Sulphur 410 Jan-Feb 2024

31 January 2024

Indonesia’s nickel surge

NICKEL

Indonesia’s nickel surge

The nickel market has been through a period of unprecedented change over the past few years due to demand for batteries for electric vehicles, with Indonesia becoming a centre for production via high pressure acid leaching.

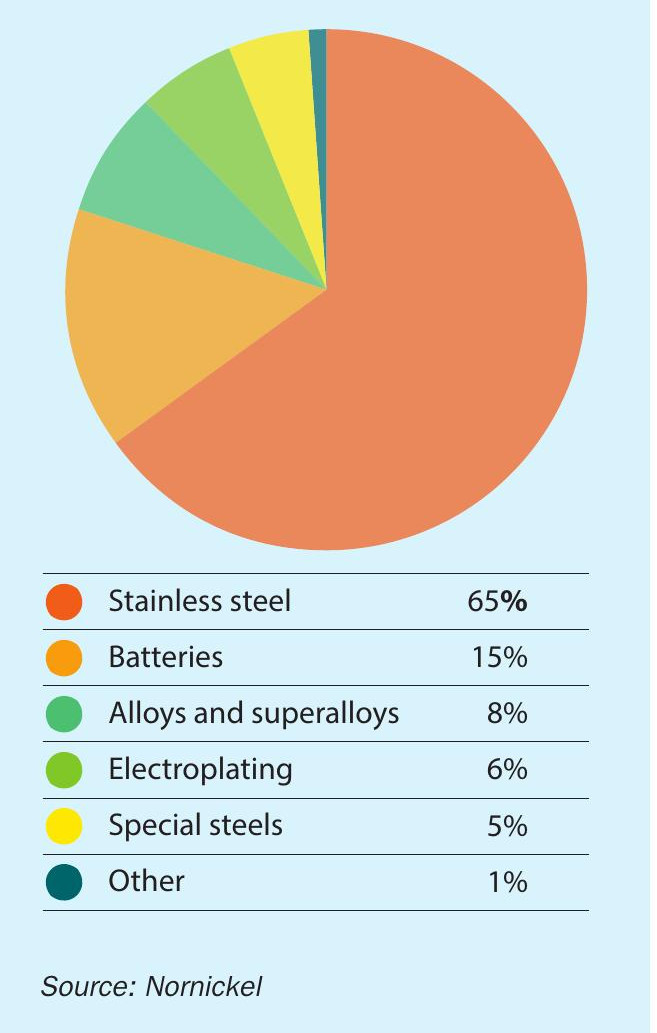

World primary nickel production continues to rise rapidly, from 3.06 million t/a in 2022 to 3.42 million t/a in 2023, according to the International Nickel Study Group (INSG), and it is forecast to rise to 3.71 million t/a in 2024. This is set against demand of 2.96 million t/a in 2022 and 3.20 million t/a in 2023, rising to 3.47 million t/a in 2024. This rapid rise, averaging more than 8% year on year, is being driven by demand from the battery industry. Stainless steel remains the main source of demand for nickel, as Figure 1 shows, but this has fallen from 70% of the market in 2019 to 65% in 2022, with battery demand rising from 4% to 15% of nickel demand in just three years. The quantity of nickel used in the battery sector is growing rapidly, as nickel is used in nickel-cadmium, nickel-metal-hydride, nickel-iron, nickel-zinc, nickel-hydrogen and, increasingly in lithium-ion batteries because of the high energy density of nickel-containing cathodes.

The changing battery market

Rapidly rising use of electric vehicles shows no sign of slowing down. Worldwide sales exceeded 10 million in 2022, meaning that EVs represented 14% of all new cars sold, up from around 9% in 2021 and less than 5% in 2020. Figures for 2023 are expected to show a 35% increase on 2022.

Three markets dominate these figures. China is the leading market for EV sales, representing around 60% of all global EV sales. More than half of the electric cars on roads worldwide are now in China and the country has already exceeded its 2025 target for new energy vehicle sales. Europe is the second largest market, with EV penetration reaching 20% of new car sales. The third largest market is the US, where EV sales increased 55% in 2022, reaching a market share of 8%.

However, at the same time, the preference for different battery chemistries is changing. Previously, two chemistries of lithium-ion batteries have dominated the EV market: nickel-manganese-cobalt (‘NMC’), and nickel-cobalt-aluminium (‘NCA’). NCA batteries have a high nickel content – the ratio of nickel to the other metals in an NCA battery is around 80%. NMC batteries began at around 33%, but are also steadily moving towards more nickel-rich formulations, as nickel offers greater energy density and storage at lower cost, delivering a longer range for vehicles. But rival iron-based chemistries, particularly lithium iron phosphate (LFP), are becoming increasingly popular, with LFP representing 60% of new EV batteries Other in China, and this share is rising. Other new technologies are undergoing rapid development, such as sodium ion batteries and various solid state technologies.

One new area of development is grid-scale battery storage systems for renewable energy applications. Alloys and superalloys Renewable energy technologies like wind and solar Batteries suffer from variable output and need storage systems Stainless to smooth steel output levels. One area that has attracted particular interest is recycling EV batteries that have lost a significant amount of charging capacity for stationary power storage applications; so-called ‘second life batteries’.

In spite of these changes, the future for nickel demand continues to be bright. Typical projections for nickel demand estimate that nickel use in batteries could reach approximately 1.5 million t/a of nickel by 2030, or 30% of total primary nickel demand by that time.

Class 1 nickel

Lithium-ion batteries with nickel-rich cathodes require high purity nickel, typically in the form of nickel sulphate. As the main feedstock for EVs battery cathodes, nickel sulphate is currently manufactured by dissolving so-called ‘Class 1’ nickel (nickel with greater than 99.8% metal purity) in sulphuric acid.

Nickel ores broadly exist in two different forms; sulphides, and laterites, which are an oxidised form found mainly in tropical regions. Processing of nickel laterite ores is more difficult and has come to rely upon two main routes; pyrochemical or acid leaching. Pyrochemical routes are generally cheaper, but the nickel that they produce is often compounded with iron. This is not a problem if the destination for the nickel is stainless steel use, but it means that the nickel cannot be used for demand uses that require high purity nickel. Much of the growth in nickel supply, especially in Indonesia, was used in China to produce so-called ‘nickel pig iron’ (NPI) for steel production.

With new sulphide deposits limited, ways will have to be found of processing laterite ores to produce Class 1 nickel. Heap leaching requires a very low iron content in the ore, and leaching at atmospheric pressures tends to require much more sulphuric acid than high pressure acid leaching (HPAL), to the extent that costs become comparable or potentially higher. The result has been an increasing focus on HPAL, using sulphuric acid at >240°C and 33-35 atmospheres pressure in titanium autoclaves, although the intensely corrosive conditions make for challenging operation.

The increasing price differential between Class 1 and Class 2 nickel has led to innovation from China in the form of so-called nickel matte production from NPI. The process to covert the NPI to nickel matte involves adding elemental sulphur to NPI or ferronickel in a converter, where it is blown with air to oxidise and separate the iron and produce a high grade nickel matte. This can then be further refined in a similar way to a mixed nickel-cobalt sulphide precipitate to produce Class 1 nickel or battery grade chemicals. However, the process is energy intensive and generates up to five times more CO2 than conventional Class 1 nickel production.

Indonesia

China remains the largest consumer of nickel, both for stainless steel production and also increasingly for batteries, with around 60% of all nickel currently being consumed in China. However, its domestic reserves of nickel are relatively modest, and so it must rely upon imports from overseas. Indonesia has become the mainstay of the nickel market in terms of production (see Table 1), and for a while exported large quantities of laterite ore to be converted in China to NPI production. However, in 2020 Indonesia banned the export of nickel ore in an attempt to force the development of domestic nickel processing industries in order to capture more of the value chain.

Initially this meant that a lot of Chinese NPI producers offshored their operations back to Indonesia. By July 2023 there were 43 NPI smelters operating, 28 under construction and 24 in the planning stage. But the increasing demand for Class 1 nickel has also led to several new high pressure acid leach projects, again dominated by Chinese investment, this time for battery production. This began in 2018 with the announcement of a 50,000 t/a HPAL project by QMB New Energy Materials, a joint venture between Tsingshan, GEM, CATL and Hanwa. This project eventually came on stream in 2022, by which time it had been leapfrogged by two other Chinese-backed HPAL plants, Huayue Nickel and PT Halmahera Persada Lygend. By the end of 2022, 160,000 t/a of HPAL capacity was operational in Indonesia.

The new plants have been built at a fraction of the cost of previous HPAL plants. Table 2 shows existing HPAL plants. Second generation plants cost several billion dollars, from Ravensthorpe and Ramu both at $2.1 billion, to $5.7 billion for Ambatovy and $5.9 billion for Goro. Conversely, PT Halmahera on Obi Island, and Huayue Nickel and PT QMB New Materials, both located in Morowali, Central Sulawesi all cost less than $1.5 billion, for an average capital intensity of around $30-35,000 per annual tonne of nickel compared to an average of $100,000 per annual tonne of nickel for the second generation plants. The difference is put down to existing infrastructure at established industrial parks, often with existing NPI production, as well as knowledge obtained from the development and operation of the Metallurgical Corporation of China’s (MCC) Ramu operation in PNG, whose engineering division, China ENFI Engineering was the developer of the flowsheet for PT Halmahera Lygend on Obi Island. Like Ramu, Halmaher used a three-stage preheating, autoclave, and three-stage flash technology, as well as a high-steam, high-leaching rate to achieve recoveries of around 85% nickel and cobalt in MHP. The application of a tested flowsheet also allowed the operation to ramp up to nameplate capacity in only 12 months, compared to an average of four years for the second generation projects. This cheaper and more rapid start-up has removed many of the concerns that the industry had over the previously difficult, expensive and occasionally unreliable HPAL process and helped pave the way to more new project announcements.

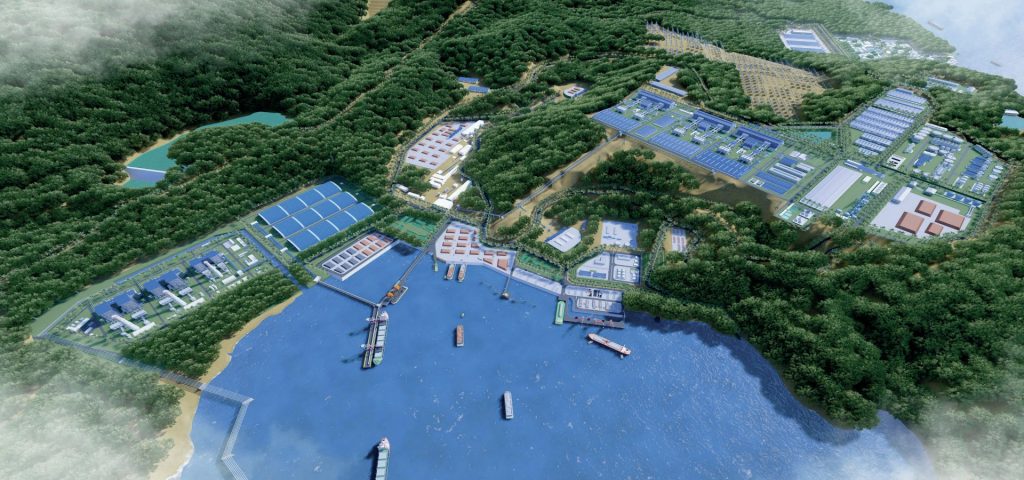

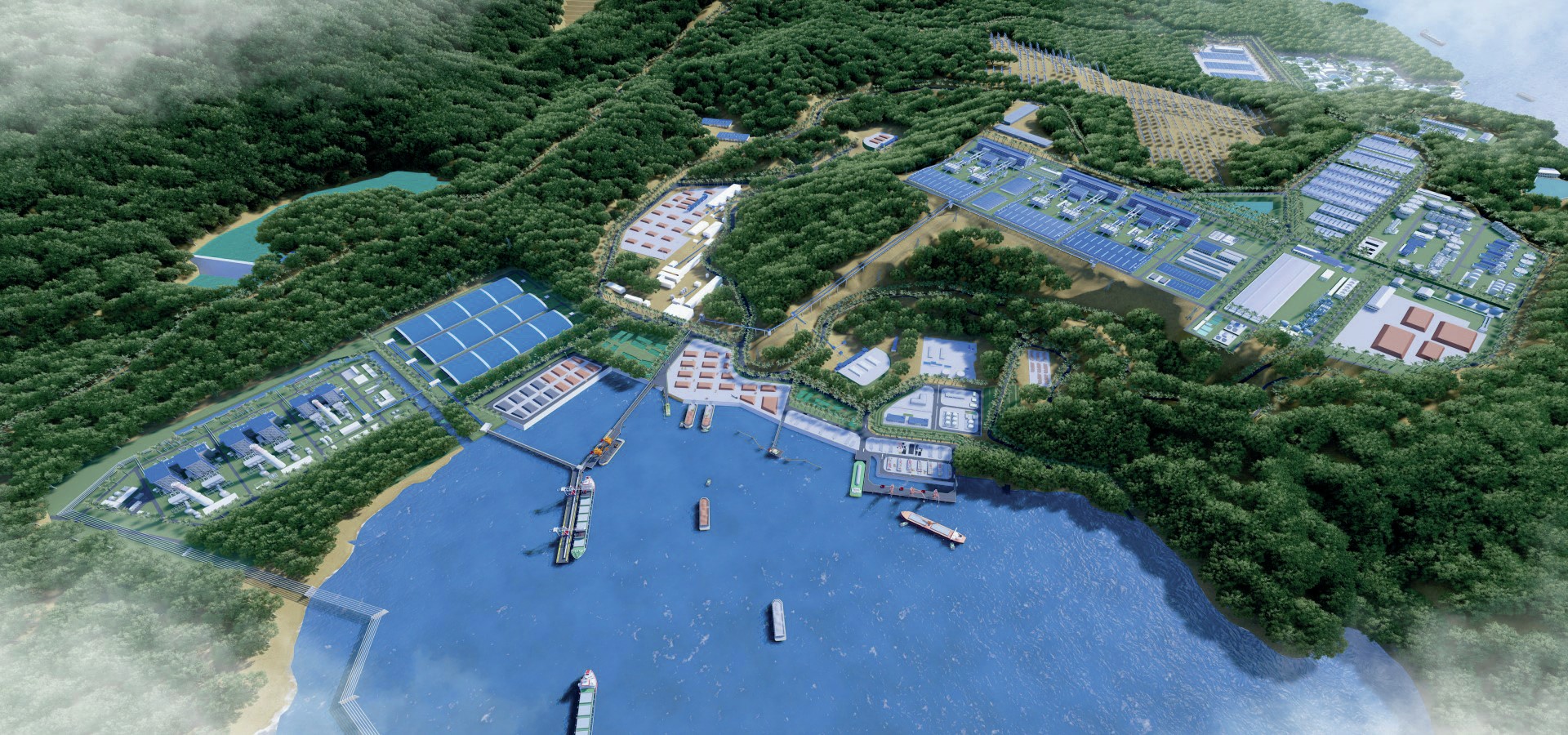

Nickel Industries has taken a final investment decision (FID) for its Excelsior Nickel Cobalt high-pressure acid leach (HPAL) project in the Morowali industrial park in Indonesia’s central Sulawesi. The project, also known as the Dawn HPAL+ project, is expected to produce 72,000 t/a of nickel as mixed hydroxide precipitate, nickel sulphate and nickel cathode with production due to start during 4Q 2025.

Indonesia’s Merdeka Battery Materials plans to build two HPAL plants, each with a capacity of 60,000 t/a. China’s stainless steel giant Tsingshan Holding Group will be a strategic partner to develop an industrial park to house the projects. Development of the first plant is under way at an estimated cost of $1.28 billion, with operations also planned for 2025.

PT Vale Indonesia has signed a cooperation agreement with Zhejiang Huayou Cobalt to develop a 60,000 t/a HPAL plant at Malili, South Sulawesi as mixed hydroxide precipitate (MHP) with cost estimated at $1.8 billion. The plant is due for completion in 2027. It follows an earlier announcement by the two companies in conjunction with Ford to develop a larger 120,000 t/a nickel MHP plant in Pomalaa, with start-up planned for 2026.

Anugrah Neo Energy Materials and China’s Gotion Indonesia Materials have also agreed to build an HPAL plant on Sulawesi Island with a production capacity of 120,000 t/a of nickel in mixed hydroxide precipitate. No start date has been announced.

Overall, Indonesia’s share of world nickel production is forecast to rise from its present 55% to more than 70% over the next five years.

Waste

One of the issues for the new HPAL plants is dealing with waste from the process. HPAL generates an acidic slurry which must be neutralised and properly dealt with. It is estimated that for every tonne of nickel produced via HPAL around 1.4-1.6 tonnes of waste is also produced. This has often led to large quantities of solution being disposed of via tailings ponds or ocean discharge of liquids, depending on access to sites for so called deep sea tailings placement (DSTP), which has been controversial. Some facilities such as Ramu Nickel discharge the tailings at the same pH as the ocean, making them effectively inert, but others discharge acidic waste with a knock-on effect on sea life. Tailings disposal is particularly challenging to deal with in environments such as Sulawesi where there is limited space for large dams due to the island’s topography, thick vegetation and high rainfall. At PT Halmahera tailings are being treated as backfill to the mining operations.

Nickel prices

The plethora of new nickel projects, especially for nickel pig iron production, in Indonesia have led to a surge of new nickel production and falling prices on the international market. Prices fell by 45% during 2023, to below $16,500/t by the end of the year, and are well down from their highs in 2022 when there were fears of an interruption in supply from Russia. The International Nickel Study Group estimated that there was a 104,000 tonne surplus in 2023 which is forecast to rise to 239,000 tonnes in 2024, the third consecutive year of surplus supply and the largest annual surplus to date. One issue has been the slowdown in the Chinese economy, restricting new demand for stainless steel. Nevertheless, as previously mentioned, new demand for batteries is expected to lead to an increase in nickel demand to 3.47 million t/a this year, and much of the surplus is in Class 2 rather than Class 1 nickel. Nickel stocks at the London Metals Exchange are actually at very low levels, and it is expected that there will be support for marginally higher prices over the next year or so. The lower capital costs for new Indonesian HPAL plants means that the projects are less sensitive to lower nickel prices than previous HPAL plants, although the startup of a 200,000 t/a nickel matte facility in China may also relieve some of the pressure on Class 1 nickel prices.

Sulphur and acid demand

The rapid boom in nickel leaching in Indonesia is leading to an equally rapid growth in sulphuric acid demand. CRU estimates that by 2027, acid demand could have risen from around 5 million t/a in 2022 to a total of 17 million t/a. Some of this demand will be satisfied by acid production in Indonesia. Smelter acid production from copper production will account for around 3.2 million t/a by 2027, and another 1 million t/a from pyrite roasting. However, the rest is likely to be accounted for by dedicated sulphur burning acid capacity at the nickel processing sites. A total of 12.8 million t/a of sulphur burning acid capacity is projected to be onstream by 2027. This will in turn necessitate 4.3 million t/a of sulphur consumption, most of which will need to be made up by imports.

Longer term there are some HPAL projects planned in Australia, but they have not made as much progress as quickly as the ones in Indonesia.