Sulphur 403 Nov-Dec 2022

30 November 2022

Sulphuric Acid News Roundup

UNITED STATES

CSB criticises refinery use of hydrofluoric acid

In its final report on the June 2019 explosion and fire at Philadelphia Energy Solutions in southwest Philadelphia, the US Chemical Safety Board has said that US refineries need to strengthen their safeguards surrounding the use of hydrofluoric acid, and has also recommended that the US Environmental Protection Agency take steps to improve its oversight of the chemical, which is used as an alkylation agent.

The incident occurred when a corroded pipe elbow ruptured, releasing process fluid into the refinery’s hydrofluoric acid (HF) alkylation unit. During the incident, over two and a half tons of toxic HF were released, a 17 ton vessel fragment was launched off-site and landed on the other side of the Schuylkill River, and an estimated property damage loss of $750 million resulted.

CSB Interim Executive Authority Steve Owens said, “This is one of the largest refinery disasters worldwide in decades in terms of cost. the local community in Philadelphia fortunately was not seriously harmed, but given the refinery’s location, it could have been much worse. This incident should be a wake-up call to industry to prevent a similar event from occurring in the future.”

Of the 155 refineries currently in operation in the US, 46 operate HF alkylation units. The CSB is that HF is “one of the eight most hazardous chemicals regulated by EPA’s Risk Management Program (RMP)” and says that the more widely used sulphuric acid route an “inherently safer design”. Although sulphuric acid is highly corrosive and can cause skin burns upon contact, it remains a liquid upon release and does not present the same risk to surrounding communities as HF, which vapourises upon release and has the potential to travel offsite. The CSB recommends the EPA require refineries to conduct analysis of alternatives as part of the RMP.

Joint venture to make electronic-grade sulphuric acid

Martin Midstream Partners has entered into a joint venture agreement with Samsung C&T America, Inc. and Dongjin USA, Inc. to form DSM Semichem LLC. The joint venture will produce and distribute electronic-grade sulphuric acid using Martin’s existing assets in Plainview, Texas and installing additional facilities “as required”. The acid will meet strict quality standards required by the semiconductor industry. In addition to owning a 10% non-controlling interest in DSM, Martin will be the exclusive provider of feedstock to the sulphuric acid facility and, through its affiliate Martin Transport, Inc., will also provide land transportation services to end-users of the acid.

Bob Bondurant, President and Chief Executive Officer of Martin Midstream GP LLC, the general partner of MMLP stated, “We are excited to partner with Samsung C&T America, Inc. and Dongjin USA, Inc. in this unique opportunity to capitalise on the diverse and complimentary skillsets, operating expertise, and vast market knowledge of the three parties. The new facilities will incorporate technology currently being utilized to produce ELSA in Taiwan, which exceeds the quality of sulphuric acid being produced in the United States today”.

Freeport in talks to buy Arizona copper smelter

Freeport-McMoRan is reportedly in talks with Grupo Mexico SAB to buy the latter’s Hayden smelter, owned by its subsidiary Asarco. Freeport operates seven copper mines in the US including five in Arizona and is increasing operating rates in the country. An additional smelter would enable more refined production for the company at a time when domestic demand for the wiring metal is expected to grow and as the US looks to boost critical mineral supply chains.

BRAZIL

New acid plant for pulp mill

Brazil’s largest paper manufacturer Klabin has successfully started up a new sulphuric acid plant supplied by Andritz at the company’s Ortigueira plant in the southeastern state of Parana. The has the capacity to produce 150 t/d of commercial-grade sulphuric acid per day via sulphur burning combined with sulphur-rich off-gases. It serves the pulp lines at Klabin’s Puma pump mill and makes the site completely self-sufficient in sulphuric acid by recycling sulphur from the waste streams, removing the need to transport hazardous cargoes to the site. Klabin says that the plant helps it control the sodium and sulphur balance and the sulphidity of the mill. As a result, less sulphate will now be discharged, improving the efficiency of input use at the Ortigueira plant. As the sulphuric acid plant meets stringent air emission limits, the process significantly improves the overall environmental footprint of the Ortigueira mill. The Andritz scope of supply included technologies on on EPCC basis for handling elemental sulphur, combustion of sulphur and concentrated non-condensable gases to form sulphur dioxide, and conversion of sulphur dioxide into concentrated sulphuric acid, as well as a flue gas treatment system.

Klabin’s Director of Projects and Engineering, Joao Antonio Braga, said: “operation of the sulphuric acid plant at the Puma Unit, Ortigueira, represents a significant advance in the circularity of the installation. The new plant allows the unit to be self-sufficient in sulphuric acid, with the additional option of selling any excess production to the market. This innovative technology, a first in this industry worldwide, supports our efforts to optimise productivity and is an important milestone in our ambition to achieve our sustainability goals.”

DEMOCRATIC REPUBLIC OF CONGO

Outotec to supply direct blister furnace to Kamoa-Kakula

Kamoa Copper SA has selected Metso Outotec to supply a high-capacity direct blister furnace to the company’s copper mining complex expansion project in the Democratic Republic of Congo. The value of the contract is believed to be between €30-40 million ($30-40 million). Metso Outotec’s scope of delivery consists of key equipment and automation for the direct blister furnace designed for the production of blister copper in a single flash furnace without the need for separate converting stages. The 500,000 t/a copper throughput furnace will have the largest licensed flash smelting capacity in the world, according to Metso Outotec. The scope also includes intelligent safety and monitoring automation systems for the furnace.

Jyrki Makkonen, Vice President, Smelting at Metso Outotec, said: “Non-ferrous metals play a key role in the green transition, and a major increase in global copper production is required to support this transition. We are pleased to support Kamoa Copper in their ambitious expansion project, in which high capacity and reliable, sustainable processes play a vital role. Our collaboration has been excellent throughout the initial stages of the process, including the initial study work, basic engineering as well as pilot testing.”

Upon commencement of Phase 3 production, Kamoa-Kakula will have a processing capacity in excess of 14 million t/a, with increased copper production capacity of approximately 600,000 t/a. Commissioning is expected at the end of 2024.

INDIA

Fertilizer subsidies double

The Indian federal government has doubled the budget continency for fertilizer subsidy for the post-monsoon (rabi) season. Combined subsidy across all nutrients was estimated at 519 billion rupees ($6.3 billion), more than double the previous estimate. The full year estimate is likely to be 36% higher than for the 202122 financial year. The government blamed high prices on international markets due to the Ukraine-Russia conflict and logistics issues relating to the covid pandemic. The subsidy will bring the cost of a bag of diammonium phosphate from 2,650 rupees ($32) to 1,350 rupees ($16.50). Most of the subsidy goes to urea, but the cost of phosphates, potassium and sulphur are also underwritten by the government. The government said that the move “will enable smooth availability of all P and K fertilizers to the farmers during rabi 2022-23 at affordable prices and support the agriculture sector. The volatility in the international prices of fertilizers and raw materials has been primarily absorbed by the Union government.”

SWITZERLAND

Arkema to divest phosphorus business

Arkema says that it plans to sell its subsidiary Febex, which specialises in phosphorus-based chemistry, to Belgian group Prayon. Febex is a global supplier of phosphorus derivatives, including high purity phosphoric acid and sodium hypophosphite and derivatives, used primarily in electronics and the pharmaceuticals industry. Febex reported sales of around €30 million in 2021, employs 59 people, and operates a single site in Switzerland. The companies said that, by joining Prayon, Febex will benefit from the Belgian group’s growth ambitions in this area. This deal, which is expected to be finalised in 1Q 2023, is subject to consultation with employee representative bodies in France and approval by the relevant Swiss authorities.

CHILE

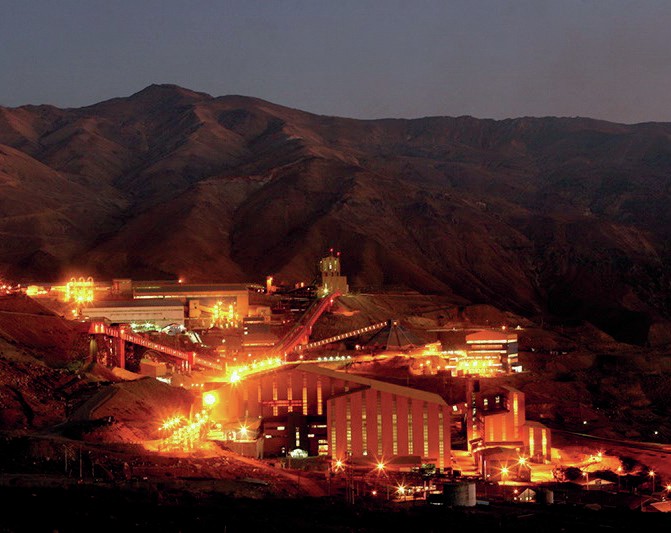

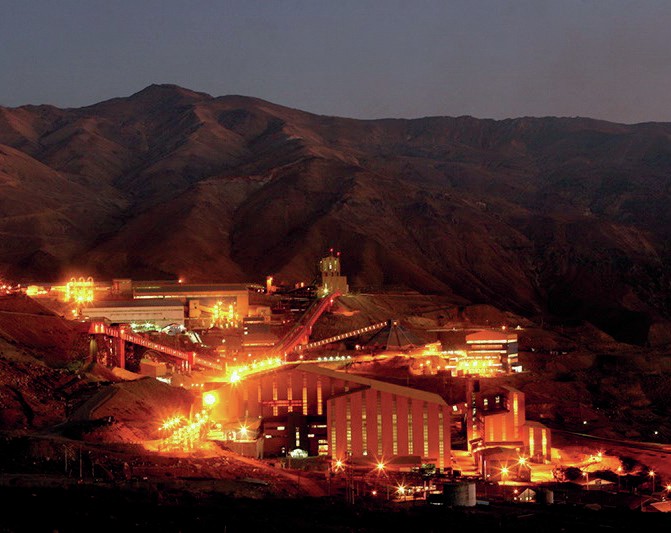

Cochilco output falls

Chilean copper commission Cochilco’s latest report shows that Chile’s production of copper in the first six months of 2022 was down by 160,000 tonnes, 6.1% lower than for the same period of 2021. The agency said that the prices of mining inputs, including sulphuric acid for SX/ EW leaching facilities, were to blame. The price of sulphuric acid was up 187% compared to 2021, the price of diesel fuel up 91%, concentrate freight and insurance 45% and electricity 9%. These costs also impacted other inputs into mining, such as tires, explosives, grinding balls and bars, chemical reagents, oils, lubricants, and spare parts, among others.

However, there are indications that this trend may have reversed during 3Q 2022. Antofagasta recently reported that copper output was 40% up in 3Q compared to 2Q 2022 after improved water availability helped output almost double at its Los Pelambres mine, though the company says that overall copper production for the current financial year will be 640-660,000 t/a, which is at the low end of its target range. Production to 3Q 2022 was 450,000 tonnes, down 17% on the same period for 2021. It projects that for the subsequent year, when construction work at the Los Pelambres desalination plant is set to be finished, output will rise to 670-710,000 t/a. Antofagasta shares have fallen by around a quarter over the past 12 months as pre-tax profits dropped by 62% to $680 million, and the company announced a cut in dividends after record earnings in 2021. Higher inflation and interest rates are causing a fall in commodity prices and an economic slowdown across many major economies, including China, where the company ships much of its iron ore. Production at the company’s Centinela mine was 14% down on 2021, but output at Antocoya was around the same as last year.

CHINA

China tightening restrictions on imported copper concentrate

The China Nonferrous Metals Industry Association is consulting with domestic smelters on tightening standards on the presence of heavy metals within imported concentrates, including lead, arsenic, cadmium and mercury. The proposal would lower the maximum allowable arsenic content in copper concentrate to 0.4% from 0.5%; the level allowed in lead concentrate from 0.7% to 0.6%; and that for zinc concentrate lowered to 0.4%, compared with the current 0.6%. According to an estimate by the International Copper Study Group (ICSG), less than half of the world’s copper concentrate has an arsenic content equivalent to or lower than 0.5%. The date for imposition of the new standards is believed to be late 2023 or early 2024. Last year, China imported 23.4 million t/a of copper concentrate, 3.6 million t/a of zinc concentrate and 1.2 million t/a of lead concentrate.

WORLD

Copper smelting activity down

Earth-i, which maintains satellite surveillance of up to 90% of copper smelter facilities worldwide, says that global copper smelting activity declined in October due to fears of a recession, weak demand and maintenance shutdowns. Smelting activity fell in all regions except North America, according to the company. The production index for China, the world’s largest refined copper producer, fell for a fifth straight month in October, as tightness in scrap supply appears to be weighing on smelter utilisation rates. There is also reportedly weakness in China’s nickel pig iron output. Thirteen of China’s 31 NPI plants were inactive at the end of October as stainless steel demand remained weak. Meanwhile in Europe, nearly two thirds of capacity was inactive due to a combination of a recession and prohibitively high electricity costs.

Elsewhere, Glencore said that its copper production was down 14% in the nine months to September 2022 at 770,500 tonnes, compared to the same period for 2021. The company said that this decrease was due to previously reported land access, geotechnical and processing constraints at Katanga, the basis change arising from the sale of Ernest Henry in January 2022, Collahuasi lower ore mined due to mine sequencing and lower copper units produced within Glencore’s zinc business.

GERMANY

Smelter hit by cyber attack

Aurubis, Europe’s biggest copper smelter, says that it was targeted as part of a wider cyber attack on the metals and mining industry on the night of October 28th which forced it to shut down its IT systems and disconnect them from the internet. Aurubis said in a press statement that the attack was “apparently part of a larger attack on the metals and mining industry,” though it did not name other companies affected. Aurubis said it was able to largely maintain production even though it was forced to shut down numerous systems at its sites and disconnect them from the internet as a precaution. It added that the extent of the impact is being assessed, and that it is working with investigating authorities in Germany.

Phosphorus recycling from sewage

There is increasing focus on recovery of phosphate nutrients from sewage waste, both to avoid eutrophication in water courses and assist with the ‘circular economy’. Now researchers from the Leibniz Institute of Freshwater Ecology and Inland Fisheries (IGB) claim to have made a breakthrough in phosphate recovery at municipal wastewater treatment plants. Phosphorus can be more easily recovered if it is present bound in salts such vivianite; an iron-phosphorus compound from which phosphorus can be relatively easily recycled. IGB investigated which factors promote the formation of vivianite and thus increase the amount of recoverable phosphorus, analysing the properties and compositions of sludge samples from 16 wastewater treatment plants, as well as the plants’ process parameters, to determine the factors influencing vivianite formation.

High iron content proved to be the most important factor in favouring vivianite formation. High sulphur content, in turn, decreased vivianite formation. “There are sulphur-containing and sulphur-free precipitants. We were able to show by comparison that the use of sulphur-containing precipitants can increase the sulphur content in the sludge and thus counteract vivianite formation. The choice of precipitant can therefore have a significant influence on phosphorus recycling,” said IGB doctoral student Lena Heinrich, lead author of the study.

Adjusting the conditions can make a difference: In the 16 wastewater treatment plants, the proportion of phosphorus bound in vivianite varied from around 10% to as much as 50%. This range shows the great potential to increase the yield of vivianite.

“For us as aquatic ecologists, the findings are very important because iron-containing precipitants can also be considered for restoration of lakes that are eutrophic, or polluted with nutrients. The efficiency of an iron salt addition is much greater if it results in the formation of stable vivianite in the sediment, which is then, perhaps one day, also available for the recovery of phosphorus,” said Hupfer.