Sulphur 414 Sep-Oct 2024

30 September 2024

Chinese sulphuric acid production and exports

SULPHURIC ACID

Chinese sulphuric acid production and exports

China’s acid production continues to grow as new smelters come on-stream. But high domestic demand from phosphate production as export restrictions are lifted and a shortage of copper concentrate may limit the potential for acid exports.

While China’s growth has slowed after the breakneck growth of the first two decades of the 21st century, it remains a mainstay of global manufacturing, and growth continues, albeit at a slower rate. GDP grew by 5.2% in 2023 and is forecast to rise by only 4.7% this year, as the economy continues to be dogged by a downturn in the property sector, high levels of indebtedness, especially among regional governments, elevated youth unemployment and deflationary pressures, as well as a demographic shift to an older population with more retirees. Nevertheless, these are still significant increases, especially in a country responsible for almost half of all global demand of some key raw materials like copper and nickel.

Phosphates

China’s sulphuric acid consumption has long been dominated by its phosphate fertilizer industry. China has the world’s second largest phosphate reserves after Morocco, and has been a major consumer of phosphate fertilizer to feed its huge population. Around the turn of the century, China was actually one of the largest importers of phosphates, but from 2000 up to 2015 embarked upon a massive expansion of domestic mono- and di-ammonium phosphate (MAP/DAP) capacity, with processed phosphate capacity more than doubling from 2008-2015.

Indeed, China overbuilt capacity to a considerable degree, and although much was able to find its way onto export markets, much was not, as China faced stiff competition from lower cost capacity in North Africa and the Middle East. Consequently the end of the 2010s led to something of a shakeout in the Chinese phosphate industry, with higher cost, less efficient capacity closing at the same time that government policy pivoted towards capping use of fertilizer to over-application and encouraging more efficient use of fertilizer; and clamping down on air and water pollution by closing factories that breach new emissions targets or which were within 1km of the Yangtse River. This led to a significant fall in Chinese MAP/DAP consumption and production, which was exacerbated in 2020 by the covid pandemic.

After a rebound in production and particularly demand in 2021, the Chinese government began to impose periodic restrictions on exports of MAP/DAP to try and keep domestic prices lower during peak application periods, including longer inspection times at ports and restrictions on availability of export licenses. In 2022, Chinese DAP exports shrank from 6.3 million t/a to 3.6 million t/a. These restrictions were eased around April 2023, leading to a rush of exports until curtailments were reimposed in October 2023. DAP exports reached 5 million t/a in 2023. A similar pattern has been seen this year, with a relaxing of restrictions in March-April, and a reimposition now in progress. Nevertheless, although Chinese export quotas for MAP and DAP are actually lower this year than last, China’s January-July DAP/MAP production actually increased 14% year on year to roughly 17.7 million tonnes, up from 15.5 million tonnes for the same period of 2023. China’s full-year 2023 DAP/

MAP production reached roughly 27.5 million tonnes, a 9% increase from 25.3 million tonnes in 2022, according to official statistics. This is higher than the figure for 2021, and approaching the peak figure of 28,8 million t/a seen in 2018. This has served to boost Chinese domestic demand for sulphuric acid for phosphate production back towards its level of a few years ago.

Batteries

At the same time, there has been a rapid expansion in production of batteries for electric vehicles, many of them based on lithium iron phosphate (LFP) cathodes. China dominates the supply and consumption of LFP and has invested heavily in capacity – indeed, as has been typical of China in recent decades, there has been an overbuilding of capacity and some rationalisation. LFP now represents one third of all purified phosphoric acid demand in China. CRU estimates that in 2023, country-wide LFP capacity exceeded 2.5 million t/a of cathode active material (CAM) and production surpassed 1.5 million t/a CAM. Production has risen rapidly but is expected to level off from 2025.

Industrial consumers

In addition to phosphates and battery production, Chinese demand for acid continues to rise from the industrial sector. Caprolactam production is a major user, as is titanium dioxide production, which accounts for around 30% of industrial demand, hydrofluoric acid production, animal feed calcium, viscose fibre manufacture and so on. Industrial demand is likely to see some of the main gains in Chinese acid consumption over the next few years, although ammonium sulphate is also leading to increased demand, as noted in our article elsewhere in this issue.

Overall Chinese sulphuric acid consumption dropped to 92.6 million t/a in 2020, but has since risen back to 107.3 million t/a in 2023 (100% acid basis), up 6% on the figure for 2022, and this year it may rise to 110.7 million t/a on the back of increased industrial demand, as well as the boost in phosphate production mentioned earlier.

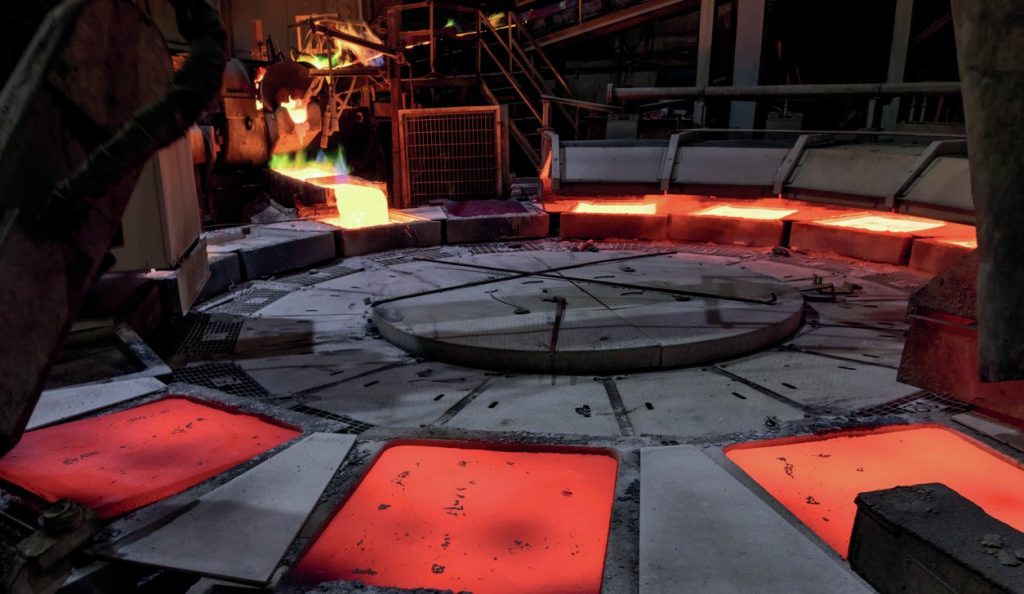

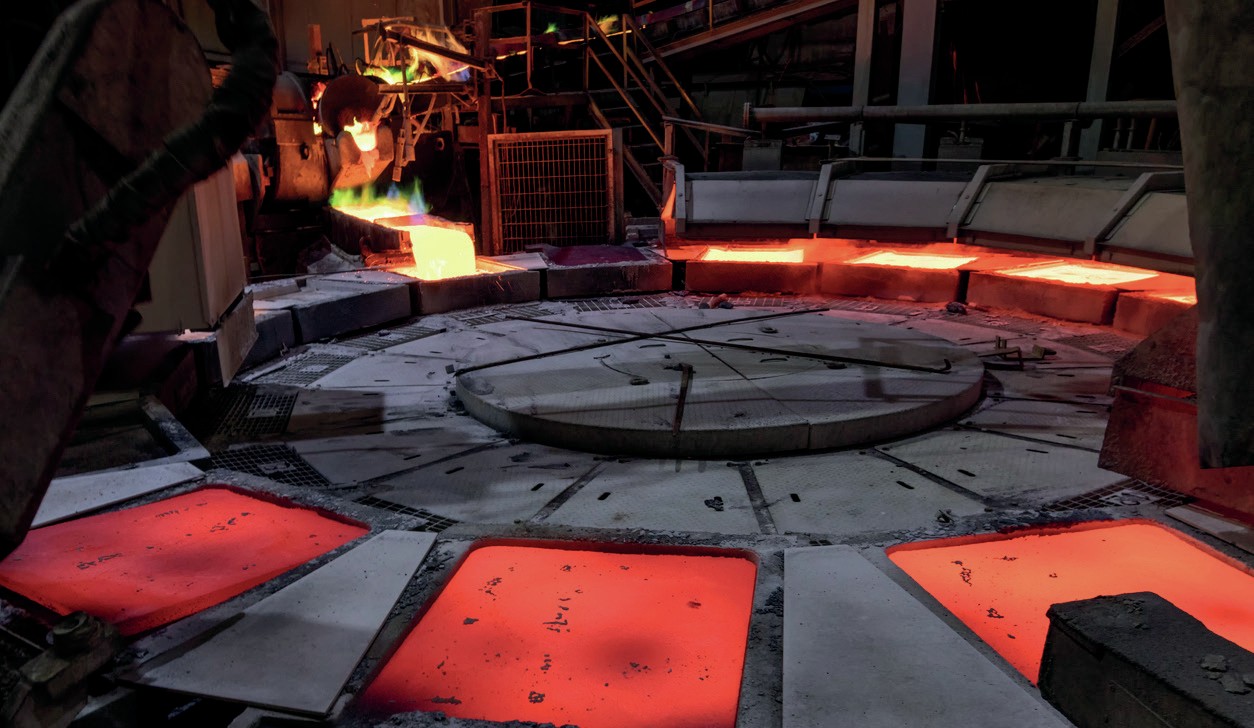

Acid production

Chinese sulphuric acid capacity has been growing rapidly, mainly due to the rapid expansion of non-ferrous metal smelting, which represents around 28% of Chinese acid capacity and 41% of production. Smelter acid production has risen by 55% in the past decade, reaching 45 million t/a as last year. Sulphur burning acid production was almost the same at 42% of production (46.2 million t/a) in 2023, and the remainder came from China’s pyrite roasting acid production, which reached 15.2 million t/a in 2023. China represents 90% of all global pyrite based acid production, although production has declined by about one quarter in the past decade. While pyrite roasting remains in relative decline in the long term, credits from the iron component of iron pyrites, with the metal slag being sold into the steel industry, have kept it afloat through times of lower acid prices.

Geographically, much of China’s sulphuric acid output is concentrated in Hubei and Yunnan provinces, with significant production also in Guizhou, Sichuan, Shandong and Anhui. Yunnan, Hubei, Guizhou and Sichuan are major fertilizer producing regions and capacity there is dominated by sulphur burning plants, while Shandong is a coastal chemical producing region, and Anhui has a lot of smelter capacity.

Acid production continues to rise, as Figure 1 shows, running just ahead of demand. In 2022, net acid exports

peaked at 3.6 million tonnes, as reduced phosphate production left more acid available. This fell to 2.5 million t/a in 2023, and is expected to fall further to 2.25 million t/a this year because of the rebound in phosphate production.

Smelter acid

China’s investment in smelter acid capacity has mainly been based on rapidly increasing copper demand in China. China already represents half of all copper consumption, and its status as the main manufacturing centre for domestic appliances as well as a need for new electric power cabling is driving new demand. The involuntary nature of smelter acid production means that it tends to be produced provided that metal prices justify it. In spite of a dip in 2022, global copper prices have been at historically high levels for the past few years, continuing to drive new investment.

However, a shortage of copper concentrate this year has forced a few smelters in China to cut output, and more curtailments could follow next year when the raw material supply is expected to tighten further. CRU predicts a shortage of concentrate feed globally in 2025 at 1.1 million t/a of copper-in-concentrate. This will likely lead to capacity closures, and an 800,000 t/a reduction in demand from Chinese smelters, lowering their utilisation rates as well as delaying some new smelter projects. While large smelters reliant on yearly contract purchases are less affected by the concentrate shortage, smaller producers are under pressure to cut production as spot treatment charges fall along with concentrate supply.

Overall, however, in spite of the fall in smelter acid production, total Chinese acid production is expected to reach 112.8 million t/a this year, with sulphur burning acid capacity for phosphate production making up most of the increase.

Sulphur production

The profitability of the 42% of Chinese sulphuric acid capacity that depends upon sulphur burning depends very much upon Chinese sulphur prices and in turn domestic sulphur production. Over the first two decades of the 21st century, the rapid growth in Chinese sulphur-burning acid capacity to feed the equally large increase in processed phosphates capacity led to a rapid ramp-up in the country’s sulphur consumption, and a corresponding increase in imports of sulphur, peaking at 12.2 million t/a in 2016, at which time Chinese imports represented over one third of all globally traded sulphur.

However, domestic sulphur production has also been rising steadily, albeit from a low base. There was an initial spurt from sour gas processing, mainly in the south-central Sichuan province, beginning with the large Puguang gas field in 2011, and then followed by Yuanba in 2014 and Chuandongbei in 2016. More recently, major refinery expansions have also been driving new sulphur production in China. Chinese refining capacity rose to 936 million t/a (18.7 million bbl/d) in 2023, making it the largest refining sector in the world in terms of capacity, according to official figures, while actual crude oil processing was 738 million t/a (14.8 million bbl/d), a record high. China’s refining capacity is expected to rise by 2.7% this year to 961 million t/a (19.2 million bbl/d), but this continues to run significantly in excess of demand, and overcapacity continues to dog the industry. Overall Chinese refinery throughput is expected to reach 752 million t/a (15.1 million bbl/d) this year, up 1.8% year on year, and equivalent to a capacity utilisation rate of 78%.

Between refining and sour gas production, Chinese sulphur production is expected to rise to 10.6 million t/a this year, and 11.7 million t/a in 2025. This is set against demand of 18.8 million t/a this year and a forecast 18.3 million t/a next, meaning that the deficit is set to fall from 8.2 million t/a to 6.6 million t/a. China’s sulphur deficit and hence imports are both forecast to continue to fall over the coming years as more sulphur capacity comes into play. Additionally, Chinese port stocks of sulphur remain at historically high levels, having peaked at around 3 million tonnes in April and declined slightly to 2.7 million tonnes in June. The decline has been driven by drawdown at river ports, typically belonging to traders, while southern stocks, mainly belonging to phosphate producers, have actually slightly increased since March. DAP prices have declined since January 2024, while sulphur prices have increased, meaning that sulphur affordability to phosphates consumers has slightly worsened. Nevertheless, sulphur’s price as a share of the DAP price remains at a relatively favourable level of around 25%, well below the long-run affordability average range of 35-42%, and Chinese sulphur burning acid capacity seems capable of weathering a surge in phosphate production.

Acid exports

At the moment, in spite of higher prices for acid which typically encourage Chinese exports, Chinese net exports of acid seem set to decline as price differentials widen the domestic premium for Chinese producers. Chinese domestic prices for acid remain relatively high on the back of increased demand for phosphate production, making supplying that more attractive, and the price differential between exporting and non-exporting regions has been narrowing.

It is expected that sulphur-burnt supply will continue to play a minor role in exports and smelter volumes will dominate in the long term, especially in the export market, but the current shortage of copper concentrate is affecting smelter acid production, meaning that exports are likely to be down this year. Chinese acid exports were 2.5 million t/a in 20223 and expected to be 2.2 million t/a for the full year 2024, dropping to 1.75 million t/a next year.