Community

31 January 2025

FLA sentiment survey: Results signal 2025 market optimism

CRU recently relaunched its Fertilizer International and BCInsight Platform. This relaunch coincided with the Fertilizer Latino Americano (FLA) conference in Rio de Janeiro, where we issued our inaugural sentiment survey for delegates. This insight presents and analyses the survey results, which point towards an optimistic tone for 2025 markets in Brazil and beyond.

Prices are expected to continue increasing

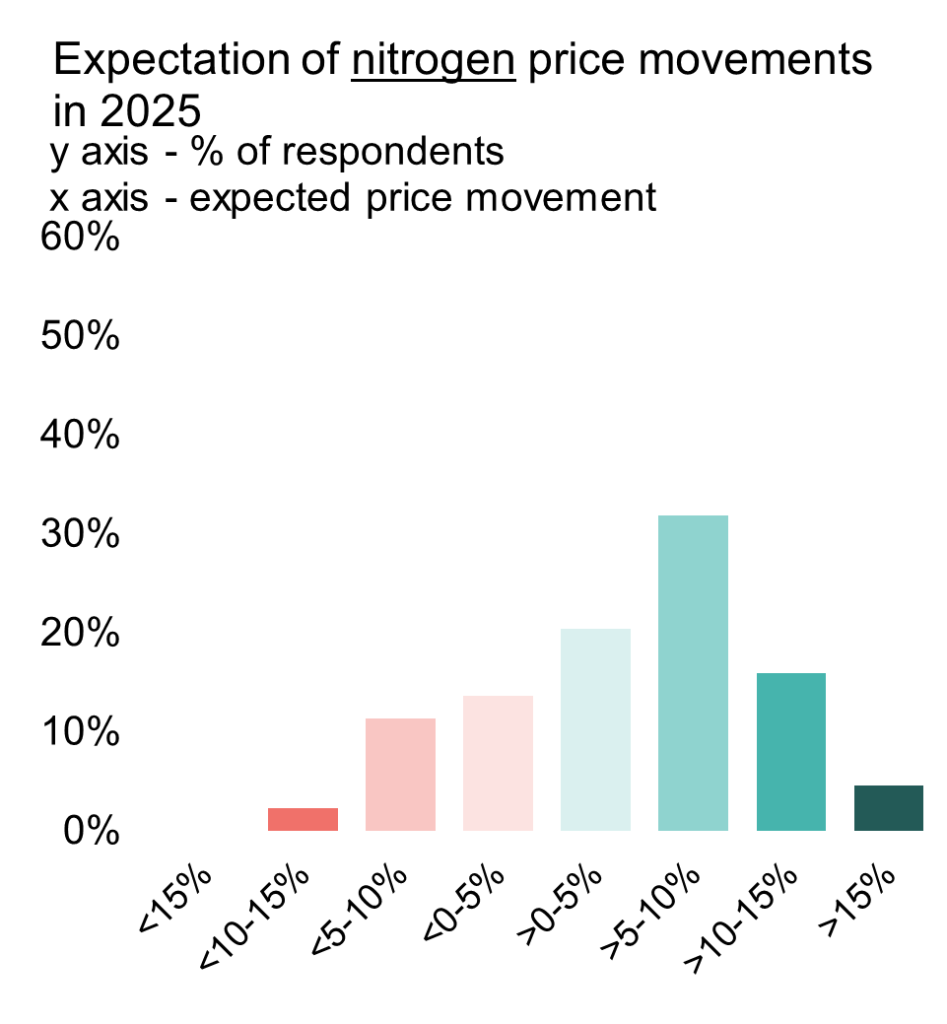

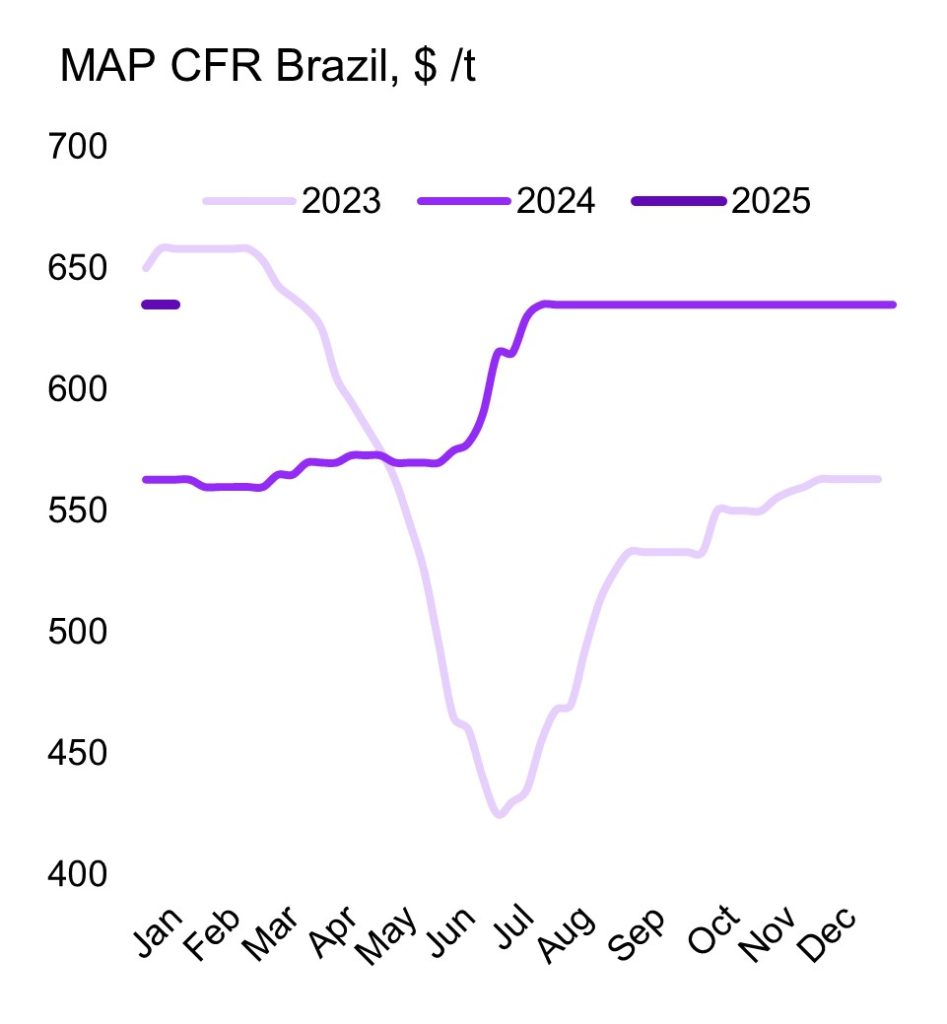

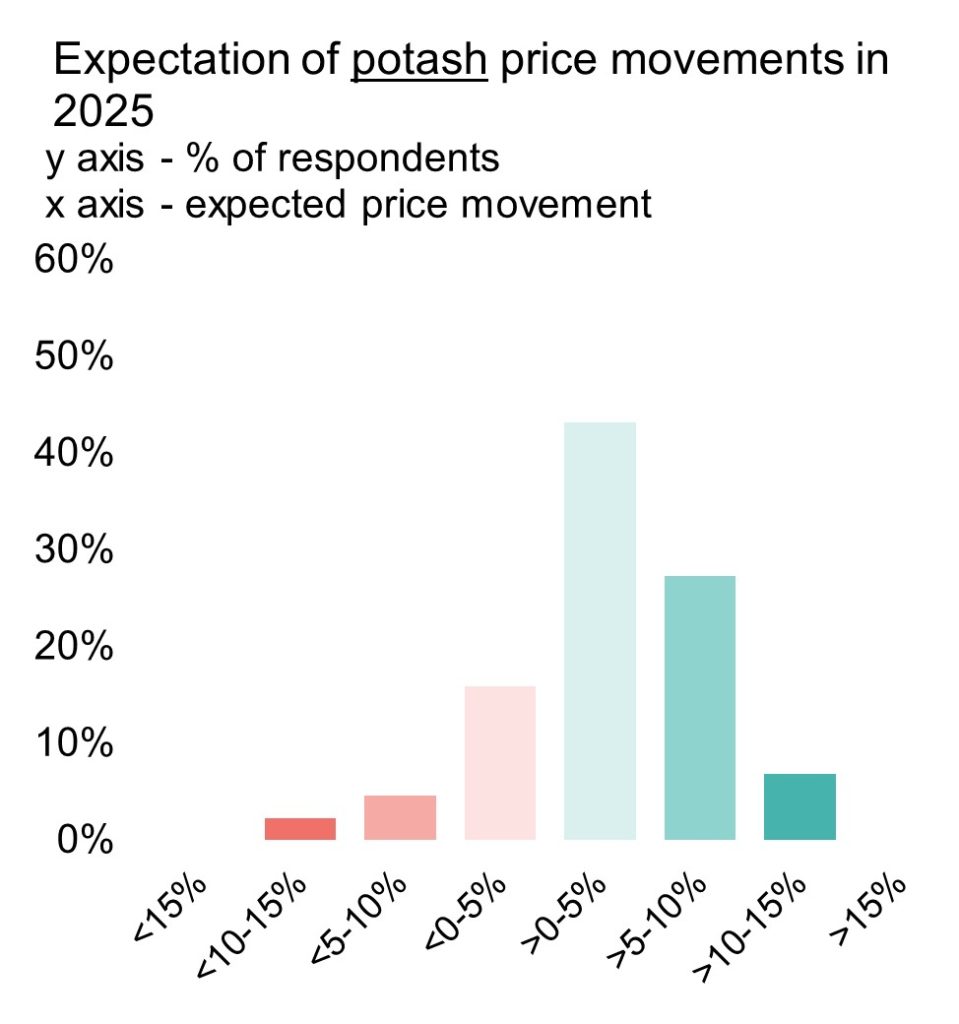

The survey began with questions on expectations for price movements in 2025. Nitrogen, phosphate and potash markets have started the year with upwards momentum, and this was reflected in the results.

Nitrogen prices expected to increase

Data: Fertilizer International, CRU Fertilizer Week

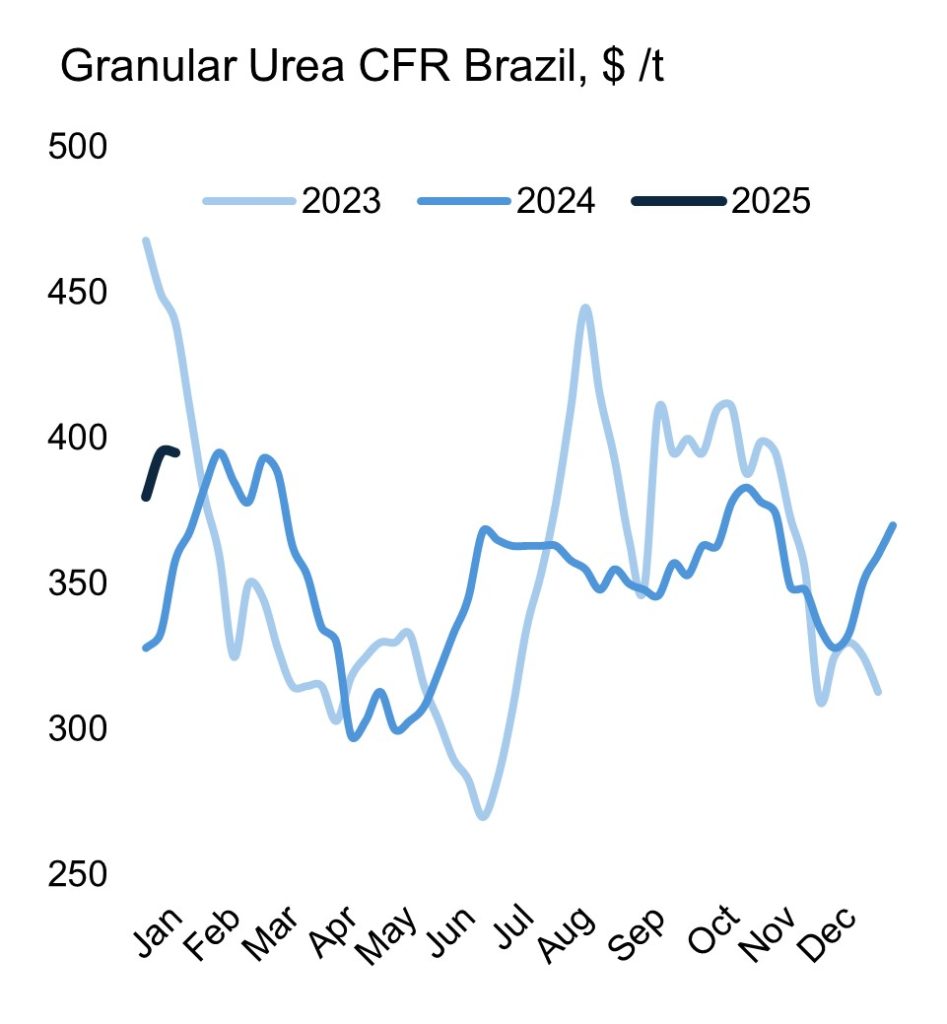

Urea prices have surged higher so far in 2025, on the back of supply shortfalls in Iran and strong demand, with key importer India tendering earlier than expected. Over half the survey respondents expect price rises above 5% for the year, but with no strong opinion on the range, with increases of 5-10% attracting 32% of votes.

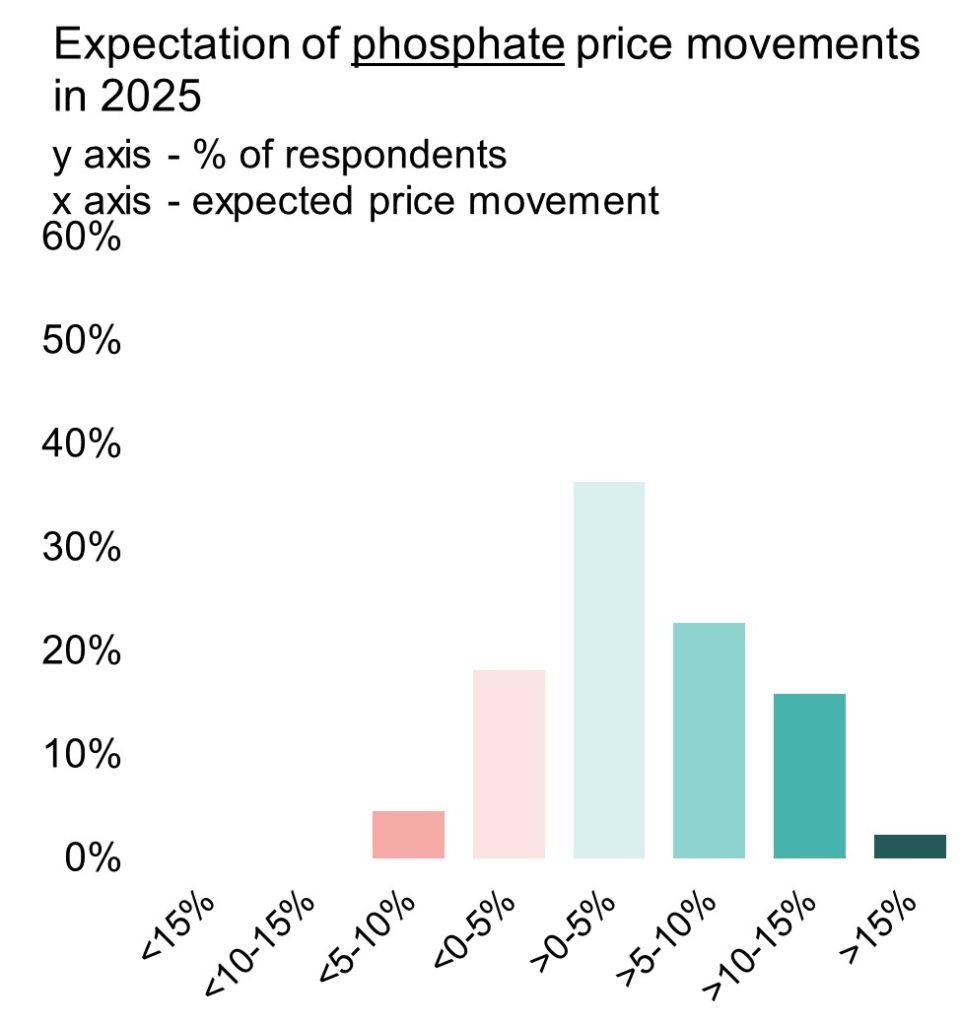

Phosphate price movements have been spectacularly unspectacular since mid-2024. Price volatility has been non-existent, despite demand concerns given the relatively high valuation of phosphate compared to nitrogen and potash. With a lack of supply relief in the pipeline, prices are expected to remain firm in 2025, and this sentiment was echoed in the survey results, with 36% of respondents expecting price rises of 0-5% for the year.

Phosphate prices will remain high after flatlining for more than 6 months

Data: Fertilizer International, CRU Fertilizer Week

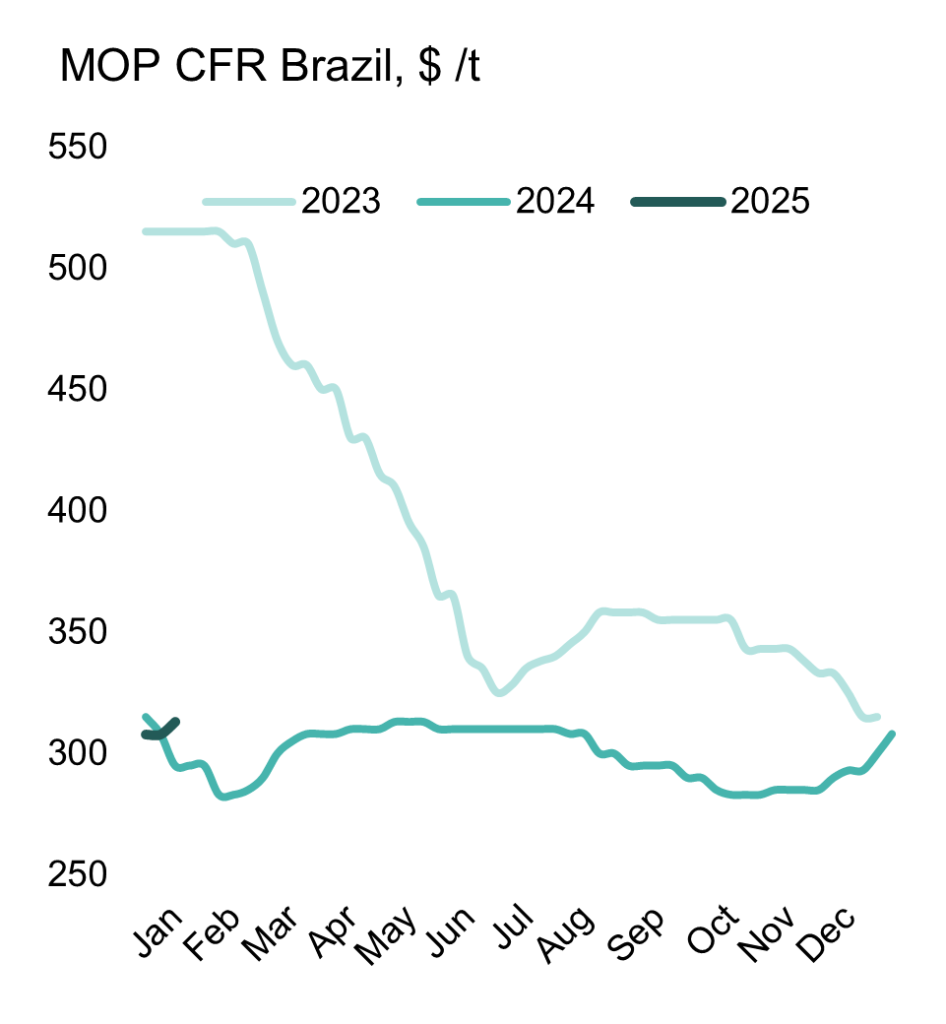

Potash prices plummeted over 2023 and remained low in 2024, following the highs of 2022. However, markets have picked up some recent momentum, increasing over $20 /t since mid-December. The consensus view is that potash prices have found a floor, and this was reflected in the survey, with 77% of respondents calling for price increases over 2025, the majority of which pegged gains at 0-5%.

Modest gains for potash prices

Data: Fertilizer International, CRU Fertilizer Week

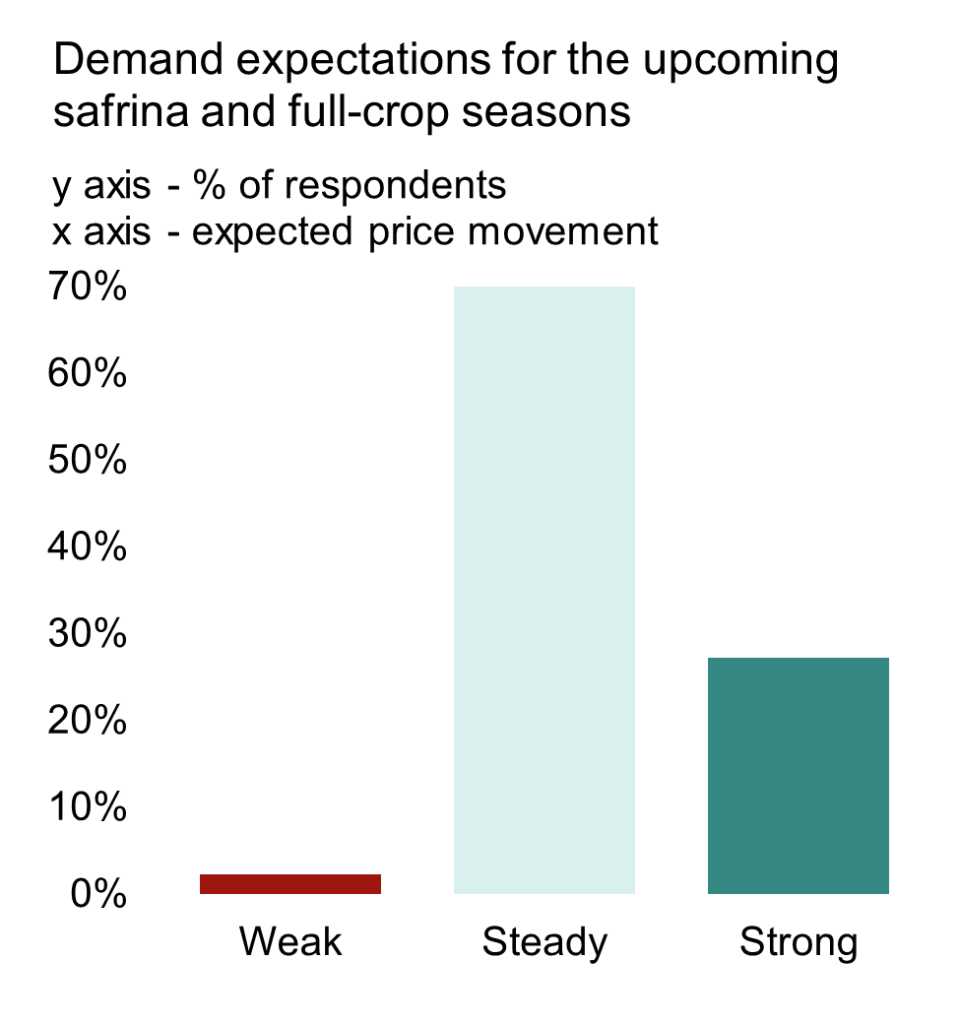

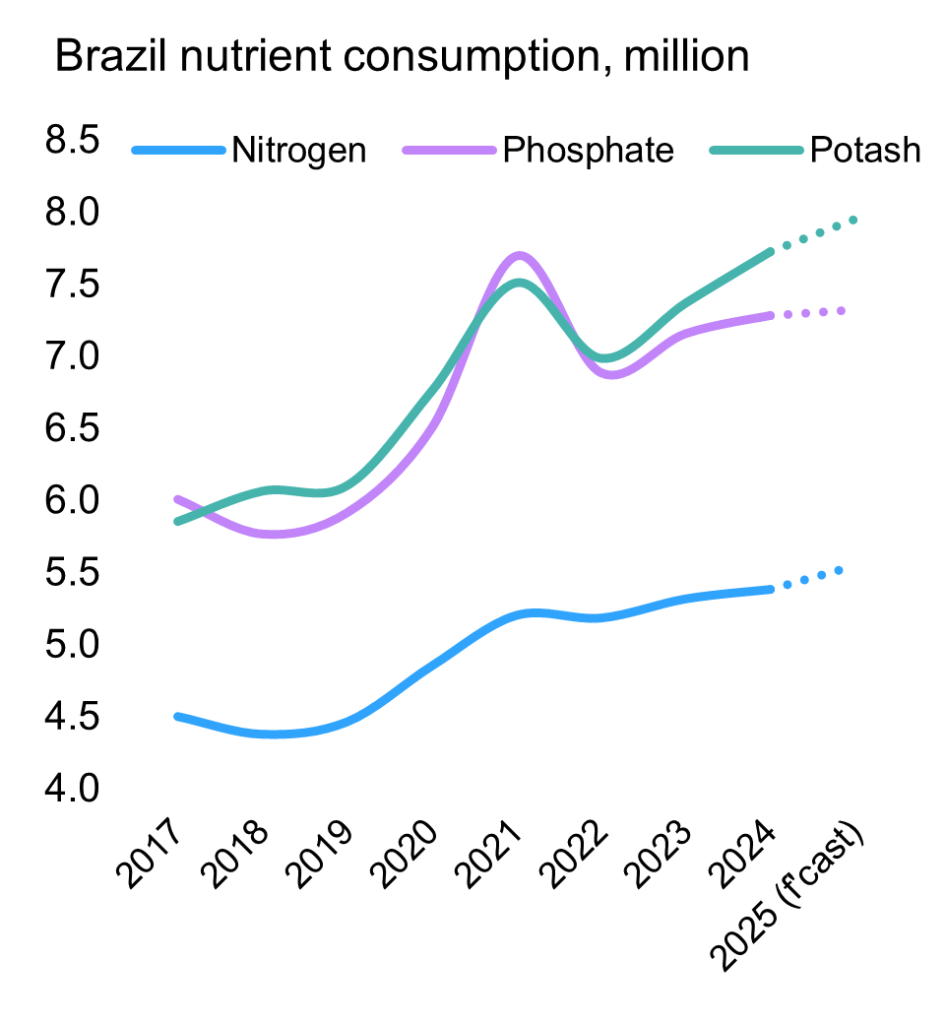

Demand again supported by robust agricultural growth

Latin American continues to be the most reliable source of demand growth for the fertilizer industry. With Trump 2.0 and tit-for-tat trade wars on the horizon, Brazil stands to benefit and become an even more important agricultural commodity exporter. While the macro factors are positive for fertilizer demand, survey respondents struck a more cautious tone, with 70% of respondents expecting steady demand in 2025. 27% chose strong demand, leaving just 3% expecting weak demand. CRU forecasts nitrogen and potash demand to grow 3% y/y in 2025, with phosphate at 1% y/y.

Survey respondents are more cautious on demand growth prospects for 2025

Data: Fertilizer International, CRU Fertilizer Week, IFA

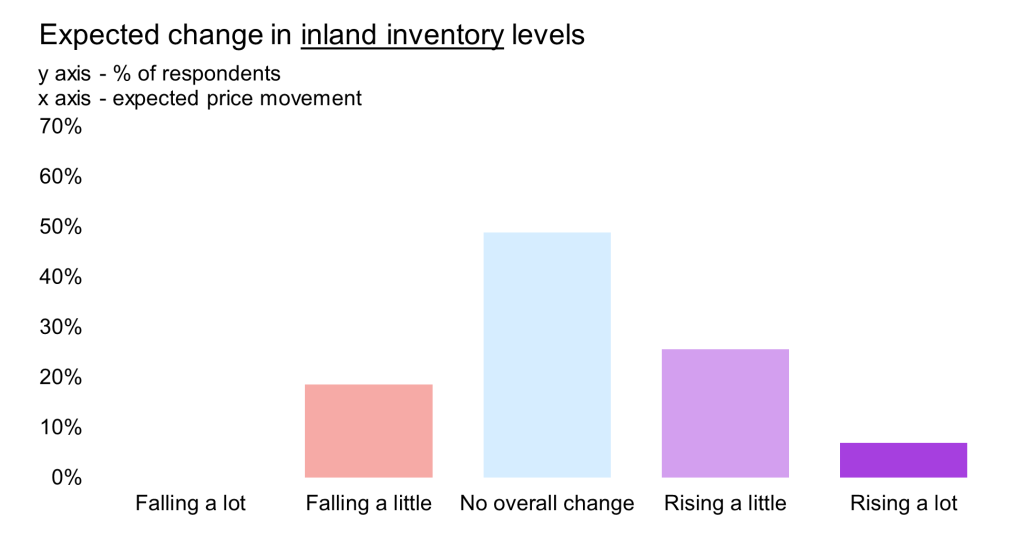

While demand is expected to increase, there is no major shift in inventories expected, reflecting confidence in the market being adequately supplied.

No major drawdown in inventories anticipated

DATA: Fertilizer International

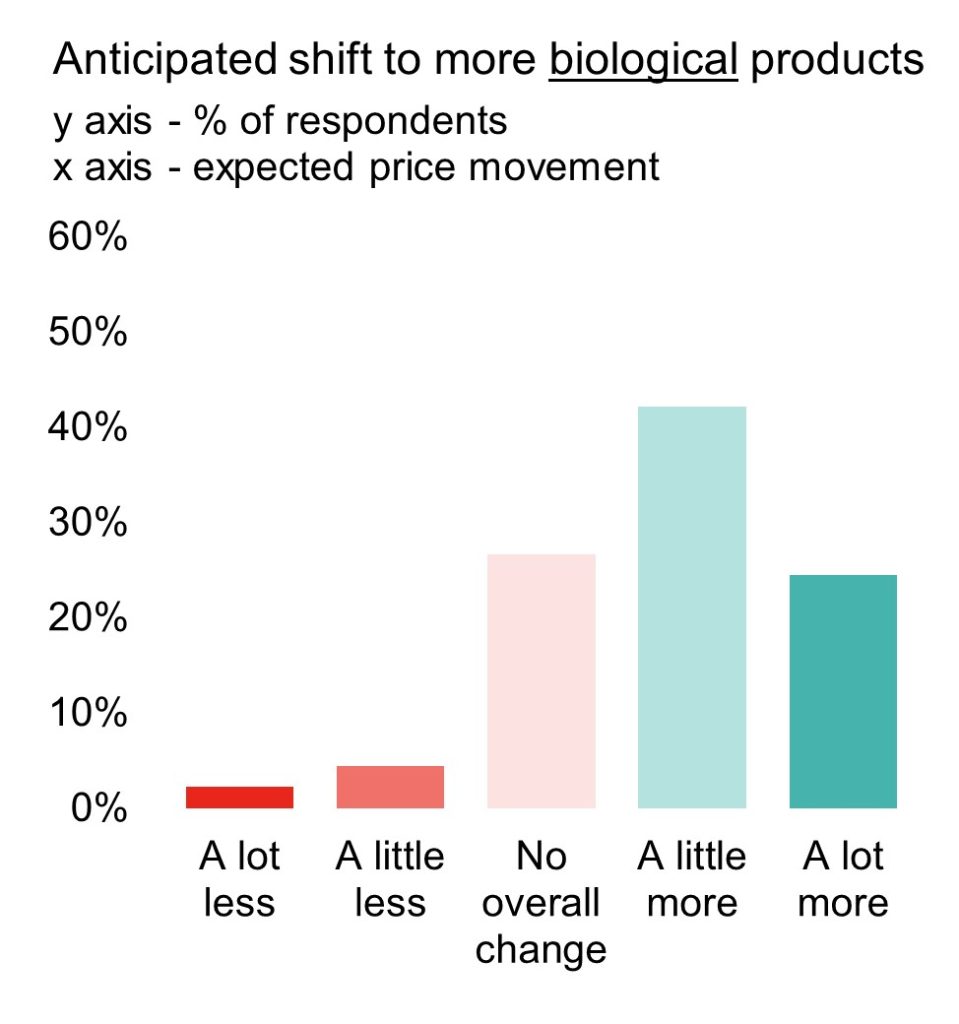

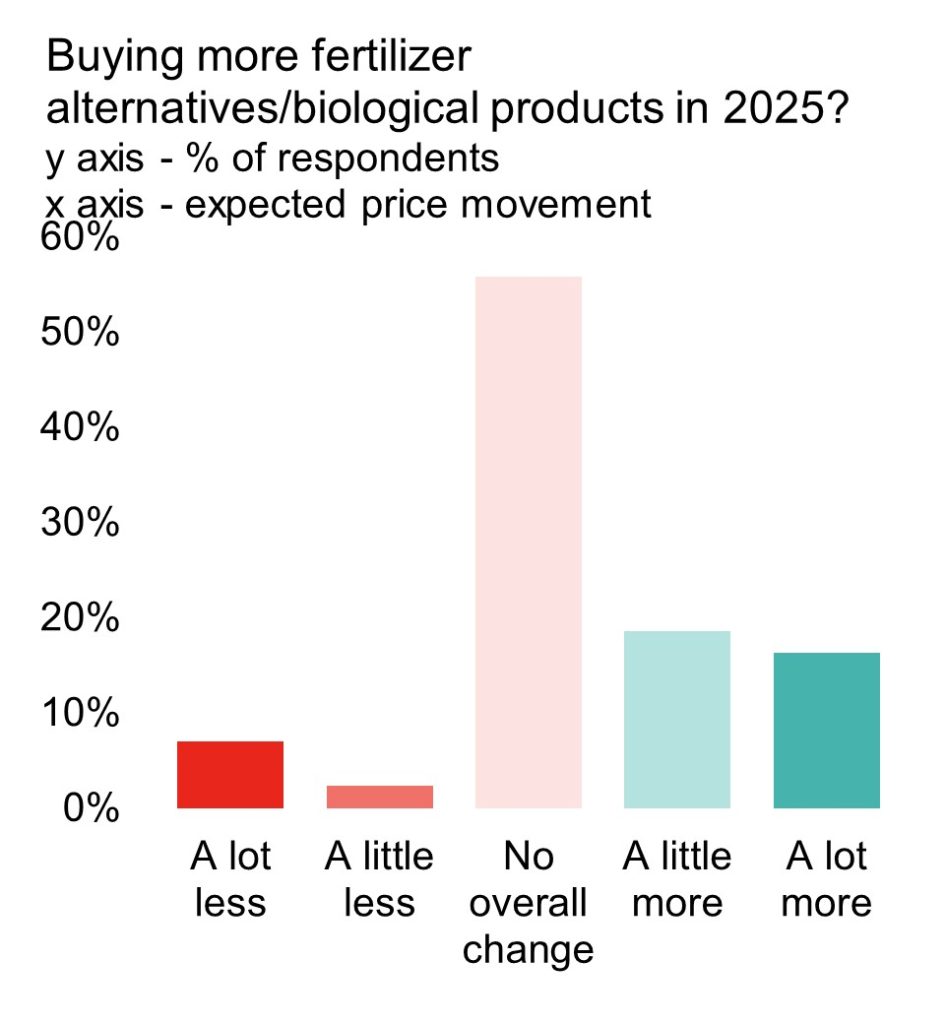

Biological and value-added fertilizers are on the up

Latin America is famed for its agricultural innovation. This is evident in the growth of specialty, biological and value-added fertilizer products across the region, particularly Brazil. 66% of respondents expect more biological products over the long term, but 56% expected little change in 2025.

A shift to more biological products over the short and long term

Data: Fertilizer International

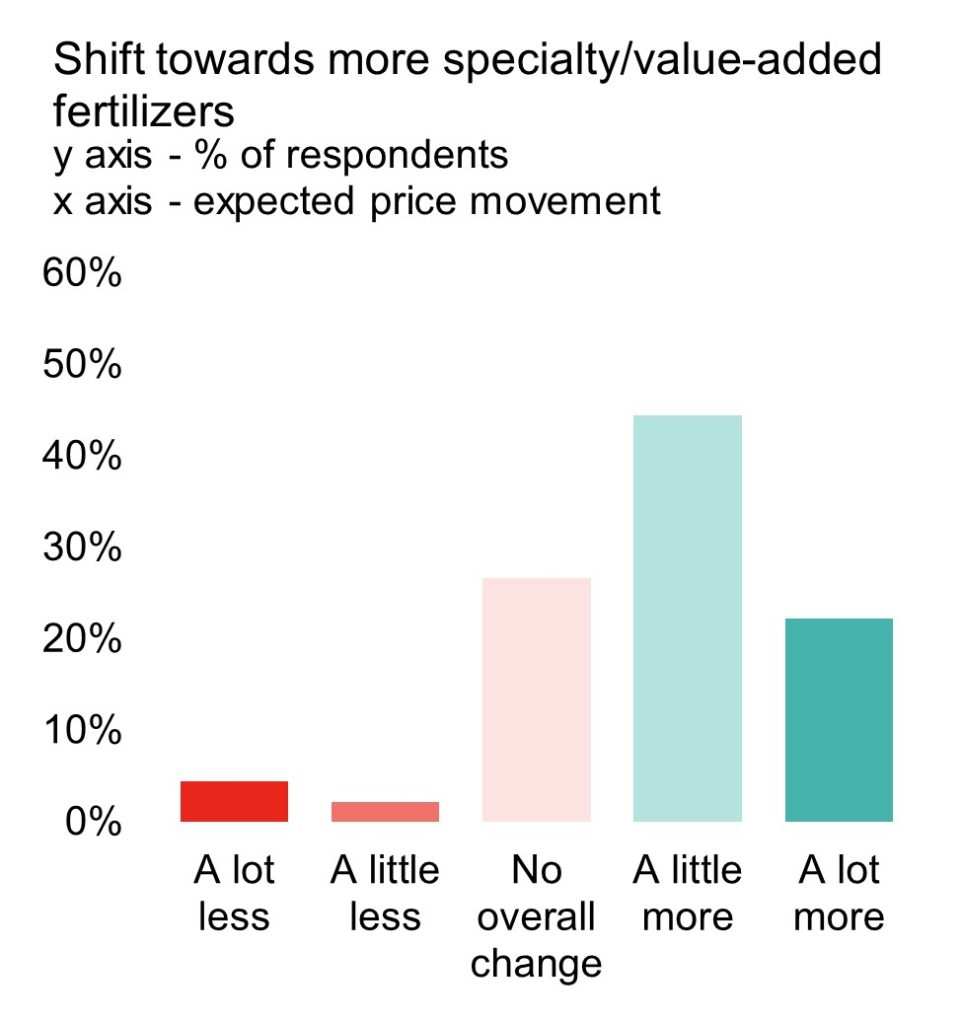

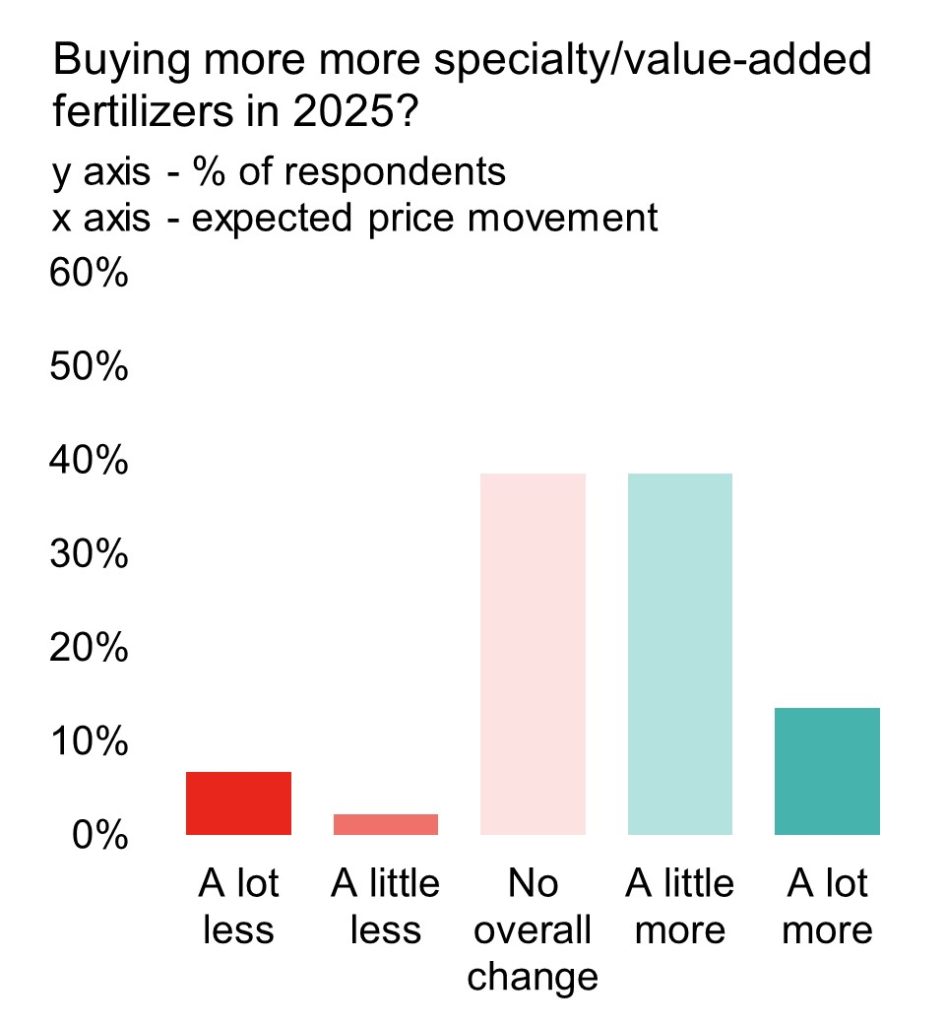

Similar results were observed for specialty/value-added fertilizer products. 66% of respondents expect a positive shift over the long term, with 53% also expecting higher applications in 2025.

Positive outlook for demand of specialty and value-added products

Data: Fertilizer International

Logistics and investments surprisingly resilient

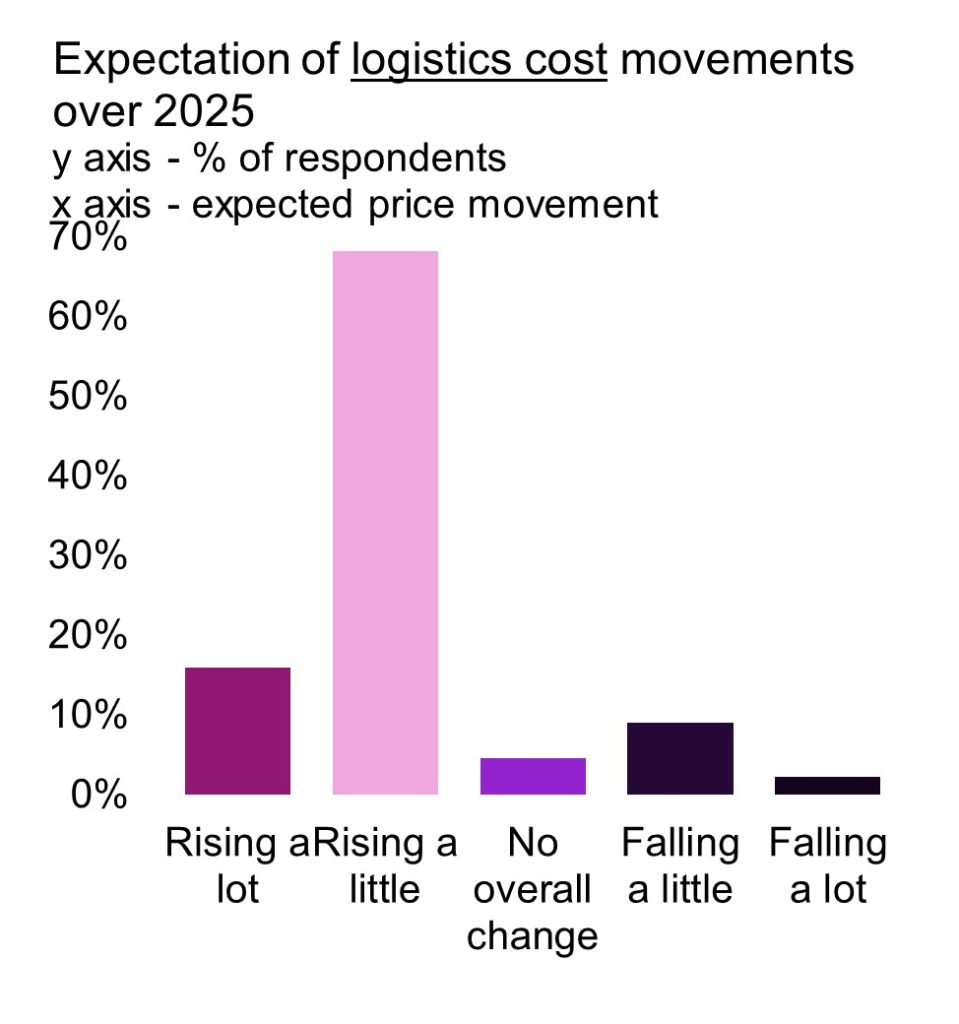

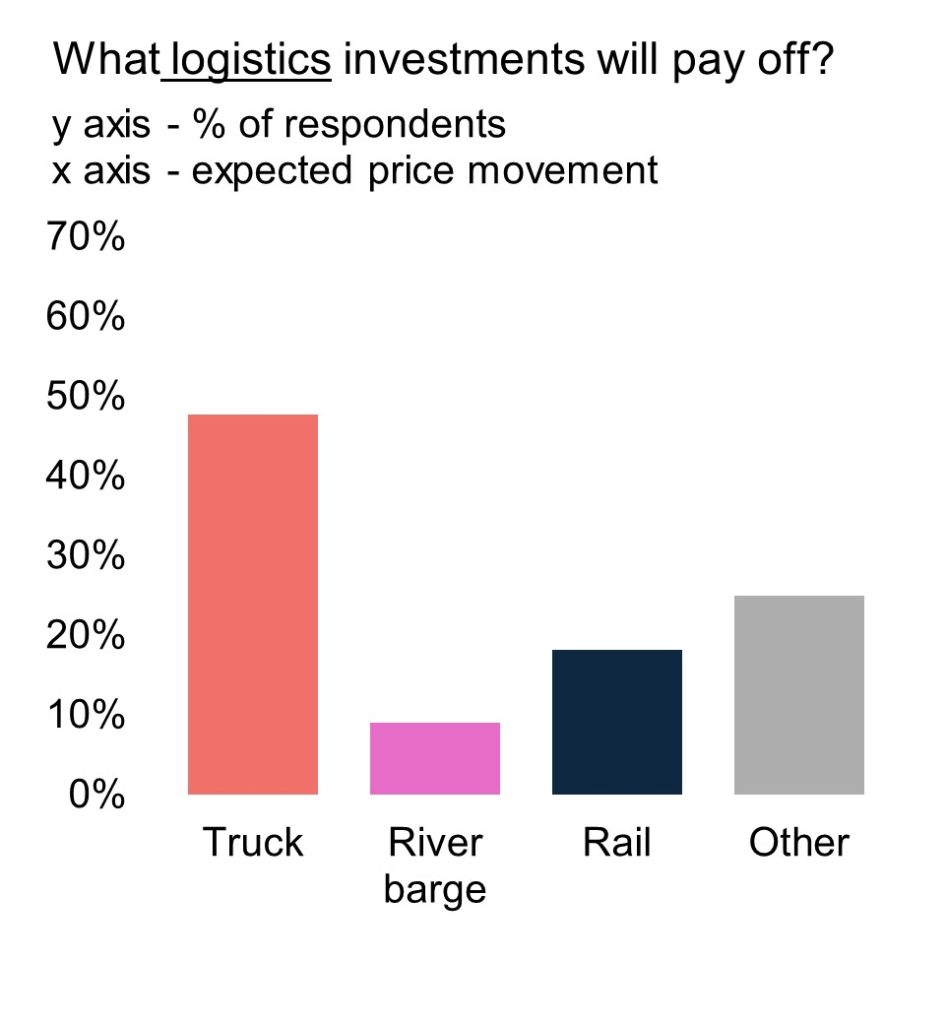

High inland logistics costs have long plagued the efficiency of the Latin American – and more specifically the Brazilian – fertilizer market. 68% of respondents expect logistics costs to rise modestly in 2025, while 48% believe the investments in trucks, rather then barges or rail, will provide the best returns.

Logistics costs expected to rise, trucks provide the best value investment

Data: Fertilizer International

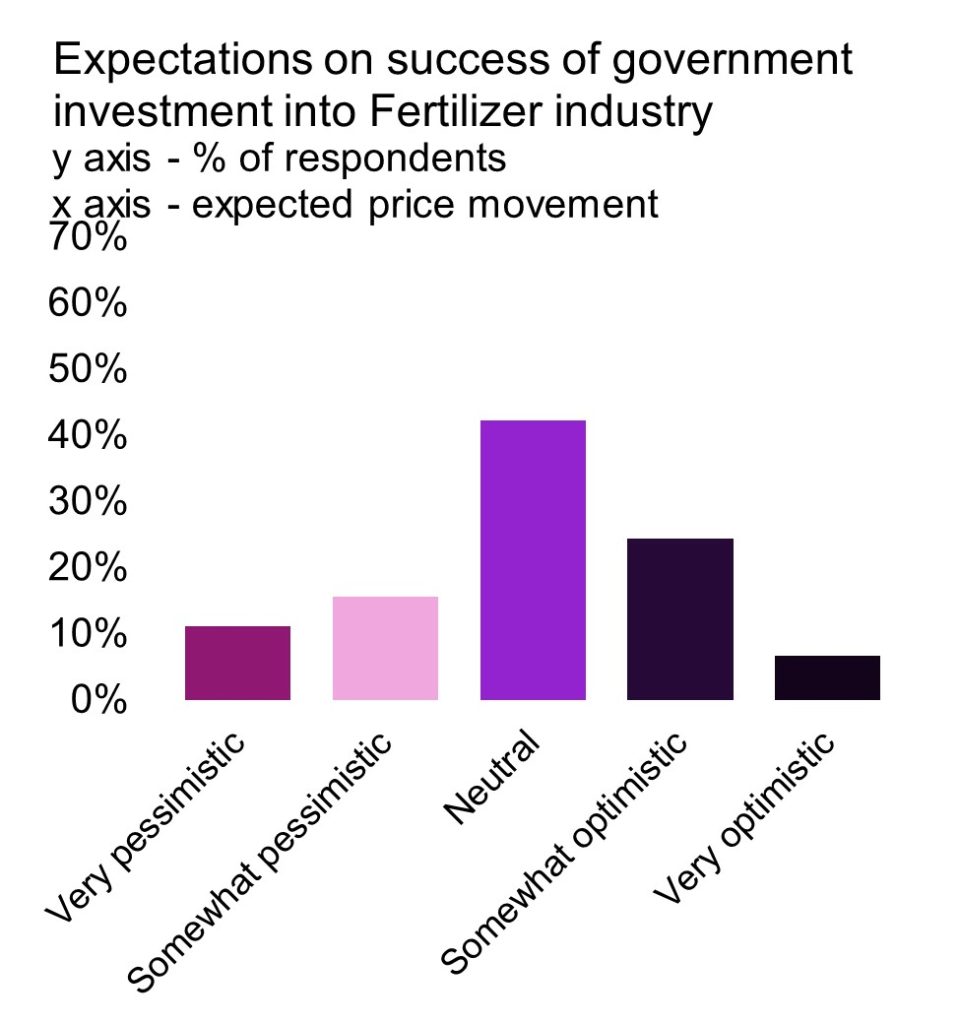

The price shocks of 2022 triggered reactionary measures from governments across the globe to invest in fertilizer supply. This was particularly the case across Latin America, with urea facilities and projects dusted off thanks to government support. 42% of respondents where neutral on the success of these investments. We had anticipated more pessimism, given the long history of failed government backed projects.

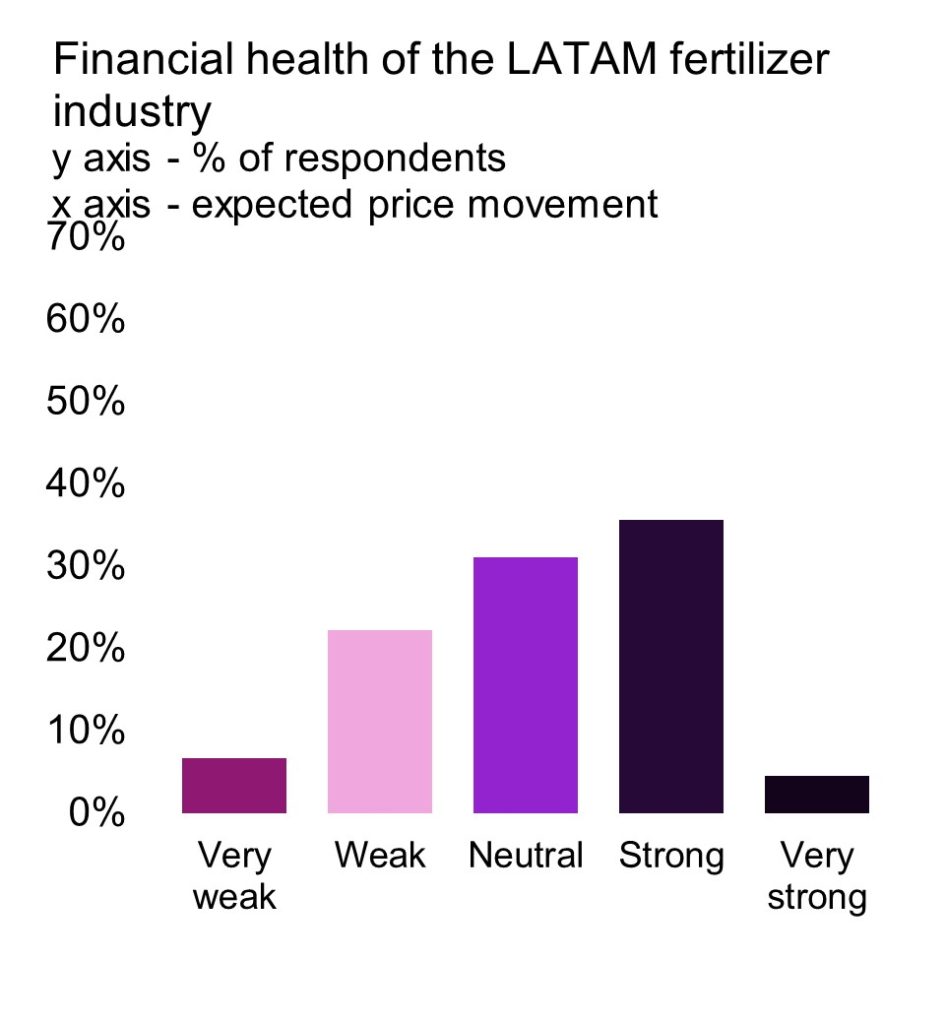

When surveyed on the financial health of the Latin American fertilizer industry, there was no dominant response. Given the financial hardships experienced across the agriculture input industry over recent years, we had anticipated more responses at the weaker end of the scale. However, 36% of respondents considered the industry to be in good financial health.

A neutral outlook for government investments and surprisingly strong financial health

Data: Fertilizer International