Fertilizer International 517 Nov-Dec 2023

30 November 2023

Europe battling a dual production and demand challenge

MARKET UPDATE

Europe battling a dual production and demand challenge

Low demand, high gas prices and cheaper Russian imports of urea and ammonia are keeping a lid on European fertiliser production, prompting fears of permanent plant closures. ICIS’s Deepika Thapliyal, Sylvia Tranganida, and Aura Sabadus examine the challenges faced by the sector and the potential long-term impacts on the European fertilizer industry.

Introduction

Thin consumption, rising gas prices and cheaper Russian imports of urea and ammonia are keeping a lid on European fertilizer production, prompting fears of permanent plant closures.

More positively, operating rates at European nitrogen plants may soon touch around 80 percent, unconfirmed data suggest, a ten percentage point increase on reported rates over the summer, with units at Poland’s Grupa Azoty and Romania’s Azomures scheduled to restart in October.

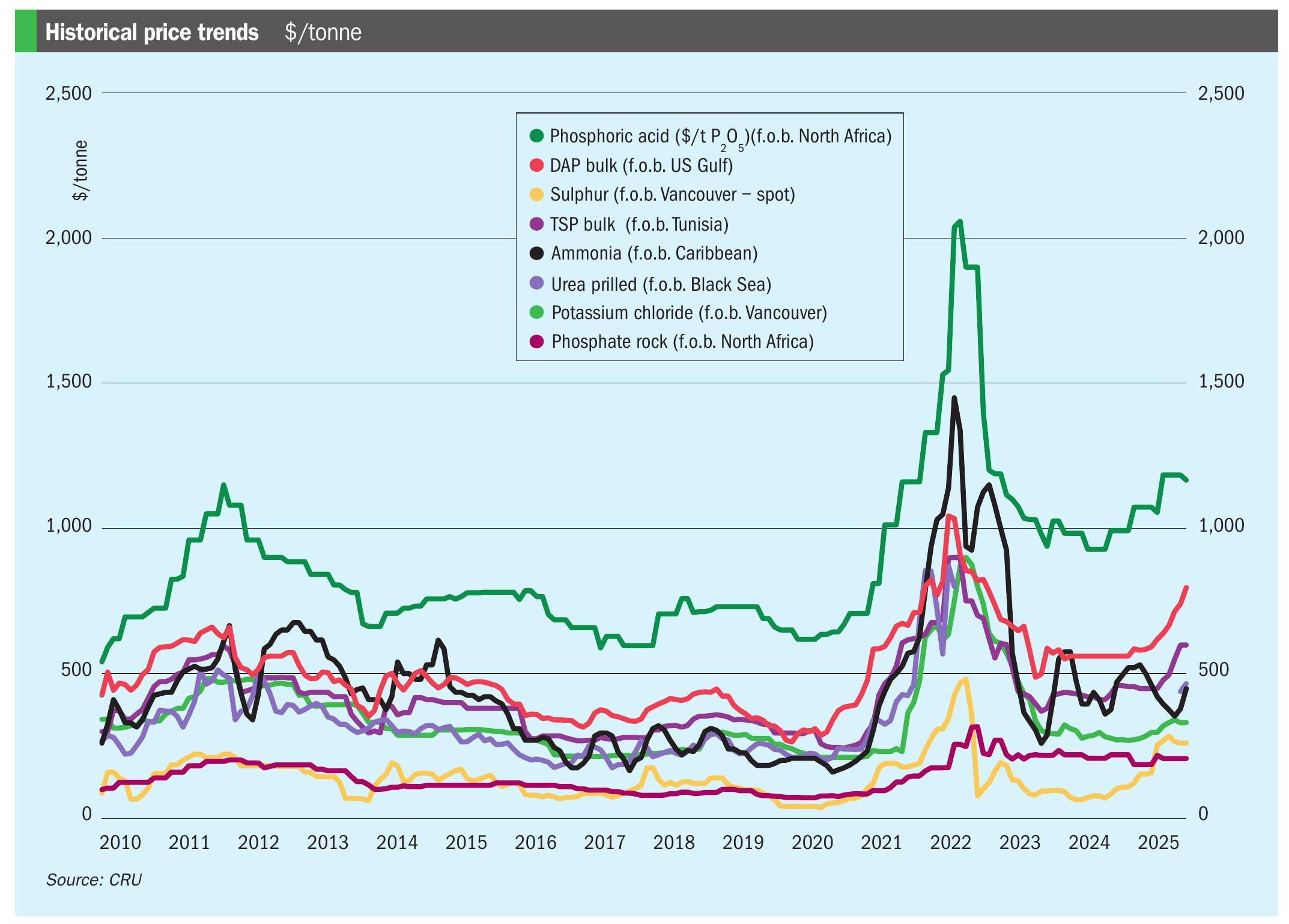

Nevertheless, Europe’s gas-intensive industries – which were severely affected last year by the record energy costs after Russia cut gas supplies to Europe –still face headwinds. The region’s fertilizer production continues to be affected by a combination of elevated gas costs and depressed demand (Figure 1).

The lower output from fertilizer and other chemical plants is reflected in lower aggregated gas demand in the higher-consuming north-west European countries, which remains at least 20 percent lower than the five-year average, ICIS tracking data reveal.

European gas prices

Gas prices, having dropped nearly tenfold since the record highs seen at the end of August 2022 (Figure 2), are still above the long-term average. Extensive unplanned outages at upstream facilities in Norway, which restricted daily supplies by almost a third in the latter part of summer, have contributed to elevated price levels.

Looking ahead, a combination of sluggish industrial demand and ample stocks (Figure 3) is likely to exert a downward pressure on gas prices, although overall price direction will largely depend on the weather this winter.

More generally, bullish and volatile gas prices combined with maintenance at fertilizer production plants globally have been squeezing margins. In some cases, producers have increased their sale prices to reflect higher feedstock costs. The October ammonia price agreed between Norway’s Yara and US producer Mosaic, for example, was set at $575/t cfr (cost & freight), an increase of $185/t on the $390/t September price.

An ammonia trader told ICIS that this new monthly price was enough to allow the seller to eke out a margin. European ammonia production costs are currently running just below $500/t (Figure 4).

Ammonia plants do not, however, pay spot market prices for their gas. Instead, Europe’s producers, because their price formulas are based on averages, will still be paying for gas in the e30-40 per MWh price range currently, in our view. Therefore, with no signs of further declines ahead, the longer-term impact of gas prices on European fertilizer sector profitability is another concern.

While high production costs have not forced any new permanent European plant closures – since BASF revealed plans in February to shut its Ludwigshafen caprolactam and ammonia units in Germany by the end of 2026 – we believe the threat of further closures by several producers in the region is very real.

Competition from cheaper Russian imports

The revival of European fertilizer production is also being hampered by the influx of much cheaper Russian products. These can cost seven times less to produce than corresponding European fertilizers.

While the EU has sanctioned a number of Russian oligarchs associated with the fertilizer sector, following the invasion of Ukraine, these are limited in scope. Consequently, Russian fertilizers such as urea are accepted into Europe and imports continue to be ample. Fertilizer products supplied by major Russian producers are no longer sanctioned in France, for example, and are also moving into other European countries.

On the demand side, the picture is equally challenging.

Poor European demand

European demand for most nitrogen products is still lacking. This is despite the recent unexpected tightening of fertilizer exports from China and the support this has given to global urea and phosphate prices.

Europe’s chemicals and fertilizer industry still has around 20 million t/a of capacity either offline or operating at reduced rates – due to the pincer effect of low demand and high gas costs (Figure 5).

The slump in European consumption may be related to macroeconomic factors, such as the weakness of sterling in the UK, suggests Adam Joslin, customer manager at ProAgrica, a sister organisation of ICIS. He thinks a combination of seasonality, inflationary pressures and higher costs is making Europe’s farmers more cautious in their buying and application of fertilizer products.

“I think the state of the economy has the potential to affect [fertilizer] demand – rising inflation globally, together with rising interest rates, is perhaps leading the market to expect recessional behaviour and demand not being as strong,” Joshlin said.

The well-supplied grain market could be another factor, especially if Russia is still selling grain from last year’s bumper harvest. Wheat prices, while lower than in recent years, do however remain above their 2013/2014 peak, points out Joshlin.

“Actually, you can see the pattern of the wheat prices spike in 2013/14 mirrored by what has happened in 2021/2022 and the decline in the following year – we do seem to be seeing a little of history repeating itself,” he said.

About the authors

Deepika Thapliyal is Deputy Managing Editor, Fertilizers, Sylvia Tranganida is Senior Ammonia Editor and Aura Sabadus is a Senior Journalist at ICIS. Visual data by Yashas Mudumbai, ICIS Data Editor.

Please note that the analysis and commentary in this article reflects the market situation as of the end of September 2023.