Sulphur 396 Sept-Oct 2021

30 September 2021

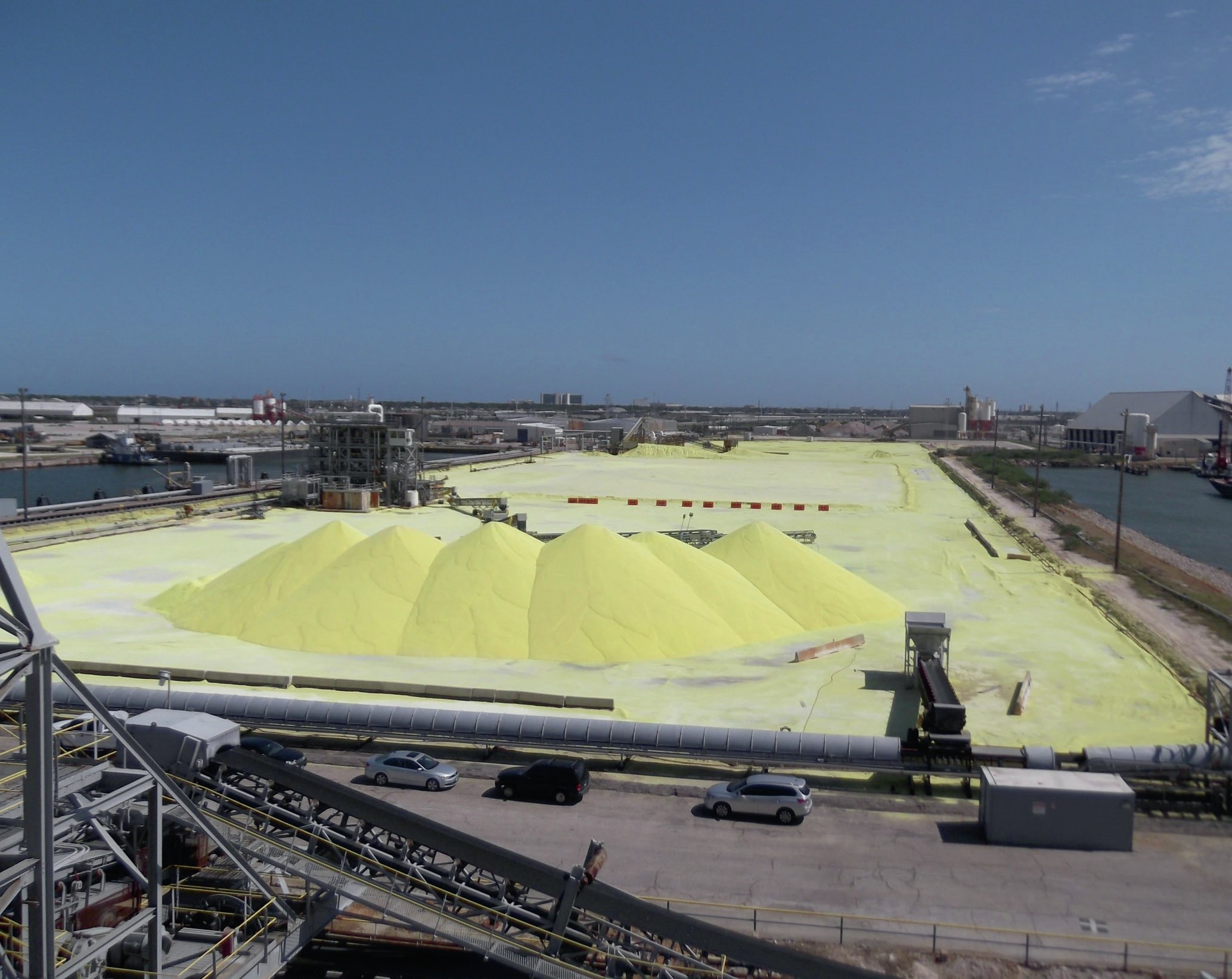

Sulphur supply chains: still mission critical in 2021

SUPPLY CHAIN

Sulphur supply chains: still mission critical in 2021

John M. Bryant, President and CEO of The Sulphur Institute, looks at how the sulphur supply chain has reacted to the extraordinary circumstances of the pandemic over the past 18 months, and the key principles of a successful sulphur supply chain.

The last 18 months have stressed global supply chains on many products like no other period in recent history. The pandemic gets credit for sparking the difficulties, but other factors, including changes in the energy sector, will ensure that significant challenges for sulphur continue into the foreseeable future. In this article I will discuss those supply chains, their post/mid-pandemic performance, and what companies can do to reduce supply chain risks going forward.

My comments on sulphur are based partly on personal experience with molten sulphur, but I observe that both formed sulphur and sulphuric acid share many parallel characteristics. A textbook definition of supply chain has the point of sulphur recovery as the start, with conclusion at the destination, often a sulphuric acid plant. In our supply chain scope are all transfer, transportation and terminalling assets. Not insignificantly, the software and management systems running the supply chain are also in play.

Sulphur’s ‘sharp edges’ deserve early reference, even though they are familiar to many readers. Supply chain assets are usually product-dedicated and are often sufficiently utilised that spot or immediate access is not possible. Next, sulphur handling does carry environmental, health and safety risks and while those concerns are manageable, specialised equipment and thorough training procedures are necessary. Finally, sulphur is also often considered to be ‘double fatal’, meaning that supply interruptions at either end, points of production or consumption, threaten operating rates on a very expensive asset. Supply chain failures can be damaging, to both large plant assets, and individuals!

In addition to the previously mentioned ‘sharp edges’ there are a plethora of significant risk factors threatening healthy sulphur supply chains. Nature delivers tropical storms, blizzards, and freezing temperatures. Accidents do periodically occur along key transportation routes, and labour-related constraints have been increasingly at the core of carrier performance problems. Plant operating rates can and do sometimes change, and a culture of ‘best efforts’ commercial agreements can hinder the ability of participants to quickly correct imbalances.

Sulphur’s performance

Given this backdrop of high supply chain risk, how has sulphur fared during the huge challenges of 2020-21? My assessment is that sulphur has held up very well, particularly compared to other materials. Certainly the industry has had threats and supply interruptions, although many of those issues were prompted by changes at origin or destination location points outside of the supply chain defined by transportation/terminals/transfers. Transportation delays did occur, but were typically expressed in days and percent impacted, and the challenges were less than for many comparable industries. Sulphur consumers did have to slow their usage rates, but most of their shortfalls were usually sparked by slowed recovered production. My positive assessment is a relative one, and not meant to sugar coat the headaches and losses experienced; I realise it is not comforting to hear for those that were impacted, but many sectors have fared far worse than sulphur.

So why have sulphur supply chains performed better than others? Two reasons occur to me, and both help make up the ‘secret sauce’ in sulphur supply chains. First, many active sulphur logistics desks operate with exceptionally smart ‘people software’ – staff that can sense issues early and manage change effectively. Coupled with that is a willingness to assist companies in need when trouble strikes, even if it involves ultimately helping an unaffiliated company. That cooperation is logical; the people recognise that their company supply chain will also someday need assistance.

Company supply chain footprints and strategic participation choices are typically driven by multiple factors, including degree of importance/fatal, performance history, and regional alternatives and resources. Strategic design tends to be stable, although changes are periodically observable. For example, since 2000 many companies have invested in forming assets to protect supply chains by adding optionality. Others have increased their direct participation to include trucking as they recognise community risks and wider ‘rings of responsibility’. Our discussion today will focus firstly and primarily on supply chain assets in place.

When it comes to supply chain management systems, individual company factors often guide selections, and indeed many businesses leverage processes and tools already in place for other co-products or raw materials. In my experience, sulphur is deserving of special modifications, partly to address those sharp edges. Two other factors tend to drive sulphur supply chain excellence. First, sulphur companies need to have strong management principles in place. Second, it is highly beneficial to custom-adopt leading practices with rigour to fit the characteristics of your supply chain.

Key principles

The management principles and behaviours that underpin effective sulphur supply chains are:

- Linguistics! Language is usually reflective of broad philosophy and perceived value. Make sure sulphur has the status of either co-product or raw material, and banish the words waste/by-product.

- No commodity here! Never make the mistake of transacting sulphur or its services on the basis of a tender or auction. Yes, sulphur *is* a bulk commodity, but only on the basis of chemistry! Service and supply performance can make a world of difference to your business and must be carefully considered in your evaluation of price-to-value.

- Team! Even in the smallest businesses, there will be important roles, responsibilities and handoffs across multiple desks and staffers. Make sure sulphur is played as a team sport.

- Discipline and rigor required! Process rigor and flawless repetition must support daily sulphur management processes. Supply excellence begins with the successful execution of daily tasks while maintaining an eye on inventory levels relative to standards. Use inventory threshold levels and alerts.

- Change management is our business. Sulphur supply excellence comes from a system of Monitor – Communicate – Change Management – Repeat.

- Safety excellence and superior housekeeping often go hand in hand with high performing supply chains, both rooted in similar principles and practices.

Leading practices

These principles flow into leading practices which can be adopted to suit your supply chain footprint and requirements:

- Start with your annual program and plan. Include changes that address updated sulphur fundamentals, both regional, national, and global. Review at least quarterly and make appropriate changes to suit evolving marketplace fundamentals.

- Have a requirement-based discussion with sulphur customers, suppliers, and service providers. Use of a performance scorecard is often surprisingly illustrative and useful, and a great insurance policy to underwrite supply chain success.

- Develop and utilise sulphur inventory models. Add frequency and key attributes (forward months and locations) to suit your footprint complexity and risks. As scale and risks increase, focus your modelling farther up and down stream when practical.

- Sulphur logistics excellence always swings on strong communication habits, internal and external. Formalize your practices and make them routine, often a daily cadence.

- Know your options, and as supply chain risks mount – ensure you own more of them. This is not just about adding physical assets; options can be addressed commercially.

- Diversification is a textbook remedy for strengthening supply chains. In my book on sulphur, it must be evaluated in the context of practical performance. Alternatives that don’t always work, don’t work! A more sensible approach exists with adding absolute capacity, whether it be via an empty tank for extra offtake, or a full tank for bolstering buffer inventory.

- When supply chain risks mount, be prepared to get granular, personal, and physical. Every ton of sulphur offtake, delivery or services can and should have a performer name attached.

Conclusion

Sulphur supply chain health will surely be just as critical and challenging in the coming years. Some industries are investing in artificial intelligence and machine learning to help them with supply chain management. From my desk, those tools are not particularly well suited to help with sulphur logistics. However, the good news is that there are other principles and leading practices that do fit sulphur very well and you can reduce your risks through adopting them to suit your sulphur activities.