Sulphur 407 Jul-Aug 2023

31 July 2023

Middle East Sulphur Conference 2023

MESCON CONFERENCE REPORT

Middle East Sulphur Conference 2023

The 2023 Middle East Sulphur Conference (MEScon 2023) was the biggest sulphur event in the region to date with over 650 attendees representing 23 countries from across the sour gas and sulphur value chain. More than a conference, this annual event offers conversation, collaboration and community, with leaders and experts from across the industry sharing knowledge, best practice and predictions for the future of sulphur.

The Middle East Sulphur Conference (MEScon) organised by CRU and UniverSUL Consulting, took place 15-18 May at the Conrad Abu Dhabi Etihad Towers in Abu Dhabi. On Day 1, three pre-conference workshops, hosted separately by BASF, BR&E, and Comprimo, took place at the conference hotel as well as a number of technical showcase presentations. A busy exhibition started on the afternoon of Day 1 and ran alongside the conference over four days with vendors highlighting product portfolios, new innovations and technologies to improve performance and/or reduce costs.

In her introductory remarks for the opening ceremony of the main conference on Day 2, Angie Slavens, Managing Director at UniverSUL Consulting, expressed that it was a pivotal moment as the event’s lead sponsors, ADNOC and Aramco, the two largest sulphur producing companies in the world (comprising approximately 20% of global production) kicked off the day’s activities, delivering inspiring welcome addresses that underlined the vital role the Middle East will continue to play in the future of the industry.

For example, the speakers discussed how growth plans across the Middle East are due to account for more than half of all sulphur production growth by 2030, with global sulphur supply due to grow from 65 million tonnes to 80 million tonnes of sulphur by 2027. Adbulmunim Al Kindy, Executive Director at ADNOC Upstream, proposed a challenge to the delegates to consider ways of extending the dual advantage that ADNOC already has in oil production, lowest possible cost and lowest possible carbon, to sulphur production. Meanwhile, Mohammed Al Abdulqader, Director of Gas Operations, Technical Support Department at Aramco, discussed Aramco’s historical and planned future sulphur growth and plans for future investment in SO2 emissions reduction for existing SRUs.

Later in the morning, CRU’s Principal Analyst for Sulphur and Sulphuric Acid, Peter Harrison, delivered a fascinating overview of the sulphur market, noting that sulphur supply in the Middle East saw significant growth from 2014-2016 and this trend is happening once again. Though, the interesting long-term challenge will be managing supply side capabilities as demand growth continues.

This demand for sulphur was a central point of discussion throughout the day, with many speakers highlighting that sulphur is not just a waste by-product of oil and gas, but instead one of the most valuable commodities in today’s market. This was evidenced by conversations around its dominance in fertilizers, supporting global food supply; but also its role in emerging markets from EV batteries through to clean energy storage – both of which are only set to expand.

CRU’s Principal Consultant, Ionut Lazar, talked about this during his presentation on the evolving role of sulphur in the EV value chain. He predicted that sustained sulphur demand will remain in the phosphates market, but lithium and battery markets will be a growth potential for acid.

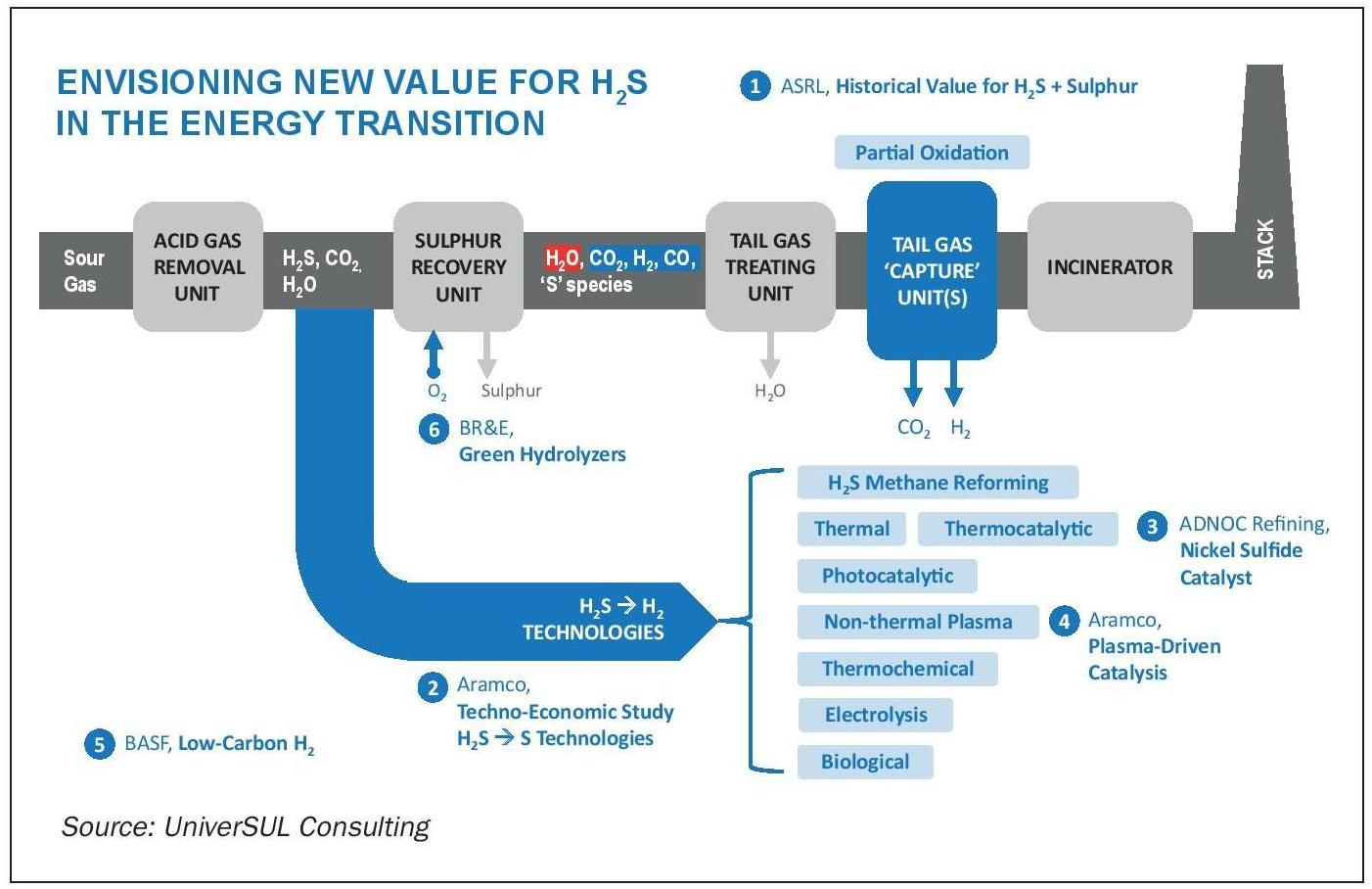

The afternoon’s technical sessions focused on outside-of-the-box thinking with regards to the value of hydrogen sulphide (H2 S) and elemental sulphur as presented by operating companies, technology providers and industry suppliers (Fig. 1). Rob Marriott, Director of Research, at Alberta Sulphur Research kicked off the session with an overview of historical attempts to create new value for H2 S and sulphur, followed by Pramod Patil, Reservoir Engineering Technology Division at Aramco, who presented multiple innovative schemes for H2 S conversion to H2 and sulphur. These two overarching presentations were followed by specific presentations on research and development in H2 S to H2 conversion, delivered by ADNOC Refining, Aramco and BR&E, as well as low carbon hydrogen schemes, presented by BASF.

Ali Al Hendi, ADNOC Gas Vice President Technical and Engineering Services, opened Day 3 of the event with a welcome speech describing the importance of MEScon to ADNOC Gas. This ADNOC company operates one of the largest sour gas facilities in the world, equipped with sulphur recovery technologies from many of the major SRU technology licensors, most of whom were attending the conference, and expressed the importance of knowledge exchange between designers and operators.

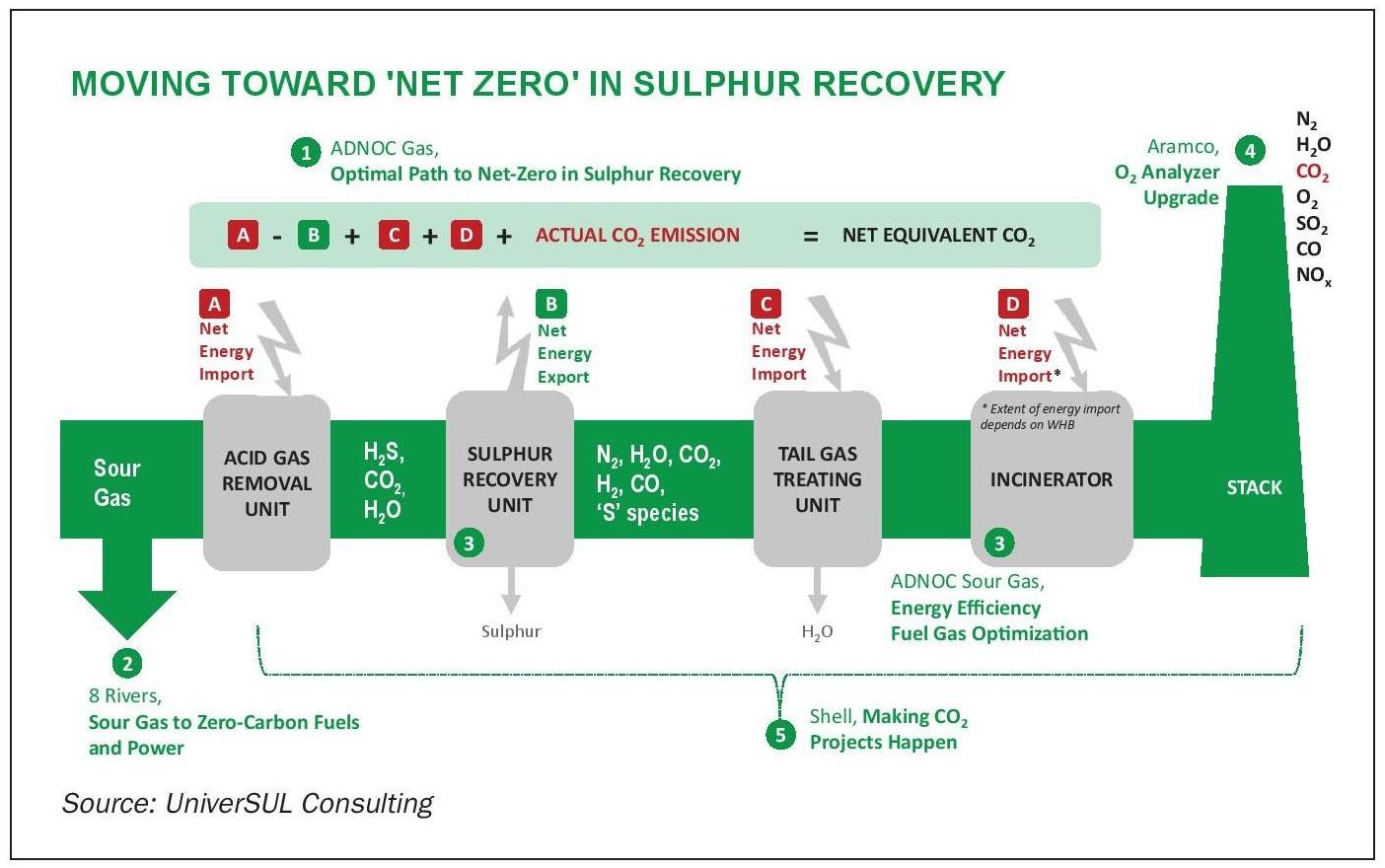

Day 3 then officially kicked off with a flurry of new participants eager to join the morning deep dive into decarbonisation in the ‘Moving toward net zero in sulphur recovery’ session (Fig. 2). Saqib Sajjad, Team Leader, Energy Management, ADNOC Gas, started the session with a comprehensive overview of the sulphur plant energy balance and explored interesting options for green energy integration. 8 Rivers’ Joe Weiner then presented an innovative sour gas treating technology, with inherent CO2 capture, utilising cryogenic distillation. Al Sail Al Jaberi, Process Engineer at ADNOC Sour Gas, then described the efforts to reduce fuel gas consumption and corresponding CO2 footprint in the reaction furnace and incinerator of the world’s largest SRU/TGTU trains at the Shah Gas Plant. Bader Alotaibi, Process Engineer at Aramco, then shared Aramco’s experience with the implementation of an innovative laser stack analyser to achieve accurate stack O2 concentration, thereby reducing fuel gas consumption and carbon footprint. Shell’s Fahd Fathi then wrapped up the session with a talk on how best to achieve viable economics for CO2 capture projects in sour gas and sulphur.

A first for the event was an operator poster session, which was briefly summarised by poster presenters during the main conference and conducted on screens in the exhibition area during breaks. On Day 3, posters were presented by ADNOC Gas, KNPC, and Aramco, providing delegates with the opportunity to learn and exchange experience directly with operating companies.

The afternoon session was also about sharing operational experiences. Ben Spooner, Principle Engineer at Amine Experts, kicked off the session with a presentation detailing his experience commissioning amine plants in extreme environments – hot, cold and offshore (as featured in Sulphur 403, pp48-53). ADNOC Sour Gas process engineers Jawwad Kaleem and Eman Al Ali then presented the many challenges the Shah Gas Plant has overcome in increasing its massive sour gas facility from 1 to 1.45 BSCFD.

More operators took the stage as Muhammad Syu`aib Mohamed Yahaya, Process Engineer at Pengerang Refining Company Sdn. Bhd., shared his learnings from a full sulphur plant complex start-up in 2018, followed by Reliance Syngas Ltd’s presentation from Alok Dwivedi and Sarbendu Kar, who explained the optimisations implemented to increase flexibility in the refinery and gasification SRUs in the Jamnagar Refinery – the largest refinery and gasification complex in the world. The session wrapped up with presentations from KNPC’s Rizwan Masood, who described the game-changing results achieved during the design and commissioning of AGRP II, followed by ADNOC Gas’ Sara Al Katheeri and Pankaj Kumar who described a dual-advantage project which improved the quality of their formed sulphur product while also decreasing capital cost.

The panel session in the afternoon provided a great opportunity for operators to interact with one another and the audience over a wide range of projects; from commissioning to revamp, and types of facilities; from gas plants to refineries to gasification facilities. What was clearly evident was that this type of discussion amongst end-users provides a much-needed feedback loop to front-end engineering designers, which strengthens the entire project execution chain.

Mohamed Bara Adi, ADNOC Sour Gas VP Projects and Technical, opened Day 4 of the event with a welcome speech harkening back to the sentiments expressed by Fahad Al Wahedi in the opening ceremony – that MEScon is a connected community that is extremely important for facilitating knowledge sharing between their operations personnel who are operating the largest sulphur trains in the world, and the global sulphur community. He congratulated the delegation for the lively discussion thus far and encouraged everyone to finish strong on this final day of the conference.

Day 4 then officially kicked off with a session on design innovations to achieve optimal performance and longevity. Gerton Molenaar, Director Business Development Americas at Comprimo, started the discussion with an overview of an innovative development to achieve precise SRU control. Bob Poteet of WIKA and Shaima Almajed of Aramco then took the stage to share their experience developing and implementing a new thermal reactor shell temperature measurement device to detect refractory failures. Johannes Derfler of AGRU then presented an innovative and robust PFA lining that has proven effective in sulphuric acid service, and the audience subsequently proposed and debated potential applications for this material in sulphur plant service in the panel session that followed. Piero Loliva of Axens and Wolfgang Röhrig of OHL then described a subdewpoint process called SmartSulf, and the collaboration between Axens and OHL to incorporate robust, reliable valves for the cyclical process.

The final presentation of the morning was an optimisation of the existing granulation facilities at the Habshan sulphur handling facility to achieve dual objectives of improved process performance and reduced capital cost, presented by Antonia Medina and Nuha Al Hajeri of ADNOC Sour Gas.

Poster sessions (during breaks) and a dedicated poster spotlight (during the main conference) continued from Wednesday with new posters from Fluor, ADNOC Gas and Aramco.

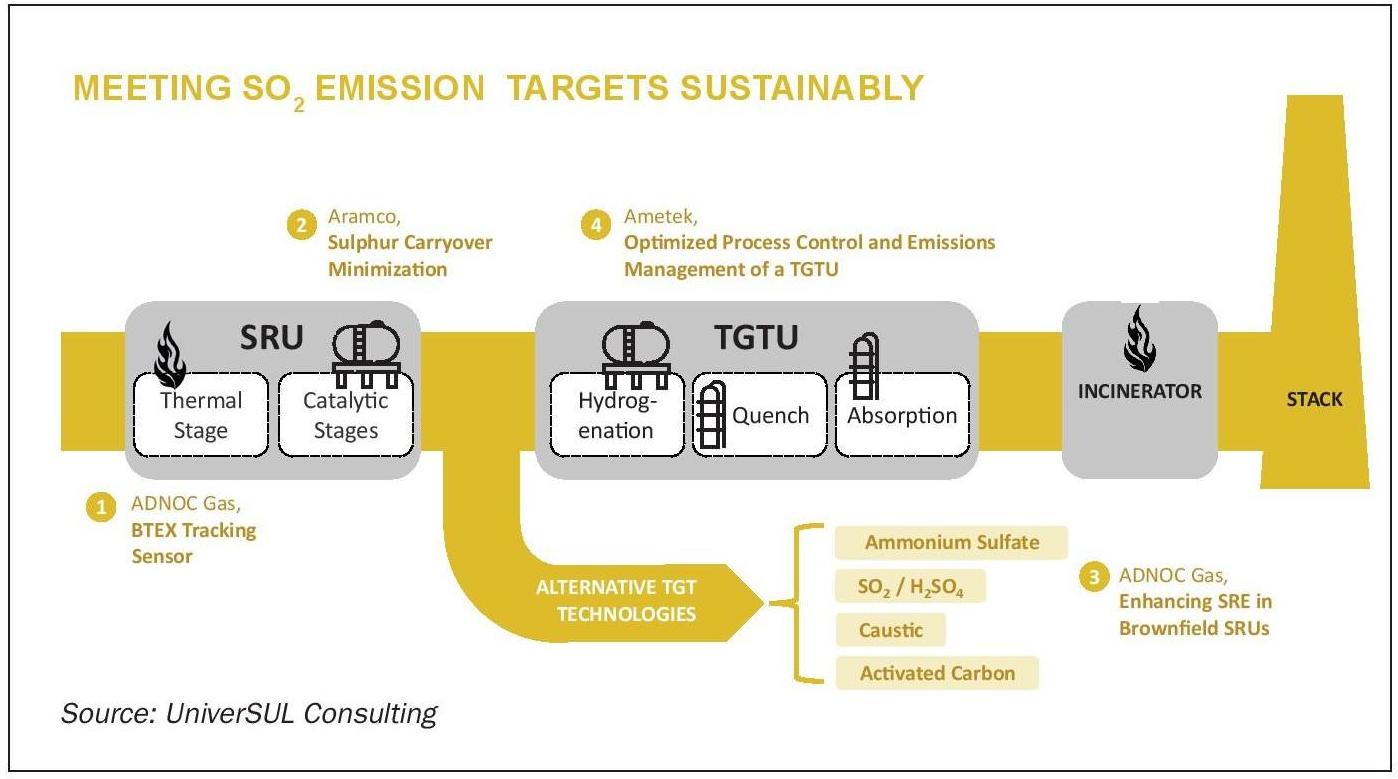

The afternoon session focused on sustainable and efficient SRU operation (Fig. 3). Satyadileep Dara of ADNOC Gas and Rob Marriott of ASRL kicked off the session with a follow-up to Dara’s MEScon 2022 presentation about a BTEX soft sensor that was in development at the time and has since been implemented. Operating data from a performance test was collected just days before the conference. The collaboration of industry and academia was noted, as both ASRL and Khalifa University took part in the development. Ibrahim Habib then presented a comprehensive root cause analysis that Aramco carried out to determine the root cause of high SO2 emissions in one of their SRUs and the steps taken to rectify the matter.

ADNOC Gas’ Dinesh Aggarwal then presented a technology evaluation carried out to assess new tail gas treating technologies to improve sulphur recovery efficiency in legacy SRUs at the Habshan complex, noting that both conventional and emerging technologies were considered. He mentioned that the evaluation is still ongoing and alluded to the possibility of presenting the selected technology at MEScon 2024. The session wrapped up with an extremely engaging presentation from Jochen Geiger of Ametek who discussed the historical developments of TGTU process measurement and how to optimise instrumentation for robust and efficient process performance.

In summary, the largest Middle East sulphur event to date was a great success and there was a general feeling from all who participated that the torch is being passed to the region, in terms of future stewardship and advocacy for the industry.