Fertilizer International 510 Sept-Oct 2022

30 September 2022

The Atlantic just widened

“Significant increases in fertilizer selling prices and increased international demand have seen substantial increases in North American producer earnings and cash flows.”

The high-price environment for fertilizers and other commodities, including natural gas, is having very different consequences globally.

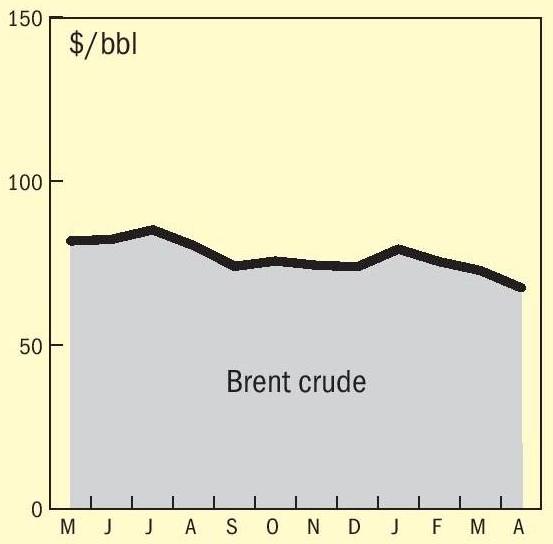

Europe is on the front line when it comes to the fallout from the Russia-Ukraine conflict, particularly the Kremlin’s use of its natural gas production might as a political and economic weapon.

The phrase ‘winter is coming’ is definitely concentrating minds on this side of the Atlantic. Ominously, as August ended, fertilizer producers across Europe responded to record gas costs by shutting down ammonia plants across the continent in preparation for months of potential gas scarcity.

At least fifty percent of the continent’s ammonia production capacity had been shuttered by the end of August, a situation which CRU described as extraordinary.

Norway’s Yara International, for example, curtailed annual production capacity across its European production sites by the equivalent of 3.1 million tonnes for ammonia and by 4.0 million tonnes for finished fertilizers. Production at BASF, Grupa Azoty, Fertiberia and many others has also been negatively affected (see p8).

Yet on the other side of the Atlantic, in the US and Canada, the state of the market looks distinctly different and much more positive. For a start, the region’s fertilizer producers, being able to access vast domestic natural gas reserves, are more able to insulate themselves from Russia’s hoarding of gas and so limit their feedstock costs.

Earlier this year, Moody’s was expecting a substantial earnings and cash flow boost for North American fertilizer producers in 2022.

“Many North American commodity producers will benefit, particularly fertilizer companies, because their raw material and energy costs remain relatively low,” Moody’s forecast in March, adding: “We expect significant increases in fertilizer selling prices and increased international demand as a result of the dramatic reduction in Russian and Belarusian exports. This will substantially increase North American producers’ earnings and cash flows.”

This has turned out to be remarkably prophetic, as the publication of first-half results this August has revealed.

Canadian fertilizer giant Nutrien, for example, delivered record first-half earnings in 2022. These increased by a staggering $4.6 billion to $7.6 billion (adjusted EBITDA), a year-on-year rise of more than 150 percent. To put these figures in perspective, Nutrien’s January-June 2022 earnings eclipsed its total earnings for the whole of 2021 ($7.1 billion).

What makes Nutrien’s 2022 first-half earnings even more remarkable is the fact that last year’s financial results were themselves unprecedented and record breaking, with 2021 annual earnings up by more than 90 percent on the previous year (Fertilizer International 508, p13).

Nutrien’s exceptional financial health has allowed the company to accelerate a range of growth-boosting projects. The company also expects to return around six billion dollars to shareholders this year.

The performance of Florida-headquartered The Mosaic Company has been similarly robust. The world’s leading combined potash and phosphate producer reported first-half 2022 earnings of more than $3.4 billion (adjusted EBITDA) in August, up from $1.4 billion in January-June 2021.

Leading North American nitrogen producer CF Industries, meanwhile, also delivered buoyant first-half earnings of $3.6 billion (adjusted EBITDA). CF’s January-June results, similar to Nutrien, exceeded its total 2021 annual earnings of $2.7 billion.

What makes Illinois-headquartered CF Industries different, though, is that it bridges the Atlantic divide through its ownership of two British fertilizer production sites operated by subsidiary CF Fertilisers UK. The company announced plans to close one of these production sites – at Ince, Cheshire – in June (Fertilizer International 509, p8). The ammonia plant at its other UK site in Billingham, Teesside will also temporarily close this autumn after a doubling in gas costs made production uneconomic.

This gives the company a unique perspective. “We continue to believe it will take several years to replenish global grains stocks, underscoring the critical role CF Industries plays supplying nutrients to farmers around the world during a period when marginal producers in Europe and Asia face production curtailments due to historically high natural gas prices,” CF’s president and CEO, Tony Will, said in August.

What is clear is that, with ammonia production being taken offline in Europe, major producers on the other side of the Atlantic (and elsewhere) will need to redouble efforts to supply fertilizers to the world’s farmers and secure the global harvest. Fortunately, they are in an exceptionally strong financial position to do so. n