Fertilizer International 499 Nov-Dec 2020

30 November 2020

Latin America, a regional powerhouse

REGIONAL REPORT

Latin America, a regional powerhouse

Latin America has confirmed its status as a pre-eminent global marketplace for fertilizers. We report on demand growth and fertilizer supply and capacity developments within this diverse region.

Latin America is a diverse, vibrant region of 19 countries with around 500 million people. But at times in recent years it has struggled economically, politically and socially – with the risk of the 2010s becoming another lost decade like the 1980s1 . In particular:

- GDP growth has slowed and lags behind levels seen in other regions

- Weak public services, security and infrastructure have provoked social discontent

- Politics has been in flux across region with 15 presidential elections taking place in 2018 and 2019 alone

- Populist regimes have emerged in the three biggest regional economies – Argentina, Brazil, Mexico

- Venezuela’s crisis and economic collapse has resulted in poverty, violence and mass migration

- Price rises – for transport in Chile and fuel in Ecuador – have sparked civil unrest

- Corruption continues to be a problem – the Odebrecht construction scandal in Brazil being a prime example.

Despite the turmoil and wider doubts, one bright spot remains the region’s significant agricultural potential. Latin America generates 84 percent of global food and agricultural commodity exports, while consuming just four percent of corresponding global imports.

Agriculture on this scale has created a massive fertilizer import market. The region imports more than 35 million tonnes of fertilizers annually, two-thirds being destined for Brazil alone, making this one country the main driver of Latin American fertilizer demand1 . This import reliance is likely to continue, given that Latin America consumes 13 percent of global fertilizer output, while only possessing just five percent of global production capacity.

Fertilizer demand in central and south American countries continues to grow strongly. Latin America is one of only three regions globally where fertilizer demand grew above the world average between 2011-2017, according to the International Fertilizer Association (IFA). It also one of the few remaining global regions where agriculture is still able to expand onto large tracts of unexploited land. There is also plenty of scope for improving Latin American crop yields. The region’s relative abundance in raw materials – natural gas, phosphate rock and potash – also supports fertilizer production growth (Figure 1).

All these factors combined provide plenty of potential for increased fertilizer consumption.

Although global fertilizer demand growth generally slowed after the financial crisis of more than a decade ago, Latin American demand has consistently outperformed the global average and is substantial across all three major nutrients. Regional fertilizer demand grew at an average annual rate of 5.3 percent between 2000-2007, for example, and at 4.8 percent between 20102019. That corresponds to world averages of 2.8 percent and 1.4 percent, respectively, over the same two time periods2 .

Latin American urea demand – 13.4 million tonnes in 2019 – is relatively modest by global standards, placing the region behind China, India and North America. Although Latin America possesses 8.2 million tonnes of urea capacity, its current output capabilities only extend to five million tonnes annually. This means the region is import reliant for urea (84 percent), even though its natural gas reserves are relatively abundant2 .

Latin America consumes phosphate fertilizers at scale and is a major monoammonium phosphate (MAP) market (3.3 million tonnes P2 O5 ). This demand is, again, mostly met by imports (83 percent), despite the availability of large phosphate rock reserves regionally. Brazil and Argentina are the second and seventh largest import destinations for phosphate fertilizers globally, importing 4.5 million tonnes and 0.9 million tonnes, respectively, on a product basis in 2018.

Latin America is a leading potash (KCl, muriate of potash, MOP) consuming region too (14 million tonnes) with nearly all its MOP requirements (92 percent) imported. Brazil is the main destination for six of the top 10 exporting countries, importing a total of 10.5 million tonnes of MOP in 2018.

Modest nitrogen demand

Latin American urea demand is expected to grow modestly over the next five years. Regional demand is generally capped by Latin America’s less nitrogen-intensive crop mix. It has also been swayed by shifts in national policy and domestic tax regimes.

Extra urea consumption out to 2025 is expected to be relatively modest (2.3 million t/a), with two countries, Brazil and Argentina, being responsible for less than one million t/a of incremental demand.

Latin America remains an attractive urea export destination though. Brazil, in particular, remains at the frontline of global supply and price battles. The region’s import supply is also experiencing a marked shift toward African dominance.

“Nigeria is the ‘elephant in the room’ with huge urea capacity additions in the coming years to further disrupt current supply patterns and increase competition for Brazilian market share,” commented Argus at the 2020 Fertilizer Latino Americano conference last January. This surplus African urea capacity could weigh on way market all the through to 2024, according to Argus1 .

Nitrogen production vulnerable

Natural gas costs are the primary cost driver across the nitrogen industry, accounting for 90 percent and 70 percent, respectively, of ammonia and urea production costs. Significantly, Latin American gas costs are higher than some of the major urea exporters, so affecting their competitiveness2 .

Nevertheless, there is still headroom to develop and expand regional urea capacity, especially in Colombia, Mexico and Brazil where demand far outstrips domestic supply. Yet, even as demand is set to further increase, prospects for a corresponding growth in domestic production remain weak, with CRU, for example, not expecting the commissioning of any new regional nitrogen projects by 20242 .

Trinidad & Tobago is the region’s nitrogen production powerhouse, with an output of 5.3 million tonnes versus production capacity of 5.7 million tonnes in 2019. Caribbean producers benefit from good governance and low costs, by regional standards, while facing declining gas reserves2 . Despite such advantages, cost and supply pressures have seen both Nutrien and Yara substantially curtail Trinidadian ammonia production during 2020.

Brazil produced 0.9 million tonnes of urea in 2019, a fraction of its 1.7 million tonne potential capacity. High costs have led Petrobras to idle its nitrogen plants, driving up Brazilian imports2 . The state-owned oil company is mothballing Araucaria, its only operational urea plant, and trying to sell its partially constructed 1.1 million t/a capacity Tres Lagoas project in Mato Grosso du Sul state. This was originally designed to use gas supplied from Bolivia via the Gasbol pipeline. The Petrobras-owned Laranjeiras and Camacari nitrogen production sites have been idle since 2019. Both sites are leased to Proquigel Quimica. Rescue talks with Acron to takeover Petrobras’ nitrogen production assets collapsed in early December 2019.

Low operating rates have affected production elsewhere in the region. In Bolivia, YPFB’s 700,000 t/a BuloBulo urea plant operated at low rates in 2019 due to gas pipeline issues and political unrest. Some 80 percent of its output is targeted at neighbouring Brazil. Pequiven’s urea production in troubled Venezuela, meanwhile, dropped to 250,000 tonnes in 2019, an operating rate of just eight percent.

Mexico imports 1.7 million tonnes of urea annually while its domestic production capacity – the dual train one million t/a capacity Pemex Pajaritos urea plant in Veracruz on the Pacific coast – remains largely dormant. Resumption of urea production at Veracruz remains a long shot, according to Argus1 .

Mexico’s faltering gas production has been a particular issue, having fallen by almost one-third since 2014. Gas volumes produced by Pemex have deteriorated from 4 bcf/d to 2.8 bcf/d in recent years. The new 2.6 Bcf/d Sur de Texas-Tuxpan offshore gas pipeline from the US, launched in September 2019, is also operating well below capacity because of a lack of interconnections1 .

Phosphates on a rising trajectory

Latin America’s finished phosphate production capacity current stands at 2.9 million t/a – and is forecast to climb by almost one million t/a by 2033. This means the region will remain in significant supply deficit over the forthcoming decade1 .

Yara’s almost completed Serra do Salitre operation – an integrated phosphates project in Minas Gerais – will add significantly to Brazilian production capacity. The project is on-course to deliver annual production output of 1.2 million tonnes of phosphate ore and 1.5 million tonnes of finished phosphates by 2021. Its product mix will include diammonium phosphate (DAP), monoammonium phosphate (MAP), nitrophosphate (NP), single superphosphate (SSP) and triple superphosphate (TSP) (Fertilizer International 488, p45). CMOC is also expected to ramp-up its MAP/TSP capacity at Catalao by 0.5 million t/a by 20221 .

Yet Brazil’s domestic producers are still not capturing growth in phosphate consumption, according to CRU2 , as domestic production has largely flatlined. Brazilian MAP production (10-19-0) has actually decreased 0.9 percent since 2010, for example, while imports have risen on average by 8-9 percent annually. MAP remains a key raw material for fertilizer blends with Saudi Arabia, Russia, Morocco and the US competing for market share.

Brazilian producers do have one key advantage, though – logistics. Major agricultural regions are located far inland, with Mato Grosso driving most of the country’s fertilizer demand. This state is around 1,500 kilometres away from the Atlantic ports of Santos and Paranagua. Imported phosphates from Morocco, Russia and the US therefore need to travel long distances from their port of arrival. Domestic plants, in contrast, are much closer to premium agricultural markets and do not incur shipping or port fees. Queuing at ports can be a major problem in Brazil, due to strike action or a lack of berths or storage2 .

Elsewhere in Latin America, Pequiven’s 450,000 t/a capacity Moron plant in Venezuela is said to be producing DAP/NPKs at very low operating rates. In Peru, Mosaic is unlikely to pursue further expansions in phosphate rock mining capacity at Bayovar, according to Argus1 .

Generally, there is more than enough regional phosphate rock supply to meet current demand levels, according to CRU1 . Mexico, however, does not have enough rock capacity and has become increasingly reliant on Moroccan imports. Mexico’s total phosphate rock imports have risen over the last five years, from around 0.8 million tonnes in 2014 to 1.7 million tonnes in 2019.

Summing up the state of the phosphates market at the 2020 Fertilizer Latino Americano conference last January1 , Argus said: “Issues of cost-competitiveness have dominated the market and 2020 prices will still be under pressure. The US is losing export share into Latin America, a region which remains on a trajectory for heavy increases in MAP and NPS consumption.”

Potash – expect increased competition

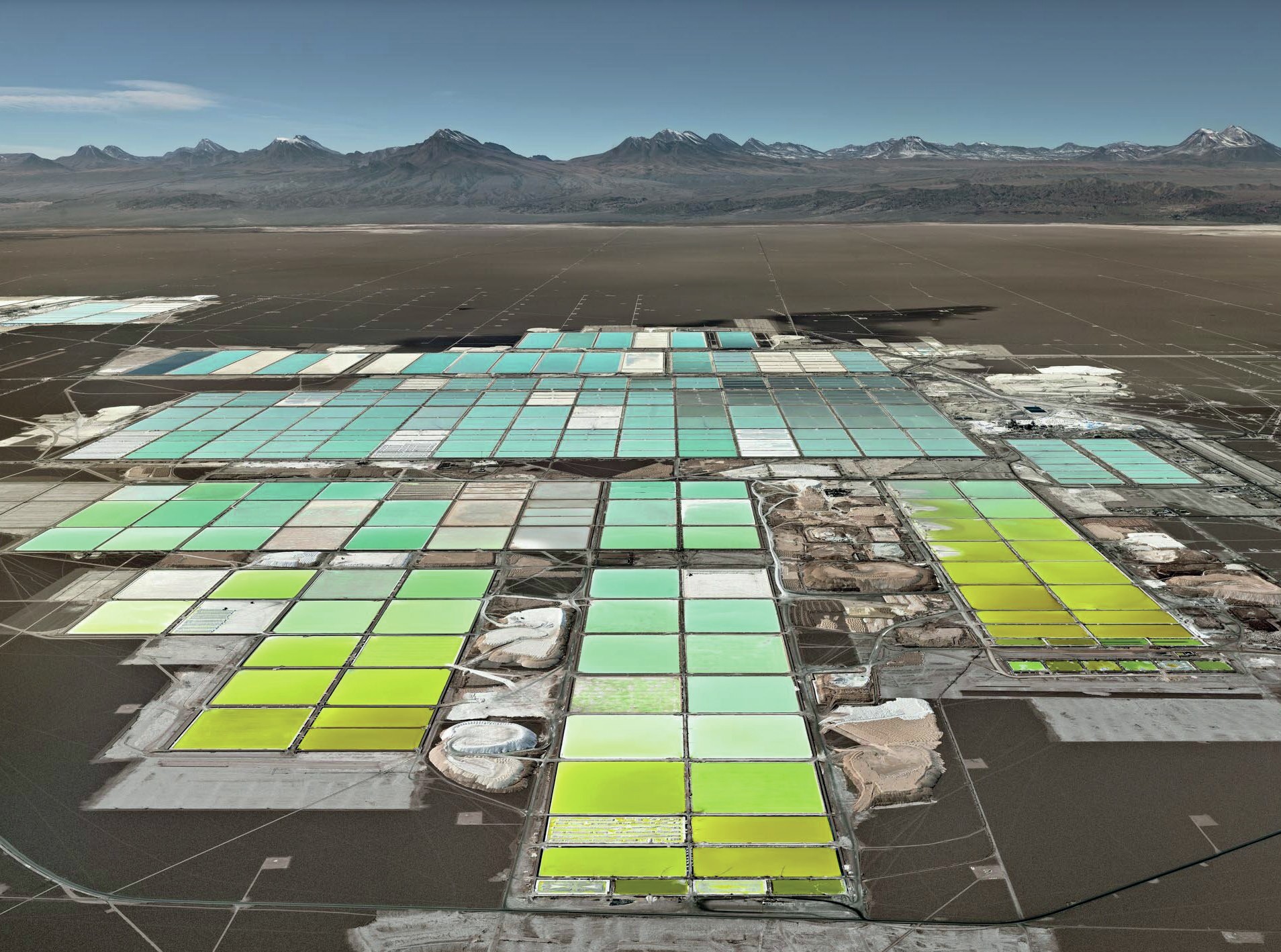

Latin America, Brazil in particular, is one of the world’s major markets for potash. Yet only a fraction of this strong demand is met by locally sourced supply. While the region possesses great potash reserves in desert salt flats, these only contribute a small portion to global capacity2 .

Chile is Latin America’s main potash producer. SQM’s Atacama operations (2.3 million tonnes nameplate capacity) produced about one million tonnes of MOP in 2019. Output is primarily used as a raw material for local NOP (potassium nitrate) production or else consumed domestically. Chile does, however, export product to Brazil via truck over the Andes. State owned Comibol in Uruguay is the second largest regional potash producer. Its Unuyi production site (400,000 tonnes nameplate capacity) produced 200,000 tonnes of potash in 2019. In Brazil, Mosaic Fertilizantes operates the Taquari MOP production plant (300,000 tonnes nameplate capacity). This, however, only produced 100,000 tonnes of product in 2019 and is scheduled to close in 20232 .

Argus is confident about future growth prospects for potash in Latin America1 : “With robust fundamentals and a crop mix particularly supportive of potash consumption, the Latin American region will boast the most significant MOP demand growth over the coming decade.”

EuroChem’s two large-scale Russian potash projects, Usolskiy and VolgaKaliy, began supplying Brazil for the first time in 2019. Both projects combined were expected to place around 1.2 million tonnes of potash on the market in 2020. K+S Canada’s Bethune potash mine also ramped-up its supply to Brazil in 2019, and is projected to supply the market with 2.2 million tonnes of potash in 20201 . Potash supply to Brazil from these new entrants is, unsurprisingly, resulting in much more import competition.

Within the region, SQM was expected to raise its MOP output in 2020 due to ‘dismal’ lithium pricing. Bolivia’s 350,000 t/a capacity CAMC plant, commissioned in 2019, had not fully ramped-up as 2020 began.

Summing up – grounds for optimism?

CRU offered the following key takeaways at the 2020 Fertilizer Latino Americano Conference in January2 :

- Latin America, overall, has great demand prospects across all three nutrients

- There is room for more regional nitrogen fertilizer capacity – subject to gas prices

- Good regional phosphate rock reserves support local production – but do face import competition

- Potash extraction from salt lake deposits continues – although lithium recovery has taken priority and disrupted potash production

- NPK/NP demand and domestic production are on the rise – yet imports still predominate.

Delegates at Argus/CRU’s January 2021 virtual conference will no doubt keenly await a detailed update on the state of play in various Latin American fertilizer markets. Some positive signs have emerged in recent months.

Brazil’s demand for fertilizer could reach 37 million tonnes in 2020, according to a spring assessment by Rabobank, compared to demand of 36 million tonnes the previous year. The latest figures from ANDA also show that January-April fertilizer consumption in Brazil rose by 18 percent year-on-year to 12.7 million tonnes in 2020, up from 10.7 million tonnes in 2019. Brazil’s 2019/20 grains and oilseeds harvest also reached a record 258 million tonnes, as total acreage increased and yields performed well. This was despite partly unfavourable weather conditions during the year.

In neighbouring Argentina, Argus reported a rise in DAP/MAP shipments to 908,000 tonnes in January-August 2020, up from 755,000 tonnes a year earlier. Scheduled arrivals for September of 143,000 tonnes were nevertheless slightly down on the 188,000 tonnes delivered in the same month in 2019.

Moroccan phosphate product made up the biggest slice of these January-August shipments – 399,000 tonnes – with OCP increasing its market share to 44 percent in 2020, up five percentage points yearon-year. DAP/MAP deliveries from the US over this period, some 253,000 tonnes, were also up significantly on the 162,000 tonnes shipped in 2019. Chinese and Russian DAP/MAP producers, meanwhile, contributed 114,000 tonnes and 45,000 tonnes, respectively.

Previous phosphate suppliers have also re-emerged. Tunisian producer GCT, for example, dispatched a 33,000 tonne DAP/ MAP cargo to Argentina in July, according to Argus, the first such shipment since 2013. Mexican phosphates were also unloaded in Argentina in August, the first time this has happened since 2018.

References