Nitrogen+Syngas 364 Mar-Apr 2020

31 March 2020

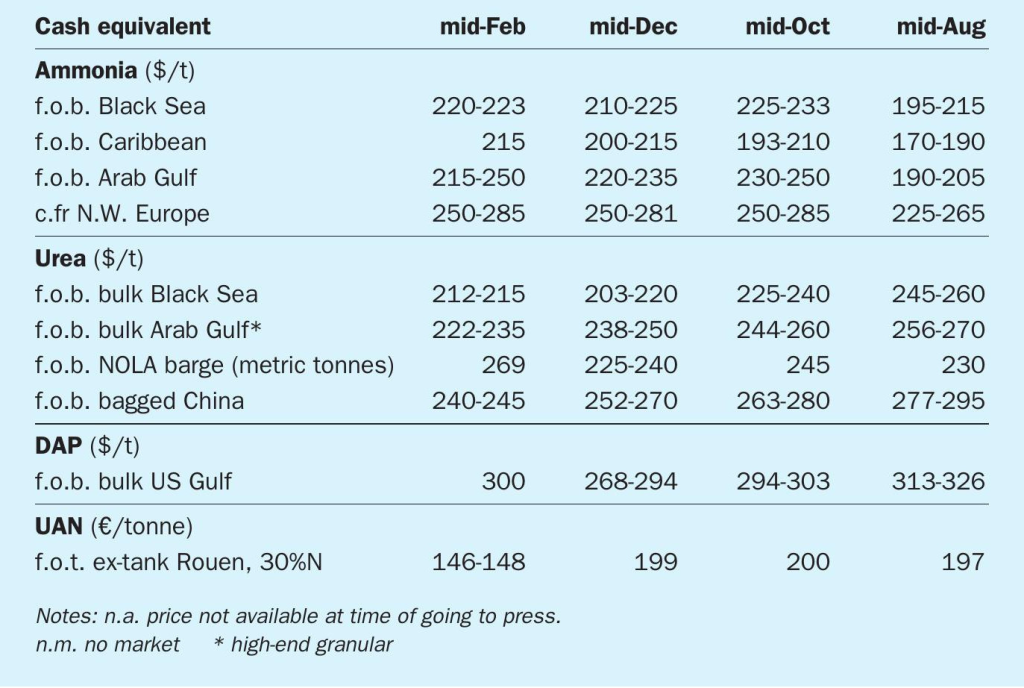

Price trends

Price trends

MARKET INSIGHT

Alistair Wallace, Head of Fertilizer Research, Argus Media, assesses price trends and the market outlook for nitrogen.

NITROGEN

The ammonia market was dominated by effects of the coronavirus epidemic outbreak during February. Chinese imports for the month fell by 30-40 per cent over volumes seen in January. Yushny f.o.b. ammonia prices remain in the low$220s/t, with suppliers mainly just covering contracts. The contract price between Yara and its suppliers in the Baltic was agreed at similar levels to January at around $218-220/t f.o.b. There is limited spot demand in Europe to raise prices. Overall, prices were steady in the west of Suez market, but starting to come under pressure in eastern markets, where c.fr rates have been higher.

Weak demand from China as a result of the coronavirus outbreak will likely continue in March, and this is weighing heavily upon Asian delivered prices. Middle East supply is lengthening, but production remains offline in Australia, where Yara’s Pilbara fertilizer plant on the Burrup Peninsula has been shut down since mid-November after seawater damage to a cooling tower, and was not expected to be back online for some weeks.

West of Suez, the ammonia market is more balanced, with the US and Europe moving into their regular annual seasonal demand peaks. Overall the second quarter of 2020 looks balanced in terms of supply and demand, but it is to be expected that prices will firm seasonally in the third quarter.

On the urea side, prices rose in February as heavy buying for the US and trader positioning saw most producers sell out early for March. Reduced export availability from China due to concerns over the coronavirus and the associated impact on production also contributed substantially to the price hike. The US almost single-handedly pulled up prices when NOLA prices rose by nearly $40/t to $270/t c.fr. Almost 500,000 tonnes of urea were bought.

With producers heavily committed for March and traders attempting to push up prices before selling long positions, the overall urea market is projected to remain firm during March. Chinese export supply is predicted to remain very low throughout the months of March and April, after the government asked domestic producers to focus on meeting internal fertilizer supply needs in order to mitigate the impact of the coronavirus outbreak. However, Argus believes that much of any increase in global prices has already taken place, and that March will see a slower rate of gain in urea pricing.

END OF MONTH SPOT PRICES

natural gas

ammonia

urea

diammonium phosphate