Sulphur 401 Jul-Aug 2022

31 July 2022

Middle East Sulphur Conference 2022

CONFERENCE REPORT

Middle East Sulphur Conference 2022

More than 400 representatives from across the global sulphur community convened in Abu Dhabi from 24-26 May 2022 for an exciting new event, the Middle East Sulphur Conference, devoted to exploring best practice operations across the entire sour gas and sulphur value chain.

The Middle East Sulphur Conference (MEScon), organised by CRU and UniverSUL Consulting, with the support of Host Sponsor, Abu Dhabi National Oil Company (ADNOC), took place at the Rosewood Abu Dhabi. This new annual gathering has come about as the consolidation of two previous conferences – MESPON and Middle East Sulphur. The unification of these events and cooperation of their organising partners offers a prime opportunity for the sulphur community to assemble annually in the Middle East, the global epicentre of sulphur production.

Against a backdrop of record sulphur prices and considerations about the future role of the sulphur industry, the inaugural MEScon was positioned at an ideal time to provide a forum to share knowledge and resources in support of continual improvements in HSE, reliability, efficiency and general best practices for the sulphur and sour gas industry.

The opening session on Tuesday 24 May provided key insights into big picture themes, with keynote messages from Tayba Al Hashmi, ADNOC Sour Gas CEO, and Ahmed Mohamed Alebri, ADNOC Gas Processing Acting CEO/ADNOC Industrial Gases Acting General Manager. The role of sulphur as a strategic commodity and ADNOC as a Centre of Excellence were explored in a high-level panel discussion featuring senior ADNOC executives, CRU, UniverSUL Consulting and Alberta Sulphur Research Ltd.

In her opening address, ADNOC Sour Gas CEO, Tayba Al Hashemi, said, “ADNOC’s gas growth, including the expansion at Shah and the delivery of the Ghasha concession, will assist in delivering gas self-sufficiency for the UAE and will also help respond to the rising global demand for sulphur, which is crucial in meeting the growing global demand for fertilizer and industrial needs. Through continued investment in growth and innovation, ADNOC will build on our position as a safe, competitive, and reliable gas and sulphur producer, to ensure we deliver at the lowest possible cost and lowest possible carbon for our global customers.”

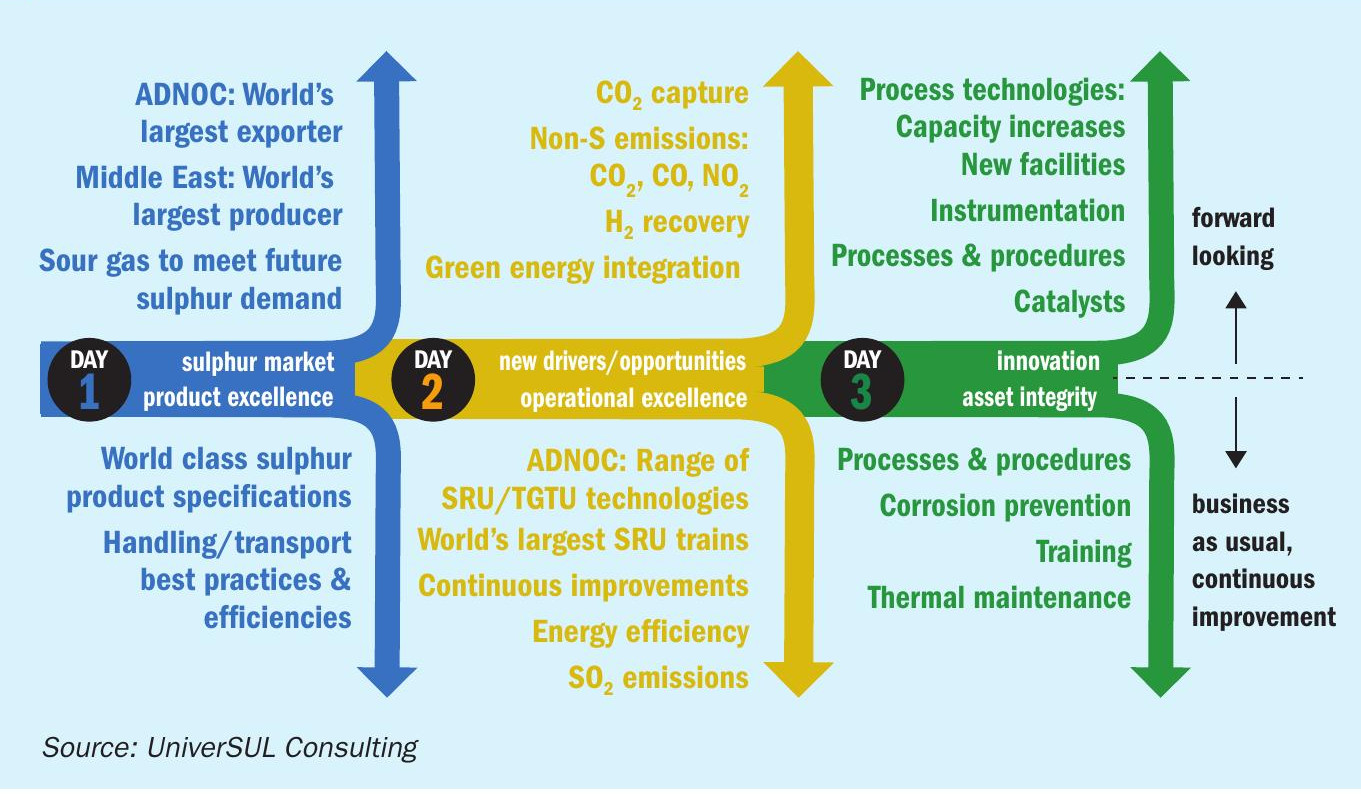

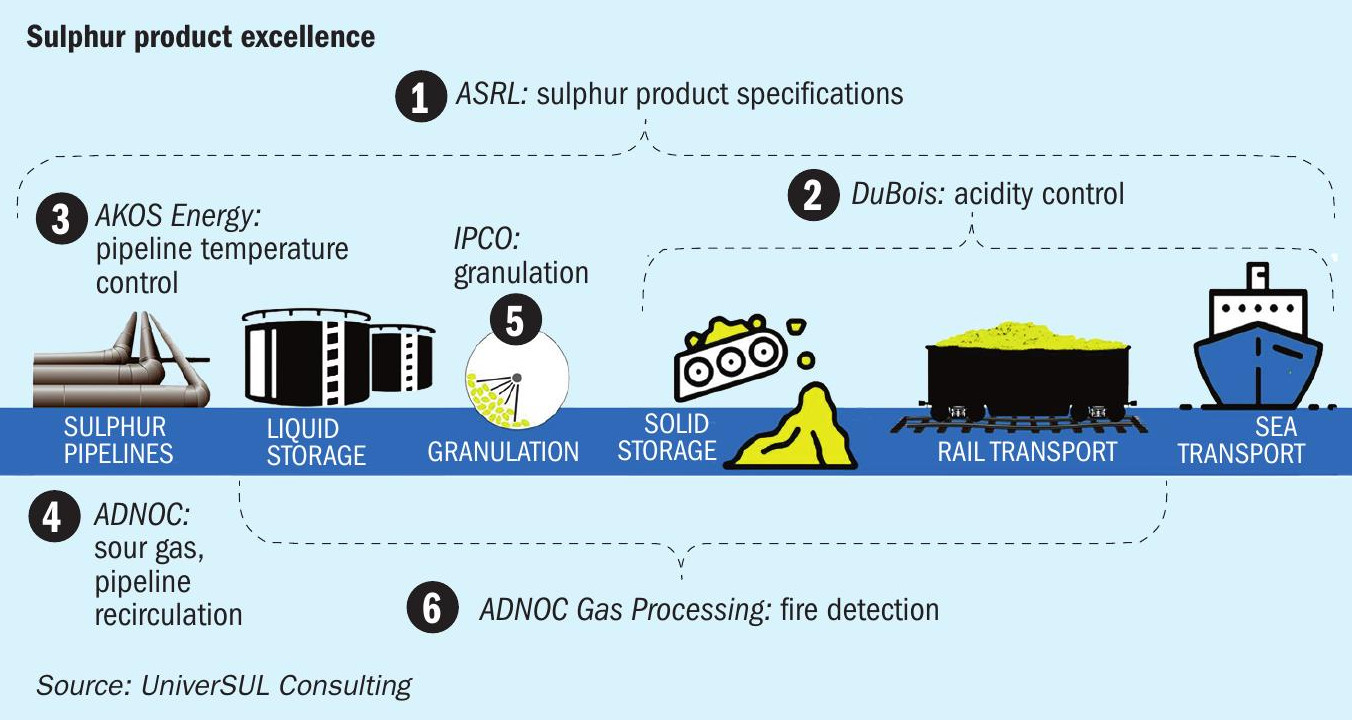

Throughout the three-day event, the agenda addressed multiple themes, alternating between forward-looking innovation/ technology developments and business-asusual, best practice knowledge transfer, and continuous improvement, as shown in Fig. 1. Each session began with the overview of a framework by UniverSUL Consulting (see example in Fig. 2), the intention of which was to provide audience perspective on what presentations they would see in the session and how each one relates back to the big picture. Each session concluded with an interactive panel discussion between the audience and all speakers from the session.

The second half of day 1 focused on formed sulphur product excellence, beginning with overarching presentations on sulphur dust and acid prevention from ASRL (Dr Rob Marriott) and DuBois Chemicals (Jeff Cooke), respectively. These were followed by presentations from AKOS Energy (Kent Kalar) and ADNOC Sour Gas (Cesar Zambrano) focused on special considerations and operating experience with sulphur pipelines. IPCO (Casey Metheral) discussed best practices for sulphur granulation and ADNOC Gas Processing (Arivazhagan Rajendran) wrapped up the session with a presentation on fire detection in sulphur handling facilities.

The first half of day 2 was dedicated to new drivers and opportunities in sulphur recovery. ADNOC Gas Processing (Saqib Sajjad) got the session underway with a presentation on green energy opportunities in sour gas/sulphur plants, followed by Comprimo (Camille Ventham) and Fluor (Thomas Chow), who each presented alternatives for CO2 capture and H2 recovery from sulphur plant tail gas. The session then shifted toward non-sulphur emissions from sulphur recovery units, with presentations from both SICK A.G. (David Inward) and Koch Engineered Solutions Middle East (Gernot Schwarting).

The afternoon of day 2 turned toward the more traditional focus of sulphur plants – SO2 emissions and operational best practices. The first presentation was provided by Ibrahim Khan and Afra Al Mansoori and offered insights into ADNOC Gas Processing’s efforts to reduce SO2 emissions in existing sulphur recovery facilities at Habshan and Ruwais. This was followed by a presentation from ADNOC Sour Gas (Al Sail Al Jaberi), which provided an overview of a recent sulphur recovery unit (SRU)/tail gas treating unit (TGTU) catalyst optimisation scheme in the world’s largest SRU/TGTU trains. Khalid Hinai then shared valuable lessons learned during the recent start-up of Petroleum Development Oman’s (PDO’s) largest sulphur recovery complex (Yibal Khuff), which is equipped with Cansolv tail gas treating technology. Finally, the session concluded with an interesting talk from ADNOC Gas Processing, showcasing recent efforts to optimize BTEX destruction in the Habshan 5 SRU/TGTU trains.

The third and final day of MEScon was dedicated to innovation in the morning and asset integrity in the afternoon. The first presentations of the morning session focused on innovations in gas treating and tail gas treating solvents from Dow and BASF (presented by Lorenzo Spagnuolo and Ashraf Abufaris, respectively). Delta Controls (Matt Coady) then gave a presentation on unpurged thermal reactor thermocouples – the second of two innovations presented by Delta Controls at MEScon 2022. The first innovation – a new thermal reactor camera – was announced on day 1 and displayed at Delta’s exhibition booth throughout the three days of the event. Euro Support (Mark van Hoeke) gave a presentation on innovations in TGTU catalyst presulphiding using titania catalyst and the session was concluded with an innovative approach toward automating SRU/TGTU start-up and shutdown, provided by Raghesh Karunakaran (ADNOC Gas Processing).

The first presentation of the afternoon session spanned both innovation and asset integrity, as Jaime Aguilera demonstrated Voovio’s technology, which uses digital replicas and simulators to enable efficient operator onboarding, increased productivity, reduced downtime, and improved asset integrity. The focus then shifted toward corrosion aspects related to asset integrity, with presentations on thermal maintenance (Justin Tucker, Ametek CSI), waste heat boiler tubesheet protection (Domenica Misale-Lyttle, Industrial Ceramics Limited) and tail gas absorber overhead piping corrosion (Muhammed Nisar and Alya Al Ali, ADNOC Gas Processing).

Feedback from the inaugural MEScon event has been positive. In the future, with the region’s prominence in the global sulphur industry, MEScon is expected to play a vital role in articulating the key strategic themes that are driving the industry. This includes how the region as the world’s largest producer of sulphur, and ADNOC as the largest exporter, are marrying operational experience with best-in-class technology to meet global sulphur demand whilst maintaining the highest levels of sustainability and efficiency.