Sulphur 391 Nov-Dec 2020

30 November 2020

Long term trends in oil and gas production

OIL AND GAS

Long term trends in oil and gas production

Demand for oil in developed countries was already falling before the coronavirus outbreak, and consumption growth is slowing in the developing world. Peak oil demand may arrive in the next decade. Coupled with more reinjection of sour gas rather than sulphur extraction, could we be seeing falling elemental sulphur production in a decade or so?

While the spread of the Covid virus has been a major public health crisis for all countries of the world, its economic effects are likely to be felt long beyond the time when the virus is – hopefully – brought under control. The effects on refinery production have already been profound, and they are likely to be part of a larger pattern of long term change in the oil and gas industries which could significantly affect the supply of sulphur in the medium and longer term.

Sulphur production is dependent primarily on recovery from crude oil at refineries, and from sour gas at processing plants. As involuntary production, sulphur supply is thus effectively dependent on global demand for refined products from refiners, and the need for natural gas, mainly for power generation. Oil demand has been falling in OECD countries for some time, due to ageing populations and greater fuel economy in vehicles, but now environmental and other factors may also bring first a plateau and then a decline in demand in developing countries, leading to the time of ‘peak oil demand’.

Medium term – the pandemic

The Covid-19 pandemic has, in the words of the International Energy Agency’s 2020 World Energy Outlook, “caused more disruption to the energy sector than any other event in recent history, leaving impacts that will be felt for years to come.” Global energy demand will be down by about 5% on 2019, and global oil consumption down an unprecedented 9.5%.

The oil market has had its third price shock in 12 years, after the global financial crisis of 2008, and the price crash of 2014, the latter driven by a slowing Chinese economy, rising shale-based production and a higher dollar exchange rate. But while there was a sharp downward correction in both cases, followed by a steady recovery, the lingering effects of Covid, including a second wave of infections across Europe, continue to make the recovery from this shock much more uncertain. Oil prices fell from $70/bbl in January to less than $20/bbl in April, and in spite of some recovery to $45/bbl over the summer, they are finishing the year heading back down around $35/bbl.

The questions for the medium term are firstly, how long will it take for the virus outbreak to finally be brought under some kind of control, and then, what will the lingering effects on our collective behaviour be? Will people return to flying as much as they did before the pandemic, or have we all got used to doing business over videoconferencing? Last year the IEA was predicting that aviation fuel demand would grow by 1% per annum over the next five years, much faster than gasoline demand, which would be virtually flat. Now however, the International Air Transport Association estimates that traffic will remain 30-40% down on pre-Covid levels even if there is a vaccine. On the other hand, growth in home deliveries and a decline in use of public transport and more personal car use will balance this to at least some extent.

Overall, OPEC predicts that world oil demand will recover next year to 96.8 million bbl/d for the full year, still 3 million bbl/d down on the start of 2020, but prolonged Covid restrictions and delays in development or distribution of any vaccine could depress this further. Prior to the pandemic, the International Energy Agency had been predicting that global oil demand would grow by an average of 1 million bbl/d per year out to 2025, at which time it would start to plateau. Wood Mackenzie’s most recent analysis suggests that 1 million bbl/d of demand could have been lost permanently, leading to consumption in 2025 still being 1 million bbl/d down on its level in 2019. A Covid-induced recession and the contraction in demand could see that gap being even larger.

Excess supply

One issue that this creates for the global oil industry is that there is too much supply – this was true b efore the pandemic and the outbreak has merely worsened matters. Part of the issue has been a breakdown in OPEC discipline, caused by the cartel having a falling share of world oil supply. This in turn has been driven by output increases in Russia, and especially the US, where shale oil has added about half of all new global oil supply over the past decade. OPEC has cut its oil and natural gas liquids production by 5.2 million bbl/d since 2016, but shale production has added 7.7 million bbl/d over the same period.

This year’s contraction in demand has seen a corresponding response from OPEC, US shale production has also fallen. US crude output dropped from 12.7 million bbl/d in March 2020 to 10.1 million bbl/d in May, and at time of writing had recovered only to 10.5 million bbl/d. Shale oil output may decline in this new lower oil price environment – the shale oil sector has struggled to turn a profit, and with several years of lower oil prices potentially on the way, investors may be wary of committing themselves. However, it means that there is still plenty of potential supply out there, OPEC and non-OPEC, which could be brought back onstream quickly if oil prices increased. The oil industry cost curve is much flatter now than it was a few years ago, so relatively low oil prices may be with us for some years to come.

Decarbonisation

In the longer term, the main threat to fossil fuel use is the so-called ‘decarbonisation’ of the energy business, as governments push towards greater use of renewable fuels. While in the past renewables often relied on government subsidies to compete with oil and gas, one of the more remarkable developments of the past few years has been the dramatic fall in costs of solar and wind-based electricity generation. International Energy Agency data shows that renewables, including wind, solar and hydropower, accounted for about a quarter of the electricity produced in countries in the Organisation of Economic Co-operation and Development last year. The IEA says that it expects renewables meet to meet 80% of the growth in global electricity demand out to 2030. Hydropower remains the largest renewable source of electricity, but solar is the main driver of growth, and the IEA forecasts that it will set new records for deployment each year after 2022, followed by onshore and offshore wind.

Some major oil companies have already decided that they are going to gradually ease themselves out of the business. Fears over the future of the oil market has halved BP’s share price over the past two years, and in August, BP published ambitious plans reach 50 gigawatts of renewable energy such as wind, solar and hydropower in its portfolio by 2030, up from just 2.5 GW now. The company also said that at the same time it would cut its oil and gas output by 40% over the decade. Eni in Italy has also committed to cut its oil production over the coming decade, though not by as much. In April Shell announced plans to become a net zero carbon emission energy business by 2050.

These targets are similar to some national targets which have been announced. The European Union is aiming to become ‘carbon neutral’ by 2050. Former vice president Biden has said that if elected he would institute a similar target for the US. China has set 2060 as its own target date. All of this is going to require a major shift in power generation capacity away from coal and, eventually, natural gas.

At the moment, renewable energy does not provide the return on investment that oil can. Large oil firms generally target a return on oil investments of about 15%, while BP said it expects returns of 8% to 10% from its low-carbon electricity investments. However, that gap is continuing to close, and in today’s lower oil price market, and with renewable costs falling, that could reverse over the decade. Furthermore, renewables projects can provide more stable revenue streams via long term contracts and remove some of the exposure to the volatility of the oil market, as well as its uncertain geopolitics, such as sanctions and price wars. US sanctions have effectively taken Venezuelan and Iranian crude off the market.

Electric vehicles

For the oil and refining industry, a potentially even greater threat to long term demand comes from a switch to electric vehicles. In 2010 there were an estimated 17,000 electric vehicles around the world. In 2019 there were over 7 million, half of them in China. Although Covid has seen total vehicle use decline by 15% this year, vehicle use is continuing to increase. Moreover, the share of electric vehicles continues to rise rapidly. The IEA now predicts that by 2030 there will be between 140 million and 250 million electric vehicles in service, representing between 7-13% of all vehicles on the road, and reaching up to a 30% market share in some sectors. This will displace an estimated 2.5-4.0 million bbl/d of oil demand. Of course, an electric vehicle needs electrical power to charge it, so that increase will also increase global power demand, by 5001,000 terawatt hours (TWh).

Refinery sulphur

So what does all of this mean for refinery sulphur output? Refineries have been progressively increasing their sulphur output as regulations on sulphur content of fuels continue to tighten, and as refiners adapt to be able to utilise sourer (and hence often cheaper) grades of crude oil. It is hard to see much more sulphur coming from tightening road vehicle fuel regulations – most countries now permit only 50 ppm of sulphur in diesel and gasoline, and all of the developed world, including Russia and China, are down to a 10 or 15 ppm standard. The last major increase has come from the reduction in permitted sulphur content of marine fuels from 3.5% to 0.5% as part of the 2020 IMO regulations. There is still no agreed standard on sulphur content of aviation fuels, so that could still boost sulphur output, but by and large refinery sulphur output is now correlated closely with demand for refined products.

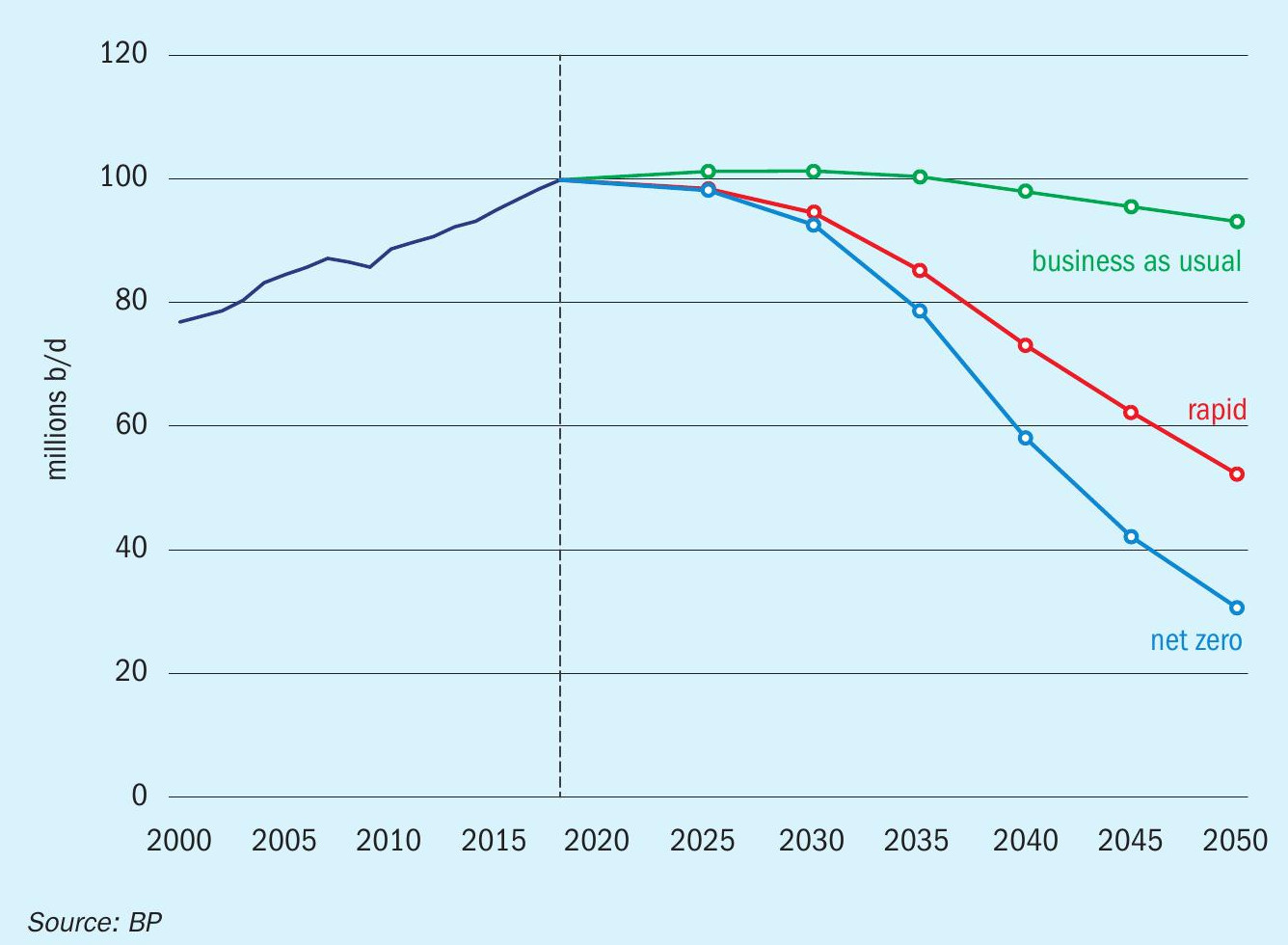

The IEA’s most recent World Energy Outlook sees global oil demand still increasing over the next decade, but not returning to the level seen in 2019 until 2023-27, depending on the scenario. However, it also acknowledges that if countries are serious about their net zero carbon targets, oil demand could peak more quickly and fall faster than in its guideline scenarios. It posits that a ‘sustainable development scenario’ would see the current recovery in demand plateau about 4 million bbl/d down on 2019 in around 2023, and thereafter start to gradually fall. BP’s projections (see Figure 1) posit a peak at 2030 even under ‘business as usual’ conditions, and a potentially more rapid fall.

On the other hand, upward pressure on liquids demand could come from rising use as a feedstock in the petrochemical sector. Despite an anticipated rise in recycling rates, there is still plenty of scope for demand for plastics to rise, especially in developing economies. At present these are primarily sourced from natural gas liquids (NGLs) and would not necessarily pass through the refining sector, but the refineries of the future may diversify into other feedstocks and business areas, increasing their petrochemicals production, and perhaps taking in chemical recycling, biofuels production, or hydrogen production, as a way of securing new revenue sources.

Overall, while some refineries, especially in Asia and the Middle East, are still installing new coking and hydroprocessing and hydrodesulphurisation capacity, the increase in sulphur production from refineries, especially as global oil demand plateaus over the coming decade, may be relatively small. This year has seen a significant fall in refinery sulphur output as oil demand has been down. USGS figures show that US refineries produced 6% less sulphur in 2020 (4.29 million tonnes) compared to 2019 for the seven months to July.

Sour gas

On the face of it the future for natural gas is potentially brighter than for oil. As noted above, the world will need more electricity over the coming years, with demand rising from 28 TWh today to 32-34 TWh by 2030, according to the IEA. And, while much of new generation capacity will come from renewables, natural gas will replace falling coal-based generation as a lower carbon (and lower SO2 and other pollutants) option. Natural gas demand for power production is forecast to rise by 15-30% over the next decade, with South and East Asia responsible for most of this. The IEA does not think that demand for gas will peak until the late 2030s, as electrification of heating and development of renewables erode long-term demand.

As with oil, the coronavirus pandemic has had an impact on gas demand, which has fallen by an estimated 5-10%, although it will recover much faster than oil. However, the liquefied natural gas (LNG) market, via which most gas is transported between regions, was oversupplied before Covid, and hence is even more oversupplied now. Prices are low, and abundant US shale gas production has generated large volumes of gas with a break-even cost lower than $2.50-3.00/MMBtu. With North America becoming one of the largest LNG exporters by the early 2020s, regional gas prices in Europe and Asia will be driven by prices at Henry Hub, plus cash costs for transportation and liquefaction (a premium of about $1/MMBtu to $2/MMBtu).

Sour gas production tends to be more expensive than sweet gas, because it must factor in the cost of processing and recovering H2 S and CO2 from the gas stream. This single fact has been the main reason for the decline in production of sour gas in North America and Europe, as it is undercut, in the US case by cheaper shale gas, and in Europe by imports from Russia, Norway, Algeria and increasingly now by cheap LNG. The regions that have become major producers of sour gas – China, the Middle East, and Central Asia – have done so for reasons particular to those regions; in China and the Middle East to boost domestic gas production where no sweet alternatives are available, and in the Middle East and Central Asia to process gas associated with oil deposits.

There are still major sour gas projects under development, especially in Central Asia and the Middle East. However, an era of low gas prices has placed question marks over some of those projects, at the very least in terms of timing. Where gas is associated, new projects are increasingly looking at reinjection of acid gas after it is separated from sales gas, in order to maintain reservoir pressures, such as at the Tengiz Future Growth Project in Kazakhstan.

There are major sulphur-producing sour gas projects still on the horizon. Abu Dhabi is looking to expand production at the Shah complex by 50% in a few years’ time, adding 1.7 million t/a of sulphur, and the commissioning of the Barzan gas project in Qatar this November will add 800,000 t/a more sulphur output at capacity. Further LNG expansions in Qatar are also slated, although the current glut in the market may push their timescales back. There are also more prospects for Central Asia, including the Galkynysh field in Turkmenistan. However, many of the big sour gas projects are now operational, and the current investment environment may mean new ones only proceed slowly.

Sulphur demand

Set against slowing growth in sulphur output, what of the future of sulphur demand? Sulphur is mainly (>90%) used for sulphuric acid production, and that is primarily used in the treatment of rock to recover mineral salts. Most goes into phosphate recovery for fertilizer production, but an increasing amount is also used for recovery of copper, nickel, uranium and other minerals. The rest of the sulphuric acid goes to a variety of different industrial processes, from titanium dioxide to caprolactam production. None of these are showing any signs of slowing down – phosphate production is continuing to increase, particularly in North Africa, the Middle East, Russia and India, averaging about 1.5% year on year growth. Acid demand for industrial uses continues to increase steadily. And the need to produce batteries for electric vehicles has led to a spurt in demand for acid to process nickel laterite ores into nickel sulphate.

Sulphur balance

With sulphur production from oil likely to peak or at least plateau in the next few years, and a slowing increase from sour gas projects, set against continuing rising demand for sulphuric acid, this may mean a sea change in the sulphur industry a decade or so down the line. Continued strong demand for sulphur, tight availability and rising prices will no doubt initially be met by the melting down of existing sulphur stockpiles. The plethora of forming projects that are being announced in Alberta may be a harbinger of that. However, even the 8 million tonnes of sulphur at Syncrude may only represent sufficient supply for a few years of deficit, after which conditions may become more difficult.

At the 2018 Sulphur Conference in Gothenburg, Sweden, Peter Clark, former director of Alberta Sulphur Research Ltd, took a look at the much longer term future, out to 2050, and suggested that higher prices for sulphur could change the economics of sour gas production; with sulphur as a co-product rather than a by-product, it might spur some sour gas developments that otherwise might have struggled to find financing. Likewise there is the potential, in a high sulphur price environment, for a return to Frasch mining, largely abandoned since the 1990s, and switch back from acid gas reinjection to sulphur recovery. Some substitution may also be possible – using nitric acid produced from ammonia instead, for example, in some processes. However, it seems increasingly likely that the times of sulphur surplus may soon be behind us for good.