Sulphur 414 Sep-Oct 2024

30 September 2024

Price Trends

Price Trends

SULPHUR

At the end of August, the Qatar Chemical and Petrochemical Marketing and Distribution Company (Muntajat) tendered for 35,000 tonnes of sulphur for September loading from Ras Laffan, with offer prices reported at or around $130s/t f.o.b., according to market sources. Bids were received at multiple levels, with market participants initially anticipating awards around the mid-$120s/t f.o.b. The tender result was higher than market expectations and would equate to delivered prices to key Asian markets at $150-155/t c.fr. But prices in China and Indonesia remained lower this week at around $140-145/t c.fr, with India at $145-150/t c.fr. Prices have increased steeply since Muntajat’s 25 June session, which was indicated awarded in the mid-$80s/t f.o.b.. and Muntajat posted its Qatar Sulphur Price (QSP) for September at $125/t f.o.b., up $19/t from $106/t f.o.b. in August. This represents the highest QSP since March 2023 at $133/t f.o.b., and reflects delivered levels to China nearing $150/t c.fr at current freight rates. Tight supply and strong downstream demand have pushed tender prices higher. Muntajat tenders were previously awarded at $92/t f.o.b. in April, up from $88/t in March and the low $80s/t f.o.b. in February.

Overall the Middle East spot sulphur assessment remained flat at $120-125/t f.o.b. this week even though prices in recent tenders were higher. In addition to Muntajat’s tender. Kuwait’s KPC closed two sales tenders over the past two weeks, both of which were indicated awarded in the high $120s/t f.o.b., up 58% over the past two months.

Spot prices for sulphur exports from the US Gulf were assessed up at $100-110/t f.o.b. at the end of Augst, up from $95100/t f.o.b. despite limited trading activity based on strengthening global prices. Offers as high as $120/t f.o.b. were heard in the market but some sources indicated the lower end at $105/t f.o.b. in the US spot market. However, spot deals remain scarce, while market participants expect activity to pick up momentum following the CMOC tender in Brazil. In the first half of this year, US exports of sulphur decreased slightly to 815,447 tonnes, down slightly from 844,430 tonnes during the same period last year, according to Global Trade Tracker data. Spot prices for seaborne sulphur exports from Canada rose slightly to $102-106/t f.o.b. Vancouver, up from $100-105/t f.o.b., as market participants remain concerned over the supply chain and prompt export availability despite rail strikes being called off. Trading activity was still limited, and some market participants expect activity to pick up as the logistics systems are back up fully and running as normal. Latest business in China, including a cargo of Canadian sulphur sold around $145/t c.fr, suggests netbacks potentially higher than the current assessed f.o.b. range, but activity in Canada remained lacklustre.

The price for PT Lygend’s latest tender for 50,000 tonnes of sulphur for October arrival was heard in the $140s/t c.fr, according to market sources. The session closed on 26 August amid firm f.o.b. prices in the spot market. Lygend was reported to have scrapped its 30 July session for 50,000 tonnes for September delivery after getting only one offer in the high $140s/t c.fr. Following this tender, both Lygend and another buyer Huayue purchased spot volumes in the low-to-mid-$140s/t c.fr, according to sources, with around seven to eight cargoes bought between them. The spot price assessment for sulphur cargoes to Indonesia was unchanged at $140145/t c.fr.

SULPHURIC ACID

The price range for sulphuric acid sales into Chile narrowed to $165-170/t c.fr at the end of August, rising by $5/t from the lower end of last week’s range of $160170/t c.fr, on the back of tight supply globally and strong Chinese export prices. AMSA closed a tender for 40,000 tonnes of acid at no higher than $167/t c.fr, while another forward deal was indicated at low $170s/t c.fr for December, with no further details given at the time of writing. Spot offers were heard at $173/t c.fr in the region. Sellers have increased their offers on any new transactions in Chile based on current freight rates and Far East export prices. At the current freights and lack of spot supply availability, deals would be concluded near $170/t c.fr, traders said. The average Chilean spot price has reached their highest level since August 2022, when the assessed price was at $160-180/t c.fr on 22 August 2022, according to CRU data

Elsewhere, BHP was last week able to resolve a six-day strike at its Escondida, the world’s largest copper mine and a major acid consumer, easing concerns of a negative acid demand impact. Exports from Peru to Chile rose in July to 100,551 tonnes, up from the previous month of 84,155 t, according to Global Trade Tracker data. However, in the year-todate period, Peruvian exports declined 13% to around 666,000 tonnes from 770,000 tonnes in the same period in 2023. Quarterly prices for Q2 supply were reportedly agreed in the upper $120s/t c.fr, while the annual contract range is published at $125-135/t c.fr. Sources indicated that quarterly agreements for Q3 were also concluded in the $150s/t c.fr. Spot prices for sulphuric acid sales into Brazil were assessed steady at $145155/t c.fr, though market sources expect prices to edge higher amid tight supply. Most recent business was concluded around the mid-to-high-$150s/t c.fr, with rumours of one deal concluded in the low $160s/t c.fr, but no details could be confirmed at the time of writing. Still, given current Europe f.o.b. prices in the $80s/t f.o.b., and NW Europe-Brazil freight rates in the low-to-mid-$50s/t, delivered prices in the $140s/t c.fr should in theory be achievable. One trader indicated that at current freights it would be more favourable to sell into Brazil than Chile, although buyers have generally remained on the sidelines.

Overall, spot activity has been limited, though Brazil imports for January-July were up 16% from last year, according to data via Global Trade Tracker. The latest purchase tender from Argentina’s Bunge was indicated in the mid-$160s/t c.fr, which equates to a Brazil c.fr around the low-to-mid-$150s/t c.fr.

Spot prices for sulphuric acid exports from northwest Europe were assessed unchanged at $80-90/t f.o.b. on balanced supply/demand fundamentals. New deals have been scarce in recent months, with buying appetite from Morocco slowing down while spot availability remained tight. Most market sources expect the supply situation to limit any price declines in the short-term, though availability is widely expected to improve in the coming months. Supply is likely to increase despite some further smelter maintenances planned for Q3 as the acid output reduction is lower than the previous quarter.

A strong maintenance slate in Europe curtailed spot availability for Q2, with some post-maintenance restart issues leaving the recent market tighter than expected. Aurubis is now returning to full production after a two-month maintenance planned at its Hamburg smelter through May and June. Issues with the restart last month led the producer to purchase acid from other producers. The smelter has acid capacity of around 1.3 million t/a.

Nyrstar and Boliden completed maintenance earlier this year, while KGHM in Poland and Atlantic Copper in Spain have maintenance shutdowns in Q3. Tight molten sulphur availability in Europe has added additional merchant acid demand from European buyers and is limiting acid production from sulphur burners, further tightening the market.

Spot prices for full cargoes of sulphuric acid to India were unchanged at $95-105/t c.fr, with buyers unwilling to accept higher offer levels present in the market. Although buyers are looking to purchase acid, lower offers were no longer available because of increased export prices in the Far East and elevated freight rates. MCFL is said to be looking for one to two cargoes of acid in a tender for October delivery, according to market sources. Offers were indicated around $105-110/t c.fr. Some traders signalled that while some cargoes might be available at the lower end of the range, securing any vessel below $105/t c.fr is unlikely. Earlier in August, Wilson International secured a 20,000 tonne cargo of acid at $100/t c.fr, scheduled for delivery to Tuticorin between late September and early October. Greenstar is believed to be the buyer, though the importer has not confirmed.

Indian acid demand should be decreasing this year due to new domestic supply, while sulphur is a more attractive alternative as current prices. CIL started new sulphur-burner capacity as of late August 2023, according to sources. The plant, which was announced in November 2021, is set to increase the company’s acid production by around 500,000 t/a. IFFCO in Paradip inaugurated its new acid plant, with capacity around 2,000 t/d on 20 February. The company indicated in July that it had commenced operations at the new acid plant, leading to a reduction in merchant acid demand. In addition, Adani Group in late March commenced operations at its new refinery, with smelter production expected to start within Q3. The smelter has 1.5 million t/a of sulphuric acid capacity.

Prices for sulphuric acid exports from China were unchanged for the fifth consecutive week at $50-55/t f.o.b. amid tight supply and low buying activity. The average price of $52.50/t f.o.b. represents the highest level since August 2022 and is up from -$5/t f.o.b. in early August 2023, though it is still well below its mid-June 2022 level of $150/t f.o.b., according to CRU data. Some market sources see prices higher following the incident in southern China, which curtailed spot supply, whereas others argued that netbacks in the $50s/t f.o.b. were not achievable given current freight rates and c.fr prices in key import markets. A furnace incident in mid-August at Shandong Humon Smelting, a subsidiary of Jiangxi Copper, led to three deaths and fourteen injuries, according to press reports. Sources suggested this would lead to a loss or delay of around 100,000-120,000 tonnes of acid supply committed to various traders.

Phosphate sentiment in China has improved over the past couple of months, with some increases in downstream production adding support to domestic acid markets, though there are signs that phosphate production may be softening slightly due to concerns over export restrictions. In the copper market, persistently low TC/RCs have put pressure on copper smelters, with reducing copper concentrate feed and using more blister and anode to maintain refined copper production, which is expected to reduce acid output as well. Tightening mine supply in the zinc and lead industry has also constrained smelter acid by-product output. With zinc TCs falling significantly in recent months, Chinese smelters are still at high risk of production cuts in Q3. Additionally, a few smelters brought forward their routine maintenances from late Q3 to July. Resistance from producers to lower export prices emerged partly because of relatively higher prices available on domestic sales. Domestic prices continue to offer a premium over achievable f.o.b. for most producers.

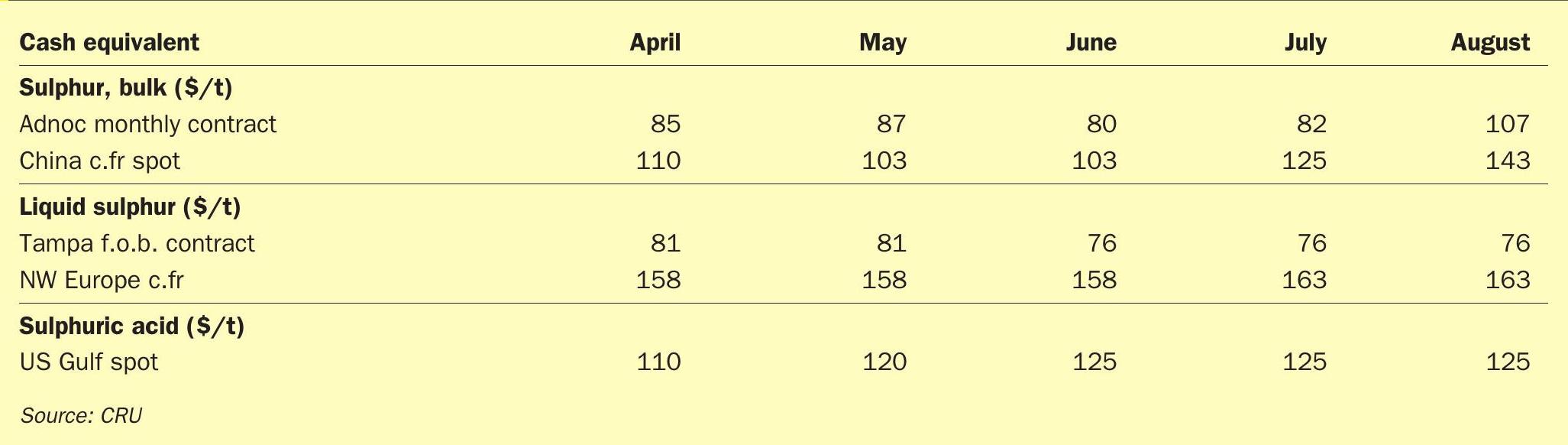

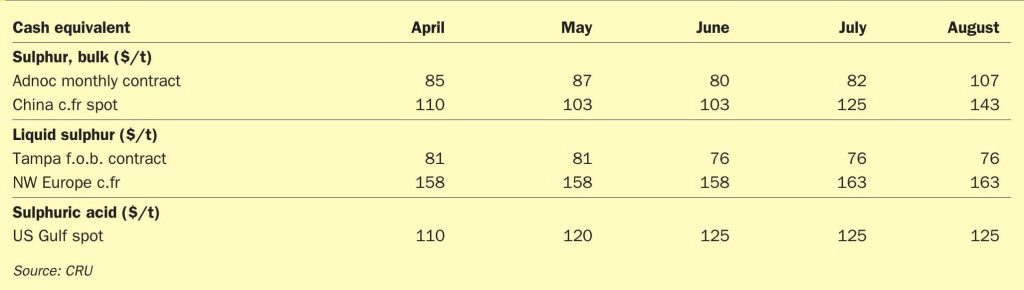

PRICE INDICATIONS