Sulphur 398 Jan-Feb 2022

31 January 2022

Sulphur + Sulphuric Acid 2021

CONFERENCE REPORT

Sulphur + Sulphuric Acid 2021

A look at papers presented at CRU’s annual Sulphur + Sulphuric Acid conference, which was once again held virtually, in November 2021.

As with last year, the continuing shadow of coronavirus hung over international meetings and travel, once again necessitating a ‘virtual’ Sulphur + Sulphuric Acid conference at the end of last year. CRU’s tried and tested conference application worked well once again, though I for one hope that we will be able to return to face to face meetings later in 2022.

The familiar structure of commercial presentations followed by technical was preserved, and Peter Harrison as usual kicked off the conference with his annual look at how the sulphur market has moved and might move in the future. Sulphur prices ran up at the end of 2020 and the start of 2021, he said, but remained stable for most of 2021, except for some freight related moves. However, the end of 2021 saw prices move up again dur to movements in sulphur consuming markets such as phosphates. Phosphate base demand growth is forecast to be strong throughout 2022-23, mainly in Morocco and Saudi Arabia, though it tails off thereafter to more ‘normal’ levels of 1.0 million t/a growth. The battery metals sector is growing very strongly, though from a low base, with both nickel and lithium consuming additional acid volumes. Indonesia’s sulphur demand is forecast to double by 2025 due to new HPAL plants, and the US is adding lithium capacity which will consume an extra 1.2 million t/a of sulphur by 2030. Peter predicted that the rebound in sulphur demand would persist into 2022, with China substituting some pyrite based acid production for sulphur burning.

On the supply side, Europe’s market is becoming tighter with falling supply from oil and German sour gas, meaning the continent may need more remelter projects. North American supply is recovering as refineries restart, though there has been disruption from storms in March and September and falling sulphur content of refinery crude inputs. Alberta sour gas production continues to fall but there is a rebound in British Columbia and some growth from oil sands. The Middle East remains the largest incremental producer, with new sulphur from Kuwait, Qatar and the UAE to come. China is also adding more sulphur from the Changdongbei sour gas project. Overall, Peter saw sulphur prices peaking in Q1 2022.

“There could be 11 million t/a of acid demand from battery metals processing by 2025.”

Peter’s colleague Daly dealt with acid markets. Acid price increases outpaced related markets such as copper, nickel and phosphates during 2021, and have continued to climbed sharply during the year as supply tightness persisted. Because acid price gains have been higher than those in demand markets, affordability has weakened and there has been an incentive for those who are able to buy sulphur-burnt acid instead. However, Chilean import demand has remained strong in spite of the price rises, at 2.6 million tonnes in 2021, and lack of availability from Peru means imports from outside the region look set to be over 1 million t/a out to 2025. New phosphoric acid plants and the continuing absence of the Tuticorin smelter are also driving increased Indian acid imports. The US has also seen additional imports with more phosphate demand and smelter outages, and there is more demand on the horizon from new lithium projects. Meanwhile, on the supply side, the high prices have led to more sulphur burning exports from Two Lions and others in China. In the longer term, Brendan said, markets for battery metals like nickel and lithium would start to drive new acid demand from around the mid-2020s, in China, Australia, the US, Indonesia and others. The ioneer Rhyolite Ridge project in the US will alone consume 900,000 t/a of acid, and Brendan projected that there could be 11 million t/a of acid demand from battery metals processing by 2025. In the short term, however, he saw softening in the acid market for 2022 in both the Atlantic and Pacific basins.

The third of the non-technical presentations was a return for the familiar face of Peter Clark, formerly of ASRL, now professor emeritus at the University of Calgary. Peter took a longer term look at the impact of trends in energy markets on sulphur production. He wondered if the dip in sulphur production from refineries as fuel demand fell during covid at the same time that phosphate demand remained strong was a foretaste of things to come as we gradually move towards electrification of road vehicles and more renewable power generation. Coal represented 35% of energy generation in 2020, and nuclear, hydroelectric and other renewables 32%, with oil and gas most of the remainder. While the focus is currently on eliminating coal, probably requiring major investments in nuclear power in countries like India and China, oil and gas will not be far behind, and may see major falls in consumption from about 2030. Since they currently provide 95% of all sulphur, alternatives need to be found. Peter speculated about recovery of sulphur from gypsum (CaSO4 ), supplies of which are “almost limitless”. However, a lot of ‘green’ electricity might be needed to do so. He foresaw a focus on phosphate recycling to ease the burden on falling sulphur availability, and possibly longer term an emphasis on population control.

Sulphur

The sulphur technology strand began with a presentation by IPCO’s Casey Metheral of his company’s SG20 drum granulator. Like the larger SG30, the SG20 has a seed generation system – the solid sulphur seeds are then added to the granulator with the liquid sulphur to begin granule formation. It can be configured with either an angled drum, allowing gravity to move the granules, or a level drum with advancing flights. Spray nozzles are heated to avoid clogging with solid sulphur. A wet Venturi scrubber or steam jacketed cyclone removes sulphur dust, and in both cases the dust is remelted and recycled back to the drum. A bolt-on system for handling H2S emissions is also available.

Cyndi Teulon of RSK described a project in Iraq for handling H2S recovered as part of a gas flaring reduction project. The H2S is treated biologically using a thiobacillus bacteria, which converts it to 43 t/d of elemental sulphur. The sulphur produced is 98.9% pure, the rest being organic matter, with no hydrocarbons or heavy metals, and it was found to be suitable for use in agriculture. A series of assessments and finally field trials were conducted between 2018 and 2020 in the UK and Iraq, and found that the micro granules were quickly oxidised to sulphate without major impact on soil pH. Significant improvements in crop yield were found in sunflowers, okra and corn in a variety of different conditions. The project is now looking at bagging and distribution options and is working with Iraqi government and farmers to secure wider acceptance.

Sulphurnet looked at dealing with emissions of sulphur dust and H2S from sulphur melting facilities. These mainly occur from the melt and precoat tanks, and the company has developed a caustic scrubbing solution for vent gases which removes H2S, which also removes microscopic sulphur dust for collection to tank for filtration, recovery and remelt.

Rohan Prinsloo presented some of Alberta Sulphur Research’s latest work; carbon disulphide destruction using commercial alumina or titania in a liquid phase sulphur recovery process. The process is a proof of concept for liquid phase sulphur recovery from Claus tail gas, using a mix of biphenyl and diphenyl ether. However, the Claus process can generate CS2 from methane or methyl mercaptan. It is removed by a catalytic hydrolysis reaction – the challenge is making it work at the ca 150C of the process working temperature. Using titania or alumina as a catalyst leads to 98% and 95% removal, respectively, and ASRL’s work in the area continues.

Case studies

Benoit Mares of Axens showcased the installation and start-up of a modular Smartsulf unit at the Jurassic facility in Kuwait. Smartsulf is a modified Claus process with two reactors, one in hot mode, and the second using sub-dewpoint operation. It has no standby reactor or regeneration loop, or tail gas treatment, but nevertheless achieves 99.5-99.7% sulphur recovery. The Kuwait installation was achieved in 17 months from award of the contract, using modular construction and fabrication in China, and assembly supervised by Axens.

“The power generated is carbon free, and could be used to generate hydrogen by electrolysis for ammonia production.”

Jan Klok of Paquell and Ellen Ticheler of Worley Comprimo described the installation of a Thiopaq unit in a refinery. The refinery was moving to a higher sulphur crude feed and could no longer rely on its previous scavenger-based recovery process, but only needed to recover around 3 t/d of sulphur from sour gas and sour water stripper gas. Thiopaq’s biological process offered the refinery the turndown capacity that it was looking for.

Gerald Bohme of Sulphur Experts recounted a tail gas treatment unit upset, and stressed the importance of proper process monitoring, using analysers and indicators in combination and showing all of the analyser range on the control system, and understanding what a readout looks like when they are not working.

Elmo Nasato of Nasato Consulting recounted a catalogue of water-related issues in sulphur recovery units, mainly waste heat boilers and condensers, including flow-assisted corrosion. Practical solutions included controlling water purity and condenser water level, especially during shutdowns, when effective shutdown procedures can minimise corrosion. Regular inspection and eddy current testing can identify tube wall thinning.

Sulphuric acid

On the sulphuric acid technology side, BASF began with a low SO2 emission sulphuric acid catalyst development, presented by Jonglack Kim and Dirk Hensel. The Quattro catalyst has a quadrilobed shape for higher surface area at normal packing density. It also has lower propensity for chipping or attrition. Conversion is increased and capacity is around 8-10% higher. An installation in Brazil showed a 13% capacity increase and 222ppm lower SO2 emissions.

Rene Dijkstra of Chemetics showcased the CORE-SO2 process, which uses stoichiometric oxygen-based combustion of sulphur to achieve smaller plant sizes for a given capacity, as it allows the removal of some large equipment items such as dry towers, gas-gas exchangers, economisers and a final absorption system. Lower tail gas volumes lead to lower emissions. An improved SO2 generation system is also currently being patented. And of course as with any acid plant, as part of a larger fertilizer complex, the power generated is carbon free, and could be used to generate hydrogen by electrolysis for ammonia production.

Shailesh Sampat of SNC Lavalin also looked at energy recovery and efficiency from an acid plant and integration of it into a larger complex. For example, hot water can be used for washing filter cake in a phosphate plant, while steam, hot air and condensate can be used in pyrometallurgical plants concentrators, granulators and dryers, especially if the SO3 cooler is replaced by a waste heat boiler to generate low pressure steam. Use of MECS HRS can also increase the energy recovered in an acid plant.

Joan Bova of CG Thermal addressed design considerations for sulphuric acid regeneration units, including vapour pressure, viscosity, materials of construction, bonded linings or retrolining for vacuum operation, and heat transfer in ceramics.

Clark Solutions

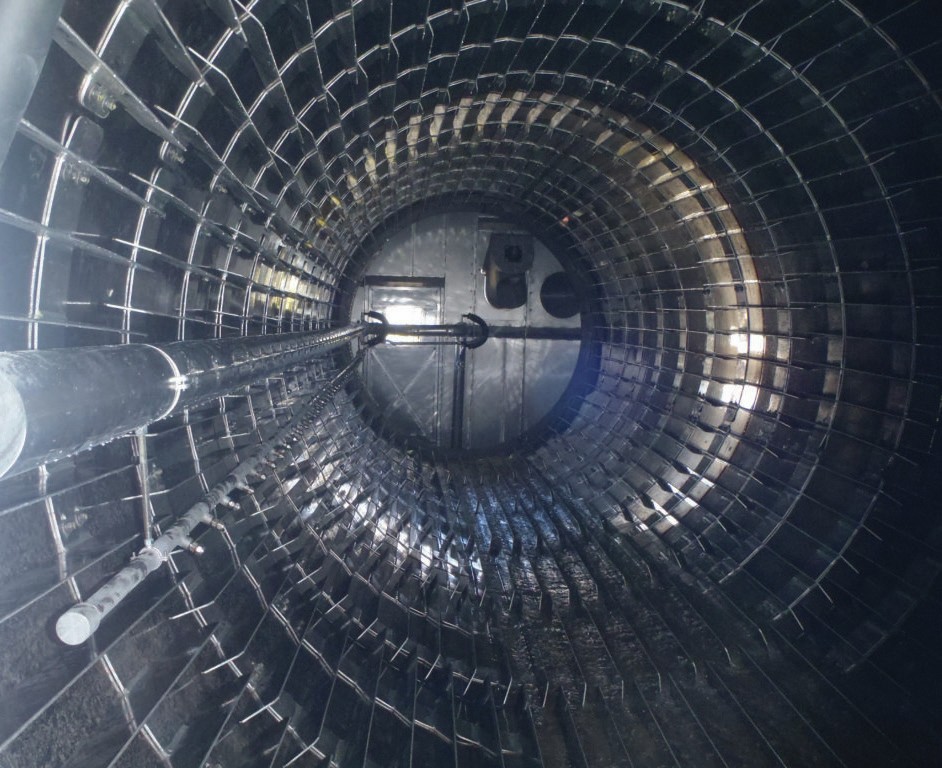

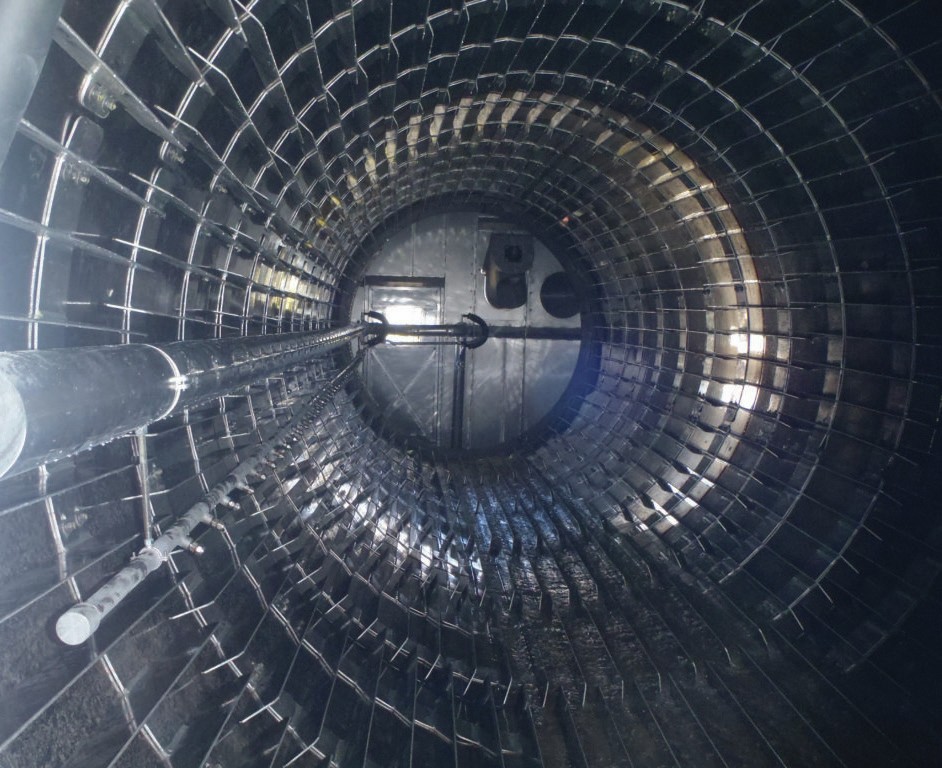

NORAM Engineering detailed the process design considerations for a catalytic converter replacement, as well as the fabrication and transport and installation issues.

Mist eliminators

Martyn Dean of Begg Cousland asked why you would want to wet mist eliminators in an acid plant. The answer was to control SO3 emissions during start-up or shut down, control SO2 , which can lead to a visible plume from the stack and emission non-compliance, and to remove NOx which can contaminate product acid. A variety of ways of getting liquid H2SO4 onto the filters was presented, with case studies of their operation.

Though for reasons of timing it ended up in the sulphur section, CECO Filters also presented on their filters and mist eliminators for sulphuric acid plants.

Plant operation

Marcelo Rios of DuPont Clean Technologies presented a case study of the application of DuPont’s Dynawave tail gas scrubber at an acid plant in Chile. Dynawave can operate at any scale of acid plant, and remove acid mist and dust and alkaline gases such as ammonia as well as SO2 , SO3 , halides and halogens, using a variety of reagents according to selectivity and cost criteria. The operator selected it because of new emissions regulations which the plant did not presently meet, and the system is now operating efficiently.

Another Chilean operation was the topic for Ellio Barazza and Collin Bartlett of Metso Outotec. Noracid at Mejillones, founded in 2007, supplies the northern Chilean mining industry using a 720,000 t/a Outotec acid plant. It has achieved high reliability – only two days were lost to unscheduled outages in 2020, and availability was 98.5%, thanks to condition-based monitoring and maintenance. All critical spare parts are available on-site with automatic restocking. The plant is now moving towards a further digital optimisation of its operations.

Marcelo Chagas of Mosaic described a new catalytic configuration at the Araxa plant in Brazil, designed in conjunction with supplier Haldor Topsoe to reduce SO2 emissions while maintaining lower pressure drop during start-up. Computer modelling led to peak SO2 emissions being reduced by 40%.