Sulphur 417 Mar-Apr 2025

19 March 2025

Price Trends

SUPHURSULPHURIC ACID

SULPHUR

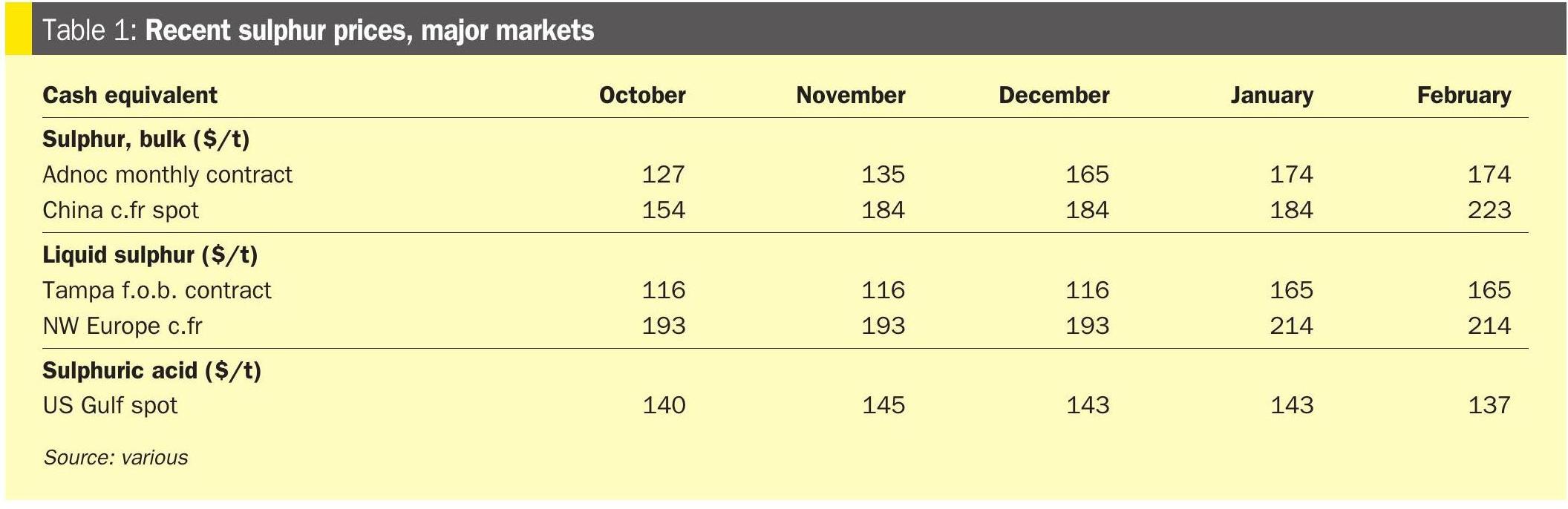

Global sulphur benchmarks rallied at the end of February, underpinned by strong demand in Indonesia and stock drawdowns in China as fresh European sanctions on Russia targeted the port of Ust-Luga. Chinese buyers paid up to $225t/t c.fr for a cargo, with unconfirmed rumours of business at even higher levels. However, delivered prices still lag domestic port spot prices in China, which are now assessed at a delivered-price equivalent of around $242/t c.fr. China’s delivered sulphur price jumped significantly as port inventories declined, and new arrivals were limited. Only two new cargoes were reported in the last week of February, one from a mainstream source into southern China at $205/t c.fr, and the second at $225/t c.fr by a phosphate producer for the Yangtze River. The sulphur port spot transaction price is reported at around 2,0402,050 yuan/t FCA ($281-283/t), with the low-end up $26/t and high-end up $25/t compared with previous settlements. That port price indicates delivered values at around $242/t c.fr, which is $17/t higher than the import price on the Yangtze. Phosphate producers need to purchase more sulphur to meet the increased buying activity in northeastern market and the improving spring application season demand in northern China. Still, market sales availability is limited, as most port tonnes are held by traders instead of end-users, while traders are selling limited quantities now to push prices higher. Chinese total port inventory dropped to 1.89 million tonnes by 26 February 2025. The quantity at Yangtze river ports declined 59,000 tonnes to 633,000 tonnes, while Dafeng port inventory decreased 20,000 tonnes to 450,000 tonnes.

Indonesia has been the focus of market attention since the start of the year as other delivered markets such as China and India have slowed down their purchasing. Four new purchases were reported by Indonesia at the end of February, and demand there was cited by most participants as the main factor pushing global sulphur prices higher. Sales ranging from $202/t c.fr to as high as $225/t c.fr were reported and the price was assessed at $215-220/t c.fr. A sale believed to be by Shell at $202/t c.fr was not deemed repeatable, and Total was linked to a sale at $216/t c.fr. Aramco was suggested as the seller of two further cargoes to Huayou, with at least one at $220/t c.fr. PT Lygend closed a tender on 26 February for another cargo for 50,000 tonnes, although no offers were reported at the time of writing and no award suggested.

Brazil stepped back into the market after a quiet start to the year with CMOC taking 40,000 tonnes for April arrival at a price close to $225/t c.fr. After limited activity since the start of the year, the delivered price into Brazil was assessed significantly higher based on the CMOC tender as well as rising prices globally. Offers in CMOC’s tender were reported as high as $230240/t c.fr, although these are understood to have been rejected. Mosaic last bought at $190/t c.fr, and most participants had not expected prices to punch higher so swiftly.

In the Middle East, Qatar’s Muntajat awarded its monthly sales tender for 35,000 tonnes at $212/t f.o.b., with bids as high as $210/t f.o.b. rejected. QatarEnergy posted its March monthly sales price at $202/t f.o.b., up $30/t from February. This new QSP reflects delivered levels to China in the low$220s/t c.fr at current freight rates. This is the highest price from Qatar since July 2022, when prices spiked following the Russia invasion. The benchmark has advanced $36/t since start of the year. ADNOC’s recent shift in sulphur trading strategy away from traders and towards moving its own tonnes was sapping liquidity from the forward market, some suggested, while one trader said there was no longer a forward market for sulphur at all, with the market essentially dominated by two major Middle East producers.

One element of the sixteenth round of European Union sanctions on Russia timed to coincide with the third anniversary of the full-scale invasion of Ukraine was a full transaction ban on three Russian ports, including Ust-Luga, which exports large volumes of Kazakh and Russian sulphur. Opinions on the impact of the fresh sanctions are mixed and the outcome is not yet clear, although they are EU not US sanctions, and US companies such as Trammo may well be unaffected. Should there be an impact on export volumes from Ust-Luga, Morocco may feel the pinch as a major buyer of Baltic tonnes, and Brazil also takes tonnes from the region.

Baltic prices were assessed unchanged, although there is a considerable degree of unease about trade from the region following the EU’s fresh sanctions on Russia this week that named Ust-Luga as a banned port. The Baltic sulphur price is assessed at $165-175/t f.o.b.

SULPHURIC ACID

Sulphuric prices declined in February in delivered markets due to a slowdown in buying activity, aided by a decline in freight rates. Weakening demand has also placed pressure on European pricing, while benchmarks have remained stable in Asia. Tight availability is still present across exporting regions but signs of this situation easing have begun to materialise.

BHP’s latest tender for 20,000 – 30,000 tonnes of acid for arrival during Q2 in February in Chile has signalled a bearish trend in acid prices, which have declined from $150-155/t to $140-150/t c.fr. The tender was said to have been awarded in the low to mid $140s/t, according to multiple sources. Limited available storage capacity, commitments to new annual contracts and ocean swells have slowed buying activity in 2025. Additionally, lower freight rates have enabled price declines, while seasonal rough seas have restricted spot deals. Similar market conditions are expected to continue until around March, according to local market participants. For the full year of 2024, Chilean acid imports fell 3.5% to 3.62 million t/a compared to 3.75 million t/a in the same 12 months of 2023.

In the US Gulf, prices decreased to $135-140/t c.fr after two months at $140-145/t, as weak import demand continued and a bearish sentiment settled in the market. Demand has been weak on the back of a price gap between acid imports and local sulphur burnt acid. The US prefers burning sulphur than taking import acid cargoes as it remains the more attractive of the two options.

The delivered price in Brazil also fell from $165-175/t to $130-140/t c.fr. Buying activity in the market has remained muted, and Brazilian imports fell by 27% year on year in January to 53,690 tonnes. Local availability is set to increase as Unigel announced in early 2025 that it will begin operations at its 450,000 t/a sulphuric acid plant by September 2025. Additionally, Petrobras commissioned its new atmospheric emissions abatement unit in late 2024, which converts sulphur oxide into sulphuric acid, adding 200,000 t/a of acid supply. Increased local supply will limit import requirements.

In India, prices declined in the first week of February from $105-110/t to $100-105/t c.fr as a slowdown in buying activity persists. Acid availability will increase in 2025 with the start-up of the 1.5 million t/a capacity Adani Copper smelter. Paradeep Phosphates (PPL) is also expected to commence sulphuric acid production in 2025 2H, increasing acid supply by 500,000 t/a. Still, the company has indicated plans to expand its phosphoric acid production that would require significant sulphuric acid volumes absorbing some of the supply increase.

An uptick in activity towards the end of 2024, amid limited availability, pushed acid prices up in China, Japan, and S. Korea, and they remained stable at $50-55/t f.o.b. in February 2025. The local Chinese market is still firm, but the pricing environment started to decline in February to an equivalent of $61/t (vs. $64/t in late December).

Weaker traded acid demand in Atlantic markets is placing pressure on prices at Europe f.o.b., with prices falling from $110-120/t to $95-105/t, according to deals recently reported in Brazil and Chile. A lack of molten sulphur coupled with a copper/zinc concentrate shortage could potentially keep European prices firmer, but Morocco’s pullback of import requirements will negatively impact prices. Morocco’s OCP, which had returned to buying acid last year, has remained absent from the spot market and sources said this has impacted the sentiment in Europe. Morocco is estimated to have imported 1.9-2.0 million t/a of acid in 2024, with requirements expected to fall to 1.1 million t/a in 2025. Multiple tenders in the region and spot deals indicated lower prices and provided the market with a bearish price signal, while freight rates also declined from key supplying regions. Seasonal rough seas in recent weeks had already dampened any spot demand in the region, while buyers were also sufficiently stocked, leaving less room for more spot purchases.

Prices remained relatively stable in Asia, however. There were some indications that buying in Indonesia is likely to begin in March. Indonesian c.fr prices are in the $90s/t but indications are that they would dip to the $80s/t. Furthermore, negotiations for quarterly contracts in Japan/South Korea and China are yet to begin, with this likely to restart towards the end of March. Prices in China were unchanged at $50-55/t f.o.b. in February. The price range in Japan/South Korea was assessed flat at $10-55/t f.o.b. Separately, Glencoremanaged Pasar announced its decision to place its Leyte copper smelter site into care and maintenance due to deteriorating market conditions. This move is set to remove at least 500,000 t/a of acid from the market, with the impact likely felt by producers in Asia.

Price Indications