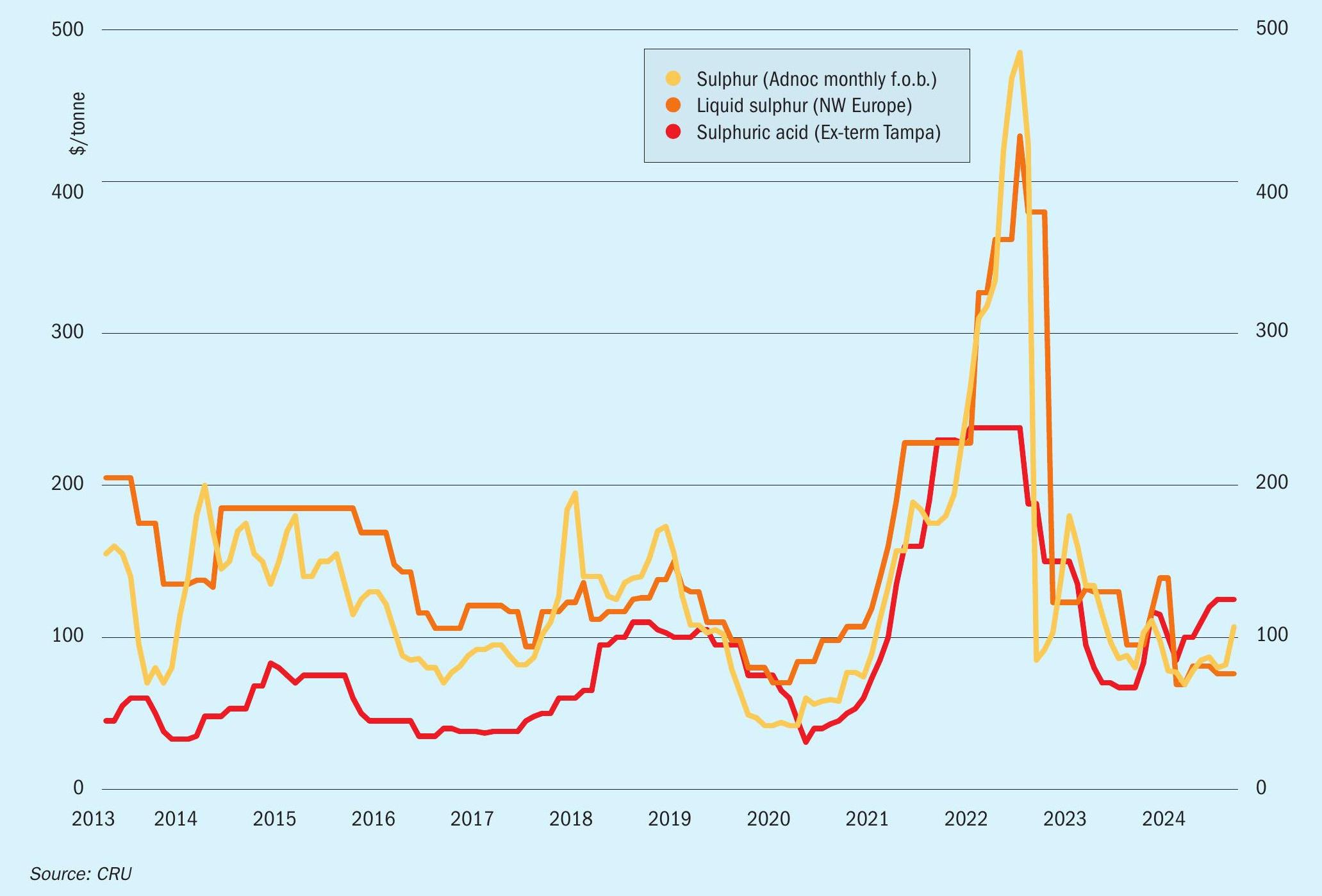

Muntajat announced its QSP for September at $125/t f.o.b., an increase of $19/t from its August price. This was following its tender earlier this week, which market sources indicated to have achieved at or around $130s/t f.o.b. Over the past two weeks, KPC in Kuwait closed two sales tenders, with both indicated awarded in the high $120s/t f.o.b. Middle East spot f.o.b. prices are at their highest level since March 2023 and have climbed 58% over the past two months.

At the same time, Chinese delivered prices climbed slightly higher to $140145/t c.fr amid latest indications, while Indonesian prices remained unchanged in the range of $140-145/t c.fr this week.

Most traders remain confident of further price increases across the globe over the coming weeks due to strong downstream markets driving increasing demand, particularly given good affordability as phosphates prices continue to climb.

Nevertheless. good overall availability should limit the upside to prices, particularly as China stocks remain high, even though a rail strike in Canada as well as refinery maintenance in Kazakhstan may tighten availability a little.

SULPHURIC ACID

Global spot prices are likely to remain relatively firm over the coming weeks. Strong Moroccan offtake has added support to some benchmarks, with further support coming from Chile’s recent return and persistently strong offtake for Saudi Arabia. Domestic acid production is set to increase in some key import markets, though this is more weighted to later in the year. Affordability relative to downstream markets is broadly acceptable, but looks particularly bad when compared with upstream sulphur.

Chinese sulphur burners are setting prices in the traded market, while the lack of domestic smelter acid supply due to raw material shortages is also reducing export availability and pushing up prices. China requires high acid prices to draw out more volume, as domestic sales offer favourable pricing, thereby limiting the potential downside for spot business.

Production issues at smelters in Japan and South Korea has restricted spot tonnes. This has allowed sellers to resist lower bids. However, high freight rates, rising supply in other Asian countries and concerns over phosphate markets may weigh on prices.

In the longer term, growth in smelter acid production is being limited by a shortage of copper concentrate. new smelter capacity in Asia is expected to be commissioned, but tightness in the copper concentrate market will limit its operations in 2024. Increased competition and declining acid import requirements are expected to cut Chinese acid exports in 2025. Consistent traded demand and weaker European exports have maintained market tightness, which will delay price declines to 2025.