Sulphur 387 Mar-Apr 2020

31 March 2020

Kuwait’s sulphur boost

KUWAIT

Kuwait’s sulphur boost

Kuwait is in the middle of a major overhaul and expansion of its refining capacity, as well as boosting LPG output and sour gas processing.

Kuwait’s history in oil and gas development dates back to 1938, when oil was first discovered in the Kingdom at the Burgan oil field. Initially the Kuwait Oil Company (KOC) was owned by Anglo-Persian Oil (later to become BP), but the Kuwaiti government gradually increased its stake in the company over the decades until by 1976 it was 100% state owned. In 1960 the Kuwait Petroleum Company (KPC) was formed as a state entity to own and operate all of the various subsidiaries – the Kuwait Oil Company, which deals with exploration and production; Kuwait National Petroleum Company (KNPC), which handles oil refining, gas liquefaction and domestic fuel distribution; Kuwait Oil Tanker Company (KOTC) which manages seaborne exports; and the Petrochemical Industries Company (PIC), which manages downstream operations.

Kuwait holds around 100 billion barrels of oil reserves, about 6% of the world’s total and the seventh largest reserve in the world. This includes about 5 billion barrels in the Neutral Zone shared with Saudi Arabia. Oil production of around 2.7-3.0 million barrels per day has not changed materially in the past decade, and the country’s reserves have likewise stayed fairly constant over the past two decades. Most of the production comes from mature oil fields discovered in the 1930s and 1950s, particularly the Burgan field in the southeast of the country, which produces around 1.7 million bbl/d. Other large fields are in the north of the country, including Raudhatain (350,000 bbl/d), Sabriya (100,000 bbl/d), Ratqa and Abdali (75,000 bbl/d total).

Production from the Neutral Zone shared with Saudi Arabia was shut down in 2014-15 over a dispute over development plans for the various fields, and has not resumed since. However, the two countries began serious negotiations to end the dispute last year, and reached an agreement in December 2019. As a result, production is expected to restart soon and begin slowly ramping up through 2020, reaching 500,000 bbl/d by the end of the year, split evenly between Kuwait and Saudi Arabia.

Domestic oil consumption is relatively limited, at about 455,000 bbl/d in 2018, mostly to feed domestic refineries. The rest of Kuwait’s crude is exported, mainly to Asia.

As with oil, gas reserves have likewise remained fairly constant over the past decade at around 1.7 trillion cubic metres. Gas production was 17.5 bcm in 2018 according to BP, falling some way short of consumption of 21.8 bcm that year, and leading to Kuwait having to import natural gas as LNG. While some of Kuwait’s gas reserves is associated gas in oil fields, where the rate of exploitation is limited by Kuwait’s OPEC quotas, there are large reserves of non-associated gas in the north of the country, although these reserves are more geologically complex, in tight or sour gas deposits, and hence they have so far not seen any significant exploitation. Currently about 80% of Kuwait’s gas production comes from associated gas.

Project Kuwait

Project Kuwait was a scheme first proposed in 1997 to increase the country’s oil production capacity and its reliance on the ageing Burgan oil field. However, the project involved exploitation of the country’s northern heavy oil field, including the Jurassic field and an expansion at Ratqa, as well as additional offshore oil production, and the resulting technical challenges meant that there would be reliance upon the involvement of overseas project partners to bring the relevant technology to tackle the very sour oil and gas that would be produced. The country’s parliament was adamantly opposed to the principle of foreign ownership of Kuwait’s oil sector, and so the project has slipped and slipped.

In 2010, Shell signed an enhanced technical services agreement (ETSA) to help develop the Jurassic gas fields; but the deal was held up by parliamentary and judicial inquiries until 2016, when KPC amended the ETSA and awarded contracts to both BP and Shell.

Project Kuwait was originally to have taken oil output to 4 million bbl/d by 2020. The country’s revised strategy is now aiming to raise crude production to 4.75 million bbl/d by 2040, and natural gas production to 2.5 bcf/d (from its current 630,000 scf/d) by 2040, via the development of the Jurassic fields in the north. There are also plans to expand downstream operations, including refining and petrochemical production. The largest expansion in the refining sector is coming from the 615,000 bbl/d Al Zour refinery, as well as the Clean Fuels Project expansion of two of the existing refineries; Mina Al-Ahmadi and Mina Abdullah.

Mina Al Ahmadi

Mina Al-Ahmadi (MAA) refinery is sited 45 km to the south of Kuwait City on the Gulf coast. It was originally built in 1949 as a simple 25,000 bbl/d refinery to supply the local market. When the refinery became part of KNPC in the 1980s, two major expansion programmes increased capacity drastically to 460,000 bbl/d, via the addition of 290,000 bbl/d of crude distillation capacity, and a fluid catalytic cracker. Part of the expansion programme added sulphur recovery capacity via four units with a total capacity of 1,334 t/d of granulated sulphur.

As well as the refinery, MAA also has an LPG liquefaction plant dating back to 1978, which produces propane, butane and natural gasoline, in addition to lean gas and residues. The gas plant was built to process all associated gas/condensates collected from KOC operations. It consists of three identical trains with a total processing capacity of 1.68 billion scf/d, including 80,000 bbl/d of hydrocarbon condensate. In 2000, the acid gas removal project was implemented to treat associated sour gas from oil fields, and in 2002, in order to meet latest diesel standards, a new gasoil desulphurisation unit was added to the refinery.

Mina Abdullah refinery

Mina Abdullah, 60km south of Kuwait City, was built in 1958 by US independent oil company AMINOIL, and had an original capacity of 30,000 bbl/d. Following several expansion projects between 1962-1967 its refining capacity rose to approximately 145,000 bbl/d. Ownership was transferred to KNPC in 1978. It was modernised during the 1980s as part of the same project to revamp Mina Al Ahmadi, and capacity was increased again, to 230,000 bbl/d. The refinery was damaged during the Iraqi invasion in 1989, and after this the government took the opportunity of repairing the damage to debottleneck capacity to 270,000 bbl/d. The refinery has a delayed coker – the only one in the Gulf region, as well as naptha, diesel and kerosene hydro-treaters and a hydrocracker. There is also an offshore island for tanker loading. Sulphur recovery is 99.9% from the amine regenerator acid gas, sour water stripper overhead gas and the recycle gas from the tail gas treating unit (TGTU). The recovered molten sulphur is degassed and sent to flaking facilities located in MAA, while the tail gas is sent to the TGTU for further processing. The unit consists of three identical trains, each with a sulphur capacity of about 270 t/d. In 2004 capacity of each unit was increased to 400 t/d using oxygen enrichment.

Shuaiba refinery

There was a third refinery, at Shuaiba, 50 km south of Kuwait City, dating back to 1968. At its peak the refinery had a capacity of 200,000 bbl/d. As it was the world’s first all-hydrogen refinery, Shuaiba could process relatively high sulphur heavy crudes. This provided the facility with the flexibility to produce high quality products for export to international markets. However, while Mina Al Ahmadi and Mina Abdullah refineries had space for expansion and the addition of extra units, Shuaiba did not, and so the main refinery was closed in April 2017 as part of the Clean Fuels Project improvements – the Clean Fuels Project would instead use Shuaiba’s storage tanks and export facilities.

The Clean Fuels Project

In 2015 Kuwait began a $16 billion strategic project to expand and upgrade both the Mina Abdullah and Mina Al-Ahmadi refineries to be an integrated refining complex with a total capacity of 800,000 bbl/d (up from the previous combined total of 730,000 bbl/d) by increasing MAA output to 346,000 bbl/d and Mina Abdullah to 546,000 bbl/d. The project will also increase the output of products meeting Euro-5 quality standards (10 ppm sulphur) and enhance operating efficiency. The initial schedule envisaged completion in late 2017, but the project has faced delays – heavy rain in November 2018 flooded the refinery and caused damage to an area under the public road, for example. Some units came on-stream during 2019, but at the end of last year lead contractor JGC from Japan said that full project completion would now be towards the end of 2020.

Al Zour refinery

In addition to the Clean Fuels Project, Kuwait is significantly expanding its refining capacity via the construction of a new grassroots facility at Al Zour. The Al-Zour refinery will process up to 650,000 bbl/d of heavy and igh sulphur Kuwait crudes to produce high value products and fuel oil, and includes a hydroskimming facility which can be upgrade to a full conversion refinery. Sulphur recovery will by 99.9% via six SRU trains, with a total sulphur capacity of 600,000 t/a.

Fifth gas train

The gas processing facilities at Mina Al Ahmadi are also being expanded to cope with an anticipated increase in non-associated gas from the Jurassic and Dorra gas fields, as well as feeds from KNPC refineries. The methane will be fed to power stations, propane and butane sent for domestic use, and ethane will go to olefins production. Propane, butane and pentane will also be exported. Overall the fifth gas train will produce 805 million scf/d of sales gas and 106,000 bbl/d of condensate, taking total gas processing capacity at the site to 3.2 billion scf/d. The $1.4 billion project was mechanically completed in July 2019, with trial production beginning in late 2019 and full operation expected by Q1 2020.

Upgraded sulphur facility

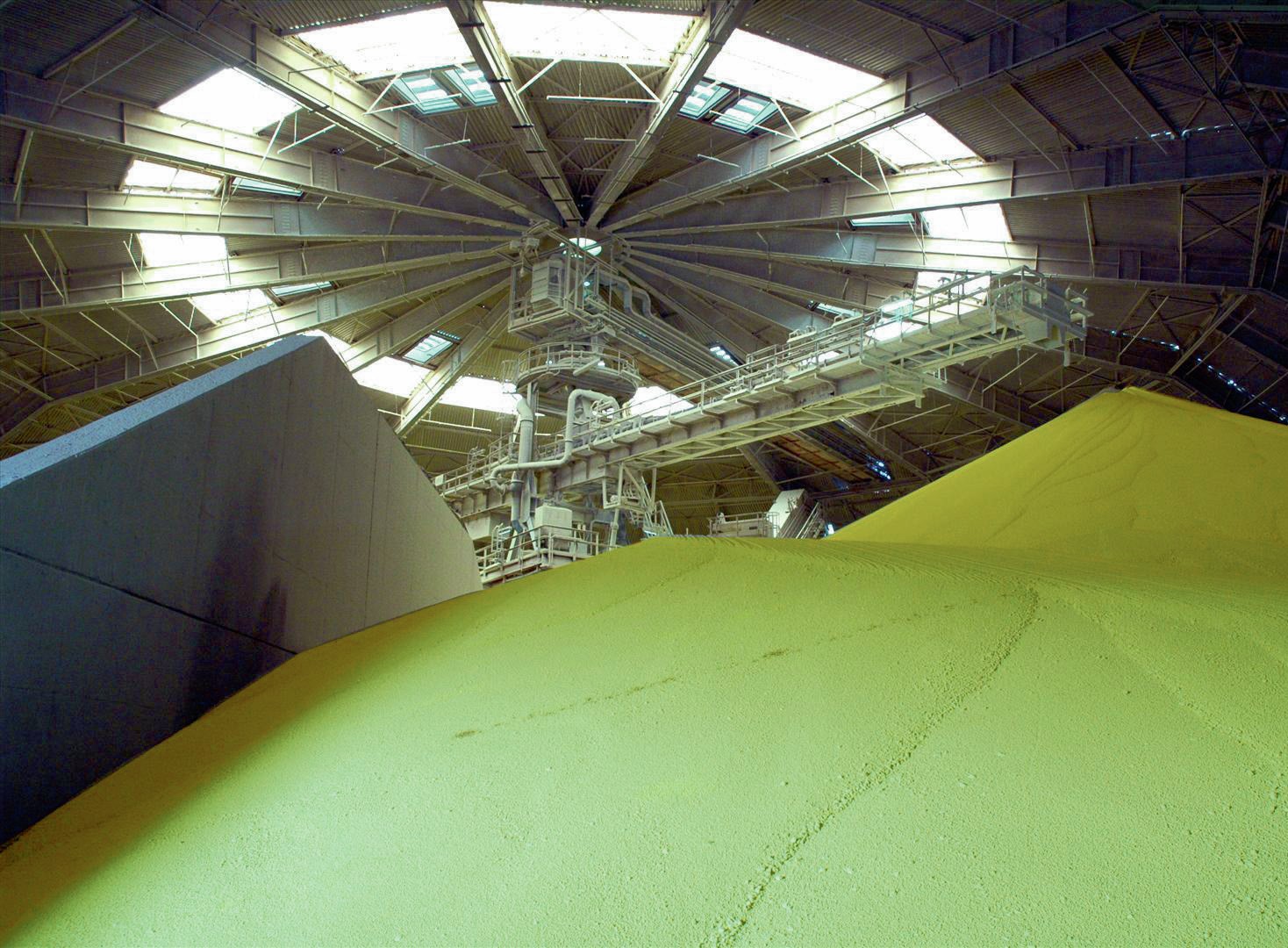

The expanded gas processing capacity at Mina Al Ahmadi has also necessitated an upgrade to the sulphur processing facility at the site. The upgrade includes boosting ship loading capacity to 1,500 t/h and the addition of a new pier giving the facility the ability to handle larger vessels up to 60,000 dwt, as well as additional liquid sulphur storage tanks and solidification units. The first phase of the upgrade project was completed at the end of 2017, with final completion in late 2019. Liquid sulphur storage has been increased by 19,000 tonnes in four tanks, and there are now five sulphur granulation units with a total capacity of 5,000 t/d. There is also 145,000 tonnes of covered solid sulphur storage capacity.

Kuwait’s sulphur output

At present Kuwait produces around 750,000 t/a of sulphur. However, this is set to rise to 2.5 million t/a with the addition of the 600,000 t/a from the Al Zour refinery, and 1.2 million t/a from Mina Al Ahmadi and Mina Abdullah, including the Clean Fuels Project and fifth gas train. The current timeline for these will see the Clean Fuels Project complete by the end of 2020 and a start-up for the Al Zour refinery in mid-2021. This would see Kuwait producing 2.5 million t/a of sulphur by 2022. With little local demand, most of this will be available for export. According to KPC, one of the consequences of this has been a move by Kuwait to monthly sulphur pricing, following in the wake of ADNOC in Abu Dhabi and Muntajat in Qatar. KPC argued at the Sulphur conference in November 2019 that quarterly sulphur pricing involves too great a time lag in the more volatile sulphur market that we are currently seeing.

Kuwait’s additional sulphur production forms part of a more general increase in output from the Middle East from 2019-2024, which will add 5.5 million t/a of sulphur production capacity, including additional LNG processing in Qatar via the Barzan project, more output from Iran’s South Pars gas field, and refineries and gas plants in Saudi Arabia, as well as additional sour gas production in the UAE. All told, Middle Eastern sulphur production may reach 22.5 million t/a by 2024, representing over 40% of growth in sulphur output over that period.