Sulphur 393 Mar-Apr 2021

31 March 2021

The changing nickel market

NICKEL SULPHATE

The changing nickel market

Demand for nickel sulphate is expected to rise rapidly this decade to feed increased battery production for electric vehicles. At the same time, diminishing sources of high grade nickel ores are leading to a renewed focus on high pressure acid leaching (HPAL) of laterite ores, with a significant impact on sulphur and sulphuric acid demand.

Nickel sulphate has become something of a gold rush for mining companies, with a plethora of new projects announced and under development. In turn this promises to increase sulphuric acid demand for leaching of nickel ores, with knock-on effects on sulphur demand over the next decade. But will the market hype translate into real increases in consumption?

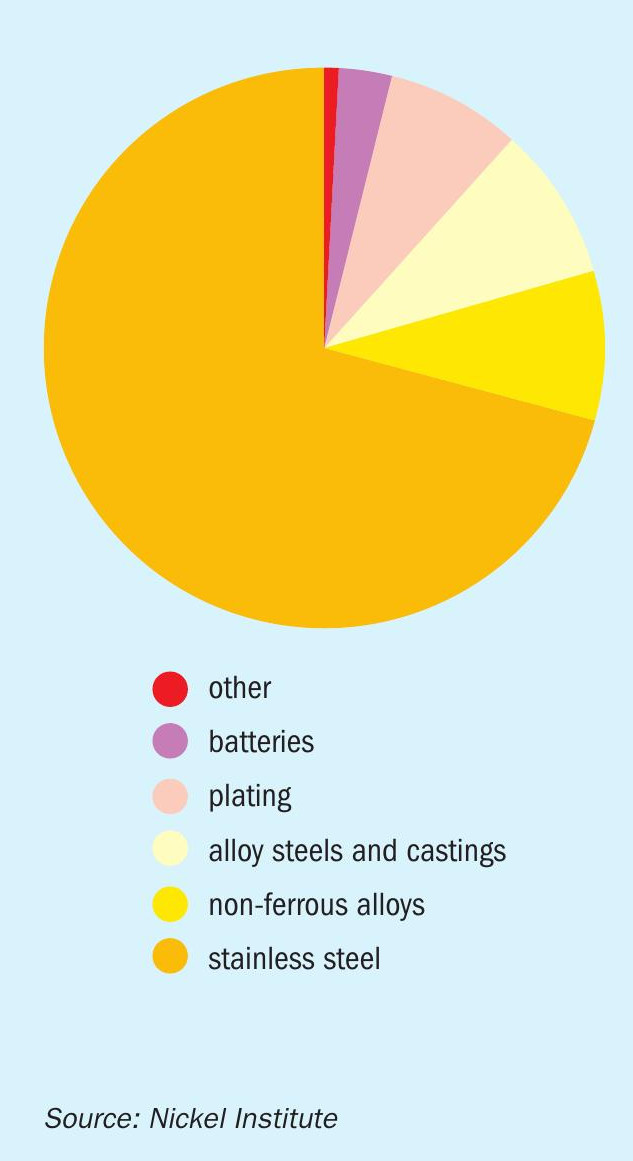

At present, according to the International Nickel Study Group, the world market for nickel reached 2.3 million t/a in 2019. Of that, around 70% of all nickel produced is used as an alloying component for stainless steel production, another 16% is used in other alloys and castings, and a further 8% for nickel plating of objects (see Figure 1). Only 4% (92,000 t/a) was used in battery production, but that figure is rising rapidly as the market for electric vehicles increases. CRU forecasts that total nickel demand could reach 2.8 million t/a by 2023, by which time nickel demand for batteries would have grown to 240,000 t/a, while the Bank of America puts nickel demand for batteries at 690,000 t/a by 2025. In its Nickel Sulphate Market Outlook to 2028 report, Roskill estimated nickel sulphate production in 2018 to have risen as much as 21% to nearly 160,000 t/a, up from less than 50,000 t/a in 2010, or 3% of the total nickel market.

The rise of EVs

Electric vehicles have been around for many years. In the UK, lead-acid battery powered vehicles for delivering milk (‘milk floats’) used to be a common sight on suburban streets, and in 1967 the UK Electric Vehicle Association boasted that the country had more electrically powered vehicles than the rest of the world put together. However, outside of such fleet vehicles operating over short distances from a central depot, the uptake of EVs was hampered by the low power density and range of contemporary batteries. The development of lithium ion batteries in the 1990s, coupled with increasing oil and gasoline prices and increasing concerns about the environment spurred a second wave of EV designs, hampered in the US by arguments over California’s attempt to create a zero emission vehicles mandate. For a while the pendulum swung towards hybrid gasoline/electric vehicles, typified by the success of the Toyota Prius, launched in 1997. This took off particularly in Japan, where 20% of all passenger vehicles are now hybrids.

But more recently, international government plans to decarbonise road transport and continuing improvements in battery technology are leading to a resurgence in electric vehicle use. China has been a particular pioneer, as it tries to improve air quality in its smog-ridden cities, but legislators have looked towards removing fossil fuel powered vehicles from the road altogether, with most countries committed to phasing out sales of new fossil fuel powered vehicles completely by 2030-2040, and many major car manufacturers committing to be all-electric by 2030.

Electric vehicle sales were around 130,000 units in 2012. By 2019 this had risen to 2.2 million, and in spite of the coronavirus pandemic, 2020 saw a huge leap in sales of 43% to surpass 3 million units, in spite of overall car sales slumping by 20% across the year as people drove less. China led the way, with sales of 1.3 million vehicles, followed by Germany (0.4 million), the US (0.3 million), and France and the UK (0.2 million each).

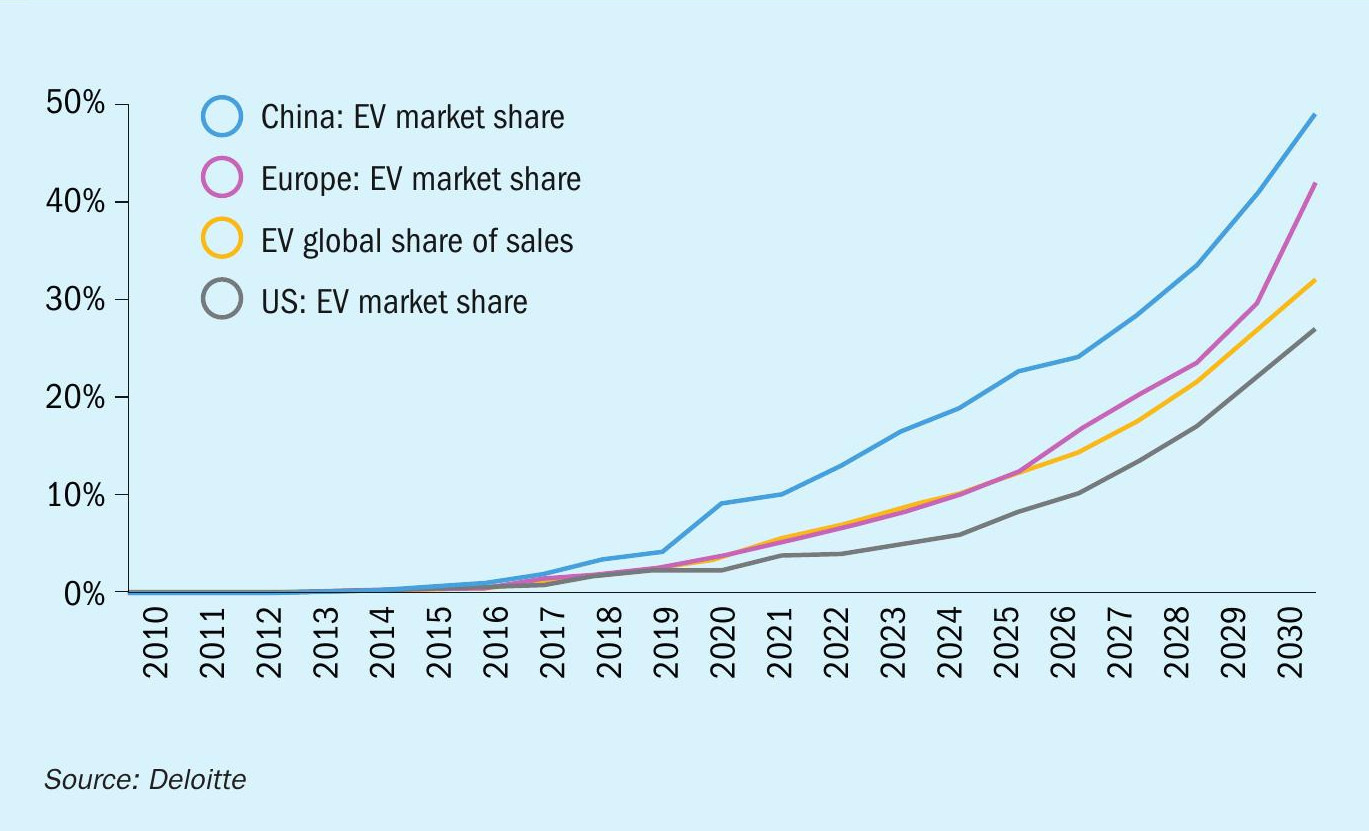

Deloitte forecasts that by 2030, battery electric vehicles will be outstripping hybrid sales by 4:1, and are likely to reach 23 million units globally, about half of which will be sold in China, 27% in Europe and 14% in the United States (see Figure 2). This represents an average annual growth rate of 29%.

Changing battery chemistry

At the same time that electric vehicle use is taking off, nickel requirements for batteries are also changing. Two chemistries of lithium-ion batteries dominate electric vehicle batteries: nickel-manganese-cobalt (‘NMC’), and nickel-cobalt-aluminium (‘NCA’). NMC batteries are used by most vehicle manufacturers, the main exception being Tesla, which uses NCA batteries. NCA batteries already have a high nickel content – the ratio of nickel to the other metals in an NCA battery is around 80%. NMC batteries began at around 33%, but are also steadily moving towards more nickel-rich formulations, from the original nickel-manganese-cobalt ratio of 1-1-1 to a 6-2-2 and even 8-1-1 (80%) ratio, the latter comparable with NCA batteries. The reason is that nickel offers greater energy density and storage at lower cost, delivering a longer range for vehicles, currently one of the restraints to EV uptake.

Class 1 nickel

Lithium-ion batteries with nickel-rich cathodes require high purity nickel, typically in the form of nickel sulphate. As the main feedstock for EVs battery cathodes, nickel sulphate is currently manufactured by dissolving so-called ‘Class 1’ nickel (nickel with greater than 99.8% metal purity) in sulphuric acid. However, nickel cathode production is steadily gravitating towards bypassing the metallic stage of Class 1 nickel and using purified nickel sulphate in solution generated during the nickel refining process.

Nickel deposits around the world exist in two main forms; nickel sulphide deposits, and nickel laterite deposits. The latter is an oxidised form, generally found in tropical climes north and south of the equator, including the Caribbean, and South America, southeast Asia and western Pacific, and central Africa. It is further subdivided into limonite and saprolite ores, depending on the relative levels of magnesia, silica and iron content. Laterites are however generally lower grade in terms of nickel (<1% Ni) than sulphide deposits. Up until now, laterites, especially iron-rich laterites, have mainly been used for production of lower grade nickel for stainless steel production. In particular this led to the production by China and Indonesia of so-called ‘nickel pig iron’ (NPI) – a ferronickel agglomeration which can be used directly in stainless steel manufacture. A pyrometallurgical process could also be used to produce similar but slightly higher grade ferronickel.

Meanwhile, Class 1 nickel used to be made predominantly from high grade nickel sulphide deposits. However, sulphide deposits are rarer, representing only around 19% of all nickel deposits, and many have already been mined out. At present only around 29% of all nickel production comes from sulphide deposits (although 60% of Class 1 nickel production). There are some new sulphide deposits, such as are aimed to be exploited by the Turnagain Project in British Columbia, and the Dumont Project in Québec. However, these are insufficient to meet the increasing requirements for Class 1 nickel going forward. Some forecasts put Class 1 nickel demand for EVs at 2.6 million t/a by 2040, more than all nickel production combined today. In its baseline outlook, Roskill forecast nickel sulphate demand to continue to grow to more than 900,000 tonnes Ni by 2029, boosted “not merely by rising adoption rates of EVs, but also by increased vehicle range (and battery size), and the increased intensity of use of nickel among various competing battery chemistries, growth in nickel sulphate demand is set to outpace that of most other battery raw materials”. Wood Mackenzie were slightly more cautious, putting nickel sulphate demand at 800,000 t/a (Ni basis) by 2035.

Elon Musk, owner of the Tesla car company (amongst his many projects), laid this out in stark terms at his so-called Battery Day event in September 2020. He said that he was aiming to be producing 20 million vehicles per year by 2030, and that in order to do so, his main raw material supply concerns are lithium (relatively abundant) and nickel. Each Tesla model uses an average of 45 kg of nickel metal. Musk’s planned production volume would thus represent 900,000 t/a of Class 1 nickel. Musk ended with a plea to nickel miners: “Well, I’d just like to re-emphasise, any mining companies out there, please mine more nickel… Tesla will give you a giant contract for a long period of time, if you mine nickel efficiently and in an environmentally sensitive way. So hopefully this message goes out to all mining companies. Please get nickel.”

HPAL

With sulphide deposits limited, ways will have to be found of processing laterite ores to produce Class 1 nickel. Purification of Class 2 nickel produced via NPI or ferronickel is prohibitively expensive at present. This leaves only one remaining way to produce Class 1 nickel from laterites – the use of high pressure acid leaching (HPAL) of iron rich (limonite) ore. Heap leaching or chloride leaching have also been investigated, but heap leaching requires a very low iron content, and leaching at atmospheric pressures tends to require much more sulphuric acid than HPAL, to the extent that costs become comparable or potentially higher.

Leaching of metal from copper oxide is an established technique, via the solvent extraction/electrowinning (SX/EW) process. However, nickel is more tightly chemically bound than copper, and consequently requires far more intensive conditions to extract it via acid leaching. As a result, HPAL is forced to use sulphuric acid at >240C and 33-35 atmospheres pressure in titanium autoclaves. The intensely corrosive conditions make for challenging operation, and HPAL is widely known as a technically demanding and difficult process. It is also expensive compared to other methods of nickel extraction, which limited its application when the first major wave of HPAL projects started up in the 1990s.

Table 1 shows previous and planned HPAL projects worldwide. While there have been some notably successful operations, including Sherritt at Moa Bay, Cuba and Sumitomo at Coral Bay and Taganito, Philippines, both of which have been expanded during their time of operation, there have also been some notable failures, such as Cawse and Bulong in Australia, and many of the other operations have struggled to reach nameplate capacity and often lost money. Cawse passed from Centaur to OM Group to Norilsk before finally being axed. Vale has suffered persistent operational problems at its Goro plant on New Caledonia, culminating in a major acid spill in 2014 which has seen local opposition to the plant rise. The Brazilian major has twice attempted to dispose of its Goro site, first to New Century Resources and more recently to a consortium led by Trafigura, but both sales fell through last year, and Vale has frequently said that it will close the site down. Ramu has been plagued by accusations of waste dumping and battles with environmental regulators, and Ravensthorpe was shut down for several years until brought back online by new owners First Quantum last year.

Beyond the technical difficulties, one of the issues with laterite processing via HPAL is ‘ESG’, short for environmental, social and corporate governance. HPAL generates an acidic slurry which must be neutralised and properly dealt with. The liquid effluent from an HPAL operation far exceeds any facility’s ability to recycle, so large quantities of solution must be disposed of, via tailings ponds or ocean discharge of liquids, depending on access to sites for so called deep sea tailings placement (DSTP), which has been contrpversial. Some facilities such as Ramu Nickel discharge the tailings at the same pH as the ocean, making them effectively inert, but others discharge acidic waste with a knock-on effect on sea life. Projects without access to deep sea disposal also face potential issues with liquid residues. Western Australia has an advantage as the dry conditions allow for net evaporation of the solution and safe stockpiling of the dry residue. Countries with significant rainfall such as Indonesia and no deep water access must build complex and significant on-land storage facilities and ensure that liquid effluent is properly treated before return to any natural waterways. This can add $500 million to the capital cost and $0.50-1.00/lb (ca $1-2,000/t) to the operating cost.

Nickel prices

Because of the expense of new nickel production, especially via HPAL, one of the issues with the nickel market over the past few years, and the reason behind some of the HPAL shutdowns noted above, has been oversupply of nickel and low prices which have deterred new investment. However, the past year has seen nickel prices rising steadily, from a low of around $11,000/t in March 2020 to highs above $19,000/t in February 2021, in no small part due to expectations of higher demand for nickel batteries (battery sales increased nickel demand by 5% last year), as well as a generally improving macroeconomic forecast as Covid vaccines offer the prospect of a return to something like ‘normal life’ once more. The industry operates a rule of thumb that a nickel price of $20,000/t is sufficient to justify investment in new supply, and the market is certainly approaching that, with supply remaining tight.

Moreover, because of the shortage of Class 1 nickel there are premium prices available for nickel sulphate, which in February 2021 reached record levels in China of 35,000-38,000 yuan ($5,414-5,878) per tonne, its highest level on record.

New projects

A number of new nickel sulphate plants are under construction to feed the Chinese market. Some are modifications to existing facilities. BHP is also adding what will eventually be a 100,000 t/a nickel sulphate facility at its Kwinana refinery, with the first 22,000 t/a stage due on-stream this year. Powdered refined nickel from the nickel smelter will be reacted with sulphuric acid from the Kalgoorlie smelter to produce nickel sulphate for battery use. In Finland, Terrafame is looking at converting its biological leach operation at Sotkamo from intermediates to nickel sulphate production to feed European battery demand.

But over and above this, and in spite of the aforementioned patchy record of HPAL plants, there are now a number of HPAL projects, mainly in Indonesia. Chinese mining firm Ningbo Lygend is aiming to complete its project on Indonesia’s Obi island in 1Q 2021, with a capacity of ‘MHP’ (mixed hydroxide precipitates), including 160,000 t/a of nickel sulphate (50,000 t/a nickel) and 20,000 t/a of cobalt sulphate, via an HPAL process.

Tsingshan Holding Group has an HPAL project at Morowali on the Indonesian island of Sulawesi, called PT Hua Pioneer Indonesia. The facility is designed to produce 37,000 t/a of nickel and around 4,000 t/a of cobalt as mixed hydroxide precipitates. The project has been delayed until at least 2022, and recently said that it would not use deep sea tailings placement to dispose of waste from the facility and is instead seeking “other technological options”.

Tsingshan is also partnering Chinese battery manufacturer GEM, and Brunp/ CATL in the PT QMB New Energy Materials project at Morowali, with another 50,000 t/a (nickel) mixed oxide precipitate process, and Tsingshan also has a 10% stake in another HPAL project, PT Huayue, with Chinese cobalt producer Zhejiang Huayou and China Moly. This is looking to 60,000 t/a of mixed nickel hydroxide cobalt production at a cost of $1.3 billion, and also decided recently not to use deep sea tailings placement. PT QMB New Energy Materials intends to process the battery-grade nickel intermediates to nickel sulphate on site, while PT Huayue will export MHP output for conversion to nickel sulphate in China.

Sumitomo Metal Mining (SMM) said in November last year that it was on track to finish a definitive feasibility study and make a final investment decision on the Pomalaa nickel project in Indonesia by the end of March 2020. This would be a partnership with PT Vale Indonesia to build a 40,000 t/a mixed nickel sulphide HPAL plant by about 2025.

Meanwhile, in Australia, Clean TeQ is aiming to produce an average of 20,000 t/a of nickel and 4,500 t/a of cobalt (as sulphates), as well as scandium oxide and an estimated 50,000 t/a of ammonium sulphate. The $1.4 billion project will include a sulphur burning acid plant to feed the HPAL autoclaves. Clean TeQ says that the ore body has a low acid consumption compared to other HPAL projects, and at capacity should require 660,000 t/a of sulphuric acid. The project has produced a final execution plant but is still securing funding and has no start-up date as yet.

BASF and Eramet have initiated a feasibility study on building an HPAL plant at Weda Bay, Indonesia with a base metal refinery at a location to be determined. The HPAL plant would process locally secured mining ore from the Weda Bay deposit to produce a nickel and cobalt intermediate. Projected capacity is 42,000 t/a of nickel and 5,000 t/a of cobalt, with a potential start-up in the “mid-2020s”.

Acid impact

Sulphuric acid consumption in HPAL is around 260-400 kg/tonne of ore processed, depending on the rock grade and reaction conditions. The three projects in Indonesia that are currently under development thus have the potential to add a considerable additional requirement for sulphuric acid. For example, Ningbo Lygend acid requirements are projected to be approximately 1.4 million t/a at capacity, and the two projects at Morowali could each require 1.7-2.0 million t/a of acid.

However, as we have noted above, HPAL is a notoriously fickle process. Historically it has required an average of four years to achieve 80% capacity for existing HPAL producers, and although some (eg Coral Bay) have been considerably faster, Murrin Murrin in Australia took seven years to achieve more than 50% capacity. This would imply on average an extra 2.5 million t/a of acid consumption by 2025, assuming that a solution can be found for dealing with the waste from the plants now that deep sea tailings placement has been ruled out. Even this might not actually significantly increase Indonesia’s sulphur or sulphuric acid imports, however, as new copper smelter capacity is also under development over the same timeline, now that Indonesia has severely restricted exports of copper and nickel concentrate in an attempt to capture more value domestically. Much will depend upon the relative timing of the various projects.

However, looking out towards 2030, the rapidly increasing demand for Class 1 nickel as nickel sulphate may well spur the development of more new projects, of which Clean TeQ and the recently announced BASF/Eramet development may be merely the tip of the iceberg.