Fertilizer International 523 Nov-Dec 2024

30 November 2024

Polyhalite – what next?

PK COMMODITY REVIEW

Polyhalite – what next?

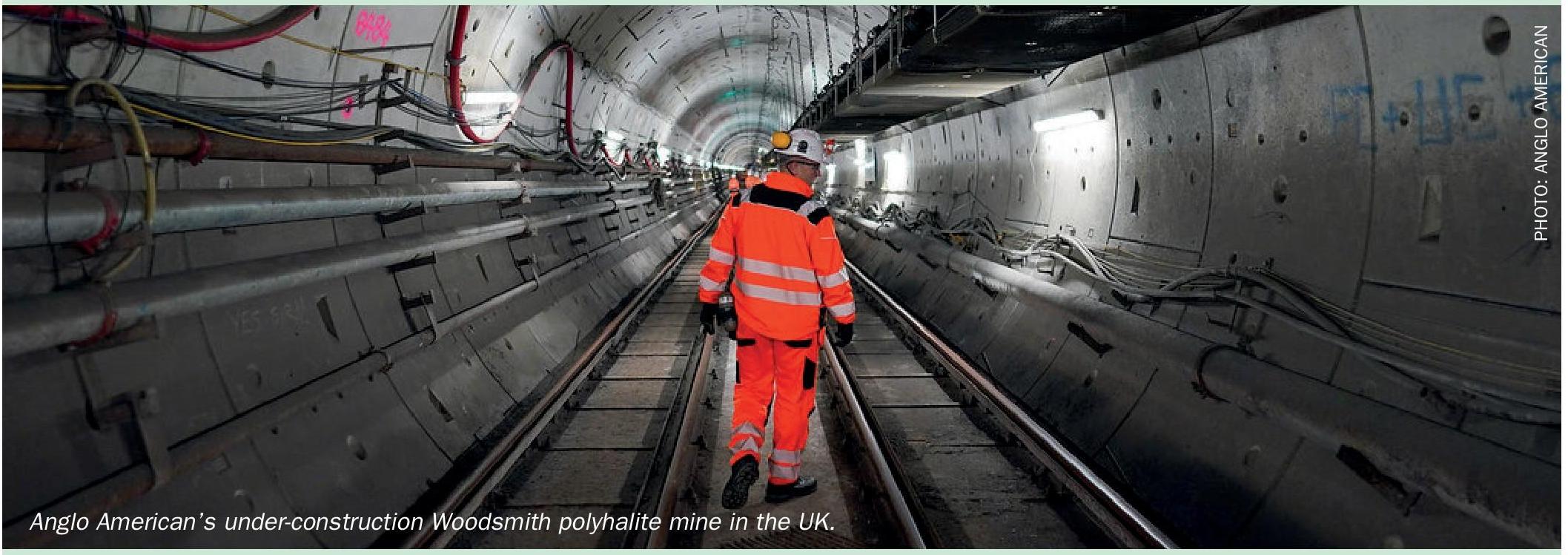

We look at the future of polyhalite mining and its use as a fertilizer following Anglo American’s announcement that investment in its UK-Based Woodsmith mine will fall to zero in 2026 under current plans.

Earlier this year, mining giant Anglo American announced it was cutting investment in its Woodsmith poly-halite mine in the UK, with this declining to $200 million next year and then to zero in 2026 as it deleverages and looks for an investor/strategic partner to take an ownership stake.

While Woodsmith is being slowed, Poly-Natura, a polyhalite project in New Mexico owned by Canadia private equity company Cartesian Capital, is being fast tracked (see project profile on page 45).

Globally, ICL remains the only company commercially mining polyhalite currently, extracting this mineral from its Boulby mine in the UK and turning it into a one million tonne market globally. The company has expanded its polyhalite product range and is also researching its potential use in cutting nitrogen losses to the atmosphere.

GoudenKorrel, meanwhile, a new Polish entrant with its own proprietary grinding and granulation process, is heavily marketing a range of four polyhalite-based products using material sourced from the UK.

Anglo American’s crop nutrient ambitions

Mining major Anglo American is currently developing the UK-based Woodsmith mine project. This will access the world’s largest known deposit of polyhalite, a natural mineral fertilizer containing potassium, sulphur, magnesium and calcium – four of the six major and minor nutrients that every plant needs to grow.

The Woodsmith mine is located around five kilometres south of Whitby, a small fishing port in North Yorkshire on England’s North Sea coast. Anglo American gained control of the project in March 2020 through the cash purchase of Sirius Minerals for $496 million (£405 million) (Fertilizer International 495, p10).

Woodsmith will extract polyhalite from the deeply buried underground ore deposit – containing 290 million tonnes of permitted reserves – via two 1.6-kilometre-deep shafts (Figure 1). Unusually, the ore extracted at the mine will then be transported to the port of Teesside through a 37-kilometre-long underground tunnel on a conveyor belt system. This mineral transport system (MTS) is designed to minimise the project’s surface environmental impact.

On arrival at Teesside, polyhalite ore will be granulated at a materials handling facility at Wilton to produce a premium-quality, low-carbon fertilizer certified for organic use. This product, known as POLY4, will be exported from Redcar Bulk Terminal, the company’s dedicated port facility.

The fortunes of the Woodsmith mine project under Anglo American ownership over the last 2-3 years can be summed up as a tale of two resets:

- Firstly, a reset in February 2023 to make the project scalable to 13 million t/a capacity, up from 10 million t/a previously, with the announcement of annual investment of $1 billion annually to deliver first polyhalite production by 2027

- Then a second reset in May 2024, triggered by a takeover bid from BHP, which effectively paused the project by cutting planned investment to zero by 2026 – while the company deleverages its balance sheet and looks for a strategic partner to take an ownership stake of up to 49 percent.

Anglo American is no stranger to the fertilizer sector, having owned Cleveland Potash Ltd (CPL), the operator of the Boulby potash mine in the UK, before selling this “non core business” to current owner ICL Fertilizers in 2002. The company also once owned niobium and phosphates businesses in Goiás and São Paulo states, Brazil, before agreeing to sell these to China Molybdenum Co (CMOC) for $1.5 billion in 2016.

Strategy update unveiled

2023 landmark was a year for Anglo American’s fertilizer market ambitions – with the mining major committing itself to investing in the region of $4 billion to complete the Woodsmith project. The new investment plans were unveiled as part of a strategy update for the large-scale polyhalite mine released at the end of February that year (Fertilizer International 514, p44).

This confirmed initial production of poly-halite by 2027, requiring an annual capital investment of around $1.0 billion. The mine’s ultimate annual output was also increased to 13 million tonnes, up from 10 million tonnes previously.

Anglo American approved $0.8 billion of investment for the Woodsmith mine in 2023, with most of this expenditure going to shaft sinking and tunnel boring activities. This came on top of $522 million of capital expenditure in 2022 and nearly £390 million in 2021 (Fertilizer International 508, p62).

Under the updated strategy, investment and construction activities were directed at core project infrastructure (Figure 1), in particular:

- The mine’s two 1.6-kilometre-deep shafts that sink down to the mechanised underground polyhalite mining operation

- The 37-kilometre-long underground mineral transport tunnel (MTS) needed to carry material from the mine to the materials handling facility (granulation plant) at Wilton on Teesside

- Three smaller intermediate access shafts to the MTS needed for maintenance and ventilation.

Delivering these project elements was seen as part of the mine’s critical path to production. Additional project activities on Teesside – the construction of the materials handling facility at Wilton and the Redcar Bulk Terminal – although not part of this critical production path, were also singled out as key elements of Woodsmith’s core infrastructure.

Going bigger for the long term?

Anglo American’s CEO Duncan Wanblad spoke in detail about the company’s new strategy for the Woodsmith mine during an annual results presentation in February 2023 – explaining how the company had reset the project during 2022.

“Firstly, …we have made significant changes to the scope, design, and approach to execution, ensuring that we bring the project up to Anglo American’s high safety and technical standards, and employing modern mining methods, to set the project and the operation up to deliver its full potential. We have changed the execution strategy to an EPCM [engineering, procurement and construction management] model… and engaged a specialist contractor to execute the deep shaft sinks.

“Secondly, on the project timelines and scope, we are making changes to allow for an expanded scope …which we want to set up correctly from the beginning. Nobody wants to turn around in ten years’ time and wish we had made everything more scalable.”

We are going bigger because we believe in the asset, we believe in the product and we believe in the market.

“The annual spend will vary from year-toyear but is likely to be around the $1 billion mark. We expect to hit polyhalite by 2027, from which point we will be in a position to bring some volume to market.

“We expect Woodsmith to have the capacity to produce up to five million t/a by 2030, with the ability to expand to 13 t/a as the market develops.”

The CEO’s vocal backing for core infrastructure upgrades (Figure 1) appeared to provide the Wordsmith mine with certainty and placed the project on a clear trajectory to production within four years. Yet before the year’s end it became clear that Anglo American, having scaled up the project and adopted higher mining standards, was looking for a strategic partner to share the growing investment burden.

Outside investors sought

News emerged that Anglo American was looking to sell a minority stake of up to 49 percent in its Woodsmith mine project following a report in The Times on 27th December 2023 (Fertilizer International 518, p9).

Work was underway to identify potential investors before starting a formal sales process, The Times said, noting that Anglo American itself had already injected $2.5bn into the project to date. At the time, CEO Duncan Wanblad told city analysts that the company was “moving at pace to find a partner” to share project costs.

There was speculation that the company was targeting infrastructure investors and sovereign wealth funds as well as chasing further binding offtake agreements from the fertilizer industry for its POLY4 product.

Wanblad said Anglo American needed “the right partner at the right price for this particular asset”. Currently, the company is looking to secure new investors for the project by early 2025, with an external stake of up to 49 percent on offer, allowing Anglo to maintain project control.

Costs have risen rapidly since the project’s inception. This is partly because Anglo American has needed to redesign what was originally a junior mining project. The Times reported on 9th November 2023 that project costs had tripled since 2017, describing the Woodsmith mine as a “money pit” for the company

In 2017, Sirius Minerals, the project’s previous owner, originally estimated that the Woodsmith mine would cost $2.9 billion to build. But Tom McCulley, the head of Anglo American Crop Nutrients, confirmed that analyst estimates from earlier this year that Woodsmith could now cost around $9 billion to complete were not “too far off”.

BHP bid prompts restructuring plan

Anglo American announced it would be concentrating on a narrow portfolio of just copper, iron ore and crop nutrients in future, as part of a “radically simplified” and “future-enabling” reorganisation plan unveiled on 14th May this year. The announcement followed an internal review of the business which began last year.

The plan involves offloading previously core assets, with Anglo American exiting from steelmaking coal and nickel and selling its Anglo American Platinum and De Beers business units, by divestment or demerger.

The company’s CEO Duncan Wanblad described these proposals as the most radical changes to Anglo American in decades.

“We set out our clear strategic priorities earlier this year – operational excellence, portfolio simplification, and growth. Our decision to focus Anglo American’s portfolio in our world-class resource asset base in copper and premium iron ore – while retaining our crop nutrients optionality at Woodsmith – marks a major new phase in executing our strategy,” he said.

“A detailed review of critical works at the Woodsmith mine has been necessary to de-risk the project schedule, preserve those areas going into care and maintenance, and keep the project in readiness for later ramp-up.”

Anglo American’s decision to drastically and voluntarily restructure itself was made in response to an unsolicited takeover bid from BHP, the world’s largest mining company by market capitalisation.

BHP made three consecutive, ever higher bids for Anglo American on the 30th April, 7th May and 20th May this year – all of which were successfully fended off. These bids valued the company at £31.1 billion (US$38.8 bn, €36.3 bn), £34 billion (US$42.6 bn, €39.5 bn) and finally £38.6 billion ($49.1 bn, €45.4 bn), respectively.

In June, Anglo American started the formal process of selling its metallurgical coal assets and exploring options for its nickel operations, after rejecting BHP’s third and final offer.

Coking coal will be the first segment offered for sale, followed by demerger of the Amplats platinum group metals business and then De Beers diamonds, CEO Duncan Wanblad said, quoted by Reuters.

Keeping faith in polyhalite?

In practice, Anglo American’s “optionality” on crop nutrients means drastic cuts to the $1 billion of planned annual investment in the Woodsmith mine, to $200 million next year and then to zero in 2026, effectively turning off capital expenditure over a two-year period.

This expenditure slowdown was necessary to “support balance sheet deleveraging [debt reduction], while critical technical studies are completed in 2025, to then support syndication”, Anglo American said.

Alexander Schmitt, the Chief Marketing Officer of Anglo American Crop Nutrients, elaborated on the company’s plans for the Woodsmith mine project on 20th May, while speaking to invited guests at the company Singapore office.

“The latest announcement means that the development of the project will be slowed down and the start of the production has been pushed out,” Schmitt said, adding that first production will be pushed out by “at least two years” beyond the previous 2027 start date.

“Some construction activities we will expect to continue. We are currently reviewing how to do that. We intend as well to focus on completing technical studies and assessing syndication partnering options, the process of bringing one or more additional investors into our crop nutrition business on board, before ramping up the construction again as soon as possible in the future,” Schmitt continued.

“I want to be absolutely clear… The slowdown should not be interpreted as Anglo American losing faith in this product. The message I want you to take away from last week’s announcement is we at Anglo American are creating a simplified organisation with an exciting future around the three core pillars: copper, iron ore and polyhalite.”

Progress update and future plans

Further details of Anglo American’s poly-halite plans also emerged in a progress update published as part of the company’s half year results at the end of July.

“On 14 May 2024, [it was] announced that in order to support deleveraging of its balance sheet, [Anglo American] will be slowing the pace of development of the Woodsmith project in the near-term. Crop Nutrients is identified as one of the three key pillars of the … more focused portfolio, and as such the focus will shift to preserving the long-term value of this high quality asset, and enabling the project’s future development,” the update said.

The wind down in capex over the next two years was also confirmed alongside the expected opex:

“Forecast capital expenditure for 2024 remains c.$0.9 billion, focused on core infrastructure, with $500 million spent during the half (30 June 2023: $307 million). Capital expenditure for 2025 and 2026 is c.$0.2 billion and nil, respectively. Operating expenditure for 2025 and 2026 is expected to be c.$0.2 billion and c.$0.1 billion, respectively.”

Additionally, the slowdown in construction – and the associated lengthening of the project schedule – prompted an impairment charge (a decrease in asset value) of $1.6 billion. The update also revealed that parts of the Woodsmith mine are being mothballed.

The sinking of the production shaft – currently at a depth of 712 metres – has now been paused and will enter care and maintenance. Sinking of the service shaft, meanwhile, will continue downwards from a depth 745 metres through the Sherwood sandstone strata, subject to the allocation of capital. The Sherwood sandstone is a key shaft zone because of its expected hardness and the potential for water fissures.

Tunnel boring activities for the MTS system, meanwhile, will continue at a reduced pace. Around 29 kilometres out of a total length of 37 kilometres had been successfully tunnelled, as of the end of June.

A detailed review has also been carried out to identify critical works at the mine. This has been necessary to de-risk the project schedule, preserve those areas going into care and maintenance, and keep the project in readiness for later ramp-up.

Critical technical studies are also currently underway in readiness for any future construction restart. The project’s configuration is being rescoped to fit the revised funding and syndication plan, with a focus on scalable mining methods and the optimisation of infrastructure. The mine’s final design capacity – around 13 million t/a currently – remains subject to further studies and approval.

ICL innovates

ICL owns and operates the world’s only polyhalite mine at Boulby in the UK. The company markets and sells this natural, multi-nutrient fertilizer as Polysulphate under its PLUS range. Production of this polyhalite product reached one million tonnes in 2023, a new annual record (Fertilizer International 520, p15)

Polysulphate has a low carbon footprint, provides four plant nutrients – sulphur, potassium, magnesium, and calcium – and is certified for organic use in many countries. It has a neutral pH and a very low salinity index, making it suitable for chloride-sensitive crops.

Polysulphate releases nutrients gradually over time, functions over a wide soil pH range, and is suitable for both sandy and clayey soils, according to ICL. It is said to provide plants with prolonged sulphur availability, while reducing the risk of leaching, both in sandy soils and under high rainfall conditions.

ICL expanded its PLUS range by adding two new product lines in 2022 – ICL NPKpluS and Polysulphate Premium (Fertilizer International 509, p22).

NPKpluS is a new NPK line that incorporates Polysulphate, and was developed in response to rising demand for magnesium and calcium and the increasing importance of sulphur as a nutrient. It allows farmers to apply six essential nutrients – nitrogen, phosphorus, and potassium along with sulphur, magnesium, and calcium – in one single application. The product is produced by ICL at plants in China (prilling) and Ludwigshafen, Germany (blending) and is available in a variety of formulations. Blends can be tailor made and incorporate zinc and/or boron, if required.

Polysulphate Premium is granulated from powdered polyhalite to form uniform and robust spherical granules that blend easily with other granulated fertilizers. These granules are resistant to abrasion, humidity and damage, while their spherical shape provides a steady flow rate and a consistent broad spread during field application.

Polysulphate Premium is produced at ICL’s Ludwigshafen plant in Germany and offers a faster mode of action compared to standard Polysulphate. It becomes soluble as soon as it reaches the soil – making essential plant nutrients available for crop uptake both immediately and over a prolonged period.

ICL has also been investigating the use of polyhalite in reducing ammonia emissions by commissioning a series of lab, greenhouse and field trials in 2022-2023 1 . These involved adding polyhalite to urea applications, animal slurries and during manure composting.

Initial results have shown that polyhalite successfully reduces ammonia volatilisation by between 8–50 percent. The precise mechanism has not been identified but possible modes of action include:

- A direct influence on the urease enzyme activity, with preliminary testing showing some inhibitory effect

- The adsorption of Ca and Mg cations onto reactive surfaces causing slight, short-term acidification

- The production of struvite from bringing magnesium into a system containing ammonium and phosphate.

“ICL expanded its polyhalite product range by adding two new lines in 2022 – ICL NPKpluS and Polysulphate Premium.”

ICL has commissioned follow up research to investigate the effects of polyhalite on nitrogen losses and ammonia volatilisation in crop systems, animal slurries and manure composting. These trials are being carried out in Germany, Israel, Netherlands, Spain and the UK – and will include in-depth studies to define mode(s) of action.

New entrant GoudenKorrel

Polish compound fertilizer producer GoudenKorrel is a relatively new entrant to the polyhalite market. The company manufactures, markets and sells a range of granulated polyhalite fertilizers (Belenus ® , Vervactor ® and PoliSulMag ® ) produced using a proprietary process (G2D Nodens Technology ™ ) at a newly built production plant at Lubien Kujawski in central Poland. This was completed in 2022.

“GoudenKorrel manufactures, markets and sells a range of granulated polyhalite fertilizers produced using a proprietary process at a newly built production plant in Lubien Kujawski, central Poland.”

The company sources its polyhalite from the Boulby mine in the UK having signed a supply contract with ICL in 2019. The company’s proprietary granulation process is designed to offer gradual and prolonged nutrient release over a three-month period and prevent rapid leaching. Early fertilizer supply to crops is also boosted with around 50 percent of nutrients (e.g., potassium, calcium and magnesium) becoming plant-available within 15 days of application.

GoudenKorrel’s ‘G2D’ production technology is a multi-stage process which – as its name suggests – literally grinds materials to dust and reduces the size of poly-halite particle to tens of microns. These micronised particles are then separated, mixed and aggregated as part of the granulation process.

Overall, these preparatory steps are designed to improve fertilizer performance by ensuring both the complete solubility of polyhalite and the gradual release of nutrients. Around 98 percent of the final product is in the form of 2-5 mm size granules.

Belenus ® is GoudenKorrel’s standard organic-certified polyhalite product and is marketed as “Eco SOP” – a source of naturally-derived sulphur, potassium, magnesium and calcium for ecological (organic) farming. This milled and granulated chloride-free fertilizer is applied before sowing and as a top dressing

Vervactor ® , in contrast, is a potassium enriched polyhalite fertilizer designed for application to broad acre agricultural crops and vegetables before sowing and as a top dressing. Although potash is added, the chloride content of the product is still relatively low at 16.5 percent, versus 45-47 percent for MOP (muriate of potash, KCl).

PoliSulMag ® , meanwhile, is a high ratio magnesium and sulphur polyhalite formulation with added potassium, calcium and sodium. This organic-certified fertilizer is intended for application to agricultural, vegetable and horticultural crops before seeding and for top dressing.

GoudenKorrel recently introduced Polyhalite Complex ® , a polyhalitebased NPK compound fertilizer. It provides 11 crop nutrients in total – in contrast to standard granulated NPKs – containing additional Ca, Mg, Na and S alongside micronutrients (B, Fe, Mn and Zn), as well as being fully water-soluble and effectively chloride-free.

References