Sulphur 415 Nov-Dec 2024

30 November 2024

Price Trends

SULPHUR

Global sulphur prices underwent increases in some key benchmark markets during October, but spot activity nevertheless remained muted, with demand subdued and availability tight. Market participants continue to closely track geopolitical developments.

The Qatar sulphur price (QSP) for November was posted at $136/t f.o.b., up $12/t from the October level. This represents the highest QSP since January 2023’s at $155/t f.o.b., and reflects delivered levels to China in the high $150s/t c.fr at current freight rates. Prices in the Middle East have been on the rise recently, with the spot price assessed at a range of $139-141/t f.o.b., and a Muntajat tender of 35,000 tonnes was believed to have been awarded at around $140/t f.o.b., according to market sources. The ADNOC monthly contract for Q4 was finally confirmed settled at $122/t f.o.b., and ADNOC’s monthly contract price for November was settled at $135 /t f.o.b. Prices at these level narrows the spread to benchmark prices in China and Indonesia, making those trade less viable.

Prices in China have also increased for both delivered and port prices, with import prices now assessed at $152157/t c.fr following reports of transactions occurring across the price range. A major phosphate producer in Hubei province purchased 20,000 tonnes of Canadian sulphur at $157/t c.fr at the end of October. This follows a trade the previous week involving Canadian sulphur to the Yangtze River at $154/t c.fr. According to market sources, other transactions were concluded around the same range. A trader sold a cargo to another trader at around $154-156/t c.fr and a southwest Chinese phosphate producer bought a cargo at $152/t c.fr. The high-end for port transactions reached RMB1,300/t FCA ($183/t), the highest level since March 2023, indicating a net-back range at around $154/t c.fr. Following the increase, downstream consumers stepped back from buying, which led to port prices declining slightly. Market sentiment is positive due to the affordable prices and high phosphate operating rate. The countrywide MAP production operating rates increased by 2% to about 57%, according to local sources. The operating of DAP is reported at 57%, down 2%, across the whole country.

Total sulphur port inventories in China declined by 78,000 tonnes to 2.31 million tonnes by 30 October. The volume at Yangtze River ports increased 22,000 tonnes to 844,000 tonnes, whereas the Dafeng port inventory decreased 51,000 tonnes to 499,000 tonnes. Sinopec’s Puguang, the largest sulphur producer in China, kept its sulphur prices at port and Dazhou factory prices unchanged. Daily production is around 4,300 t/d in Wanzhou and 930 t/d in Dazhou. Factory prices at Dazhou were unchanged at RMB1,180/t EXW ($166/t) for both truck and rail volumes.

The spot price assessment for sulphur cargoes to Indonesia was up to $150155/t c.fr after five consecutive weeks at its previous price level of $145-147/t c.fr. The latest transactions have concluded towards the middle point of the newly published range, according to market sources. Additionally, PT Lygend awarded a tender early last week at a price around $152/t c.fr. In spite of concerns that higher sulphur prices from the Middle East have made trade less viable for both China and Indonesia, it is believed that sulphur consumption in Indonesia will still increase further this year, though demand may be partly offset by increased domestic smelter acid production.

European sulphur contracts for the fourth quarter have settled at an increase of $30/t from Q3. The published ranges are $154-184/t c.fr Benelux for barge/ railcar and $173-213/t CPT NW Europe truckload. A rise in settlement prices was widely expected due to global price increases in Q3 and the tight availability in the region. The Baltic spot price was assessed up to $100-110/t f.o.b. from $85-90/t f.o.b. based on delivered prices to Brazil at $140-150/t c.fr.

A recent CMOC tender awarded at $145/t c.fr which is understood to be of Kazakhstan origin would signal an FOB price at this range with current freight rates around $22-25/t. Kazakhstan cargoes are predominantly transported via rail to the port of Ust-Luga and into the Baltic Sea. For Q1-Q3 2024, Kazakhstan exported 3.63 million tonnes of sulphur. This represents a year-on-year increase of 30%. Its main export partners during this period have been Morocco with 2.62 million tonnes, Israel with 326,000 tonnes, and Senegal with 227,000 tonnes. Cargoes to Brazil were 49,000 tonnes and Argentina 21,000 tonnes. Spot prices for sulphur cargoes to Brazil were assessed flat at $140-150/t c.fr for the second consecutive week.

In North America, spot prices for seaborne sulphur exports from Canada rose slightly to $110-118/t f.o.b., up from previous assessments of $108-115/t f.o.b., amid low spot trading activity. Recent transactions into China, involving Canadian sulphur cargoes sold at $154157/t c.fr, would place the netback in this current assessed FOB range, and global price climbs suggest that prices in China are likely to increase further, but activity in Canada remained lacklustre.

India’s sulphur prices held unchanged at $140-145/t c.fr as steady contract shipments continued to meet demand, offsetting tight supply. Iffco’s recent procurement of spot cargoes from its regular Middle Eastern suppliers had minimal impact on overall price and demand. Iffco secured approximately 80,000-90,000 tonnes of sulphur at mid-$140s/t c.fr India in a deal that was finalised in mid-October. The company is understood to renew its purchasing of sulphur around the end of November. Indian sulphur imports surged in October to 172,000 tonnes, which is a 35% year-on-year increase.

SULPHURIC ACID

Sulphuric acid benchmarks were largely unchanged at the end of October. In Asia, China’s export price was assessed at $50-55/t f.o.b., for the second consecutive week with availability for the spot market expected until November as tight spot availability offset a lack of demand. The higher end of the range could be edging higher towards $60/t f.o.b., according to market participants, but no deals were reported concluded at this level at the time of writing. The Daye smelter incident on 14 September brought a minor rebalancing in the Chinese market with other producers adjusting but prices are reflecting the reduced availability. The Daye smelter in Hubei province was forced to shutdown its main operations after a fire, with the ensuing shutdown expected to last for three months. In spite of the removal of 1 million t/a of acid capacity from the market, it is not expected to impact the market significantly, as it may actually boost supply at other smelters – because raw material availability is tight, there are plenty of buyers for what Daye is unable to produce. It may also boost sulphur demand in the short term to plug the domestic gap. Supply is very tight and no spot availability is expected until the end of November or early December, according to market sources.

The spot market for Japan and South Korea has been pegged up to $4550/t f.o.b. Although transactions have been limited due to tight availability, at least one cargo has been offered within the newly published range. The published index is assessed up at $-5-50/t f.o.b., with the lower end representing contracts. Q4 contract prices for supply to China were indicated as settled at around the high $20s/t c.fr. Based on current freight rates, the $-5/t at the lower end of the range, therefore, remains possible.

Prices for sulphuric acid to Turkey were assessed up at $140-150/t c.fr for spot and contract sales. This would represent a $25/t increase to the range, which previously stood at $115-125/t c.fr. Turkish imports for January-August 2024 were up 63% year on year at 525,000 tonnes, with 97% of this from Bulgaria, according to data via Global Trade Tracker (GTT). Turkey’s exports of sulphuric acid, from January-August 2024, reached 120,000 tonnes, a year-on-year increase of 600%. The main export partner for this period was Morocco, which received around 97,000 tonnes.

The North African spot price range for sulphuric acid narrowed to $140-160/t, rising on the lower end of the range from previous assessments of $110-160/t c.fr. Tight availability, high European prices and current freight rates have edged prices higher. From January-August 2024, Morocco imported sulphuric acid primarily from China, with volumes reaching 304,000 tonnes, followed by Bulgaria with 189,000 tonnes and Spain with 156,000 tonnes, according to Global Trade Tracker data.

India’s sulphuric acid market remained stable, with prices flat at $102110/t c.fr, on weak spot demand. No spot deals were reported in the market in late October as several regular importers held off on new purchases. Offer prices are currently in the $105-110/t c.fr India range amid tight supply, but saw no buyers stepped in at these levels. Chinese offers are still around $55-60/t f.o.b., which would suggest a higher delivered price at $110-115/t c.fr India. However, other f.o.b. offers were heard in the mid-$40s/t range, bringing c.fr India to approximately $100/t. The market remains cautious over reduced import demand amid increased domestic production. Growing output from Indian smelter plants has tempered the need for imports, adding to price stability. Additional shifts in market supply are anticipated with PPL’s upcoming sulphuric acid facility expected to launch next year and potential capacity developments at Greenstar, which could further reduce import volumes. India’s October sulphuric acid imports reached approximately 142,000 tonnes, reflecting a slight 5% year-on-year decline.

Sulphuric acid prices for sales into Brazil were unchanged at $160-170/t c.fr for the fourth consecutive week on limited demand. Current European f.o.b. prices in the $100-110/t range and NW Europe-Brazil freight rates around the $50s/t, make delivered prices in the $160s/t c.fr in theory possible. The higher end of the range could be edging to the mid-$170s/t, according to some market participants. Last month, Brazil’s imports of sulphuric acid fell by 18% to 49,850 tonnes, down from September 2023 at 60,854 tonnes. Brazil’s annual record remains 2022 when imports of acid totalled 845,000 tonnes.

Spot prices for sulphuric acid sales into Chile were assessed unchanged at $170-175/t c.fr for the fourth consecutive week. However, no fresh spot sales or enquiries were reported. Chile will be celebrating two national holidays on the 31 October and 1 November so limited remained activity in the markets. From January to August 2024, Chile has imported 2.19 million tonnes of acid, which is a decrease of 18% compared to volumes in the same period in 2023. In the month of August 2024, Chile imported 226,000 tonnes of sulphuric acid which represents a 35% increase compared to August 2023. The biggest imported volume came from Peru with 90,484 tonnes, followed by Japan with 35,932 tonnes and China with 31,938 tonnes.

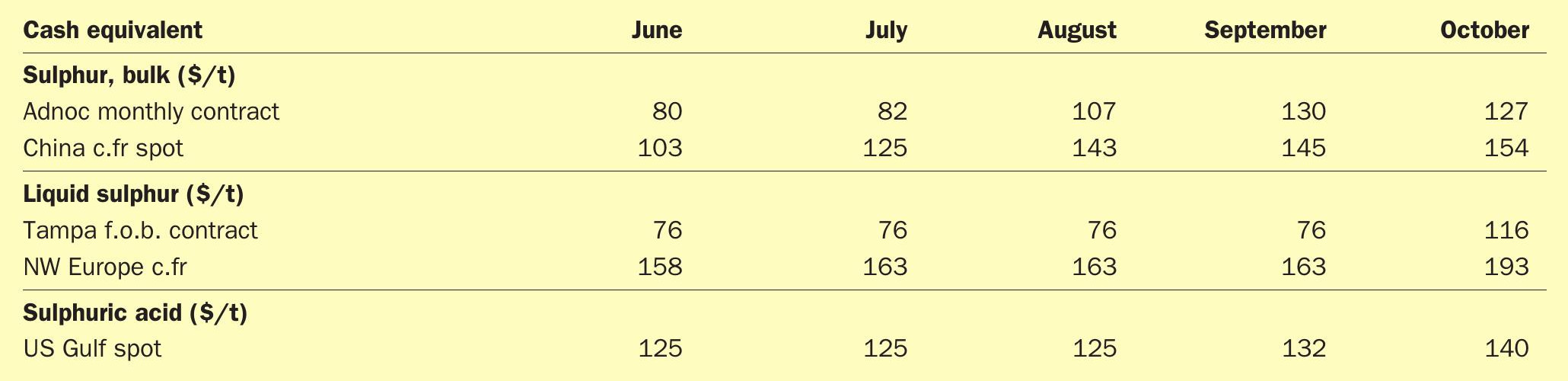

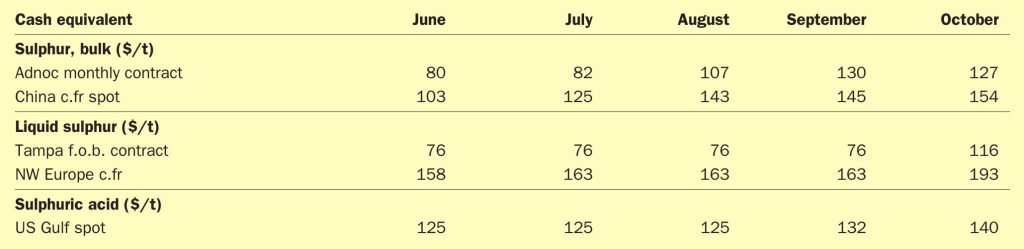

PRICE INDICATIONS